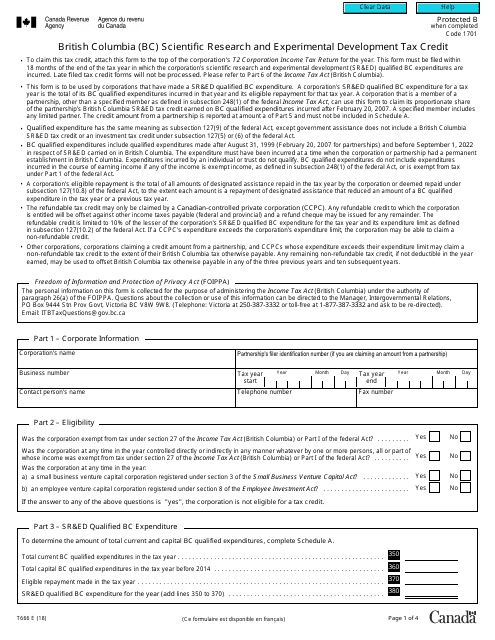

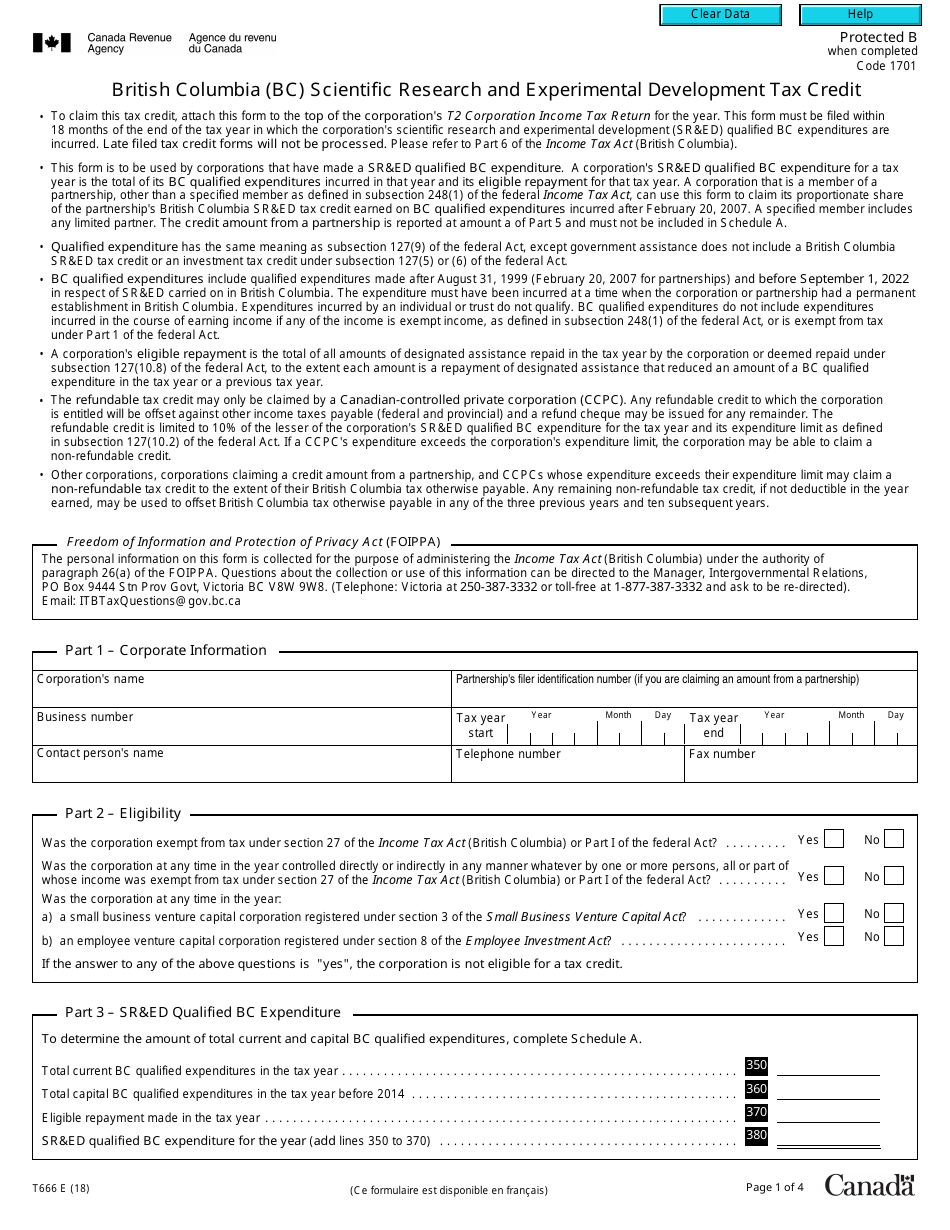

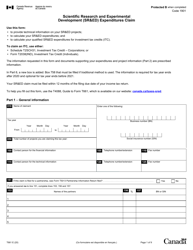

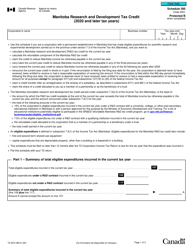

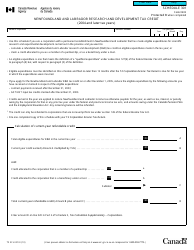

Form T666 British Columbia (Bc) Scientific Research and Experimental Development Tax Credit - Canada

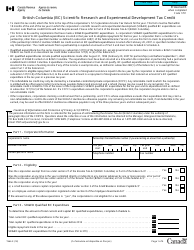

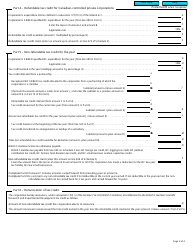

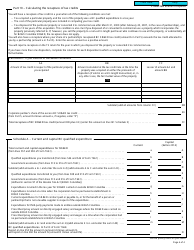

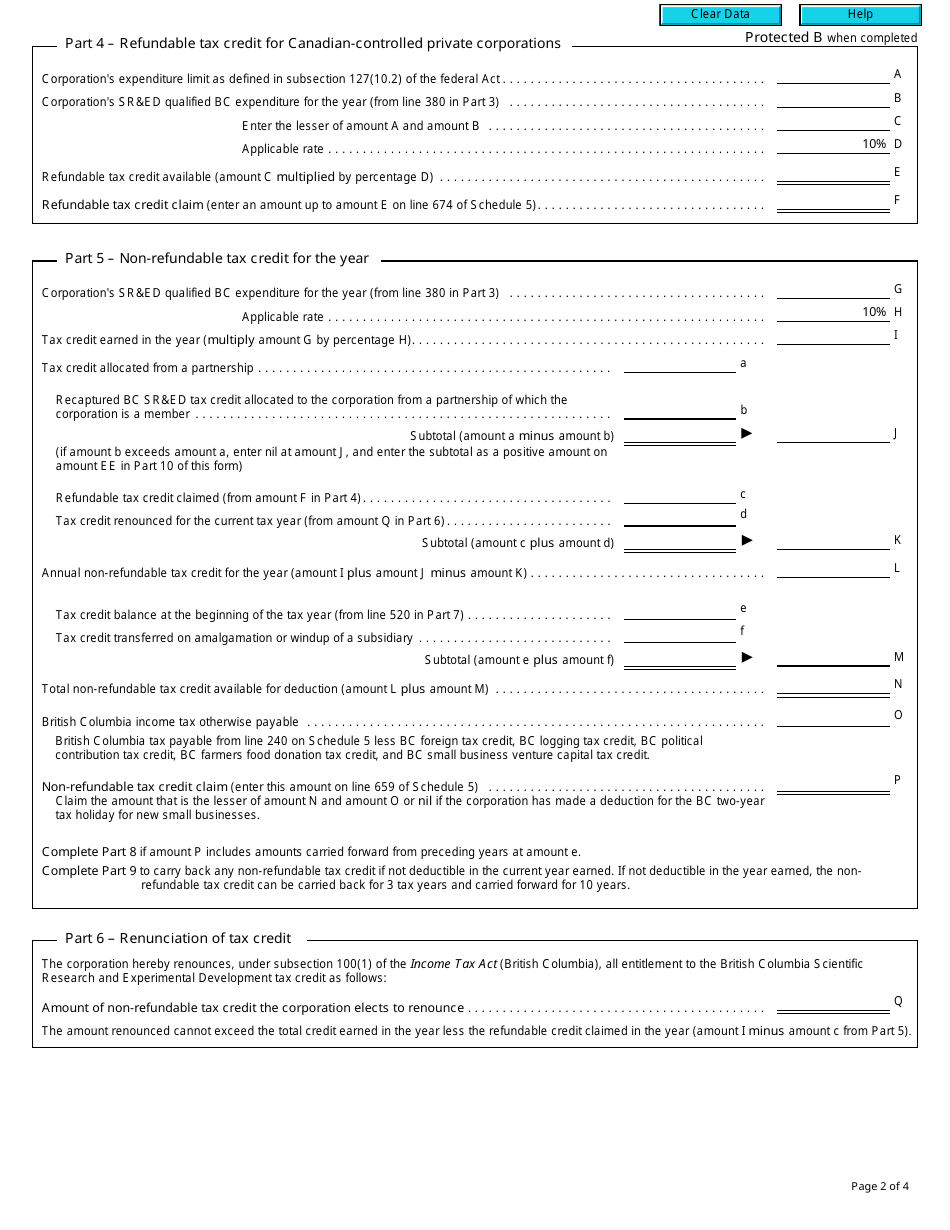

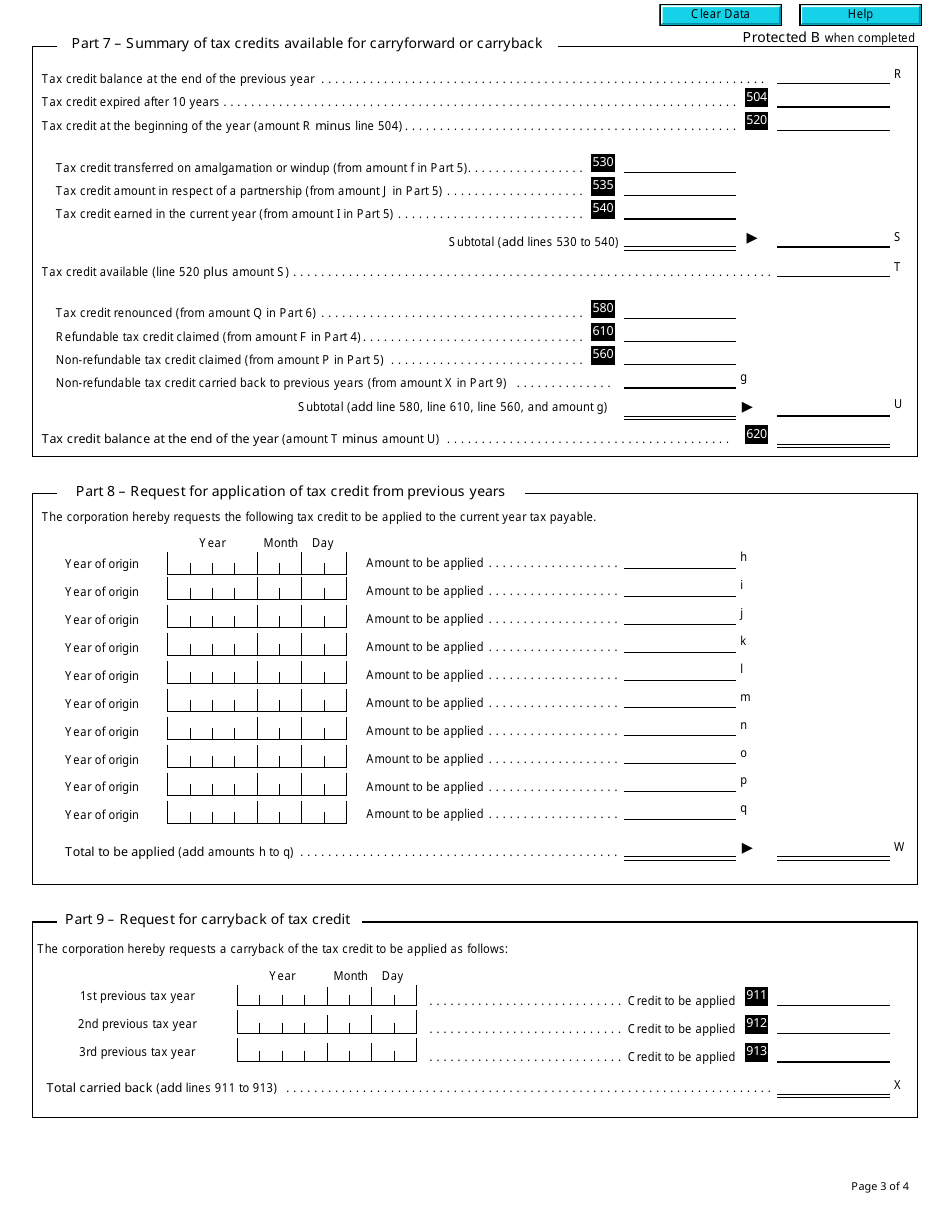

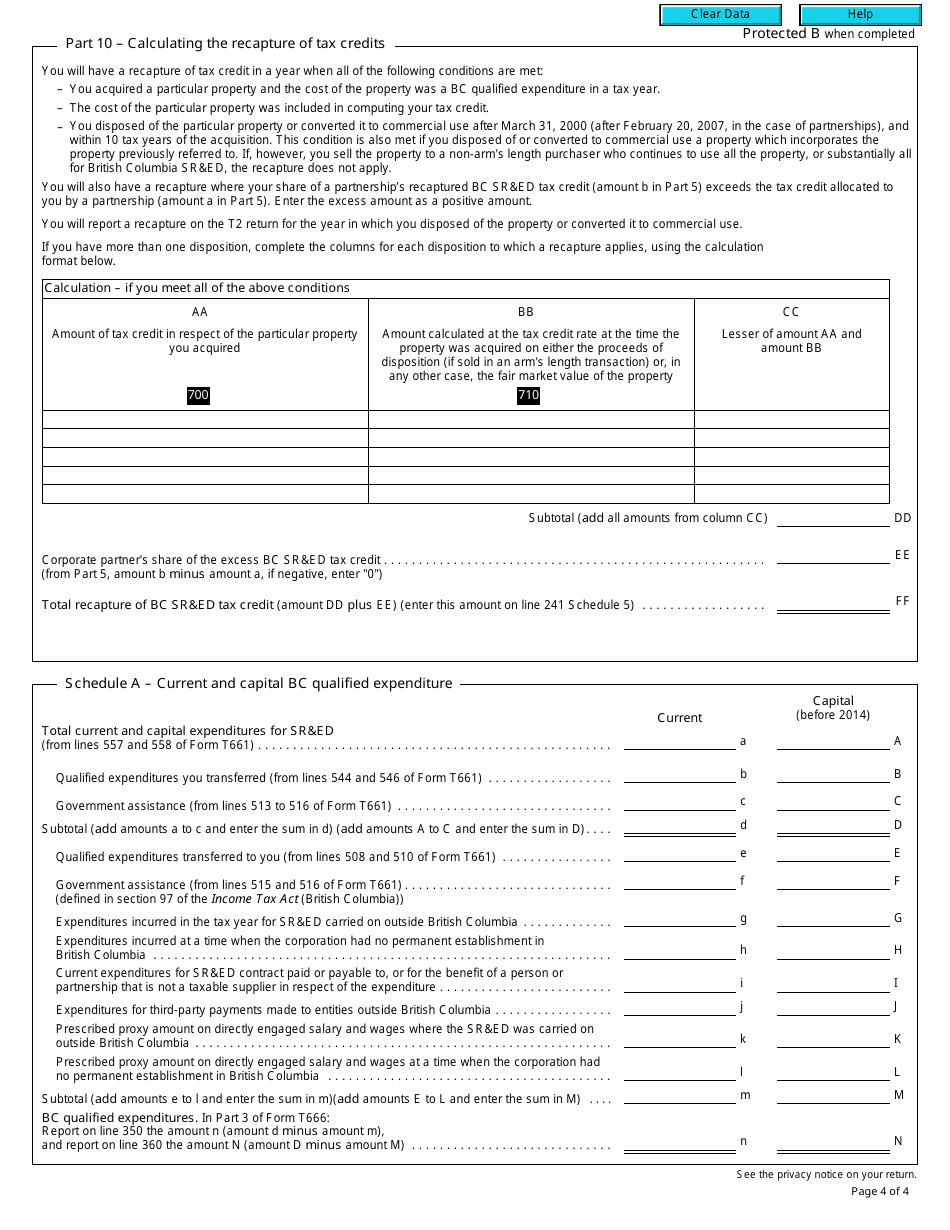

Form T666 is used in British Columbia, Canada for claiming the Scientific Research and Experimental Development (SR&ED) Tax Credit. This tax credit is provided to taxpayers who have undertaken eligible scientific research and experimental development activities in British Columbia. The form is used to provide details about the claimed expenditures and the qualifying activities.

The Form T666 British Columbia Scientific Research and Experimental Development Tax Credit in Canada is typically filed by corporations or individuals who are claiming the tax credit for scientific research and experimental development conducted in British Columbia.

FAQ

Q: What is Form T666?

A: Form T666 is a tax form used in British Columbia, Canada.

Q: What is the BC Scientific Research and Experimental Development Tax Credit?

A: The BC Scientific Research and Experimental Development Tax Credit is a tax credit program in British Columbia, Canada.

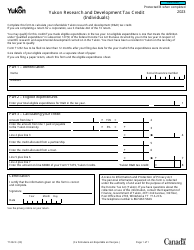

Q: Who is eligible for the BC Scientific Research and Experimental Development Tax Credit?

A: Eligible organizations that conduct scientific research and experimental development activities in British Columbia can apply for this tax credit.

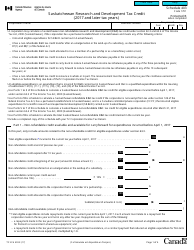

Q: What expenses qualify for the BC Scientific Research and Experimental Development Tax Credit?

A: Expenses related to scientific research and experimental development activities, such as wages, materials, and overhead costs, may qualify for this tax credit.

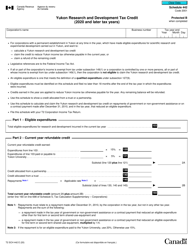

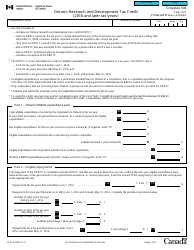

Q: How much tax credit can be claimed through the BC Scientific Research and Experimental Development Tax Credit?

A: The amount of tax credit that can be claimed varies depending on the type of eligible organization and the qualifying expenditures.

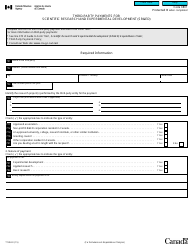

Q: How do I apply for the BC Scientific Research and Experimental Development Tax Credit?

A: To apply for this tax credit, organizations need to complete and submit Form T666 to the Canada Revenue Agency (CRA).

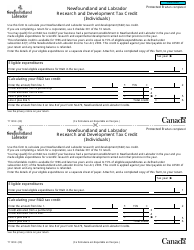

Q: Can individuals claim the BC Scientific Research and Experimental Development Tax Credit?

A: No, this tax credit is specifically designed for eligible organizations and not for individuals.

Q: Is the BC Scientific Research and Experimental Development Tax Credit refundable?

A: No, this tax credit is non-refundable, which means it can only be used to reduce the organization's tax liability.