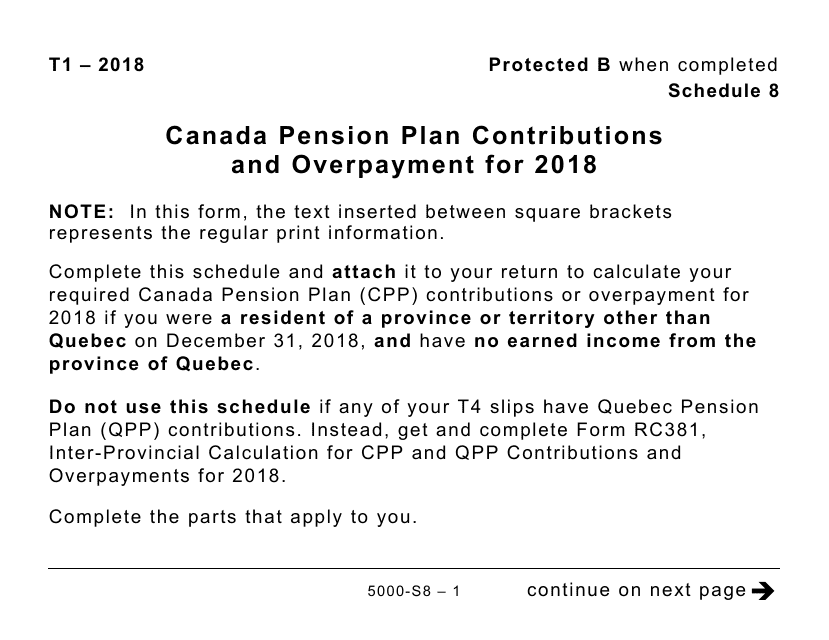

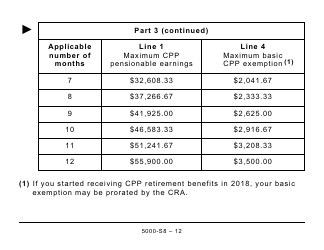

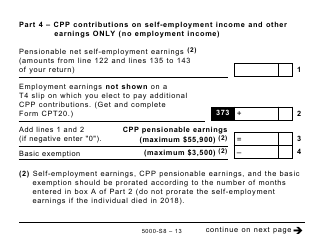

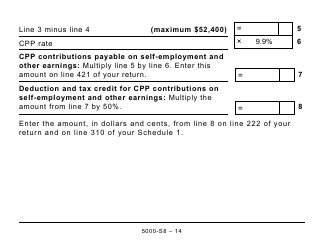

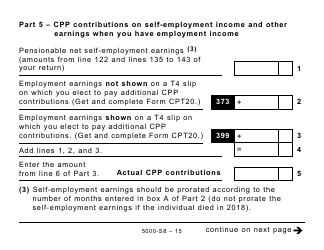

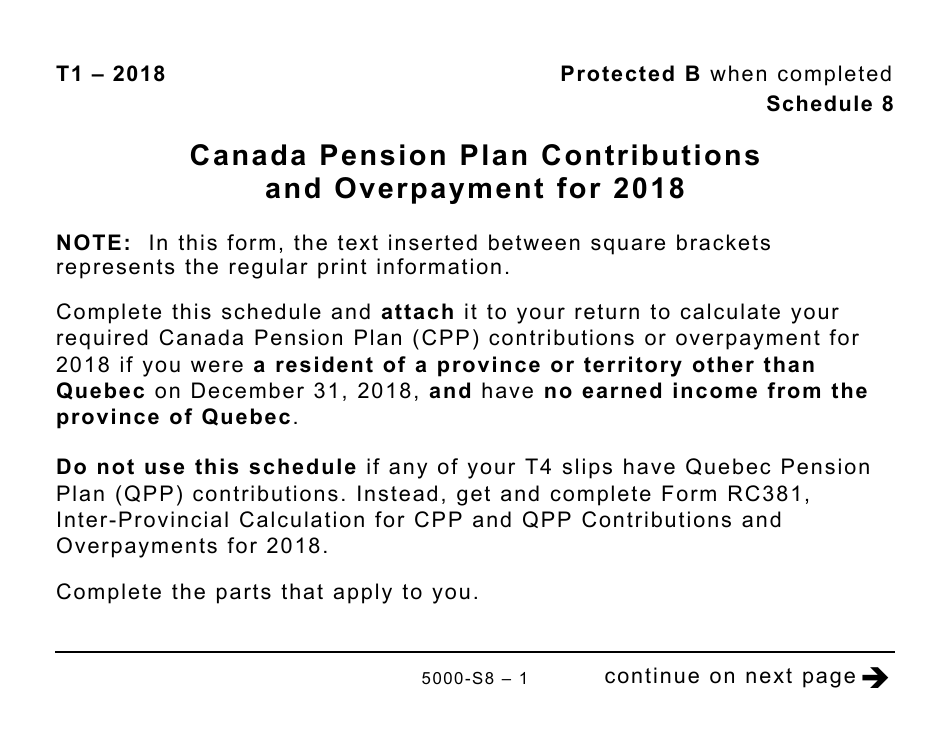

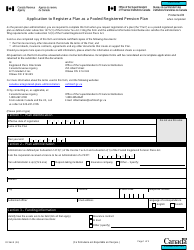

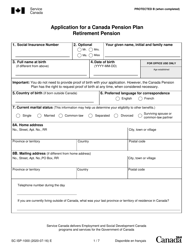

Form 5000-S8 Schedule 8 Canada Pension Plan Contributions and Overpayment (Large Print) - Canada

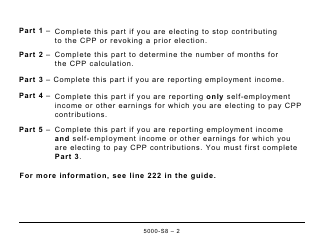

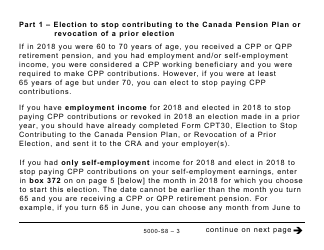

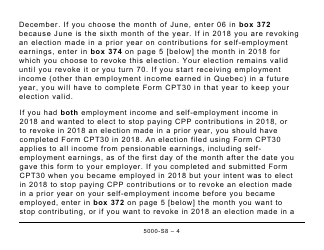

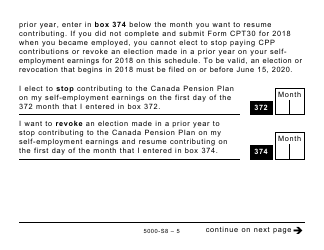

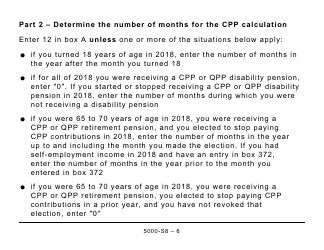

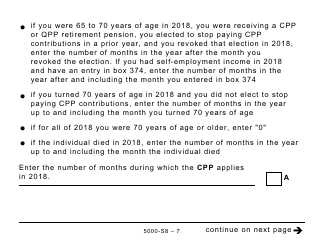

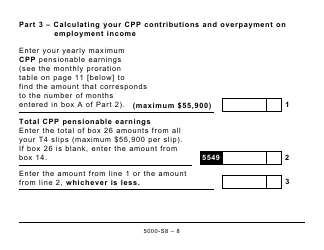

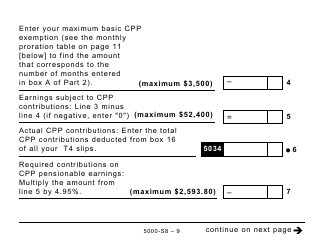

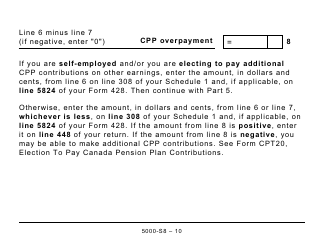

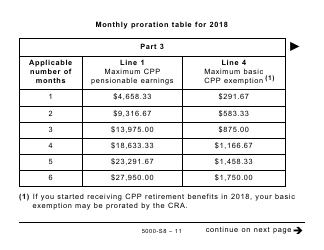

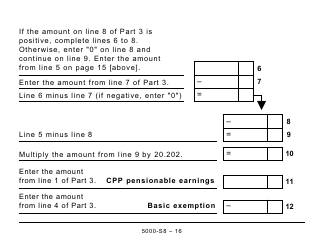

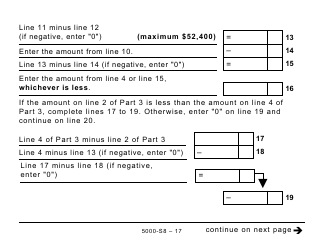

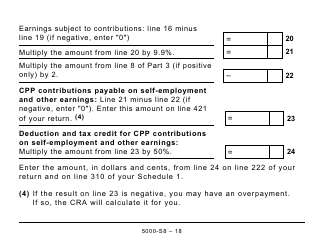

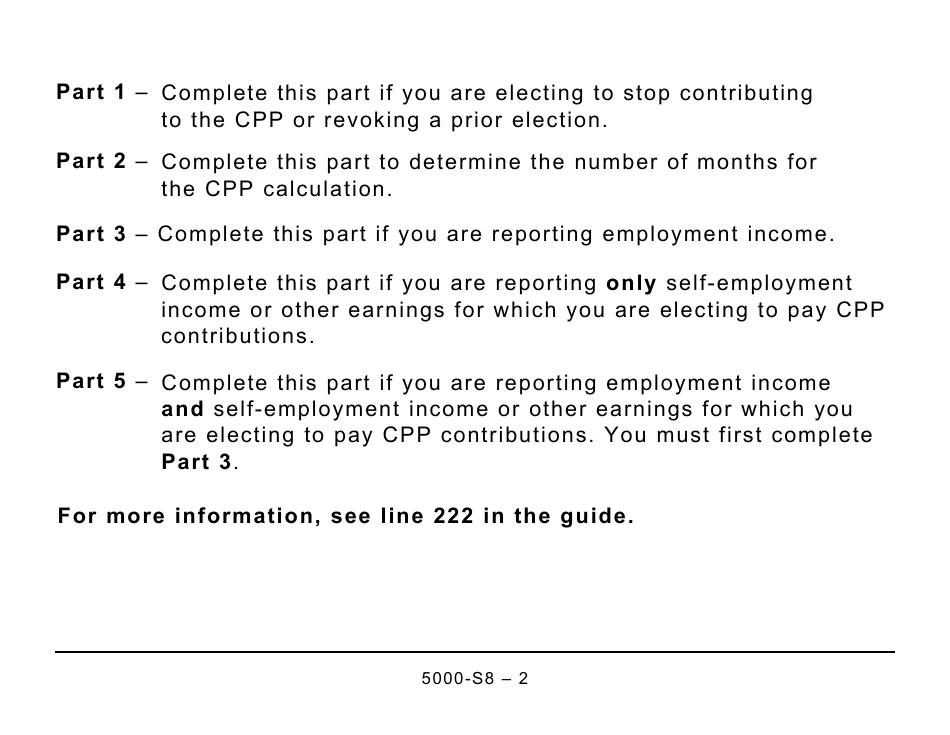

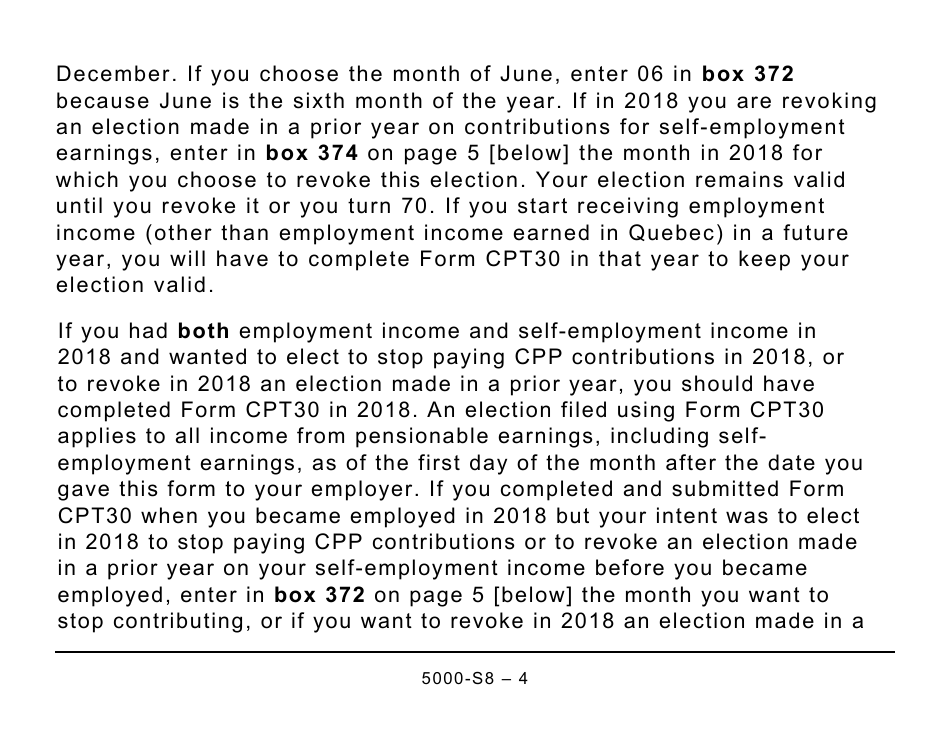

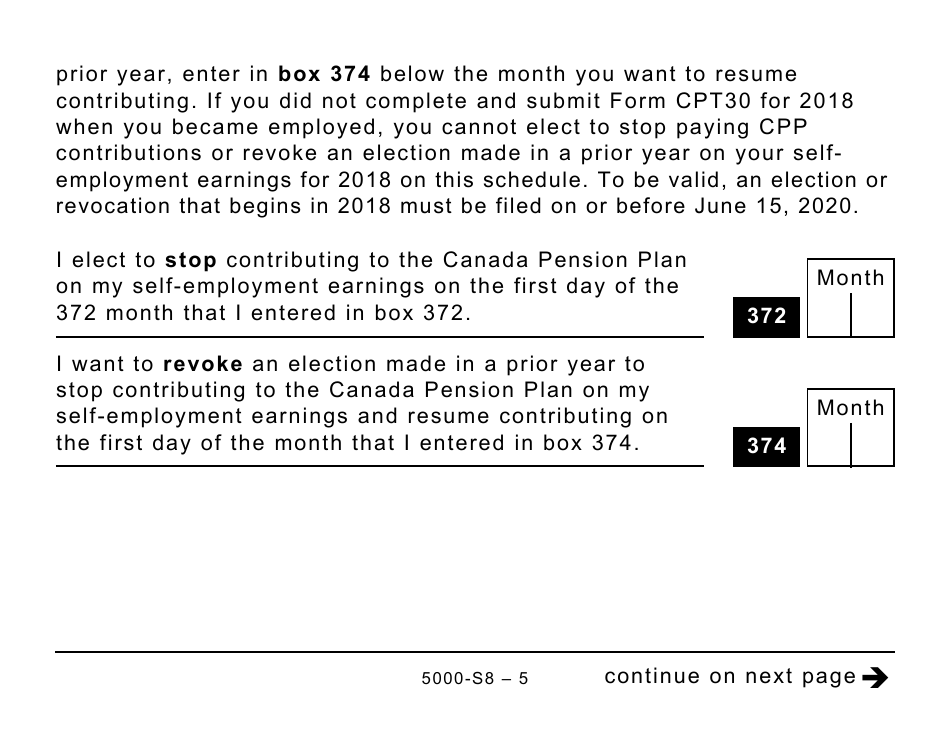

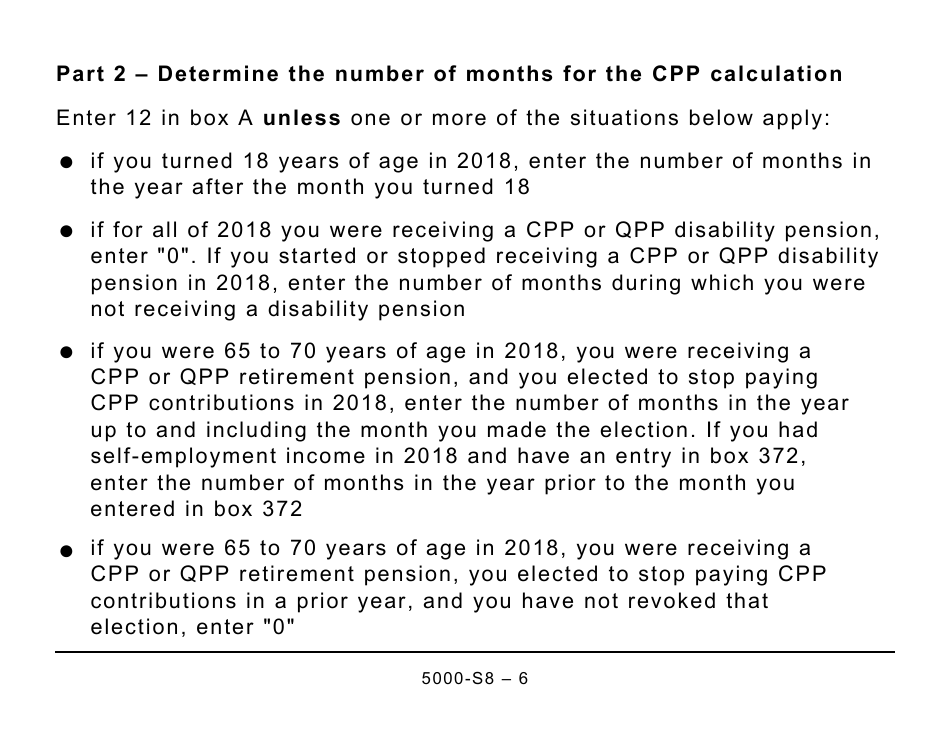

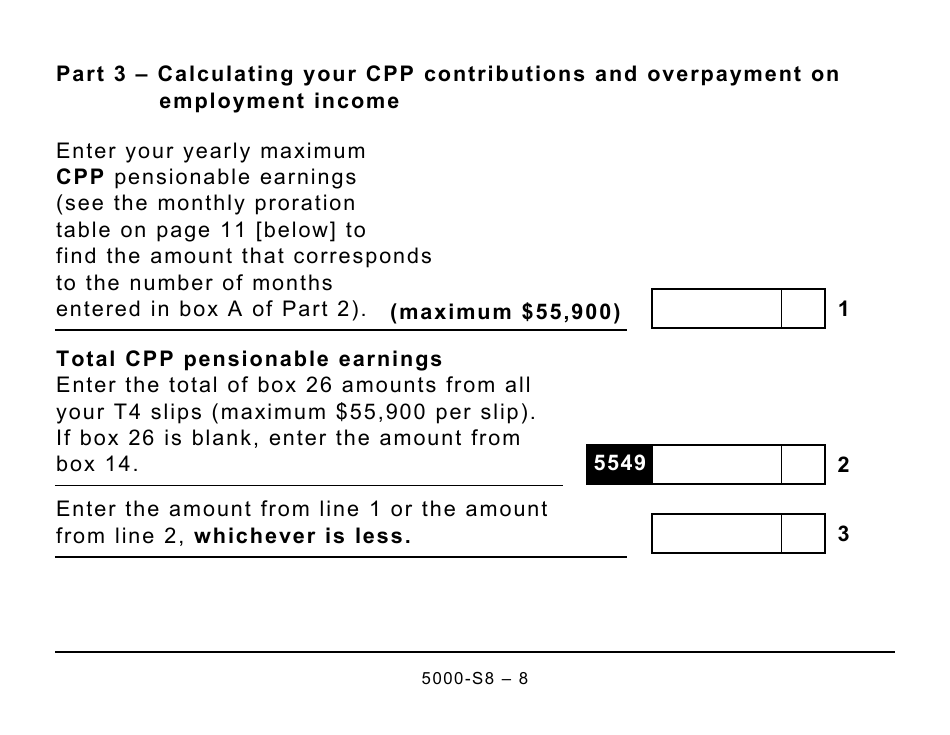

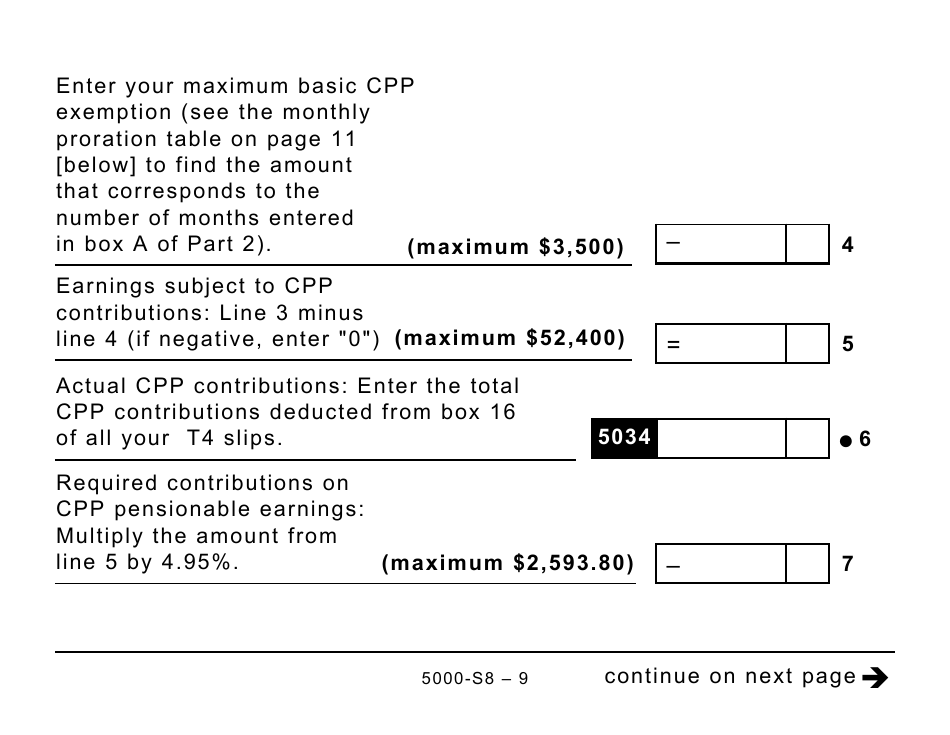

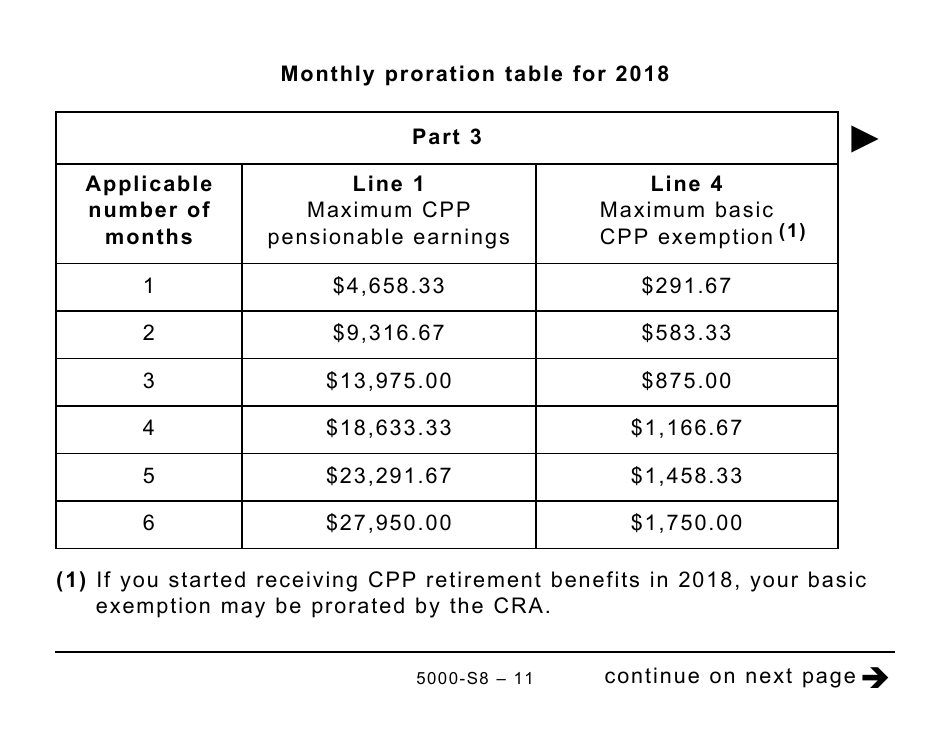

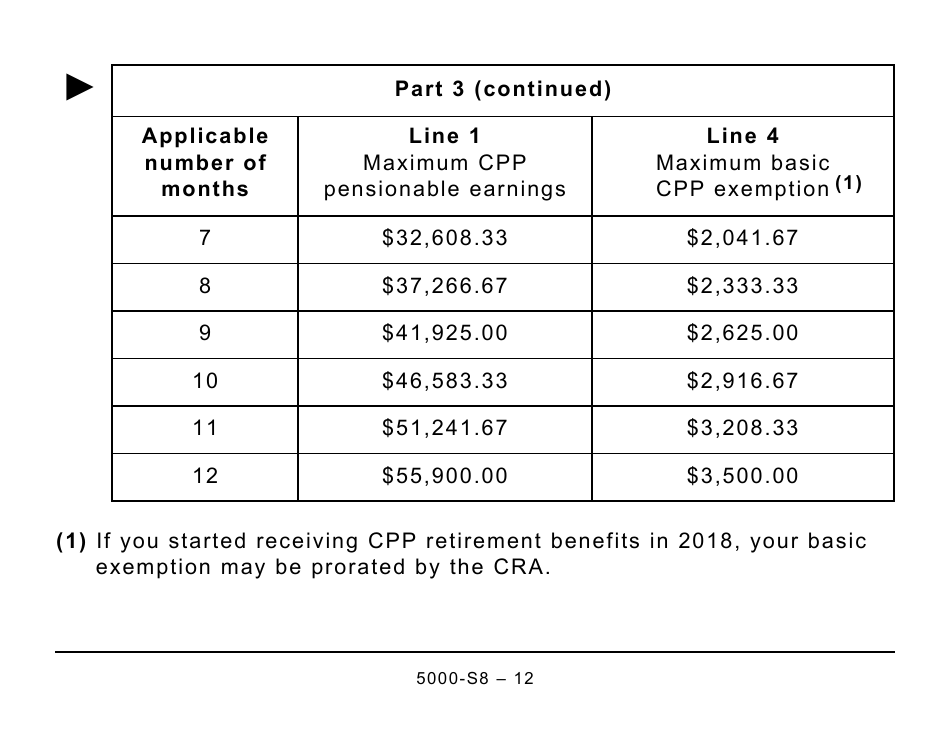

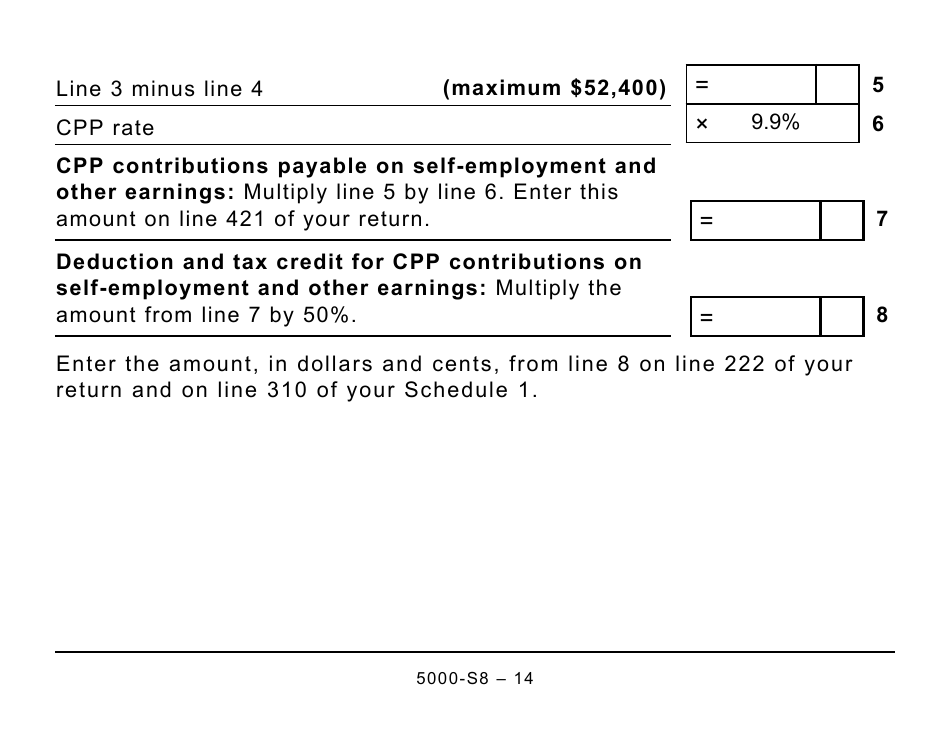

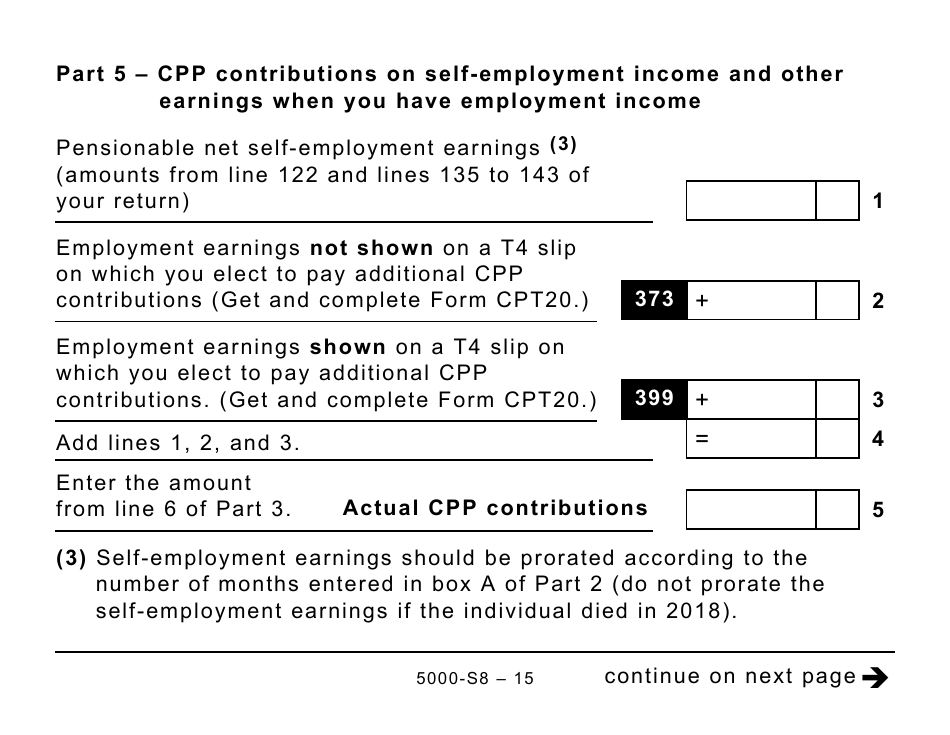

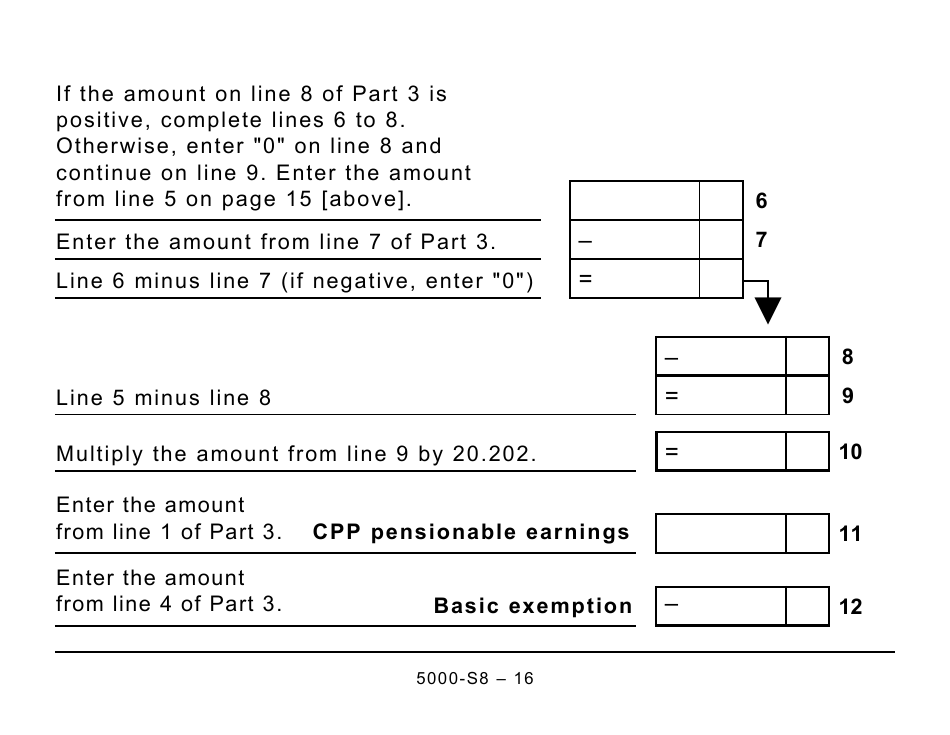

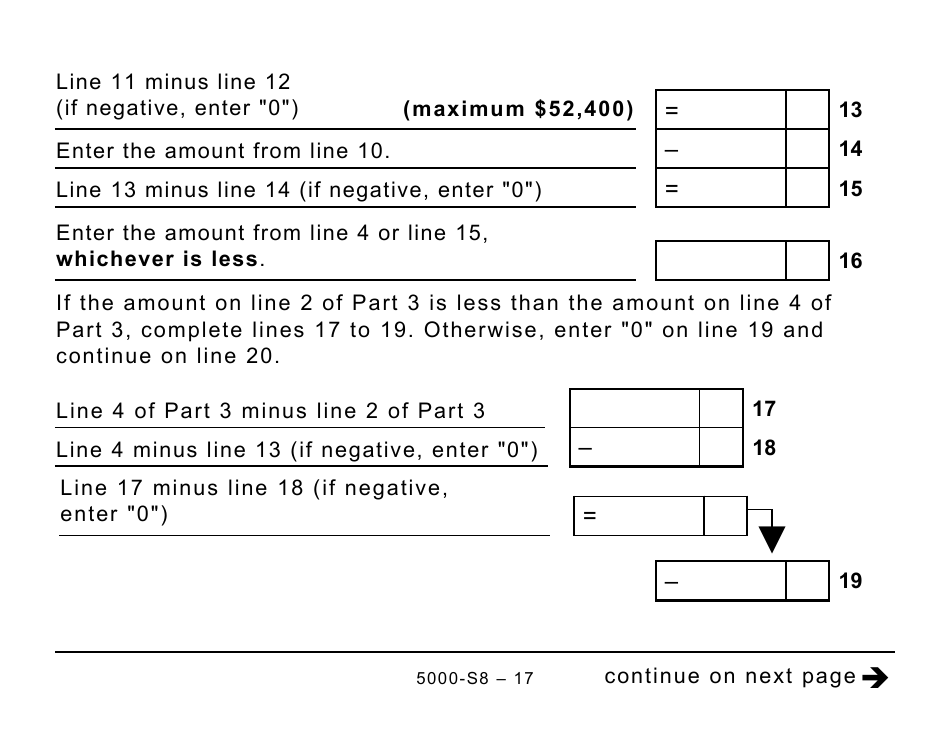

Form 5000-S8 Schedule 8 Canada Pension Plan Contributions and Overpayment (Large Print) is used for reporting and calculating Canada Pension Plan (CPP) contributions and overpayments. It specifically caters to individuals who require large print versions of the form.

Individuals who have made contributions to the Canada Pension Plan (CPP) and have overpaid can file the Form 5000-S8 Schedule 8 Canada Pension Plan Contributions and Overpayment (Large Print) in Canada.

FAQ

Q: What is Form 5000-S8 Schedule 8?

A: Form 5000-S8 Schedule 8 is a document used in Canada to report Canada Pension Plan contributions and any overpayment.

Q: Who should use Form 5000-S8 Schedule 8?

A: Form 5000-S8 Schedule 8 should be used by individuals who need to report their Canada Pension Plan contributions and any overpayment.

Q: What is the purpose of Form 5000-S8 Schedule 8?

A: The purpose of Form 5000-S8 Schedule 8 is to provide information about Canada Pension Plan contributions and any overpayment for tax purposes.

Q: Is Form 5000-S8 Schedule 8 available in large print?

A: Yes, Form 5000-S8 Schedule 8 is available in large print for individuals who may require it.