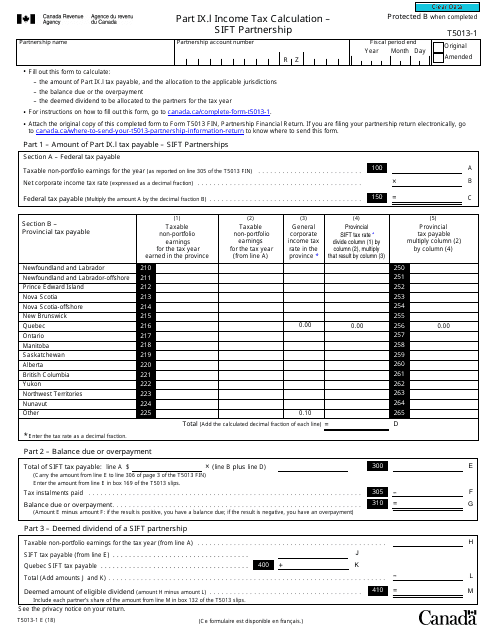

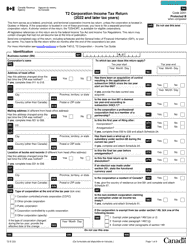

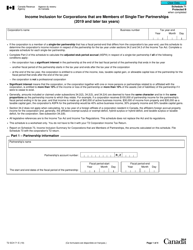

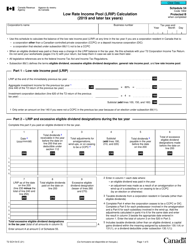

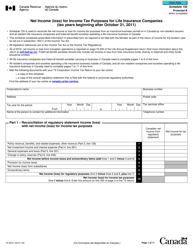

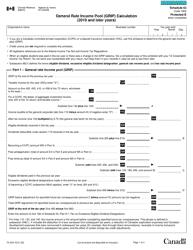

Form T5013-1 Part IX.I Income Tax Calculation - Sift Partnership - Canada

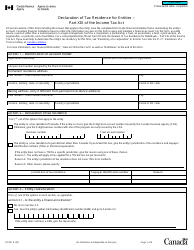

Form T5013-1 Part IX.I Income Tax Calculation for Sift Partnership in Canada is used to calculate the income tax liability of a Sift partnership. It helps the partnership determine the amount of income tax owed to the Canadian government.

The Form T5013-1 Part IX.I Income Tax Calculation for Sift Partnership in Canada is filed by the partnership itself.

FAQ

Q: What is Form T5013-1?

A: Form T5013-1 is a tax form used in Canada for reporting the income, expenses, and other tax-related information of a partnership.

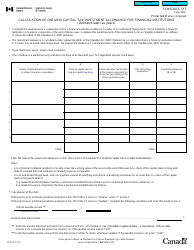

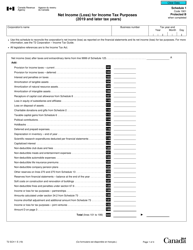

Q: What is Part IX.I of Form T5013-1?

A: Part IX.I of Form T5013-1 is the section where the income tax calculation for the partnership is reported.

Q: What is Sift Partnership?

A: Sift Partnership refers to a specific partnership that is likely related to the document or context.

Q: What is the purpose of Part IX.I Income Tax Calculation?

A: The purpose of Part IX.I is to calculate the income tax payable or refundable by the partnership.

Q: Who should complete Form T5013-1?

A: Partnerships in Canada who meet certain criteria are required to complete Form T5013-1.

Q: Are individuals required to file Form T5013-1?

A: No, Form T5013-1 is specifically for partnerships and not for individuals.

Q: What should I do if I have questions or need assistance with Form T5013-1?

A: If you have questions or need assistance with Form T5013-1, you can contact the Canada Revenue Agency (CRA) or seek help from a tax professional.