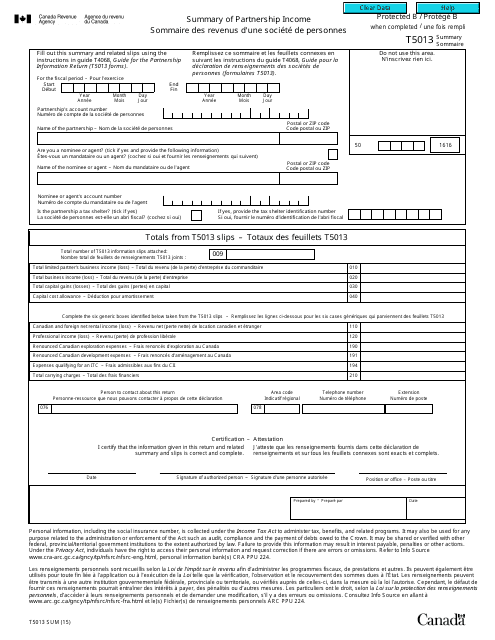

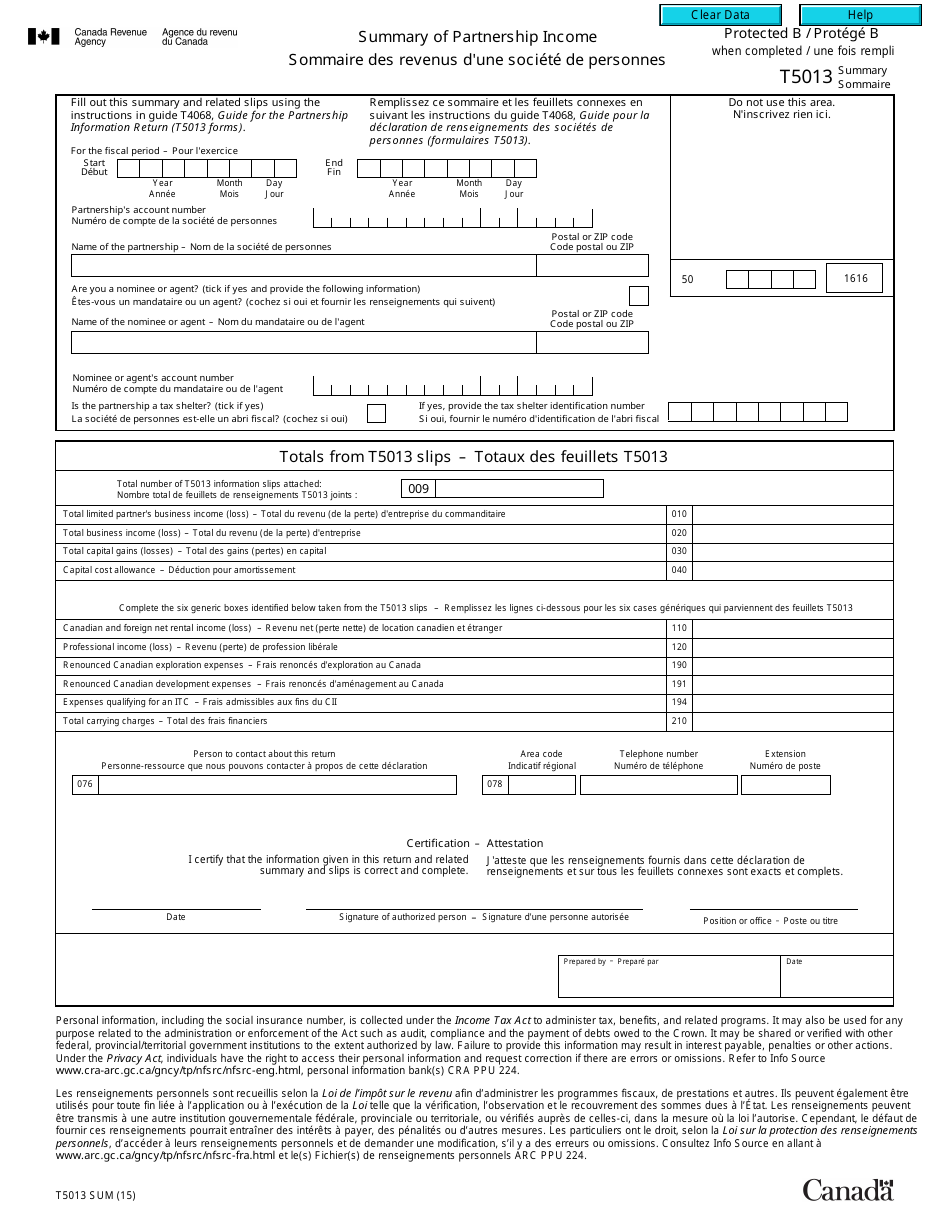

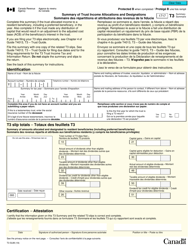

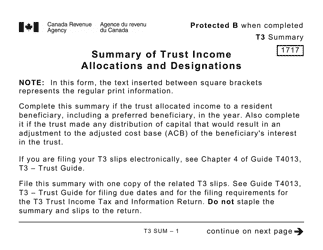

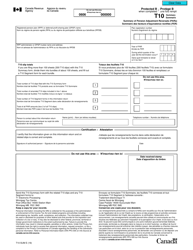

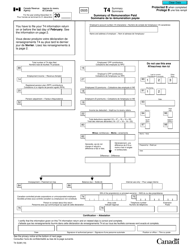

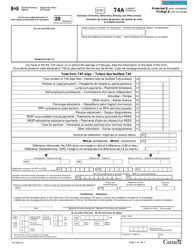

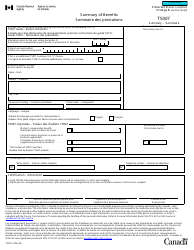

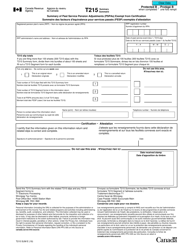

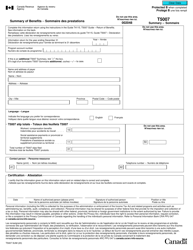

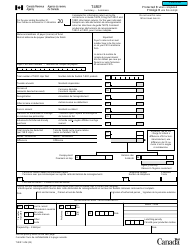

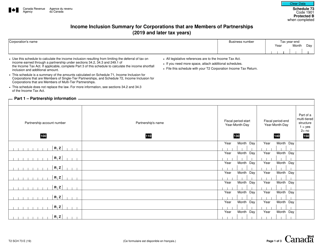

Form T5013 SUM Summary of Partnership Income - Canada (English / French)

Form T5013 SUM Summary of Partnership Income in Canada is used to report the income, losses, and expenses of a partnership for a specific tax year. It provides a summary of the partnership's financial information, including income distribution to partners, capital balance, and other relevant details. This form is to be filled and submitted by partnerships in Canada to the Canada Revenue Agency (CRA) for tax purposes. It helps ensure accurate reporting and compliance with the tax laws. The form is available in both English and French to cater to the bilingual requirements of Canada's official languages.

The Form T5013 SUM Summary of Partnership Income in Canada is typically filed by the partnership itself. This form provides a summary of the partnership's income, deductions, and other financial information. It is necessary for partnerships to accurately report their income and distribute T5013 slips to their partners. The form can be filed in either English or French, depending on the preference of the partnership.

FAQ

Q: What is Form T5013 SUM?

A: Form T5013 SUM is the Summary of Partnership Income for Canadian tax purposes.

Q: Who needs to file Form T5013 SUM?

A: Partnerships in Canada are required to file Form T5013 SUM.

Q: When is the deadline to file Form T5013 SUM?

A: The deadline to file Form T5013 SUM is within six months after the end of the partnership's fiscal period.

Q: Can Form T5013 SUM be filed electronically?

A: Yes, Form T5013 SUM can be filed electronically using the Canada Revenue Agency's (CRA) Internet File Transfer service.

Q: What information is required to complete Form T5013 SUM?

A: Form T5013 SUM requires information such as the partnership's name, address, fiscal period, income, expenses, and other financial details.

Q: Is Form T5013 SUM available in both English and French?

A: Yes, Form T5013 SUM is available in both English and French versions for taxpayers in Canada.

Q: Are there any penalties for not filing Form T5013 SUM?

A: Yes, failure to file Form T5013 SUM can result in penalties imposed by the Canada Revenue Agency (CRA).