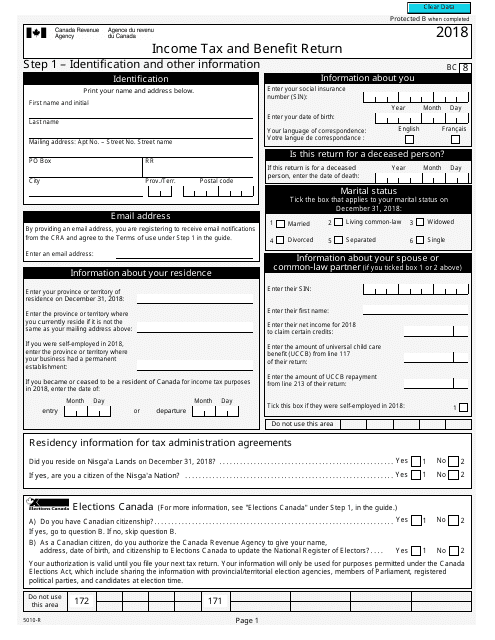

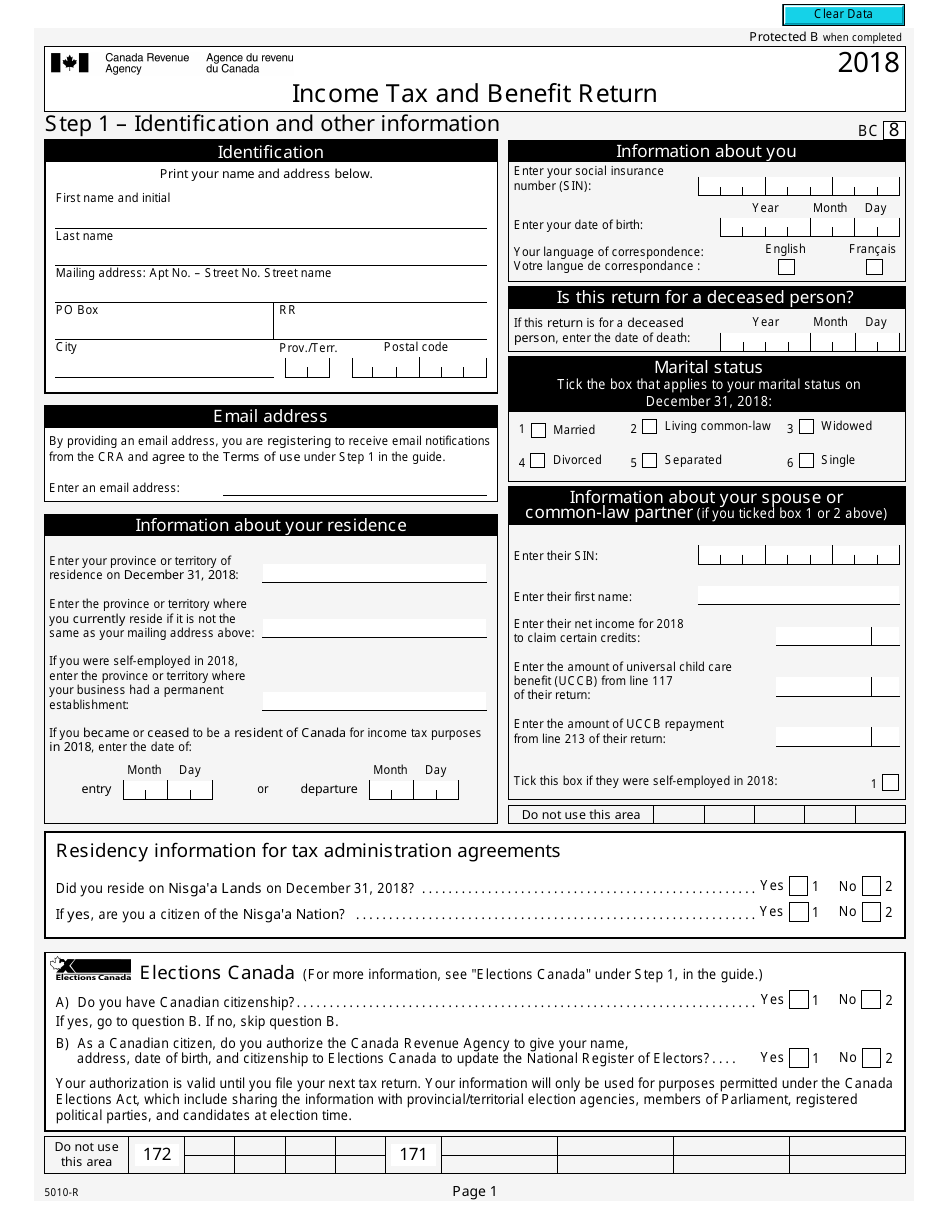

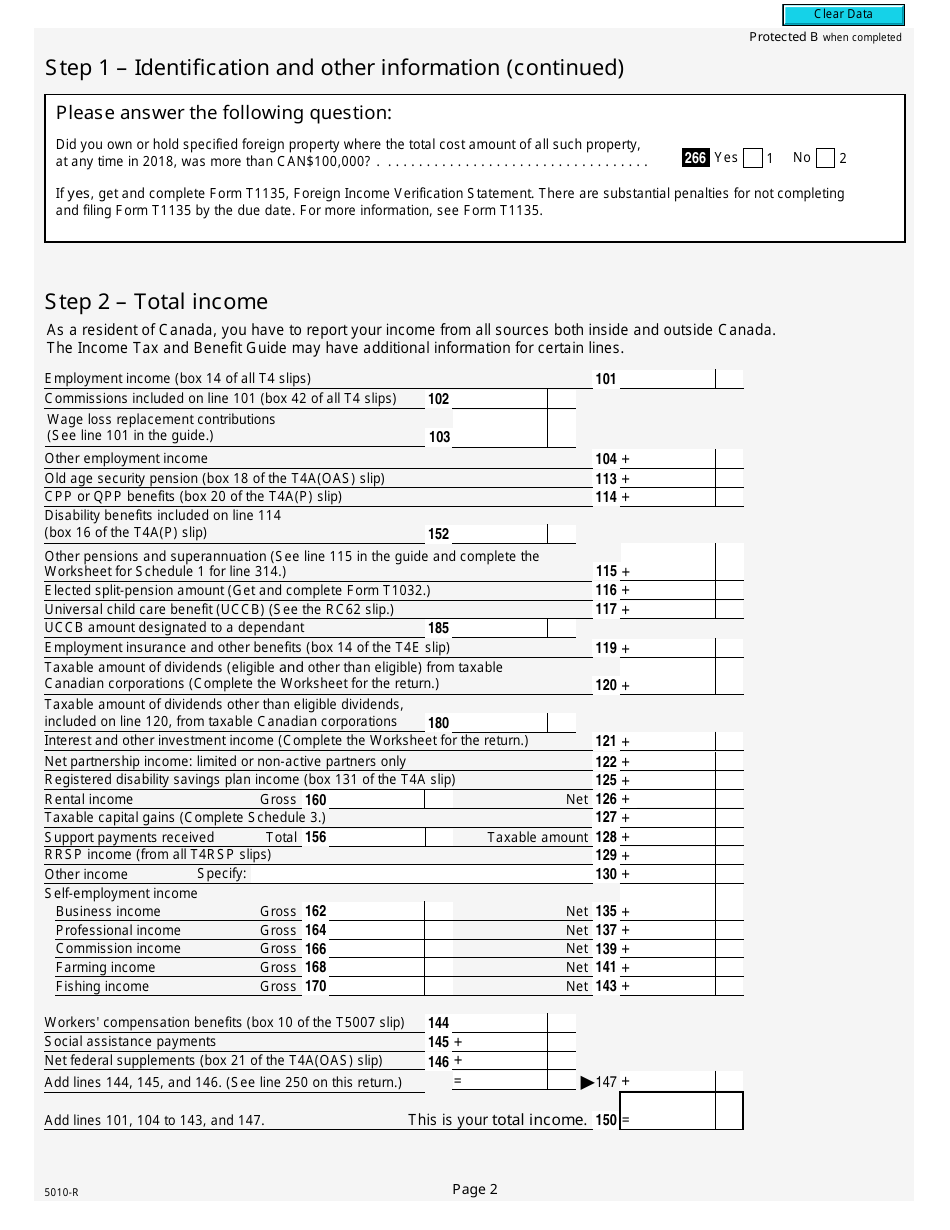

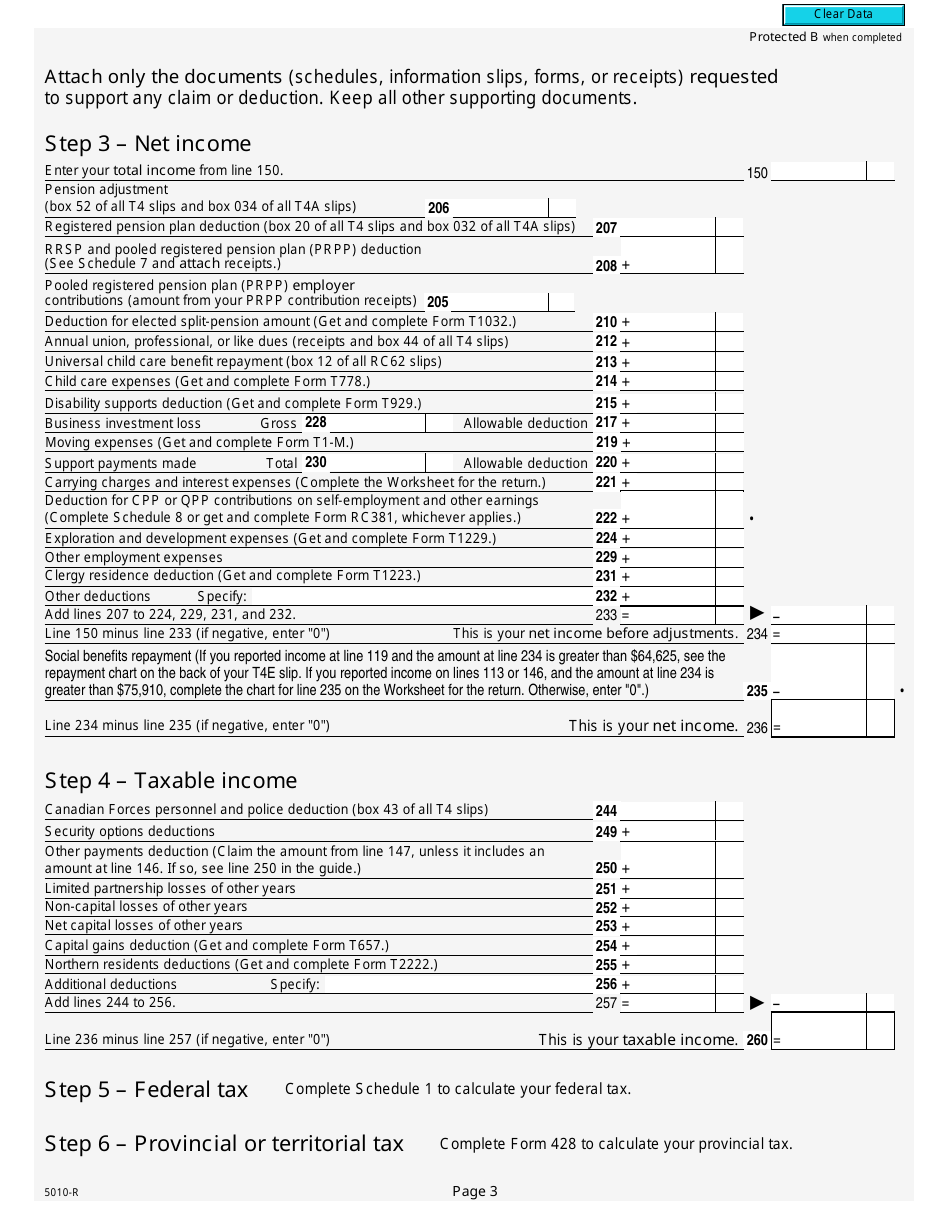

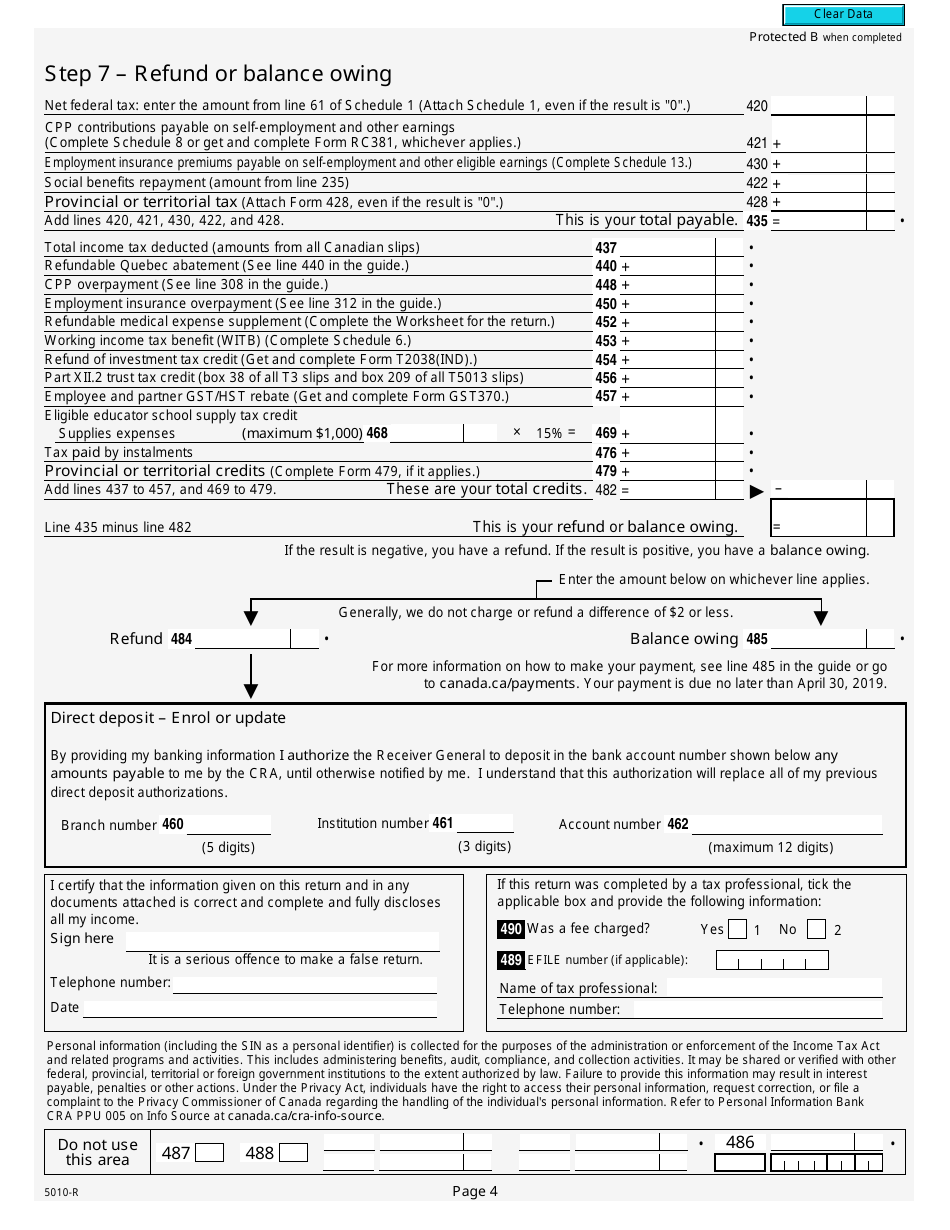

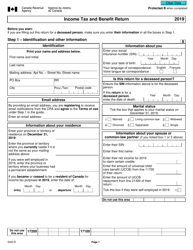

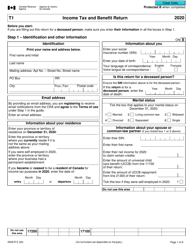

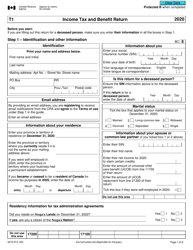

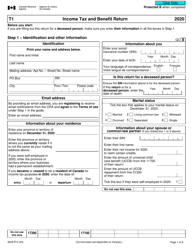

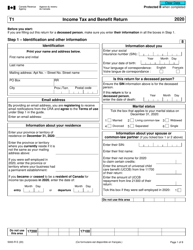

Form 5010-R Income Tax and Benefit Return - Canada

This Canada-specific " Income Tax And Benefit Return " is a document released by the Canadian Revenue Agency .

Download the fillable PDF by clicking the link below and use it according to the applicable legal guidelines.

FAQ

Q: What is Form 5010-R?

A: Form 5010-R is the Income Tax and Benefit Return form used in Canada.

Q: Who needs to file Form 5010-R?

A: Canadian residents and income earners who have to report their income and claim tax benefits need to file Form 5010-R.

Q: What information do I need to complete Form 5010-R?

A: You will need to gather your personal information, income details, and any applicable deductions or tax credits to complete Form 5010-R.

Q: Is there a deadline to file Form 5010-R?

A: Yes, the deadline to file Form 5010-R is usually April 30th, unless you or your spouse is self-employed, in which case the deadline is June 15th.

Q: What happens if I don't file Form 5010-R?

A: If you don't file Form 5010-R or file it late, you may face penalties and interest charges on any taxes owed.

Q: Can I get help completing Form 5010-R?

A: Yes, you can get help completing Form 5010-R from a registered tax professional or through the Canada Revenue Agency's helpline.