This version of the form is not currently in use and is provided for reference only. Download this version of

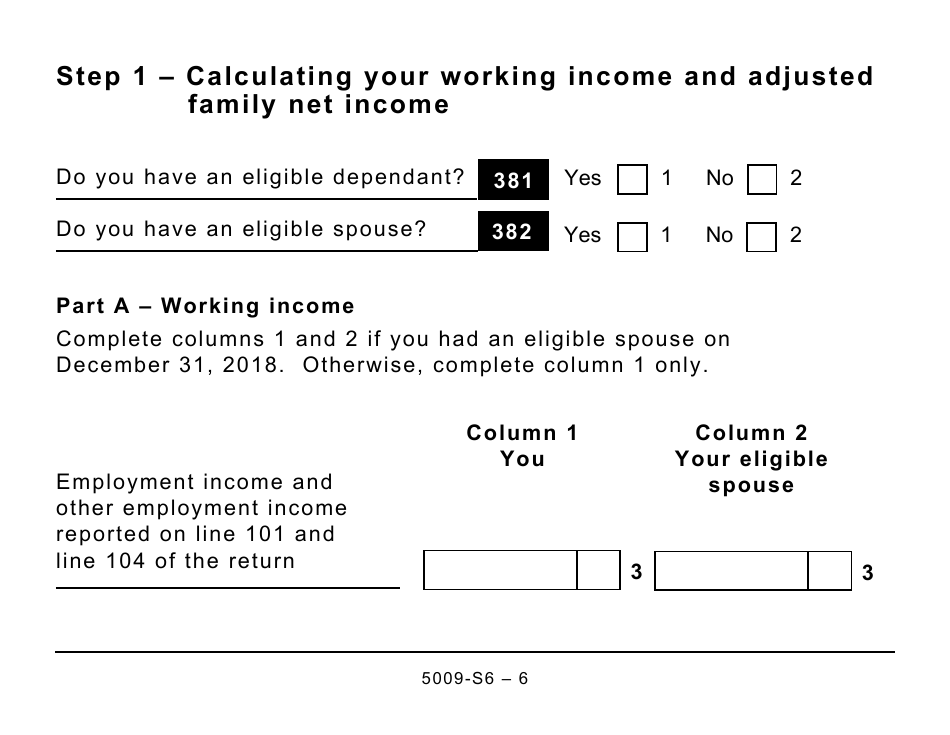

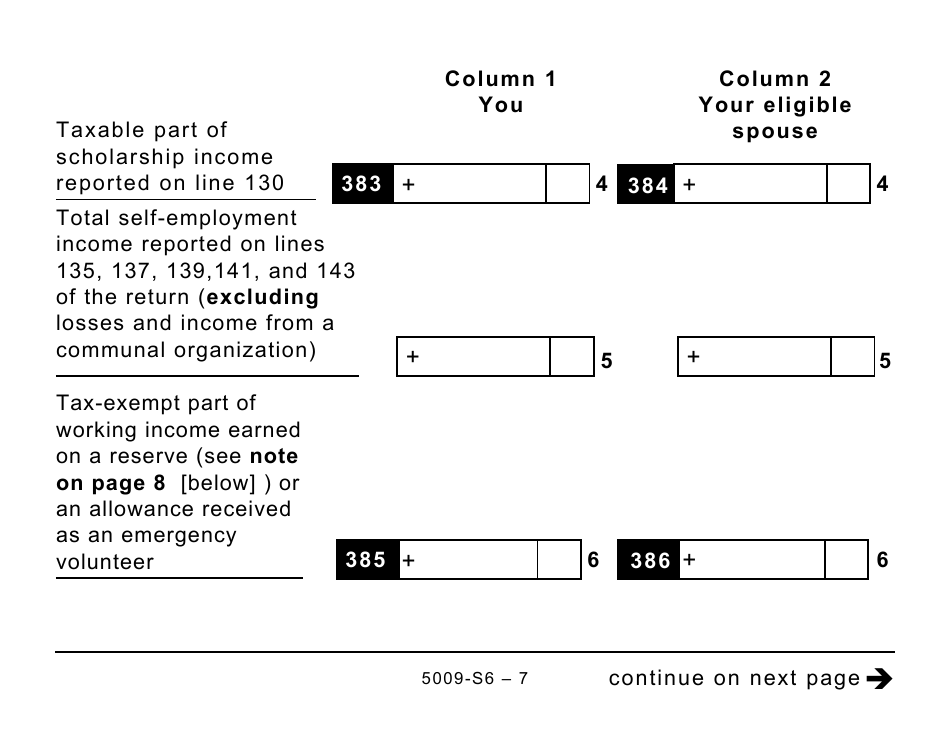

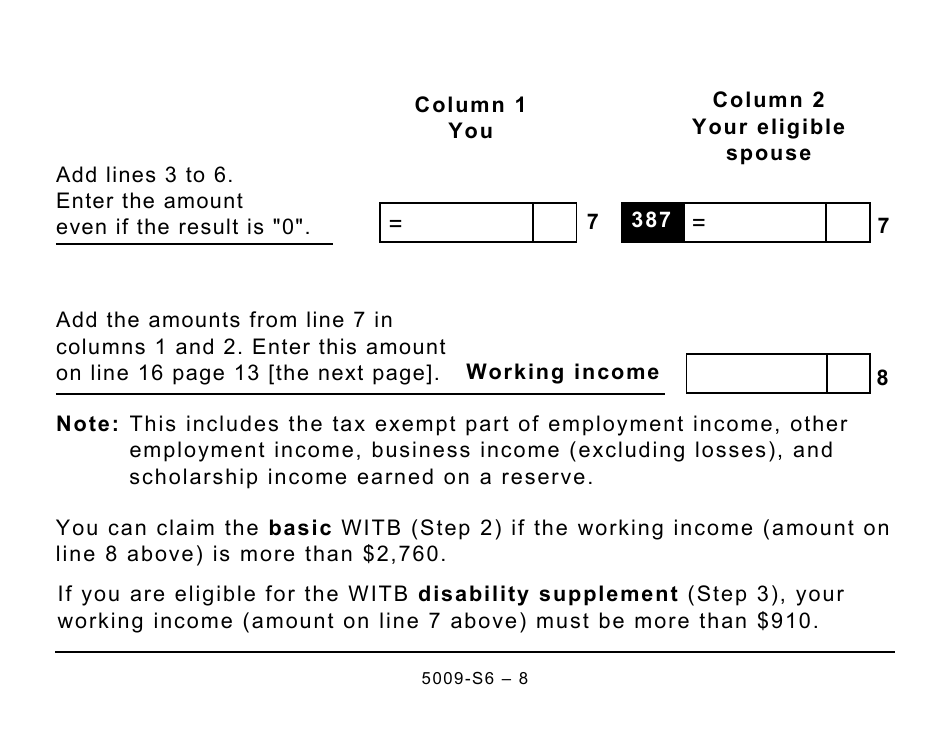

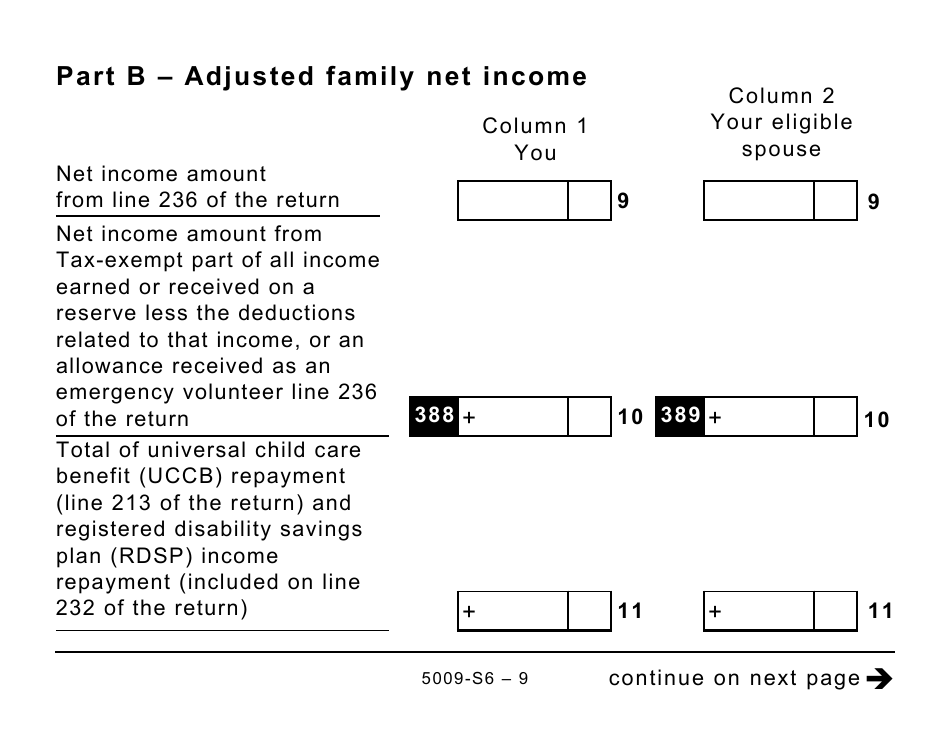

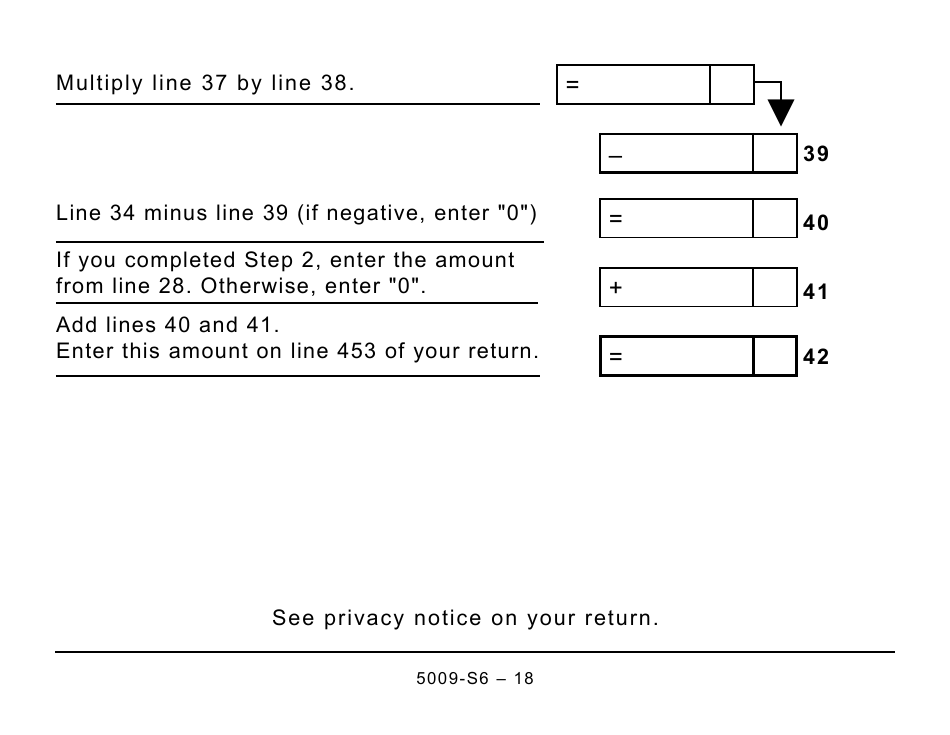

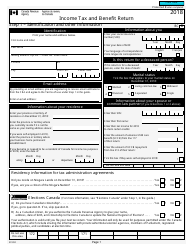

Form 5009-S6 Schedule 6

for the current year.

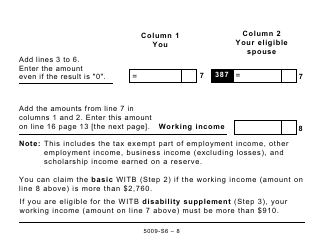

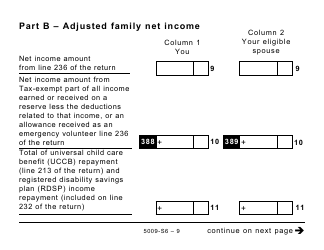

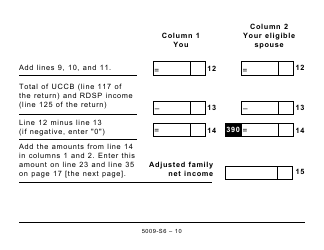

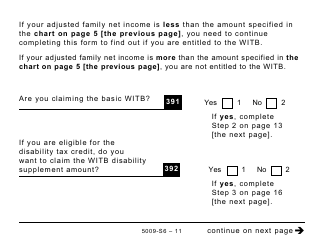

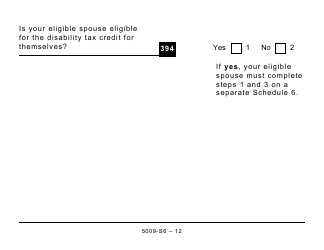

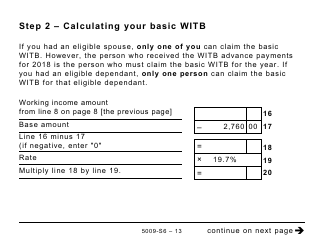

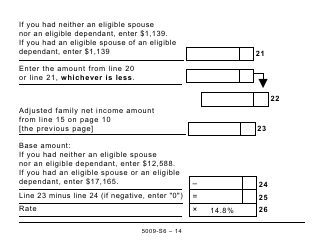

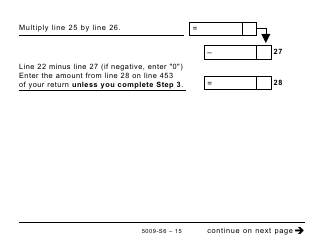

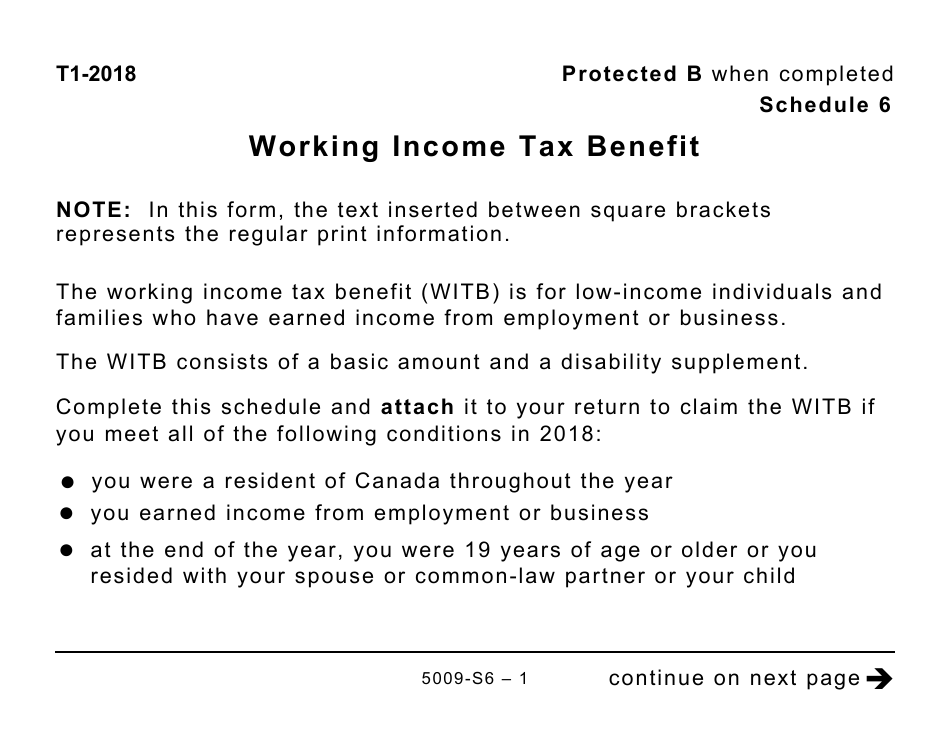

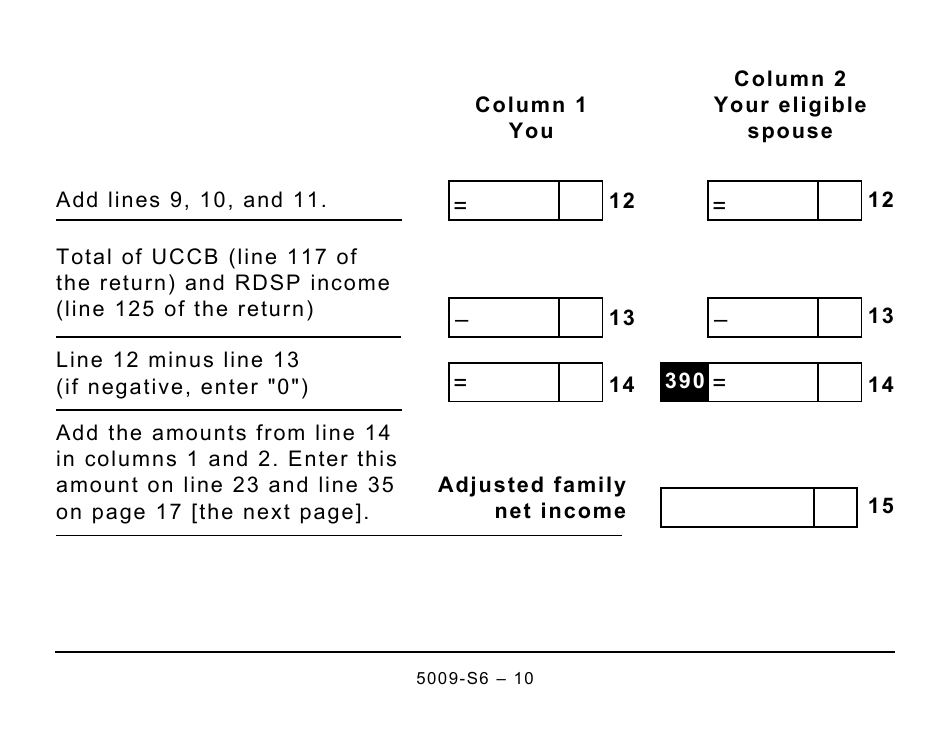

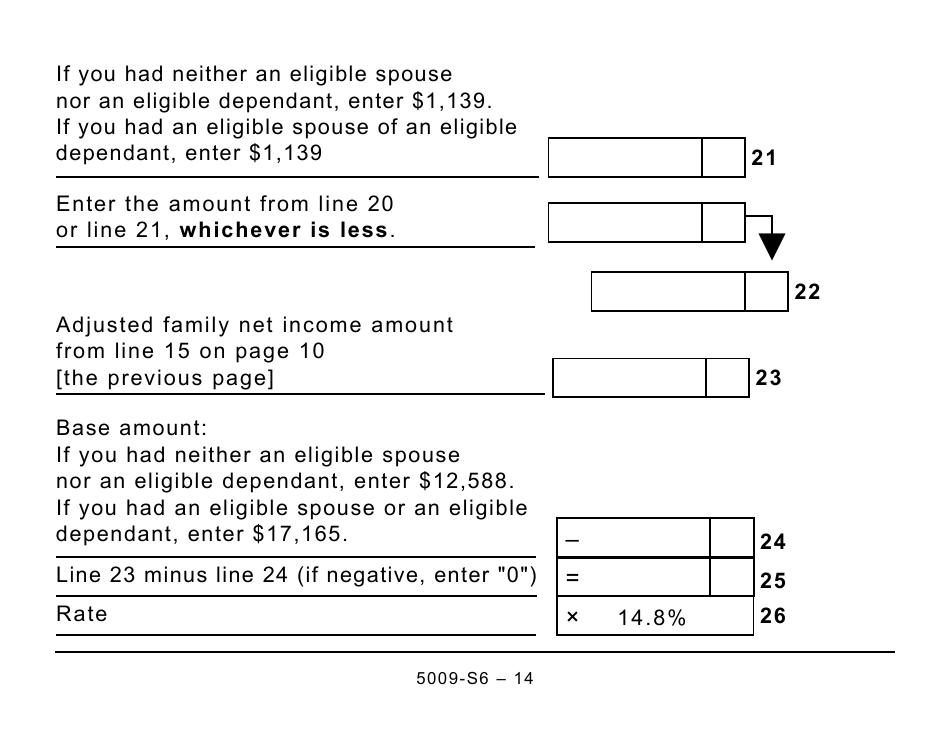

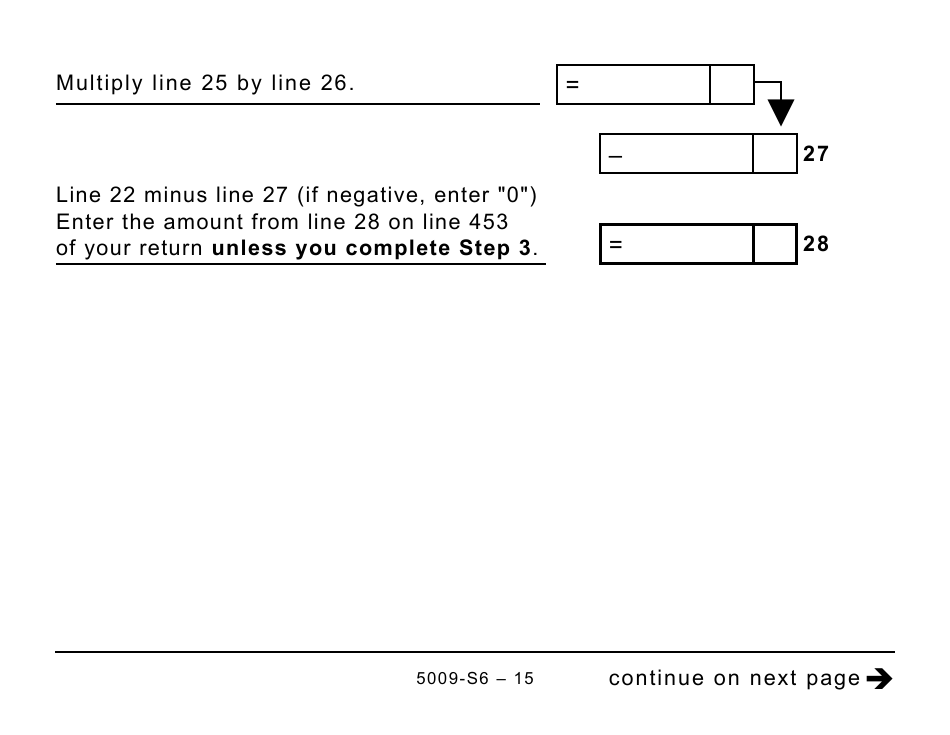

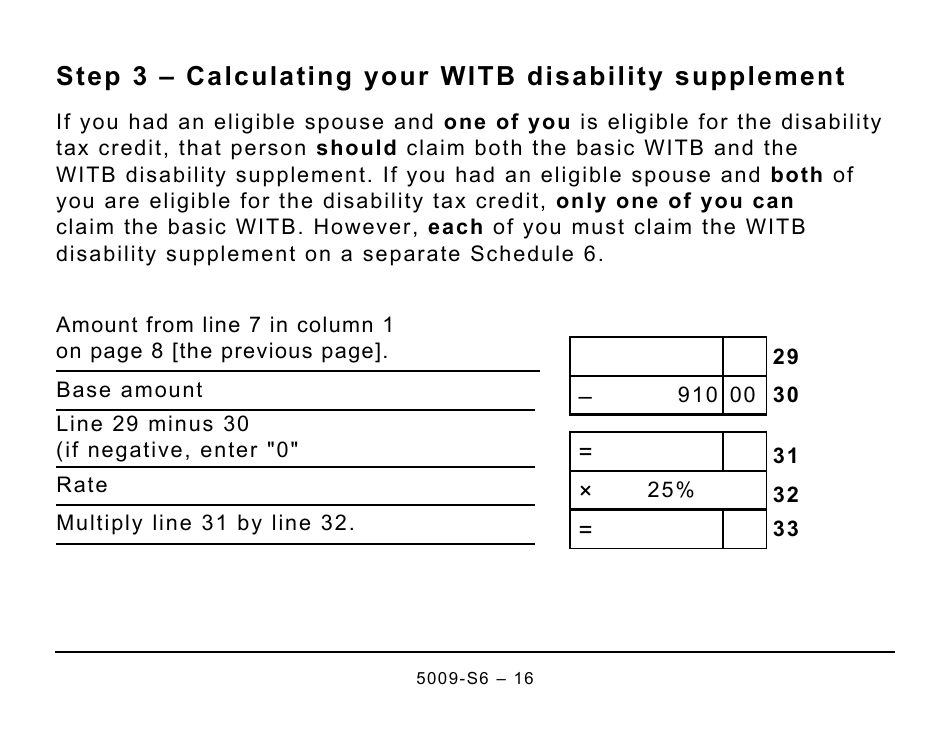

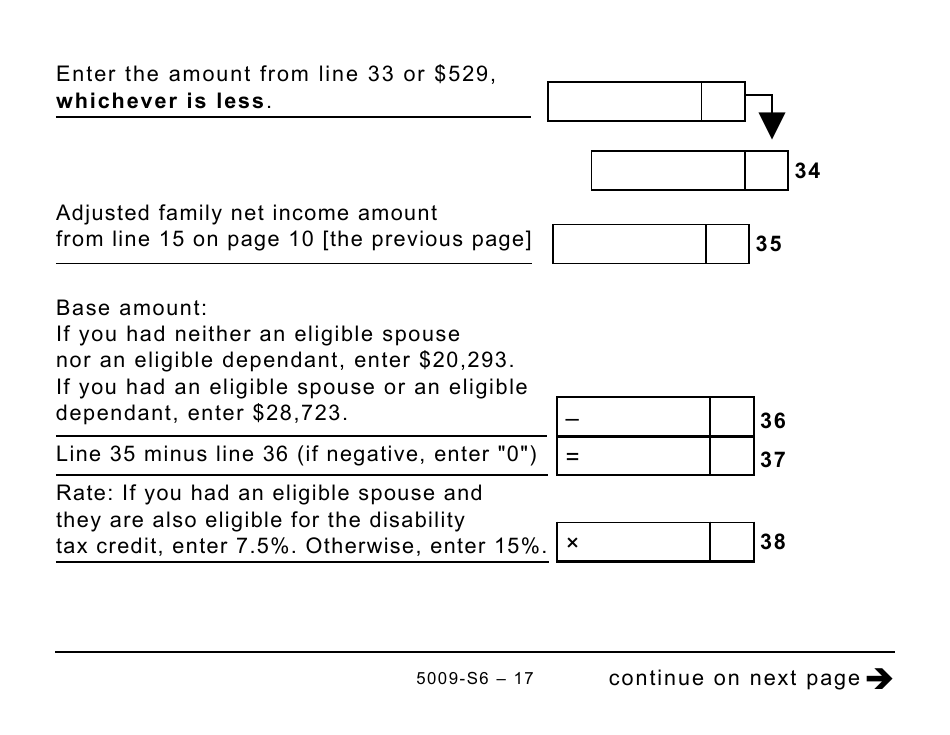

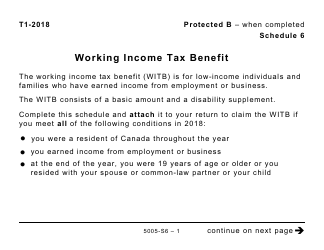

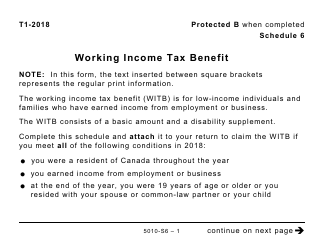

Form 5009-S6 Schedule 6 Working Income Tax Benefit (Large Print) - Canada

This fillable " Working Income Tax Benefit (large Print) " is a document issued by the Canadian Revenue Agency specifically for Canada residents.

Download the PDF by clicking the link below and complete it directly in your browser or through the Adobe Desktop application.

FAQ

Q: What is Form 5009-S6?

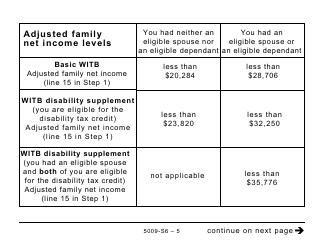

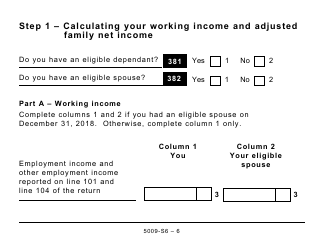

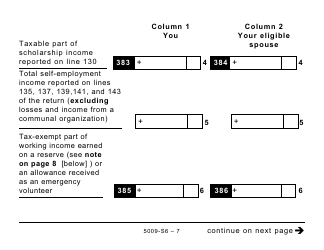

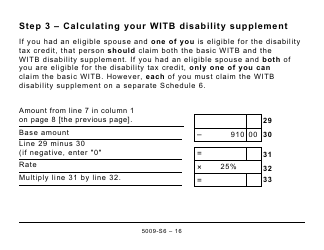

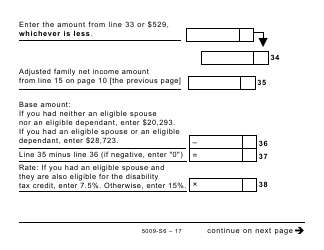

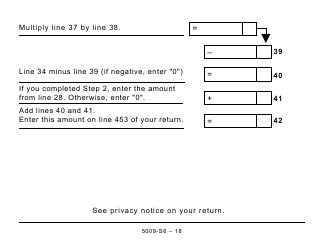

A: Form 5009-S6 is a schedule for reporting Working Income Tax Benefit in Canada.

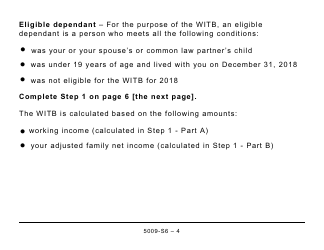

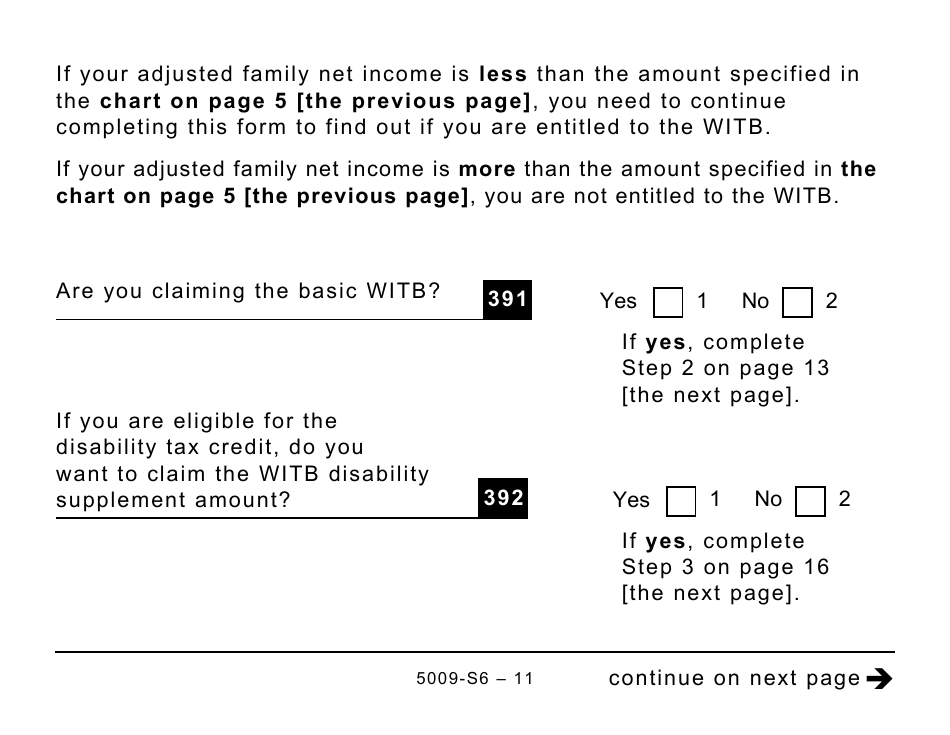

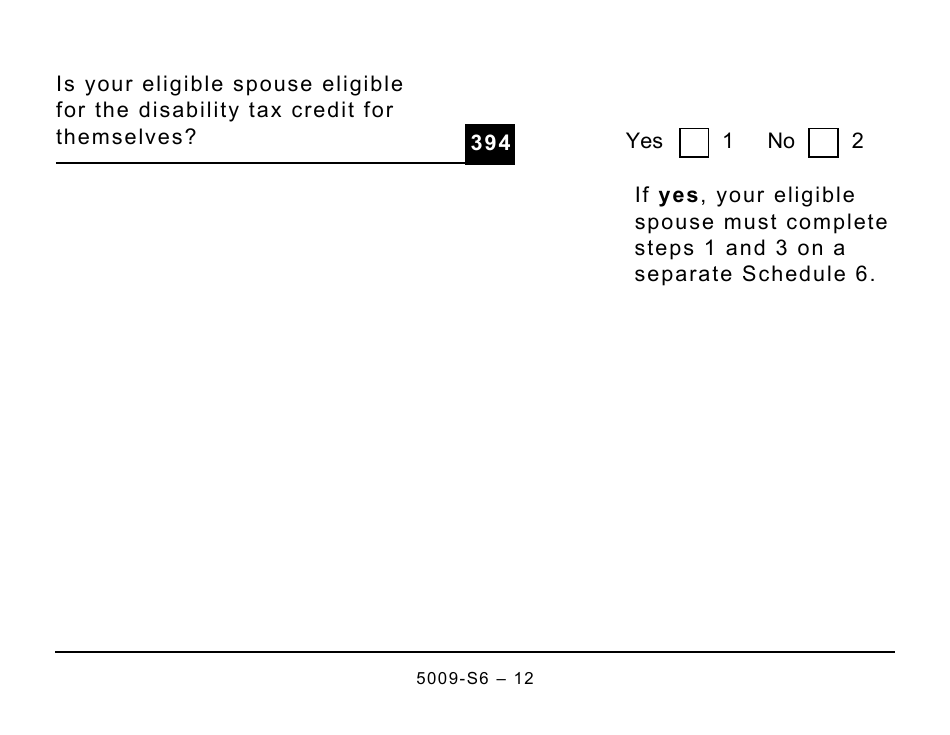

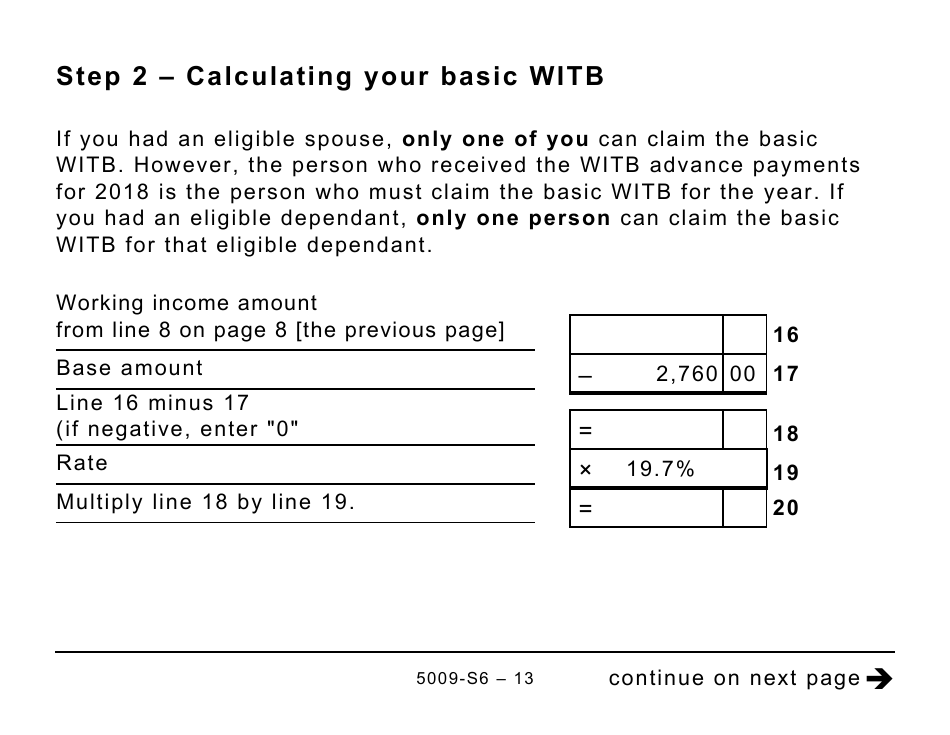

Q: What is the Working Income Tax Benefit (WITB)?

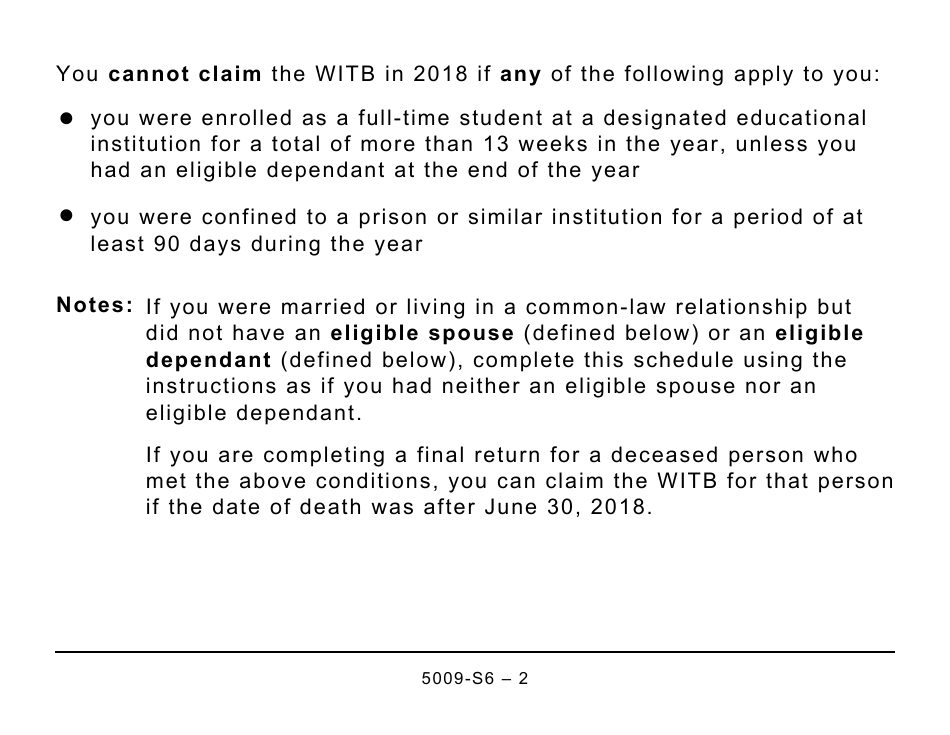

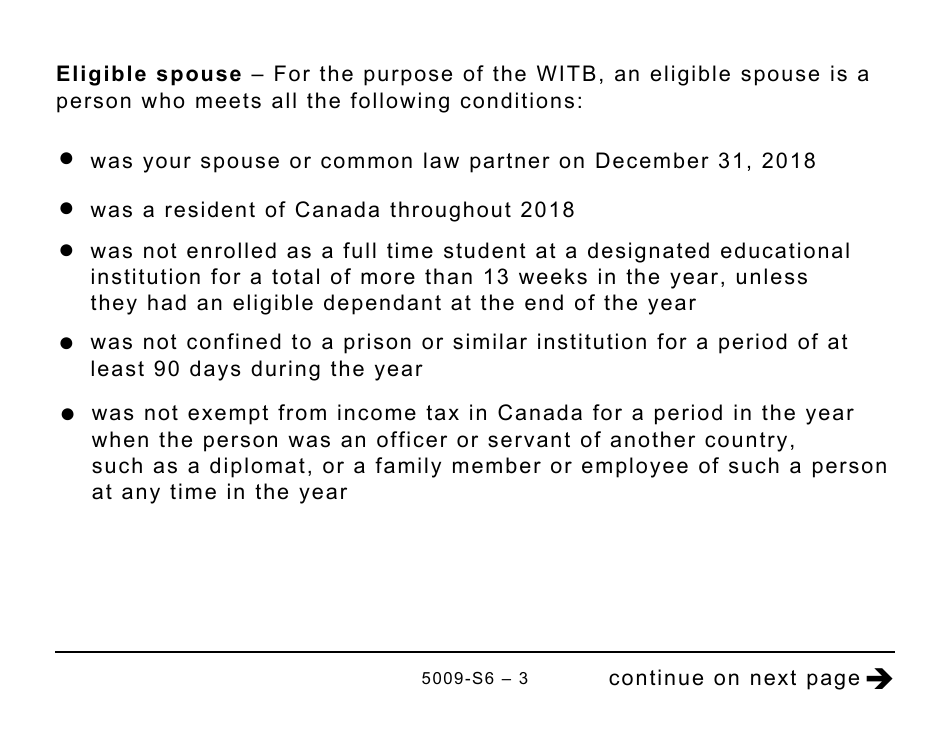

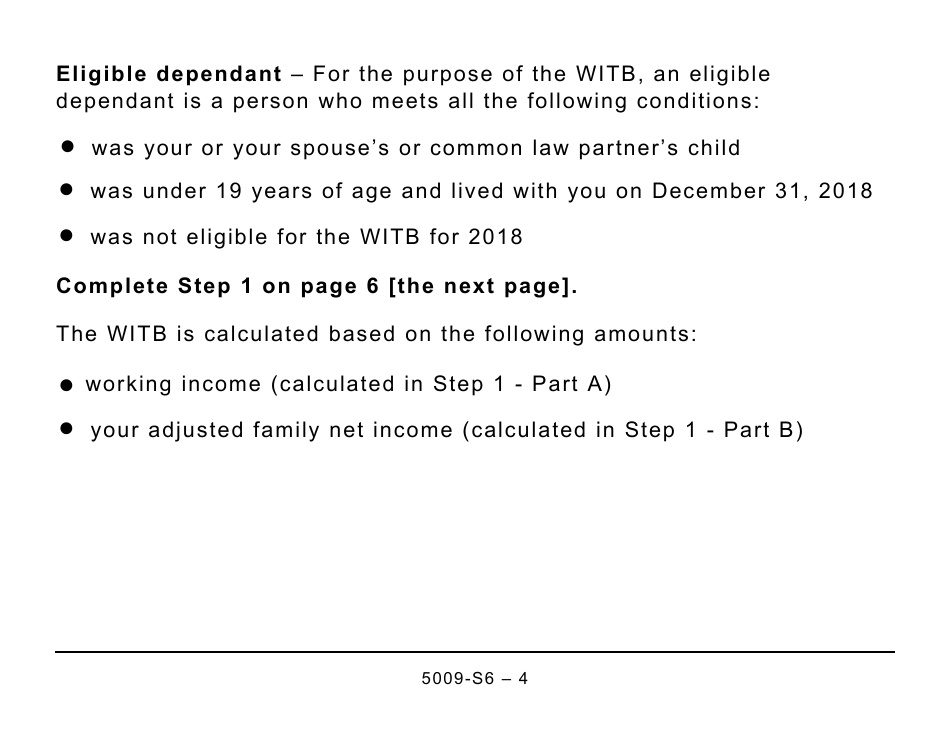

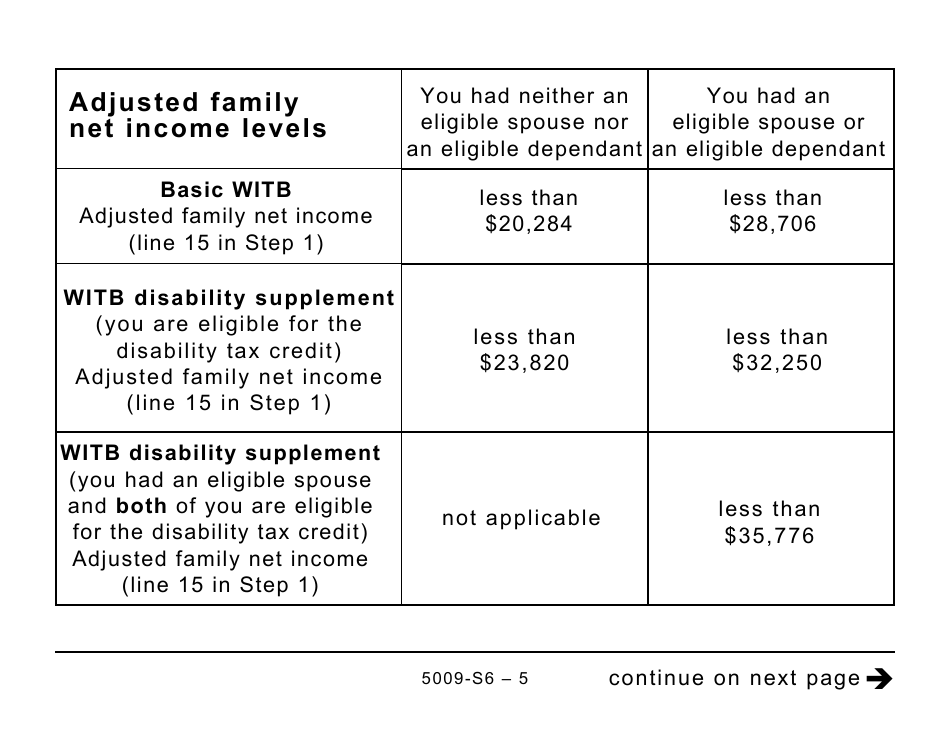

A: The Working Income Tax Benefit (WITB) is a refundable tax credit for low-income individuals and families who are working.

Q: Who is eligible for the Working Income Tax Benefit?

A: To be eligible for the Working Income Tax Benefit, you must be a resident of Canada, over the age of 19, and have earned income from employment.

Q: What is the purpose of Form 5009-S6?

A: Form 5009-S6 is used to calculate and report your Working Income Tax Benefit.

Q: Do I need to fill out Form 5009-S6?

A: You need to fill out Form 5009-S6 if you are eligible for the Working Income Tax Benefit and want to claim the credit.

Q: Is there a deadline to submit Form 5009-S6?

A: The deadline to submit Form 5009-S6 is usually April 30th of each year, but it may vary if you are self-employed.

Q: Can I file Form 5009-S6 electronically?

A: Yes, you can file Form 5009-S6 electronically using NETFILE if you meet the criteria.

Q: What do I do if I made a mistake on Form 5009-S6?

A: If you made a mistake on Form 5009-S6, you can file an adjustment request using Form T1-ADJ.