This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5000-S6 Schedule 6

for the current year.

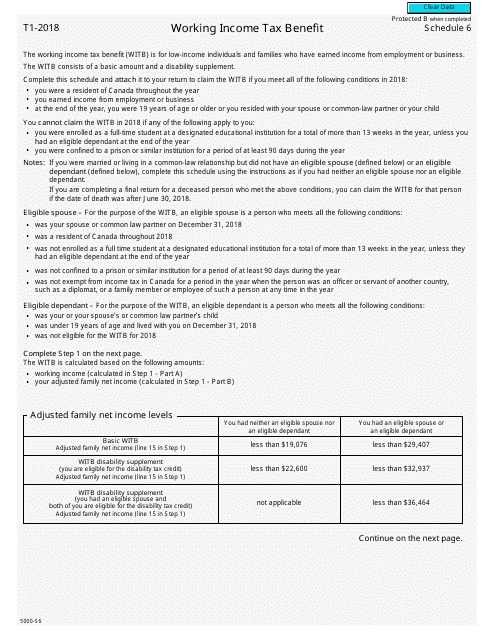

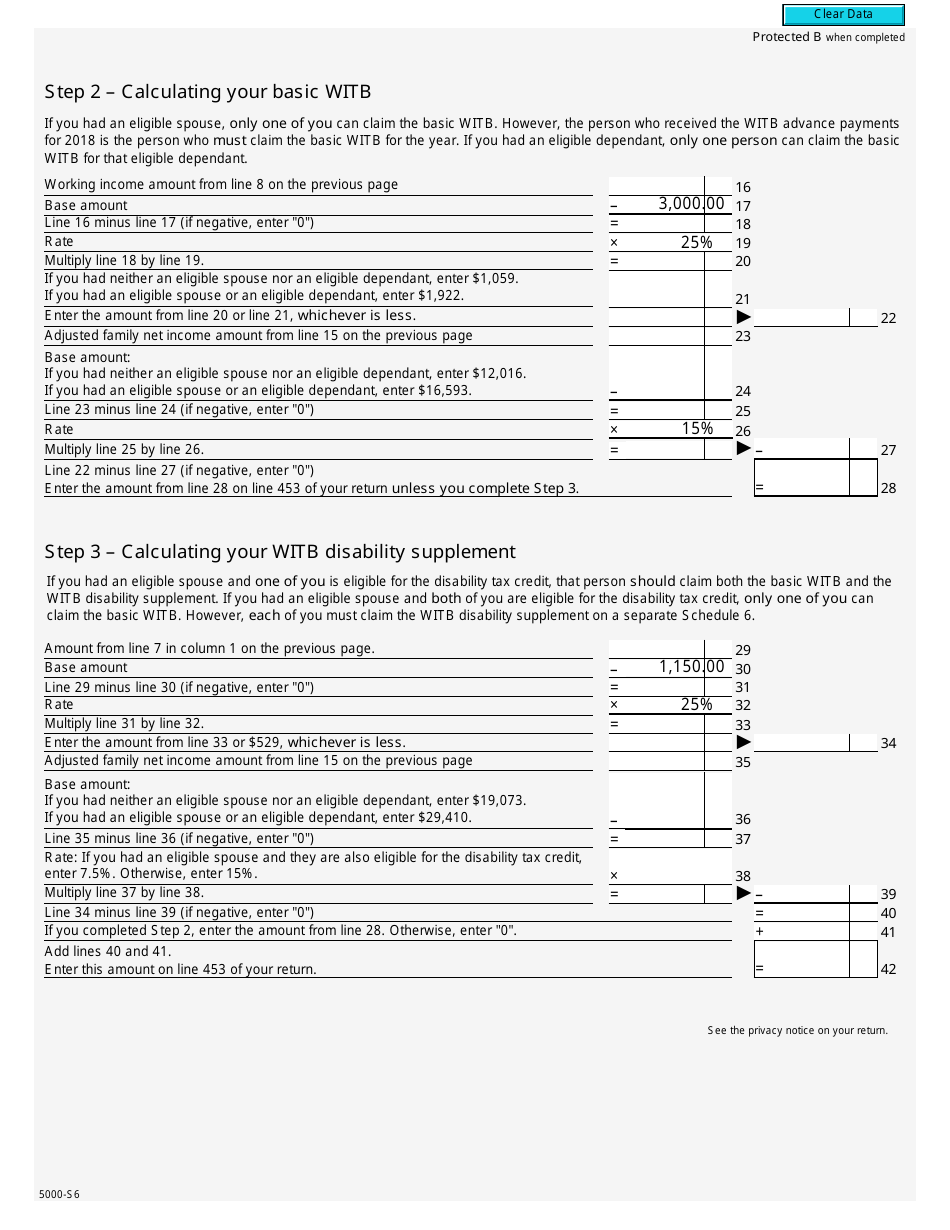

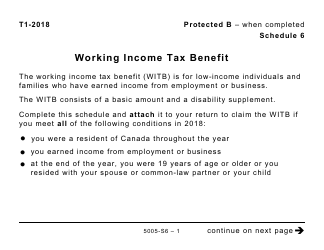

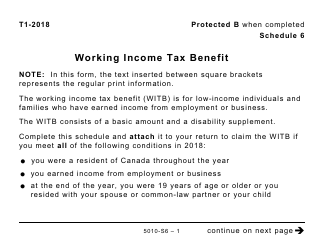

Form 5000-S6 Schedule 6 Working Income Tax Benefit - Canada

This Canada-specific " Working Income Tax Benefit " is a document released by the Canadian Revenue Agency .

Download the fillable PDF by clicking the link below and use it according to the applicable legal guidelines.

FAQ

Q: What is Form 5000-S6?

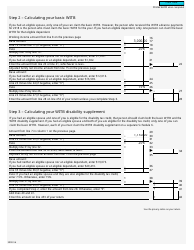

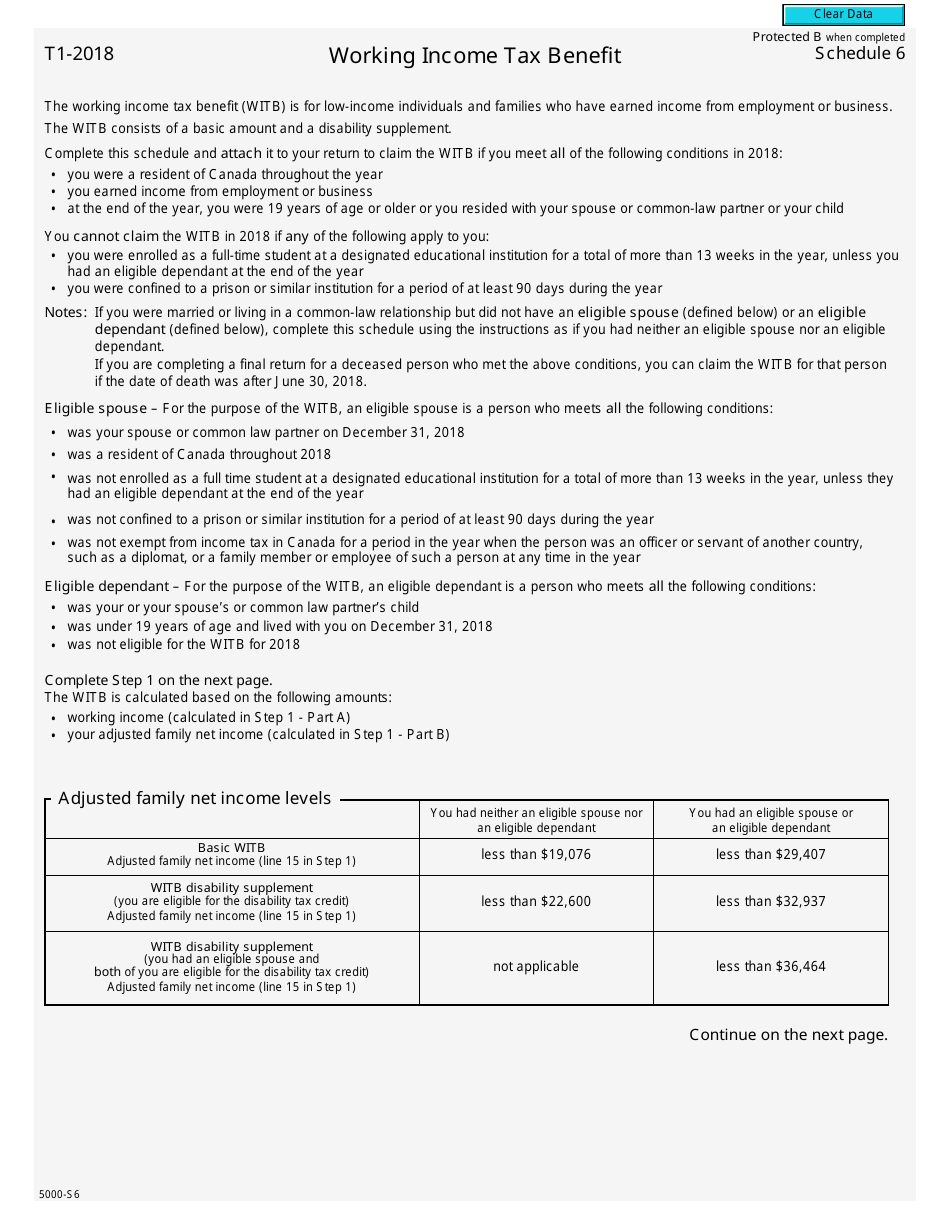

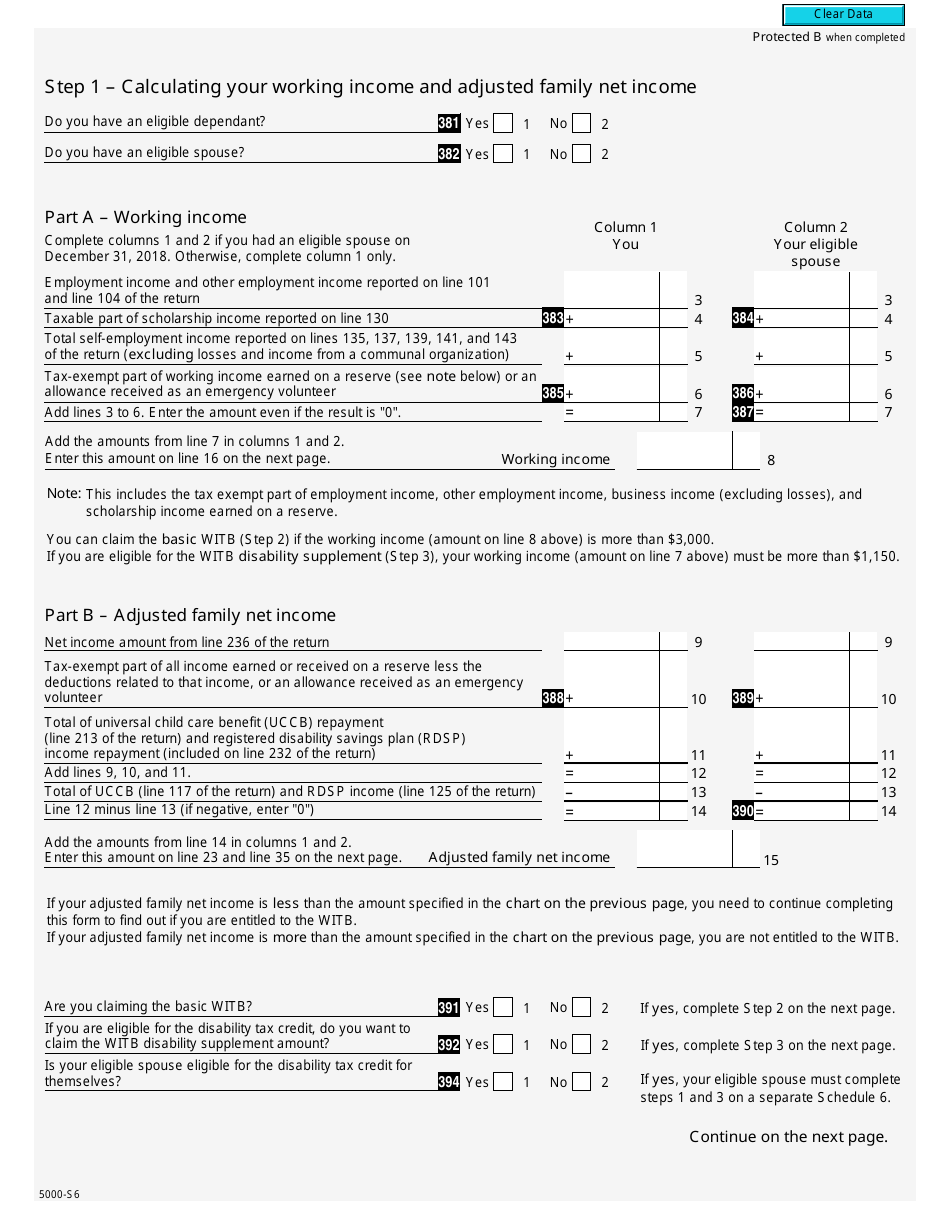

A: Form 5000-S6 is a schedule used in Canada to claim the Working Income Tax Benefit.

Q: What is the Working Income Tax Benefit (WITB)?

A: The Working Income Tax Benefit (WITB) is a refundable tax credit in Canada designed to help low-income individuals and families who are in the workforce.

Q: Who can claim the WITB?

A: Individuals and families in Canada with working income and who meet certain eligibility criteria can claim the WITB.

Q: What information is required to complete Form 5000-S6?

A: To complete Form 5000-S6, you will need to provide your personal information, such as your name, Social Insurance Number (SIN), and working income details.

Q: How do I submit Form 5000-S6?

A: You can submit Form 5000-S6 along with your income tax return to the Canada Revenue Agency (CRA).

Q: When is the deadline to file Form 5000-S6?

A: The deadline to file Form 5000-S6 is the same as the deadline for filing your income tax return. It is typically April 30th, but may be extended in certain circumstances.

Q: Is the WITB taxable income?

A: No, the Working Income Tax Benefit (WITB) is not considered taxable income.