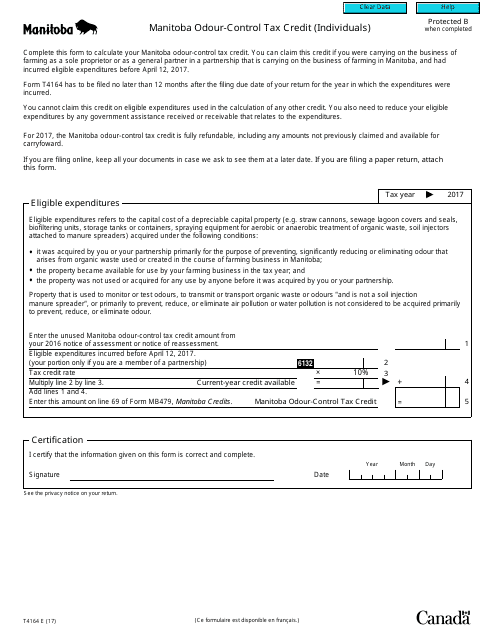

Form T4164 Manitoba Odour-Control Tax Credit (Individuals) - Canada

The Form T4164 Manitoba Odour-Control Tax Credit is a tax credit for individuals in Manitoba, Canada. It is specifically for individuals who have incurred expenses related to odour-control equipment for their personal residence and wish to claim a tax credit for those expenses.

The form T4164 Manitoba Odour-Control Tax Credit (Individuals) in Canada is filed by individuals who are eligible for claiming the Manitoba Odour-Control Tax Credit. This credit is specifically for individuals who have made eligible expenses related to odour control equipment in Manitoba.

FAQ

Q: What is the Manitoba Odour-Control Tax Credit?

A: The Manitoba Odour-Control Tax Credit is a tax credit available to individuals in Manitoba.

Q: Who is eligible for the Manitoba Odour-Control Tax Credit?

A: Residents of Manitoba who have purchased eligible odour-control equipment for their property may be eligible for the tax credit.

Q: What is considered eligible odour-control equipment?

A: Eligible odour-control equipment includes devices that are designed to control or mitigate odours originating from agricultural or industrial operations.

Q: How much is the tax credit?

A: The tax credit is equal to 10% of the cost of eligible odour-control equipment, up to a maximum of $2,500.

Q: Are there any restrictions on the tax credit?

A: Yes, the tax credit can only be claimed once per property in a taxation year, and the equipment must be purchased and installed between April 15, 2013, and April 14, 2025.

Q: How do I claim the Manitoba Odour-Control Tax Credit?

A: To claim the tax credit, you must complete and file Form T4164 with your personal income tax return.

Q: Is the Manitoba Odour-Control Tax Credit refundable?

A: No, the tax credit is non-refundable, but any unused portion can be carried forward and applied against future tax payable.

Q: Can I claim the Manitoba Odour-Control Tax Credit if I rent my property?

A: No, only individuals who own their property and have incurred the expense of eligible odour-control equipment are eligible to claim the tax credit.

Q: What documentation do I need to keep to support my claim?

A: You should keep receipts, invoices, and any other supporting documentation related to the purchase and installation of the eligible odour-control equipment.