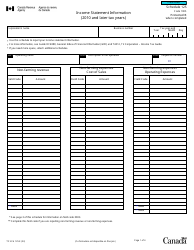

This version of the form is not currently in use and is provided for reference only. Download this version of

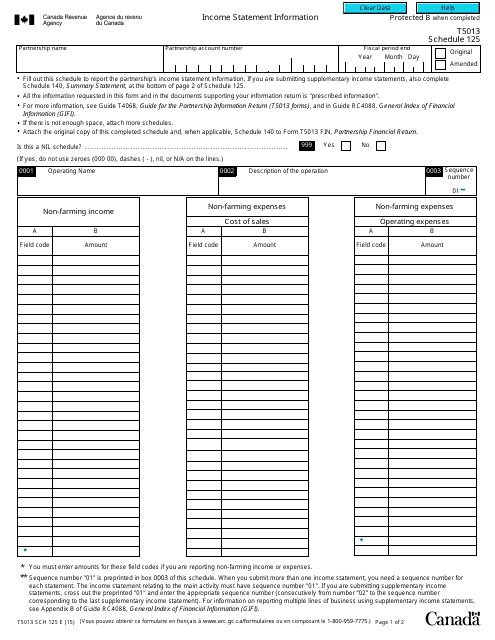

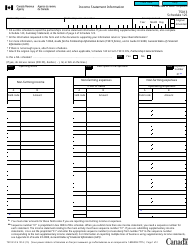

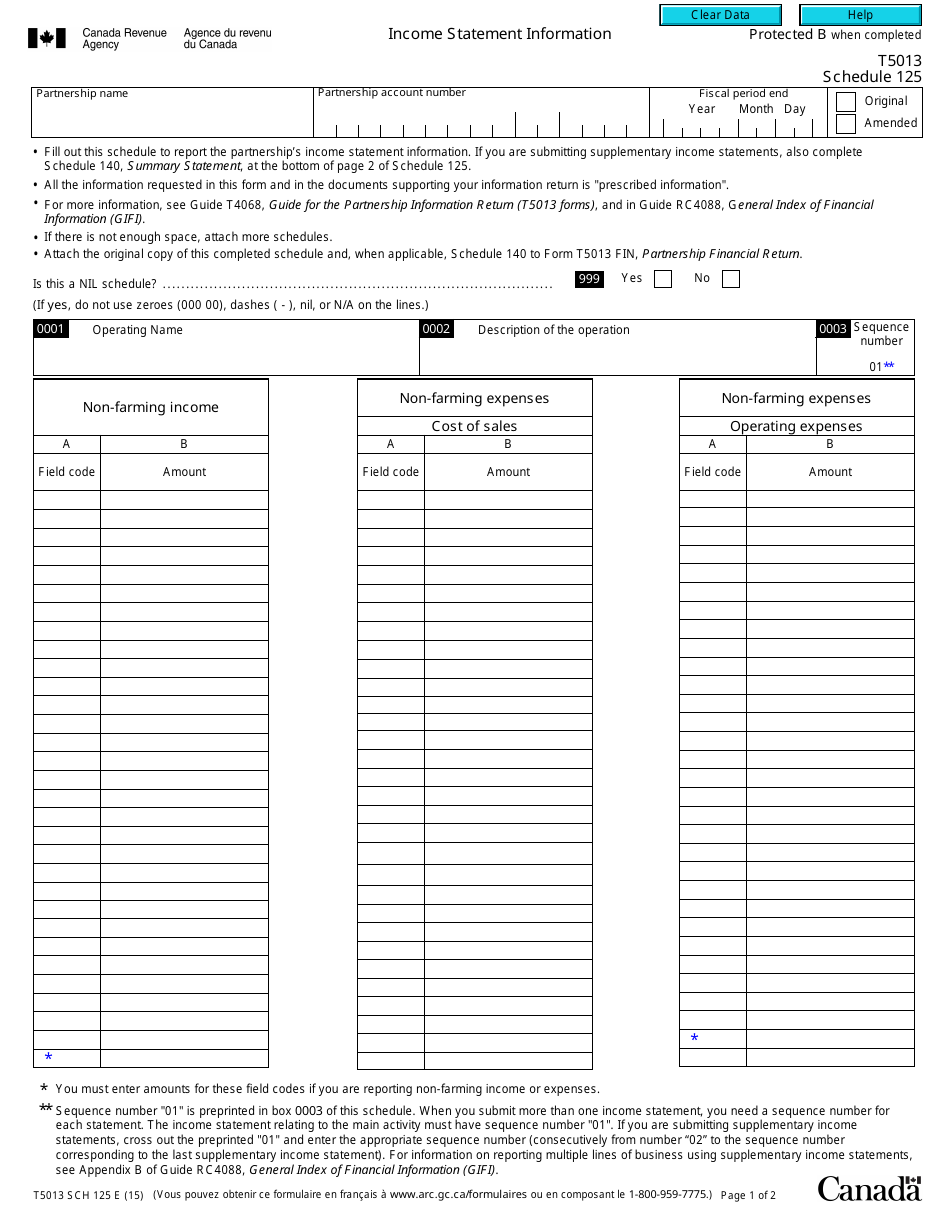

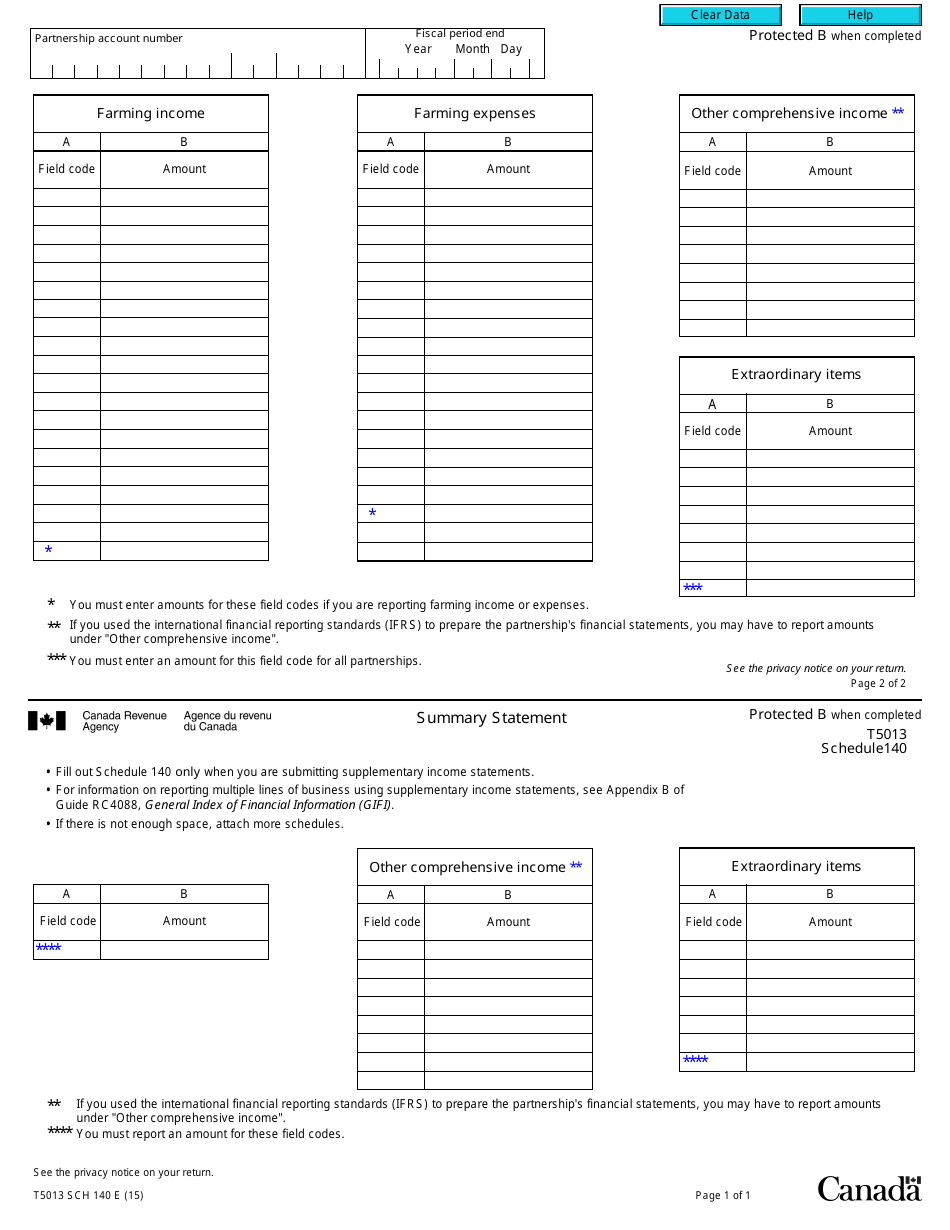

Form T5013 Schedule 125

for the current year.

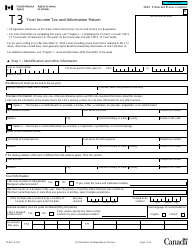

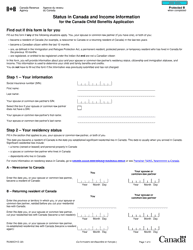

Form T5013 Schedule 125 Income Statement Information - Canada

Form T5013 SCH 125 is a Canadian Revenue Agency form also known as the "Form T5013 Sch 125 Schedule 125 "income Statement Information" - Canada" . The latest edition of the form was released in January 1, 2015 and is available for digital filing.

Download an up-to-date Form T5013 SCH 125 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T5013 Schedule 125?

A: Form T5013 Schedule 125 is a form used in Canada to report income statement information from partnerships.

Q: Who needs to use Form T5013 Schedule 125?

A: Partnerships in Canada need to use Form T5013 Schedule 125 to report their income statement information.

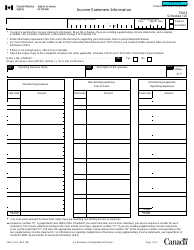

Q: What information is reported on Form T5013 Schedule 125?

A: Form T5013 Schedule 125 is used to report the partnership's income, expenses, and other financial information.

Q: How do I file Form T5013 Schedule 125?

A: Form T5013 Schedule 125 is filed as part of the T5013 Partnership Information Return.

Q: What is the deadline to file Form T5013 Schedule 125?

A: The deadline to file Form T5013 Schedule 125 is the same as the deadline to file the T5013 Partnership Information Return, which is usually 5 months after the partnership's fiscal year-end.

Q: What are the penalties for late filing of Form T5013 Schedule 125?

A: The penalties for late filing of Form T5013 Schedule 125 can vary depending on the circumstances, but it is generally advisable to file the form on time to avoid any penalties or interest charges.

Q: Are there any exceptions or special rules for Form T5013 Schedule 125?

A: There may be certain exceptions or special rules that apply to filing Form T5013 Schedule 125, so it is recommended to consult the CRA or a tax professional for specific guidance.

Q: Is Form T5013 Schedule 125 only for partnerships?

A: Yes, Form T5013 Schedule 125 is specifically for partnerships and is not used for reporting income statement information for other types of entities.