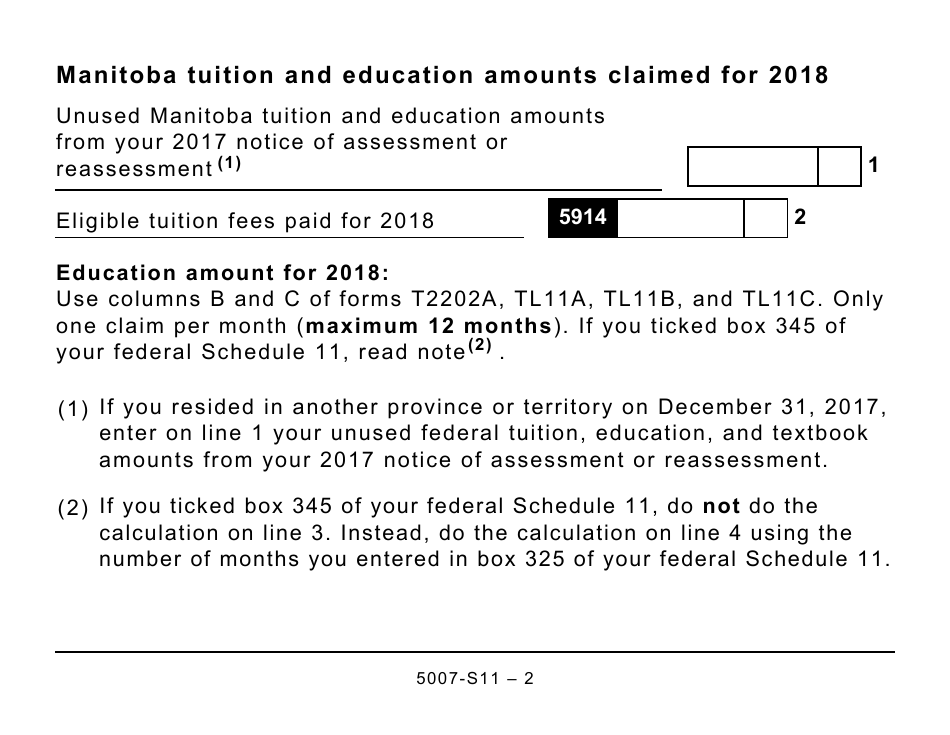

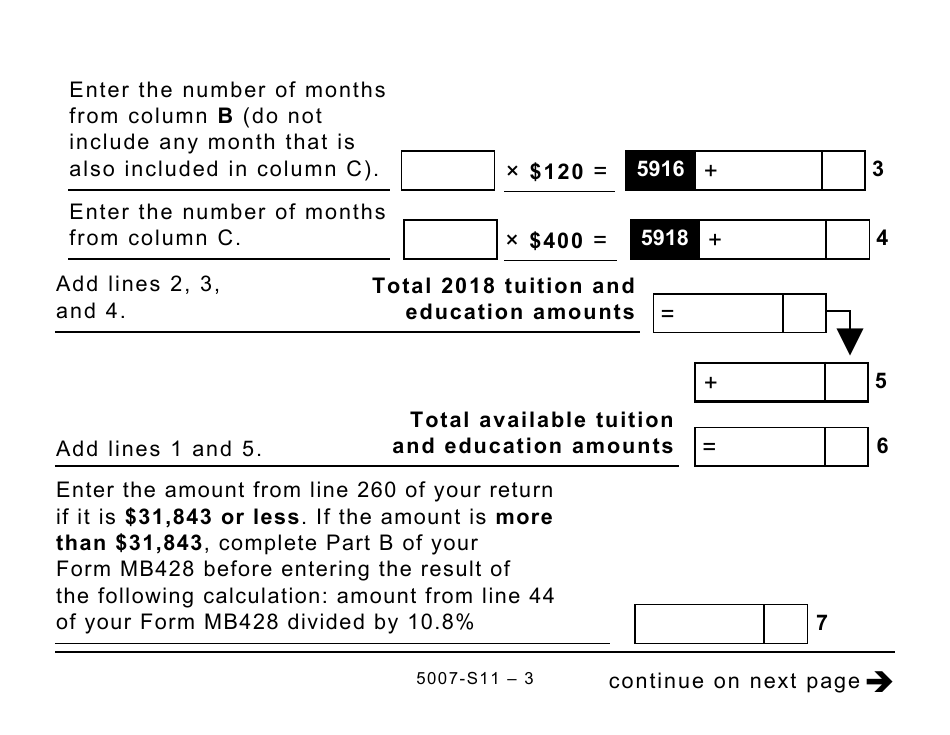

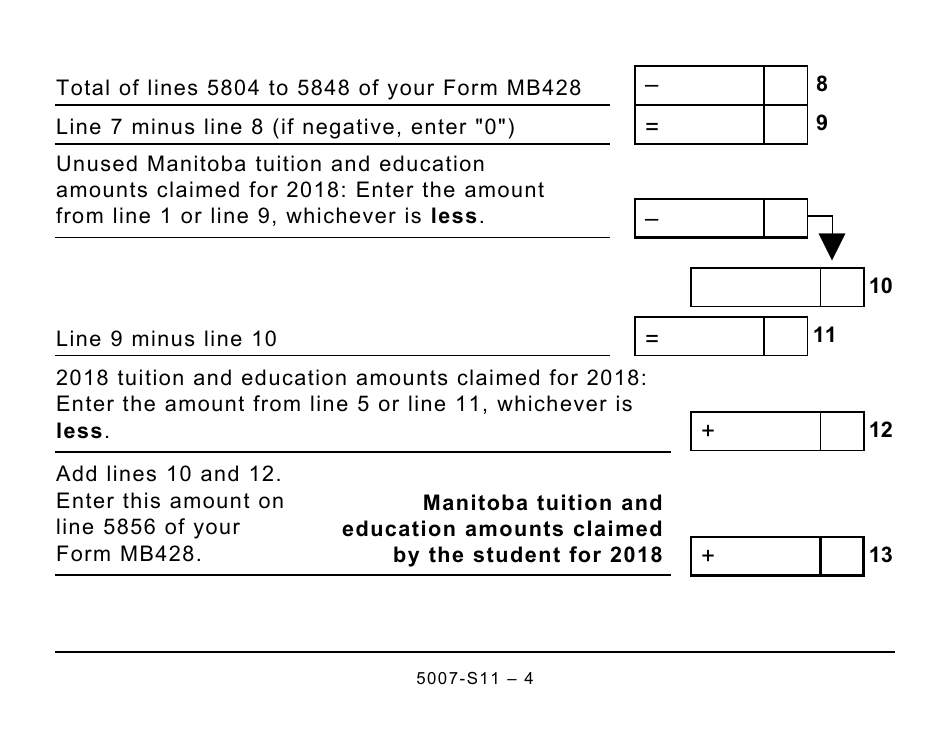

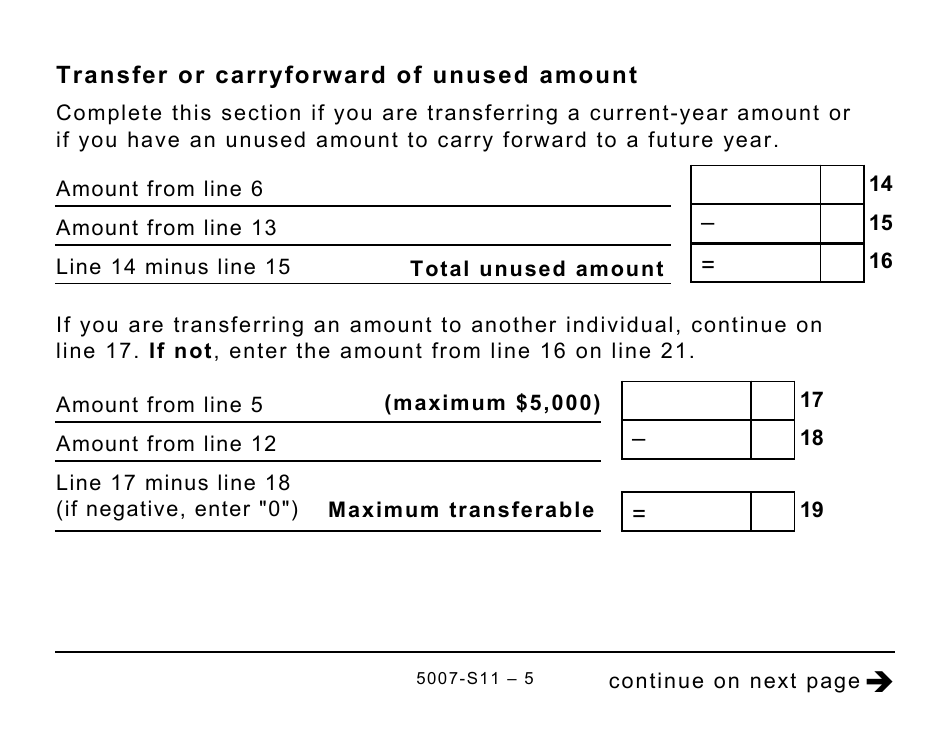

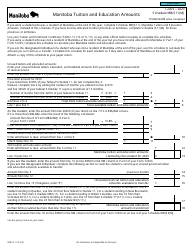

Form 5007-S11 Schedule MB(S11) Provincial Tuition and Education Amounts (Large Print) - Canada

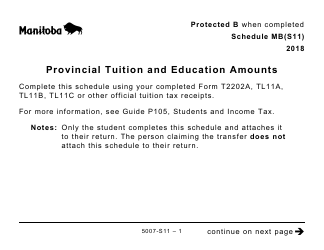

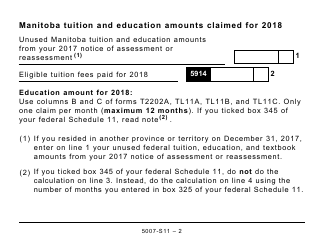

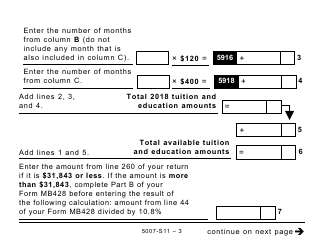

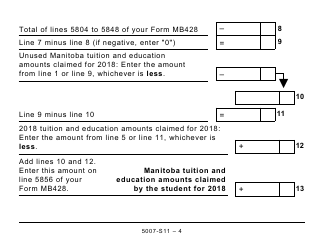

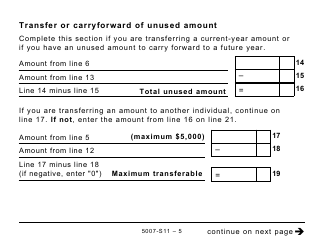

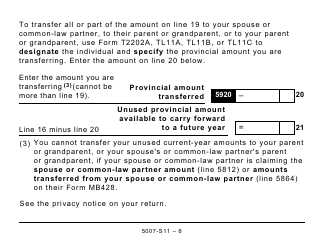

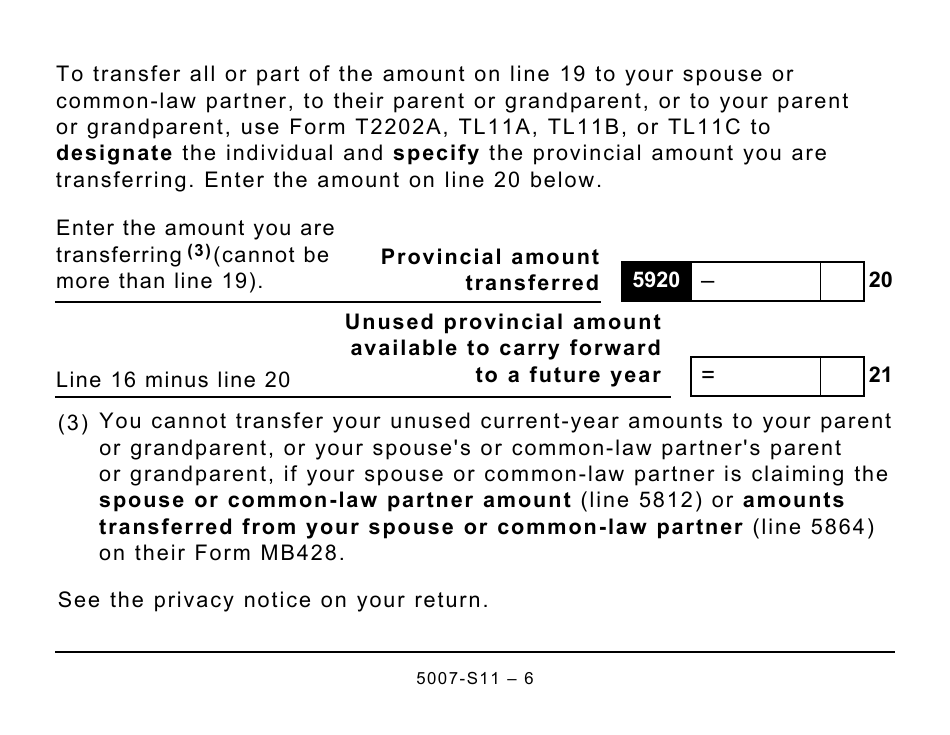

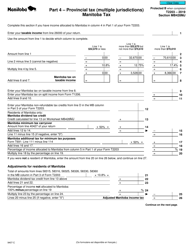

Form 5007-S11 Schedule MB(S11) Provincial Tuition and Education Amounts (Large Print) is a tax form used in Canada to claim provincial tax credits for tuition and education expenses.

FAQ

Q: What is Form 5007-S11 Schedule MB(S11)?

A: Form 5007-S11 Schedule MB(S11) is a form used in Canada for reporting provincial tuition and education amounts.

Q: Who needs to use Form 5007-S11 Schedule MB(S11)?

A: Form 5007-S11 Schedule MB(S11) is used by Canadian residents who want to claim provincial tuition and education amounts on their tax return.

Q: What is the purpose of Form 5007-S11 Schedule MB(S11)?

A: The purpose of Form 5007-S11 Schedule MB(S11) is to allow Canadian residents to claim provincial tuition and education amounts, which can help reduce their tax liability.

Q: Is Form 5007-S11 Schedule MB(S11) available in large print?

A: Yes, Form 5007-S11 Schedule MB(S11) is available in a large print format for individuals who have visual impairments.

Q: What information do I need to fill out Form 5007-S11 Schedule MB(S11)?

A: To fill out Form 5007-S11 Schedule MB(S11), you will need information about your provincial tuition and education amounts.

Q: When is the deadline to file Form 5007-S11 Schedule MB(S11)?

A: The deadline to file Form 5007-S11 Schedule MB(S11) is usually the same as the deadline for filing your income tax return, which is April 30th for most individuals.

Q: Can I claim provincial tuition and education amounts on my tax return?

A: Yes, if you meet the eligibility criteria, you can claim provincial tuition and education amounts on your tax return to potentially reduce your tax liability.

Q: What other forms do I need to include with Form 5007-S11 Schedule MB(S11)?

A: You may need to include other forms, such as Form T2202, depending on your specific situation and the provinces you are claiming amounts from.