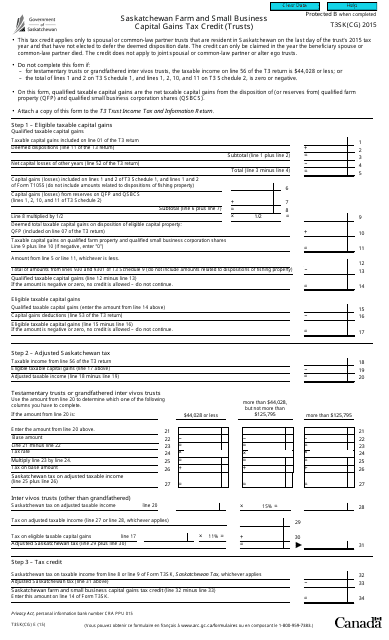

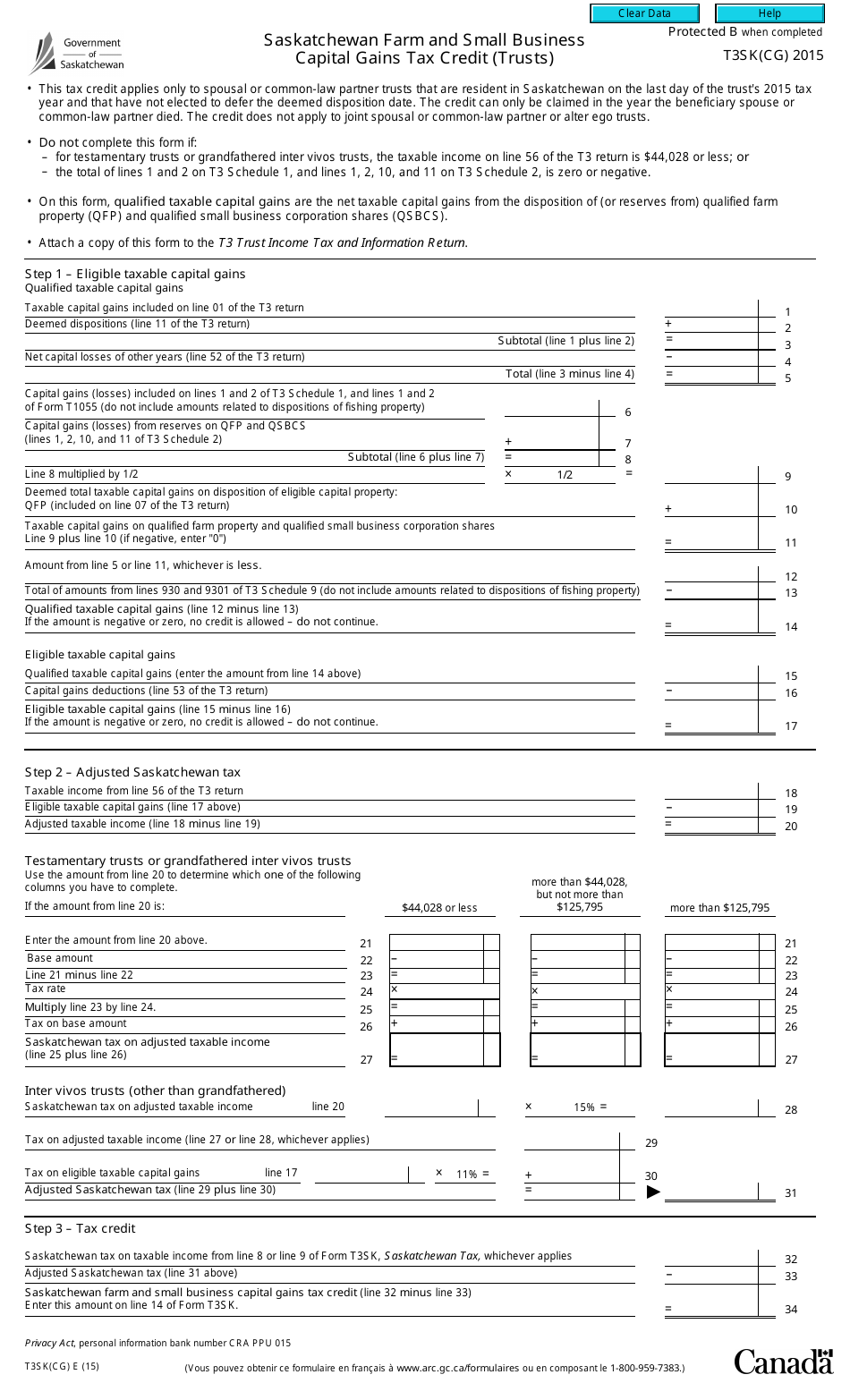

Form T3SK(CG) Saskatchewan Farm and Small Business Capital Gains Tax Credit (Trusts) - Canada

Form T3SK(CG) is used in Canada for claiming the Saskatchewan Farm and Small Business Capital Gains Tax Credit for trusts. This credit is designed to provide tax relief for trusts that sell qualified farm or small business property in Saskatchewan. Please consult the Canada Revenue Agency (CRA) or a tax professional for specific guidance on using this form.

The Form T3SK(CG) Saskatchewan Farm and Small Business Capital Gains Tax Credit (Trusts) in Canada is filed by trusts that qualify for the tax credit.

FAQ

Q: What is Form T3SK(CG)?

A: Form T3SK(CG) is a tax form in Canada specifically for trusts claiming the Saskatchewan Farm and Small Business Capital Gains Tax Credit.

Q: Who is eligible to use Form T3SK(CG)?

A: Trusts in Canada claiming the Saskatchewan Farm and Small Business Capital Gains Tax Credit are eligible to use Form T3SK(CG).

Q: What is the purpose of the Saskatchewan Farm and Small Business Capital Gains Tax Credit?

A: The purpose of the Saskatchewan Farm and Small Business Capital Gains Tax Credit is to provide tax relief to trusts that earn eligible capital gains from the sale of farmland or small businesses in Saskatchewan.

Q: What is the benefit of claiming this tax credit?

A: By claiming this tax credit, trusts can potentially reduce the amount of tax they owe on eligible capital gains.

Q: How do you claim the Saskatchewan Farm and Small Business Capital Gains Tax Credit?

A: To claim the tax credit, trusts must complete and file Form T3SK(CG) with their tax return.

Q: Are there any specific requirements to claim this tax credit?

A: Yes, there are specific requirements that trusts must meet in order to qualify for the Saskatchewan Farm and Small Business Capital Gains Tax Credit. These requirements may include the type of property sold, the ownership period, and the use of proceeds.