This version of the form is not currently in use and is provided for reference only. Download this version of

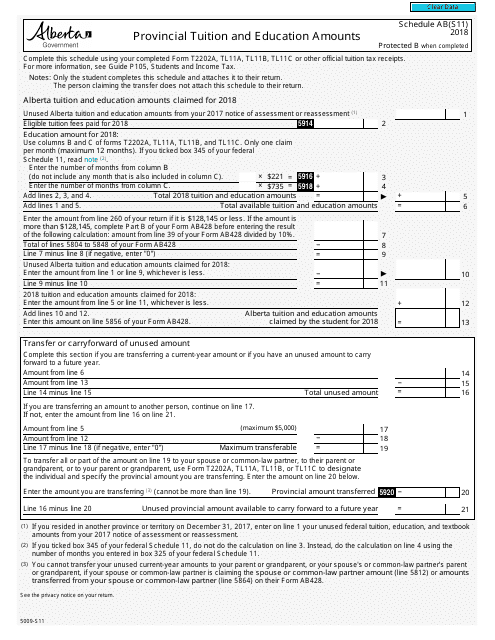

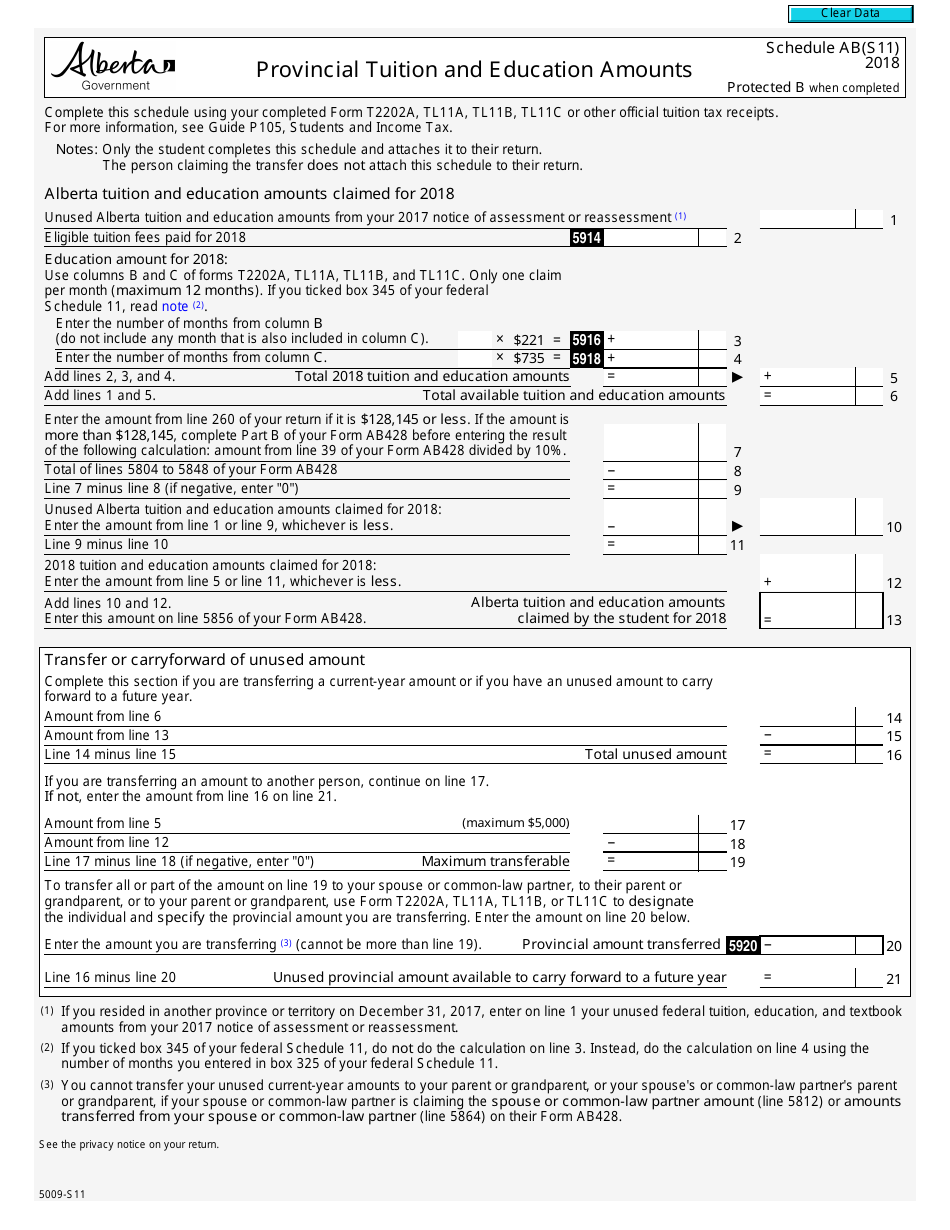

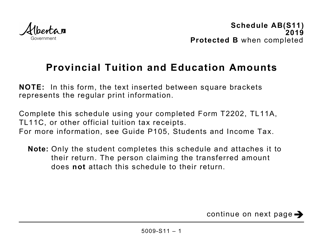

Form 5009-S11 Schedule AB(S11)

for the current year.

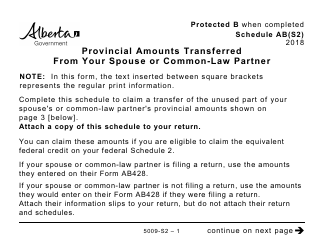

Form 5009-S11 Schedule AB(S11) Provincial Tuition and Education Amounts - Canada

This Canada-specific " Provincial Tuition And Education Amounts " is a document released by the Canadian Revenue Agency .

Download the fillable PDF by clicking the link below and use it according to the applicable legal guidelines.

FAQ

Q: What is Form 5009-S11 Schedule AB(S11)?

A: Form 5009-S11 Schedule AB(S11) is a tax form used in Canada to claim provincial tuition and education amounts.

Q: What are provincial tuition and education amounts?

A: Provincial tuition and education amounts are tax credits that can be claimed by eligible individuals to reduce their income tax liabilities.

Q: Who is eligible to claim provincial tuition and education amounts?

A: Eligibility to claim provincial tuition and education amounts varies by province. Generally, students enrolled in post-secondary education programs may be eligible.

Q: How can I claim provincial tuition and education amounts?

A: To claim provincial tuition and education amounts, you need to complete and submit Form 5009-S11 Schedule AB(S11) with your tax return.

Q: When should I file Form 5009-S11 Schedule AB(S11)?

A: Form 5009-S11 Schedule AB(S11) should be filed along with your annual income tax return.

Q: Are there any deadlines for claiming provincial tuition and education amounts?

A: Deadlines for claiming provincial tuition and education amounts vary by province. It is important to check the specific deadline for your province.

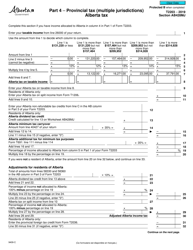

Q: Can I claim both federal and provincial tuition and education amounts?

A: Yes, you can claim both federal and provincial tuition and education amounts if you meet the eligibility criteria.

Q: What documents do I need to support my claim for provincial tuition and education amounts?

A: You may need to provide supporting documents such as T2202A forms or official receipts to claim provincial tuition and education amounts.

Q: What happens if I am audited for claiming provincial tuition and education amounts?

A: If you are audited for claiming provincial tuition and education amounts, you may be required to provide additional documentation to support your claim.