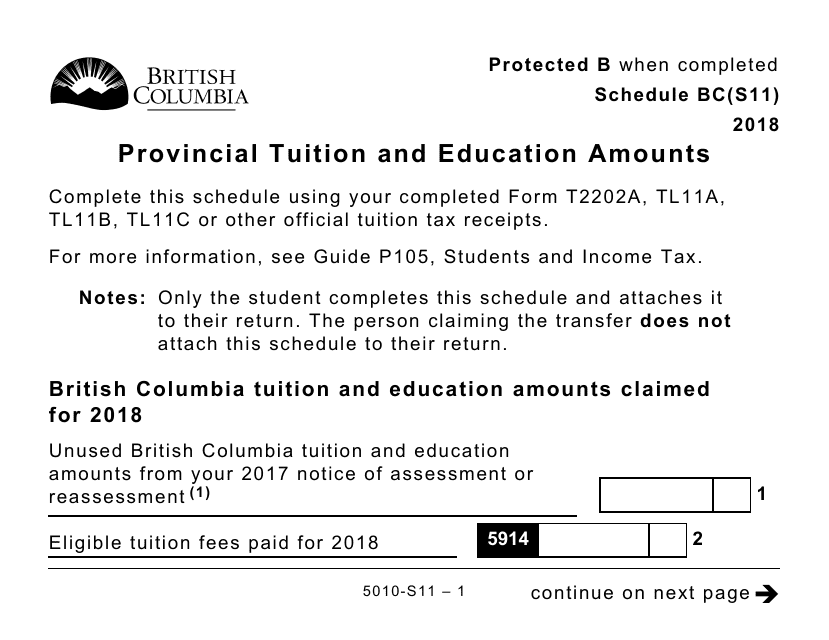

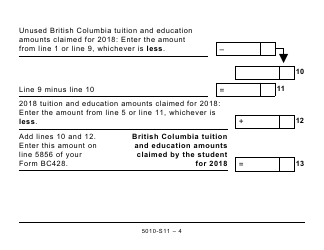

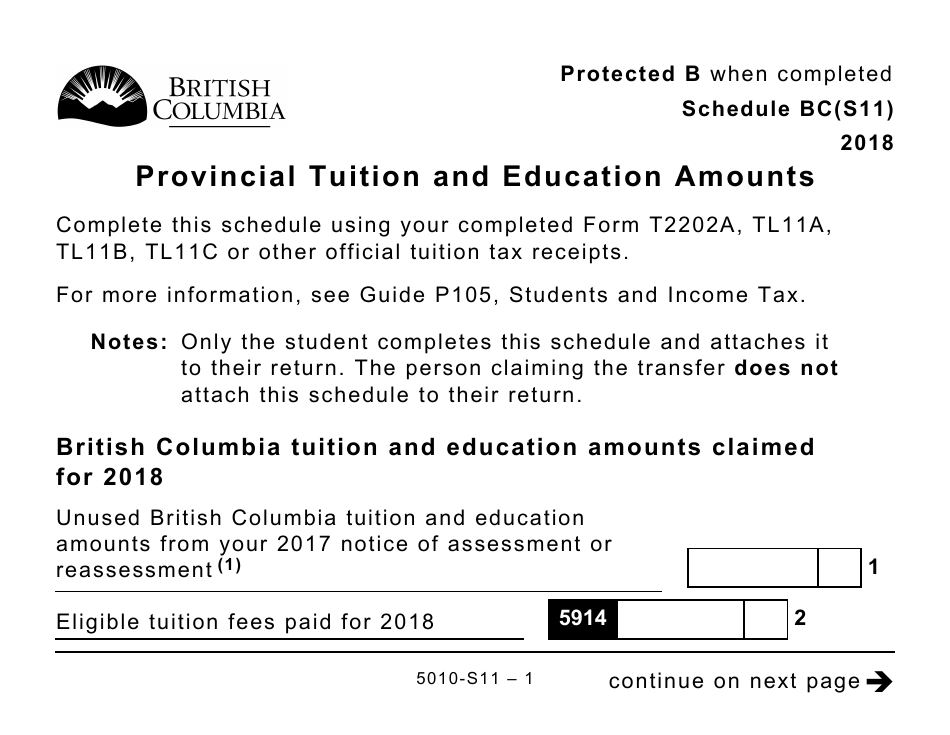

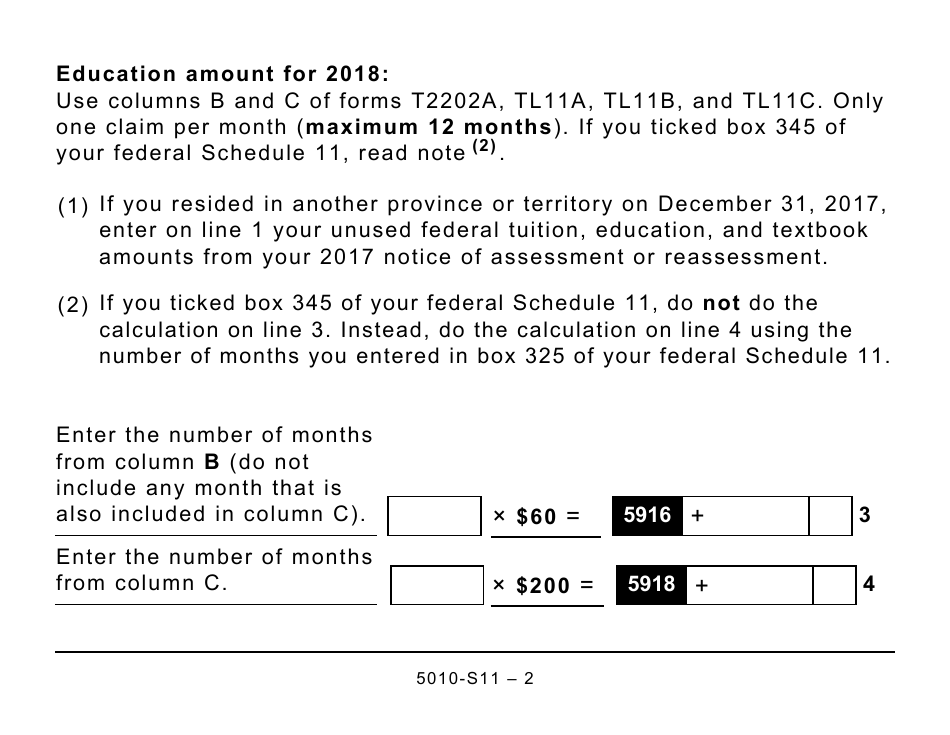

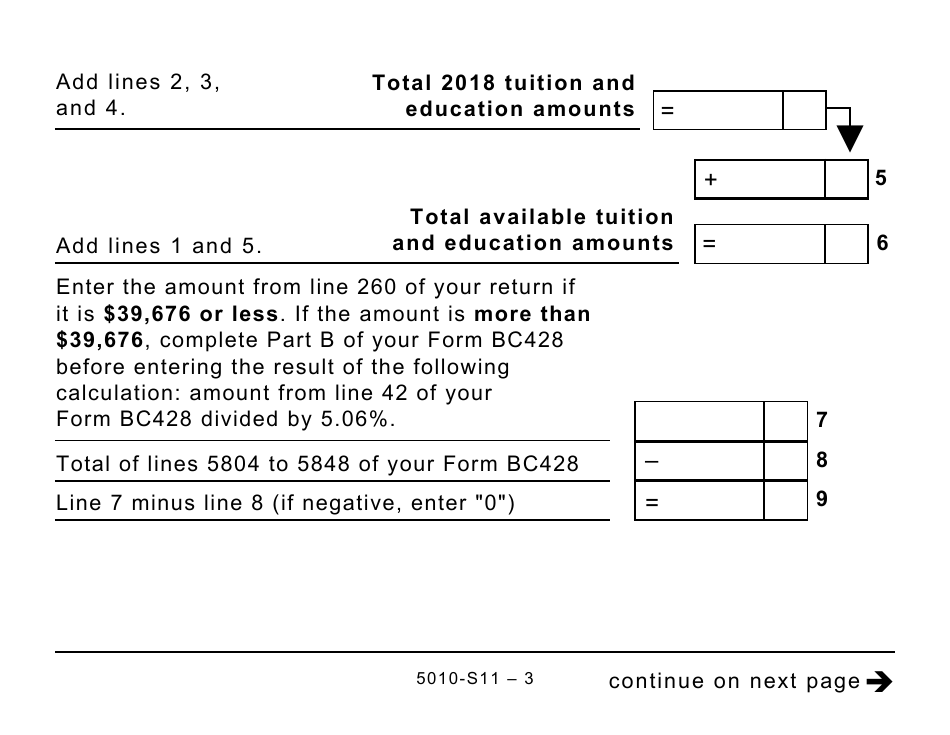

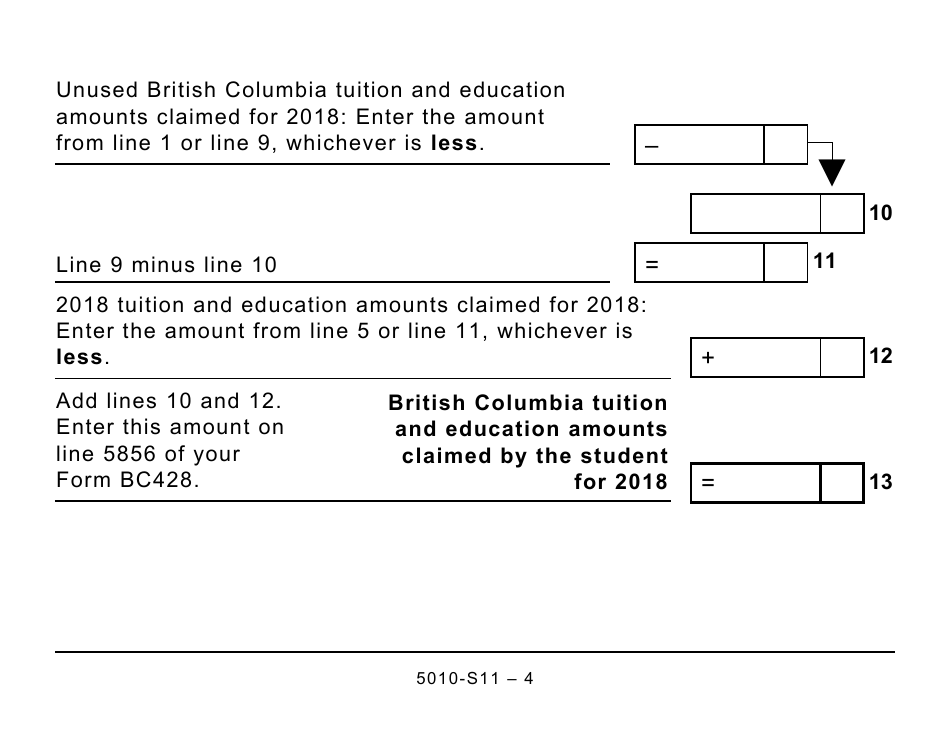

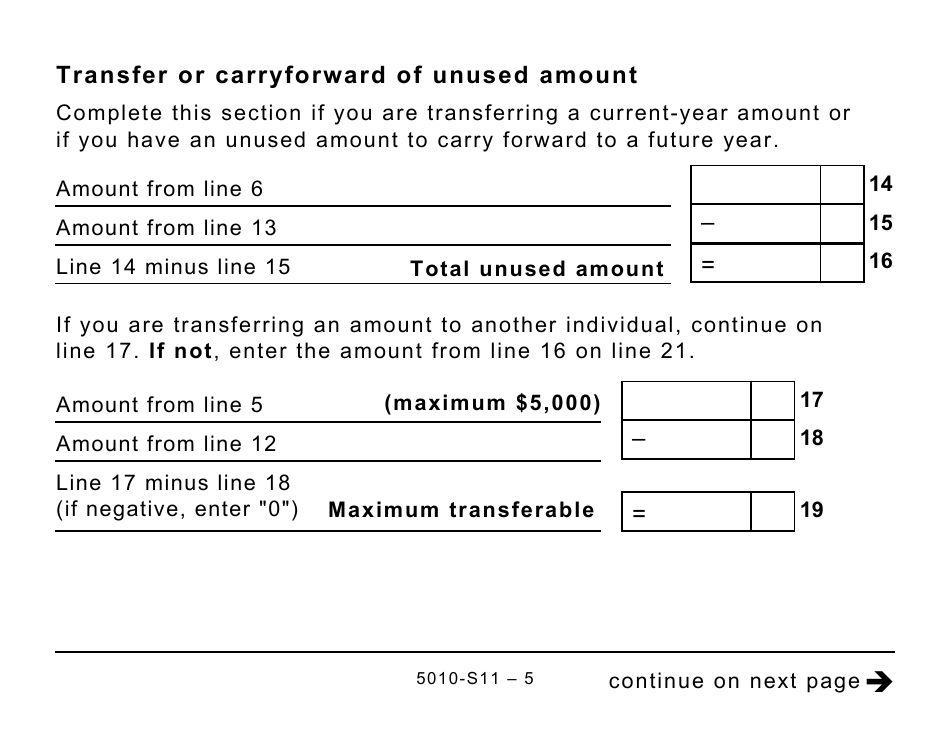

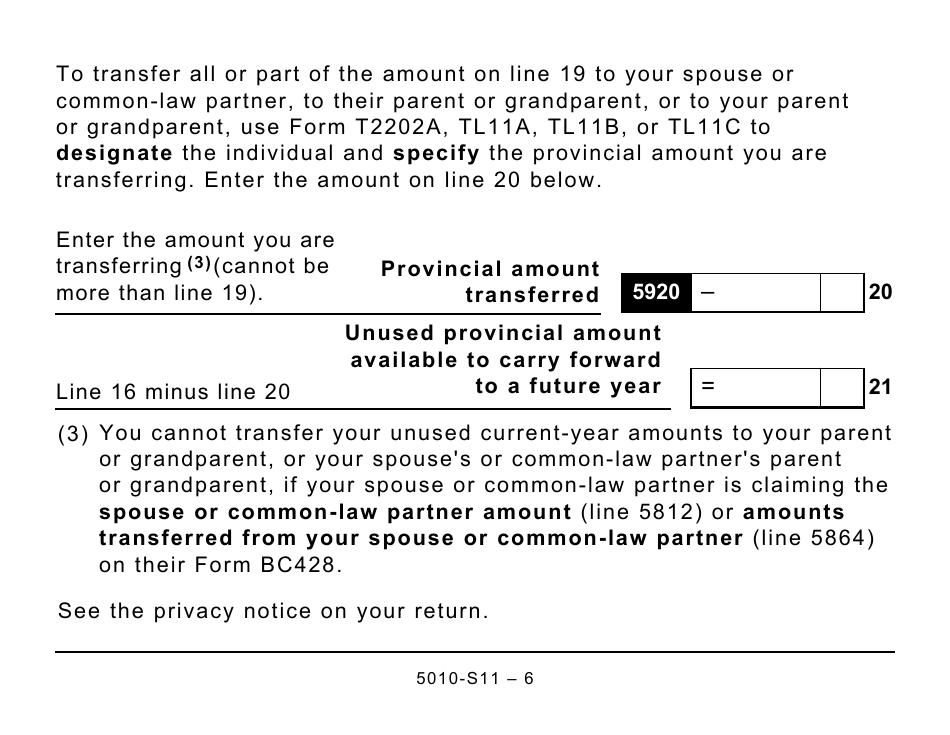

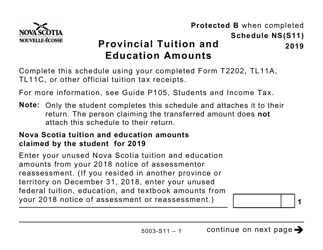

Form 5010-S11 Schedule BC(S11) Provincial Tuition and Education Amounts (Large Print) - Canada

Form 5010-S11 Schedule BC(S11) Provincial Tuition and Education Amounts (Large Print) in Canada is used to claim provincial tax credits for tuition and education expenses. It is specifically designed for individuals who have visual impairments and need a large print format.

The student files Form 5010-S11 Schedule BC(S11) Provincial Tuition and Education Amounts (Large Print) in Canada.

FAQ

Q: What is Form 5010-S11 Schedule BC(S11)?

A: Form 5010-S11 Schedule BC(S11) is a tax form used in Canada to claim provincial tuition and education amounts.

Q: Who can use this form?

A: Canadian residents who have paid tuition fees for post-secondary education in British Columbia can use this form to claim provincial tuition and education amounts.

Q: What are provincial tuition and education amounts?

A: Provincial tuition and education amounts are tax credits that can reduce the amount of tax you owe.

Q: What is Large Print version?

A: Large Print version refers to a version of the form with enlarged text for easier reading for individuals with visual impairments.

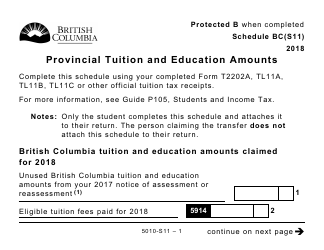

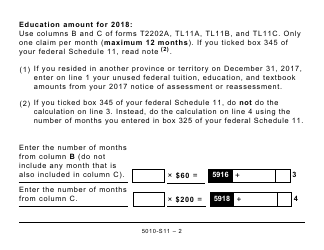

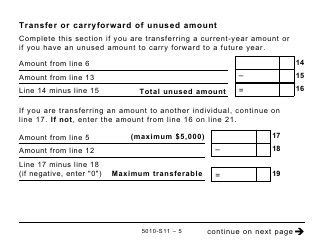

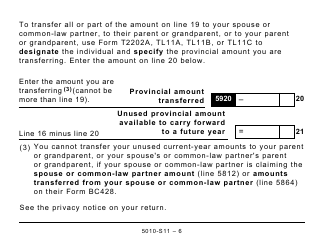

Q: How do I fill out this form?

A: You will need to provide information about your education expenses and any scholarships or grants you have received. Follow the instructions on the form carefully to ensure you complete it correctly.

Q: Can I claim both federal and provincial tuition and education amounts?

A: Yes, you can claim both federal and provincial tuition and education amounts if you meet the eligibility requirements for both.

Q: What documents do I need to support my claim?

A: You may be required to provide documentation such as T2202A forms, receipts for tuition fees, and other supporting documents. Keep all relevant documents in case you are asked to submit them.

Q: Can I e-file this form?

A: Yes, you can e-file Form 5010-S11 Schedule BC(S11) if you use certified tax software or a tax professional who offers e-filing services.