This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5007-S11 Schedule MB(S11)

for the current year.

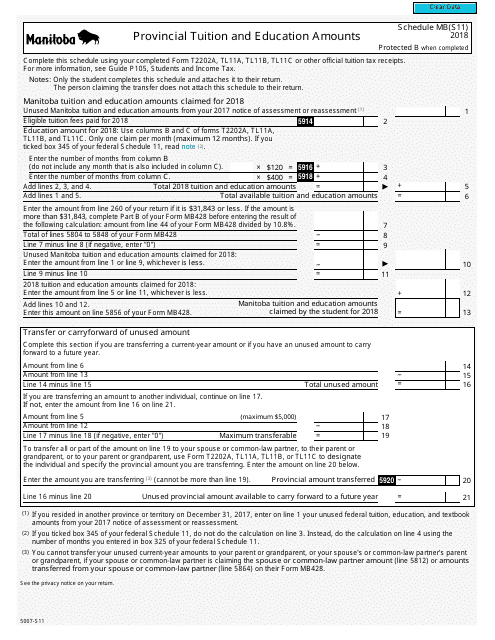

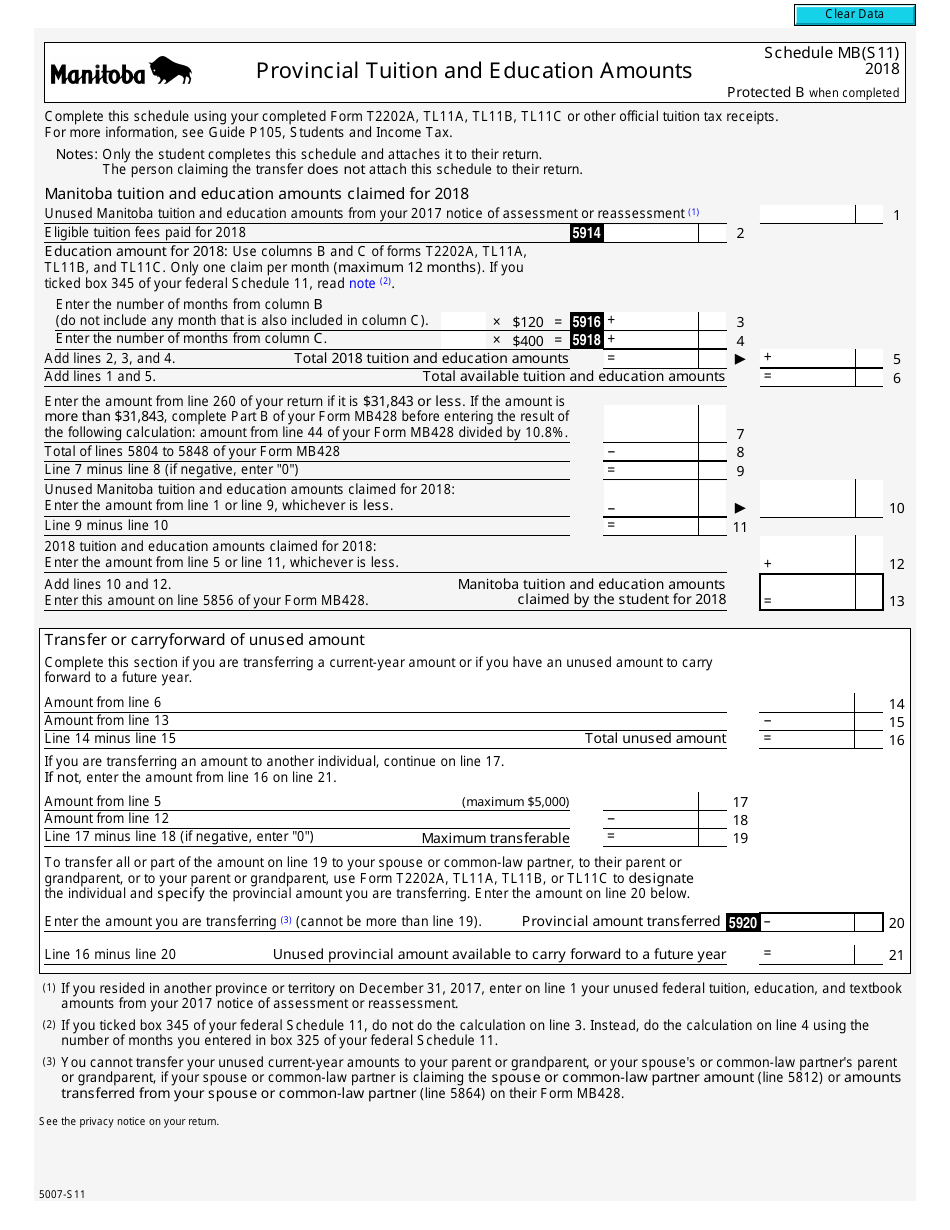

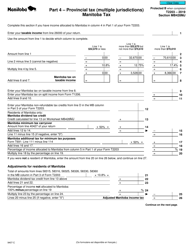

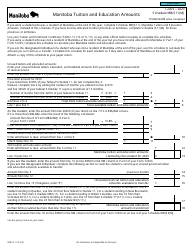

Form 5007-S11 Schedule MB(S11) Provincial Tuition and Education Amounts - Canada

Form 5007-S11 Schedule MB(S11) Provincial Tuition and Education Amounts in Canada is used to calculate the provincial or territorial tax credits for tuition and education expenses. It is for Canadian residents who attended a designated educational institution in some provinces or territories.

The Form 5007-S11 Schedule MB(S11) for Provincial Tuition and Education Amounts in Canada is filed by individual taxpayers who are residents of Manitoba.

FAQ

Q: What is Form 5007-S11 Schedule MB(S11)?

A: Form 5007-S11 Schedule MB(S11) is a tax form used in Canada to calculate provincial tuition and education amounts.

Q: What does Schedule MB(S11) calculate?

A: Schedule MB(S11) calculates the provincial tuition and education amounts that can be claimed on your Canadian tax return.

Q: Who can use Form 5007-S11 Schedule MB(S11)?

A: Canadian residents who paid tuition fees or educational expenses at a designated educational institution in their province can use Schedule MB(S11).

Q: How do I fill out Form 5007-S11 Schedule MB(S11)?

A: To fill out Form 5007-S11 Schedule MB(S11), you need to report your tuition fees and education expenses for the tax year.

Q: What is the purpose of claiming provincial tuition and education amounts?

A: Claiming provincial tuition and education amounts can reduce your taxable income and potentially result in a tax refund or lower tax liability.

Q: When is the deadline to file Form 5007-S11 Schedule MB(S11)?

A: The deadline to file Form 5007-S11 Schedule MB(S11) is usually the same as the deadline for filing your Canadian income tax return, which is April 30th of the following year.

Q: Can I claim both federal and provincial tuition and education amounts?

A: Yes, you can claim both federal and provincial tuition and education amounts on your Canadian tax return, as long as you meet the eligibility criteria.

Q: What supporting documents are required for Form 5007-S11 Schedule MB(S11)?

A: You may be required to provide supporting documents, such as tuition receipts or certificates, when claiming provincial tuition and education amounts. Check the CRA guidelines for specific requirements.

Q: Can I carry forward unused provincial tuition and education amounts?

A: Yes, you can carry forward unused provincial tuition and education amounts to future tax years, within certain limits set by the CRA.