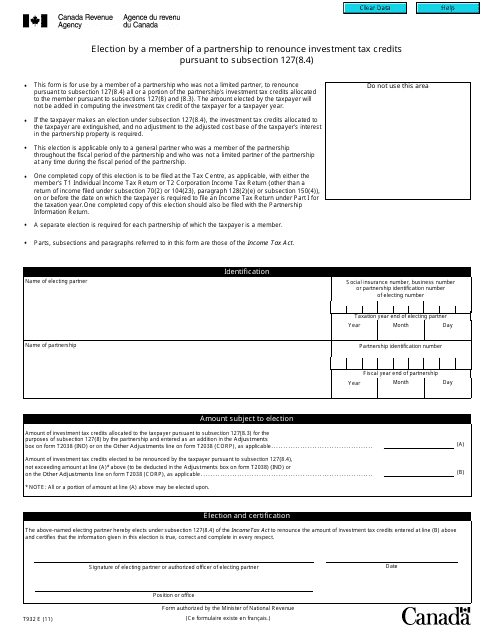

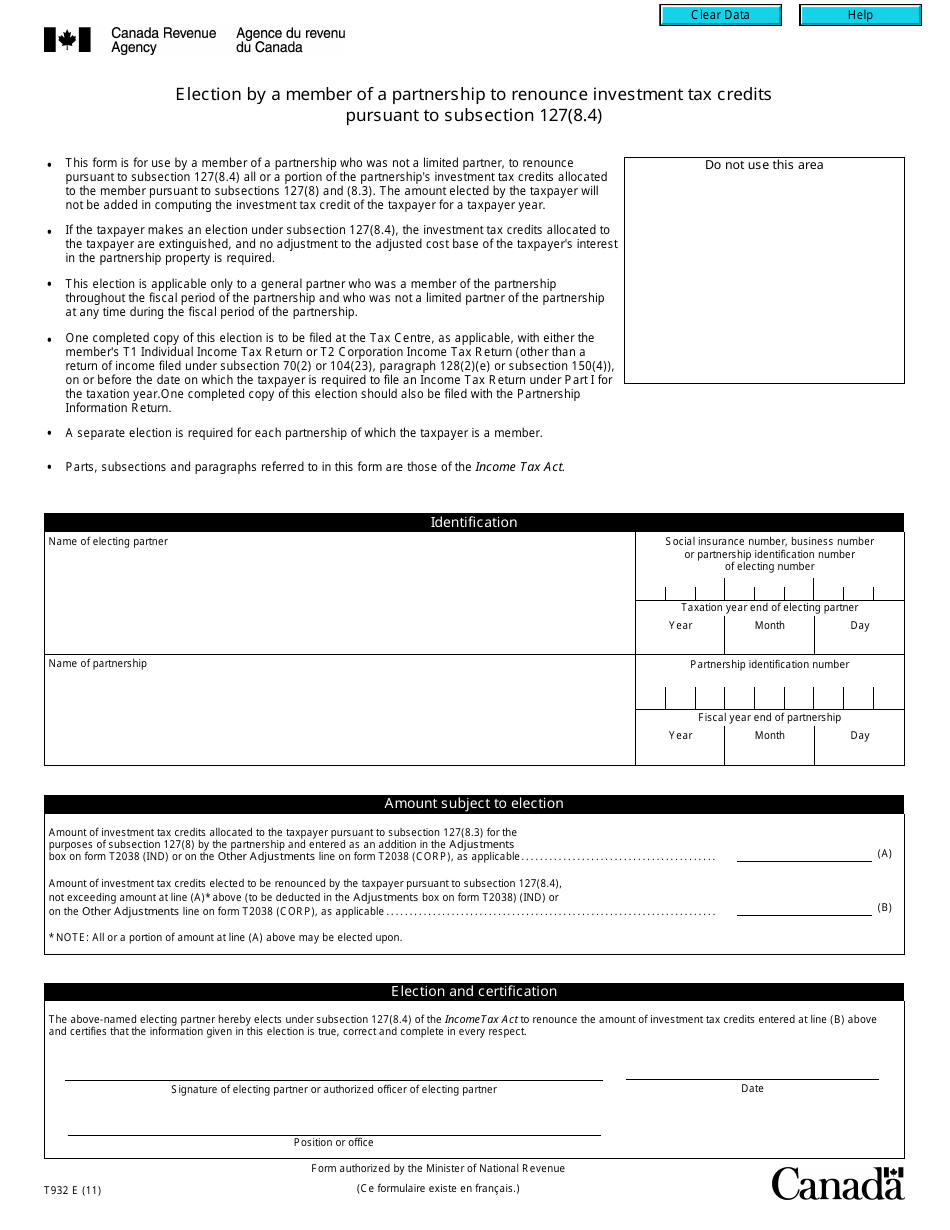

Form T932 Election by a Member of a Partnership to Renounce Investment Tax Credits Pursuant to Subsection 127(8.4) - Canada

Form T932 is used in Canada to renounce investment tax credits by a member of a partnership. By completing this form, the member can elect to renounce their share of investment tax credits under subsection 127(8.4) of the Canadian Income Tax Act. This renouncement allows the other members of the partnership to utilize those tax credits instead.

FAQ

Q: What is a Form T932?

A: Form T932 is a form in Canada used by a member of a partnership to renounce investment tax credits.

Q: What is the purpose of Form T932?

A: The purpose of Form T932 is to renounce investment tax credits.

Q: Who can use Form T932?

A: Form T932 is used by members of partnerships in Canada.

Q: What does it mean to renounce investment tax credits?

A: To renounce investment tax credits means to give up or reject the credits.

Q: What is Subsection 127(8.4)?

A: Subsection 127(8.4) refers to a specific section of the Canadian tax law.

Q: Why would a member of a partnership want to renounce investment tax credits?

A: There could be various reasons for a member of a partnership to want to renounce investment tax credits, such as not needing them for their own tax purposes.

Q: Are there any requirements or conditions to renounce investment tax credits using Form T932?

A: Yes, there may be specific requirements or conditions outlined in Subsection 127(8.4) and other relevant tax laws.

Q: Is Form T932 applicable only to residents of Canada?

A: Yes, Form T932 is specific to Canadian tax laws and is applicable only to residents of Canada.

Q: Can Form T932 be used for other tax credits?

A: No, Form T932 is specifically for renouncing investment tax credits.

Q: Is professional assistance required to complete Form T932?

A: It is recommended to seek professional assistance, such as a tax advisor or accountant, to ensure accurate completion of Form T932.