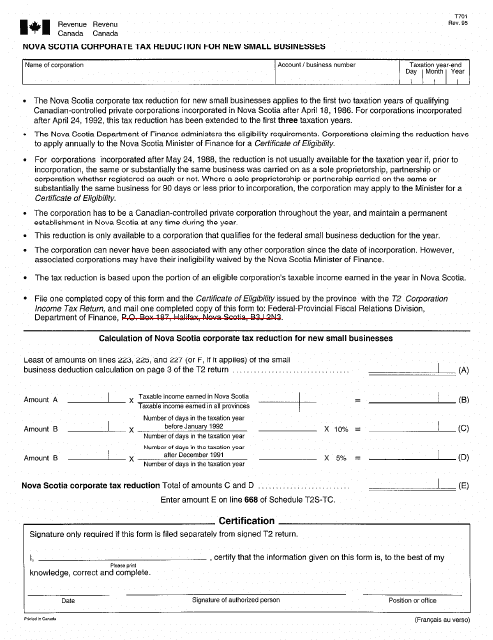

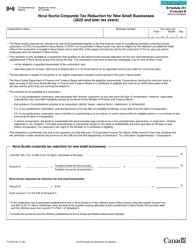

Form T701 Nova Scotia Corporate Tax Reduction for New Small Businesses - Canada

Form T701 Nova Scotia Corporate Tax Reduction for New Small Businesses is used to claim the Nova Scotia Small Business Investor Tax Credit. This credit provides tax reduction to eligible small businesses in Nova Scotia for investment made by an individual in the shares of a qualified small business corporation.

The Form T701 Nova Scotia Corporate Tax Reduction for New Small Businesses in Canada is filed by small businesses in Nova Scotia.

FAQ

Q: What is Form T701?

A: Form T701 is a tax form used in Nova Scotia, Canada.

Q: Who can use Form T701?

A: Form T701 is used by new small businesses in Nova Scotia.

Q: What is the purpose of Form T701?

A: The purpose of Form T701 is to claim a reduction in corporate tax for new small businesses in Nova Scotia.

Q: What is the criteria for eligibility?

A: To be eligible for the corporate tax reduction, businesses must meet certain criteria such as being a new small business in Nova Scotia.

Q: Are there any deadlines for filing Form T701?

A: Yes, there are specific deadlines for filing Form T701. It is important to check with the CRA or consult a tax professional to ensure compliance with the deadlines.

Q: What are the benefits of using Form T701?

A: Using Form T701 allows eligible new small businesses to reduce their corporate tax liability in Nova Scotia.

Q: Can Form T701 be used in other provinces?

A: No, Form T701 is specific to Nova Scotia. Other provinces may have their own forms and programs for tax reductions.

Q: Are there any limitations or restrictions for claiming the tax reduction?

A: There may be limitations and restrictions for claiming the tax reduction outlined in the instructions and guidelines provided with Form T701. It is important to review and follow these guidelines.

Q: Is professional assistance required to fill out Form T701?

A: While professional assistance is not required, it is recommended to consult a tax professional or accountant for accurate completion of Form T701.

Q: What should I do if I have more questions about Form T701?

A: If you have more questions about Form T701, you can contact the CRA directly or consult a tax professional or accountant for guidance.