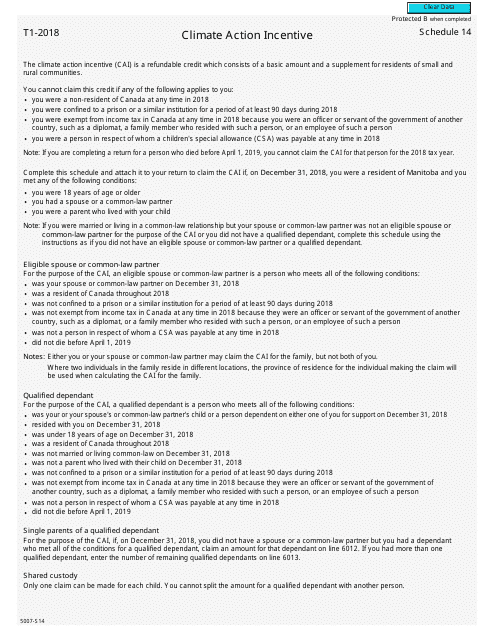

Form 5007-S14 Schedule 14 Climate Action Incentive - Canada

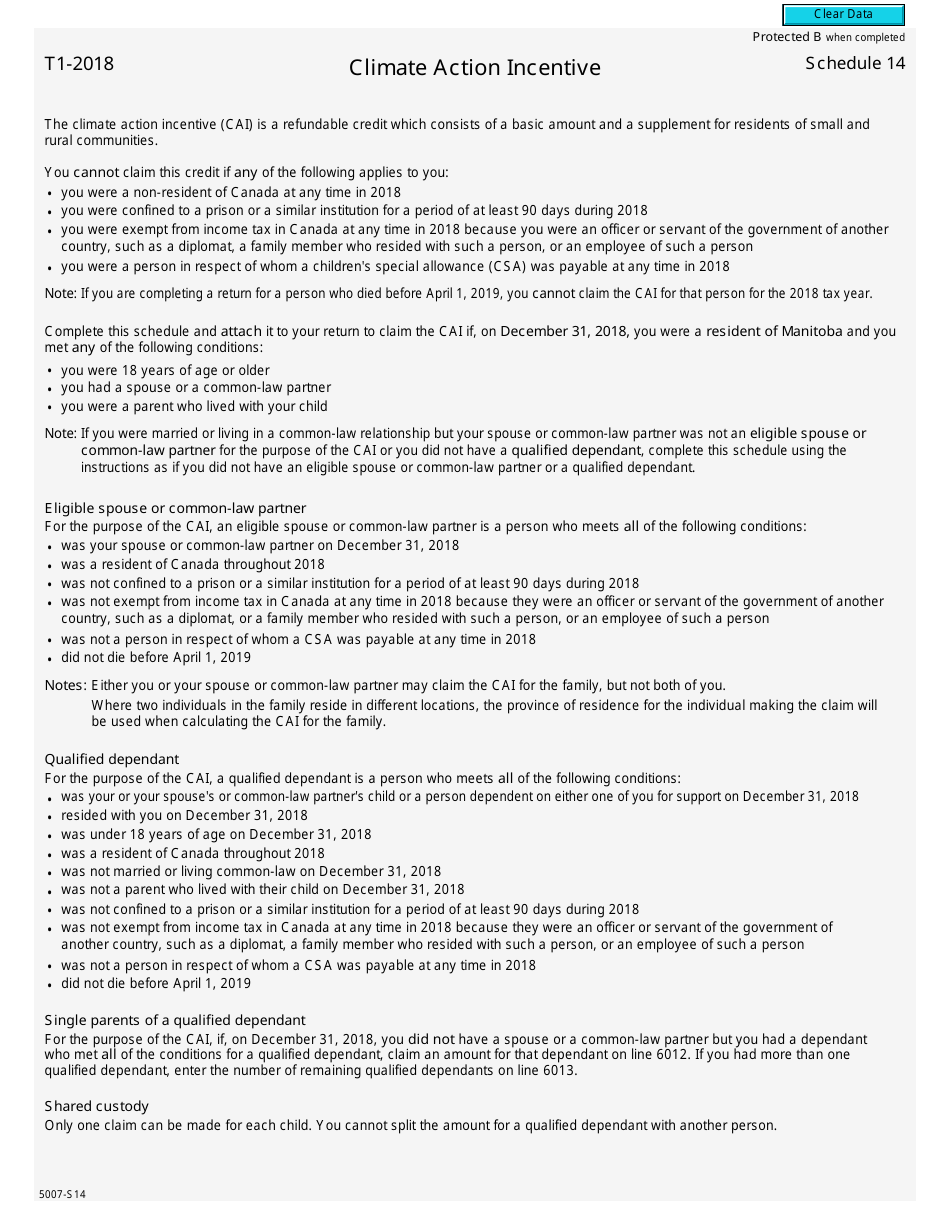

Form 5007-S14 Schedule 14 Climate Action Incentive is used in Canada to claim the Climate Action Incentive payment, which is a refundable tax credit provided to eligible individuals in certain provinces to help offset the cost of carbon pricing.

The Form 5007-S14 Schedule 14 Climate Action Incentive in Canada is filed by individuals who are looking to claim the Climate Action Incentive payment on their tax return.

FAQ

Q: What is Form 5007-S14?

A: Form 5007-S14 is the Schedule 14 Climate Action Incentive form in Canada.

Q: What is the purpose of Form 5007-S14?

A: The purpose of Form 5007-S14 is to claim the Climate Action Incentive on your Canadian tax return.

Q: Who can use Form 5007-S14?

A: Form 5007-S14 can be used by individuals who are eligible for the Climate Action Incentive in Canada.

Q: What is the Climate Action Incentive?

A: The Climate Action Incentive is a tax credit provided to residents of provinces with a federal carbon pricing system in Canada.

Q: Which provinces are eligible for the Climate Action Incentive?

A: The provinces eligible for the Climate Action Incentive are Ontario, Manitoba, Saskatchewan, and New Brunswick.

Q: What is reported on Form 5007-S14?

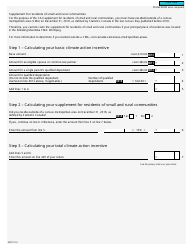

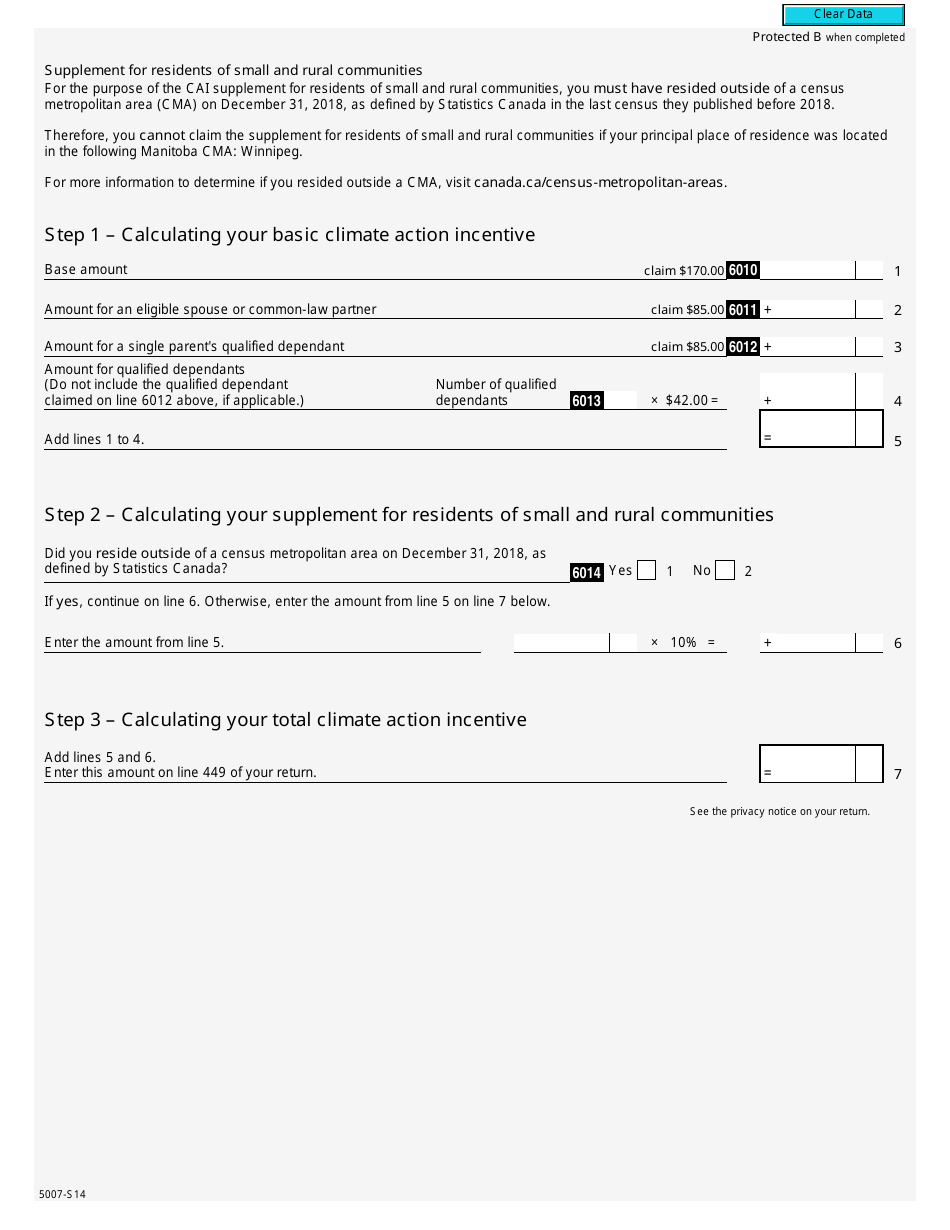

A: Form 5007-S14 is used to report the amount of the Climate Action Incentive you are claiming on your tax return.