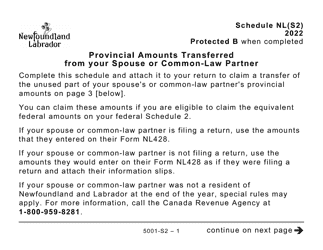

This version of the form is not currently in use and is provided for reference only. Download this version of

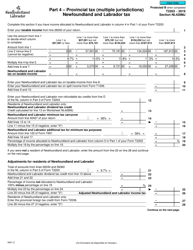

Form 5001-S2 Schedule NL(S2)

for the current year.

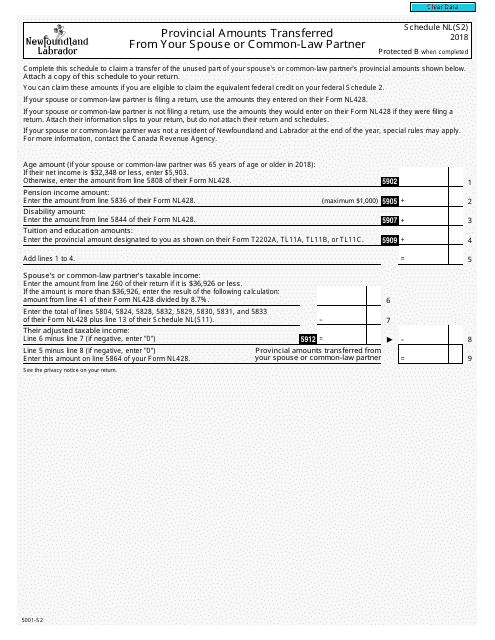

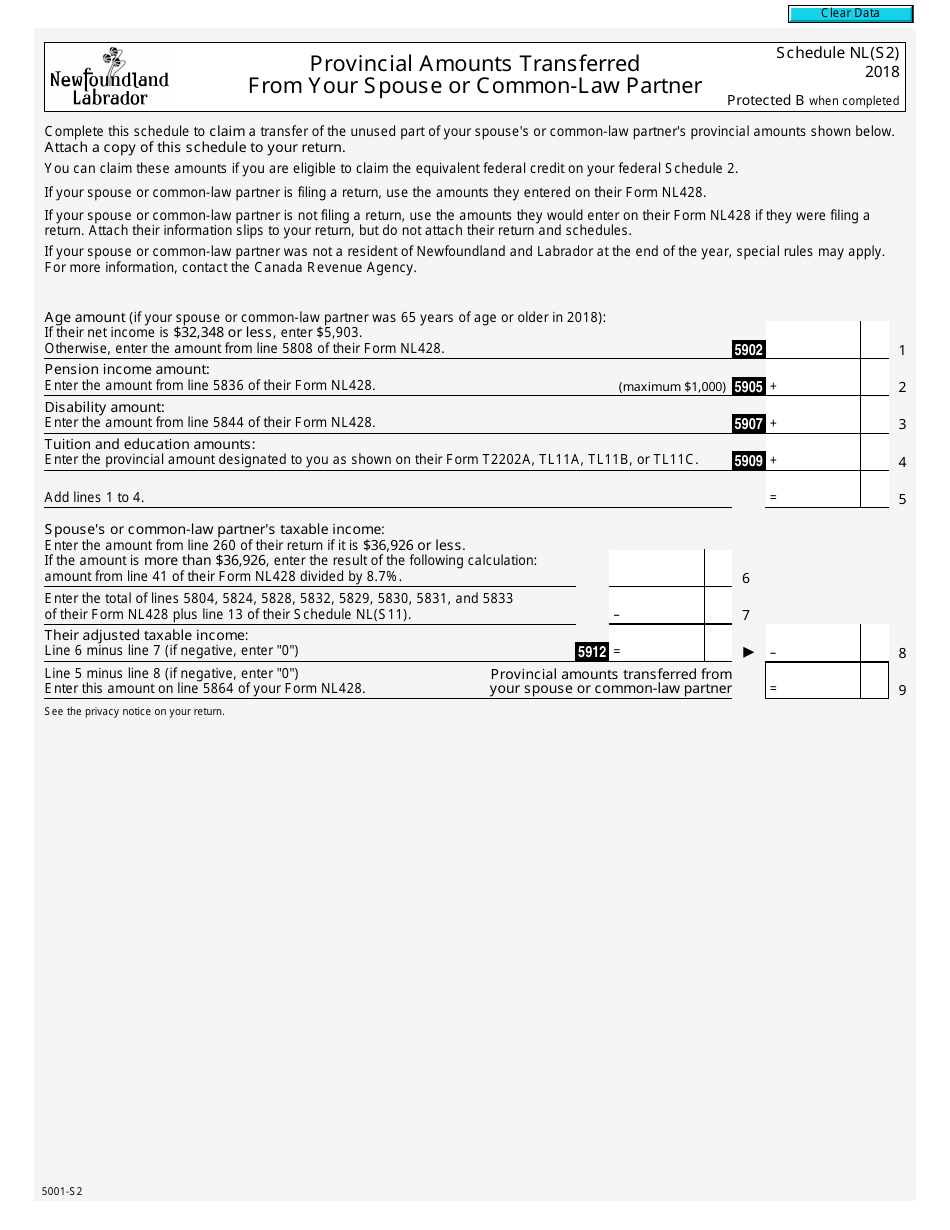

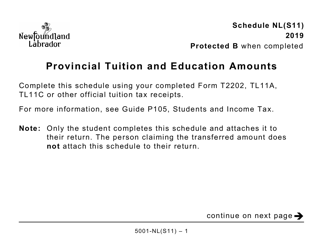

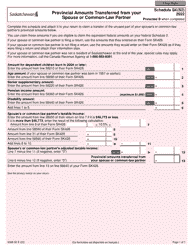

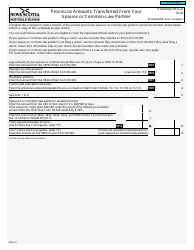

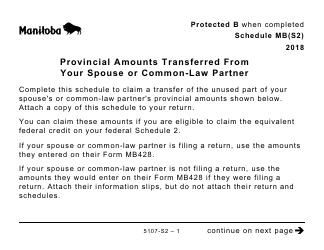

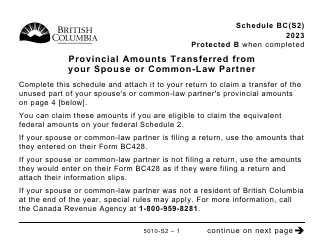

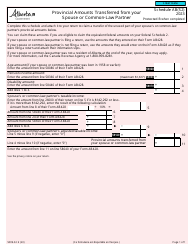

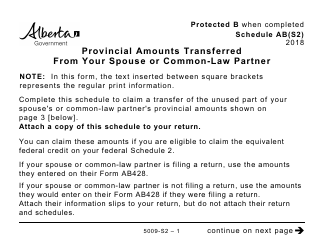

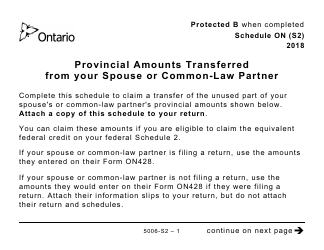

Form 5001-S2 Schedule NL(S2) Provincial Amounts Transferred From Your Spouse or Common-Law Partner - Canada

Form 5001-S2 Schedule NL(S2) is used in Canada to report the provincial amounts transferred from your spouse or common-law partner. It is a part of the Canadian tax documentation process.

The taxpayer who wants to report the provincial amounts transferred from their spouse or common-law partner files the Form 5001-S2 Schedule NL(S2) - Canada.

FAQ

Q: What is Form 5001-S2?

A: Form 5001-S2 is a schedule used in Canada to report provincial amounts transferred from your spouse or common-law partner.

Q: What is Schedule NL(S2)?

A: Schedule NL(S2) is a specific section of Form 5001-S2 that is used to report provincial amounts transferred from your spouse or common-law partner.

Q: What are provincial amounts transferred?

A: Provincial amounts transferred refer to certain deductions or credits that can be transferred from your spouse or common-law partner to reduce your provincial taxes.

Q: Who should use Form 5001-S2 Schedule NL(S2)?

A: Individuals in Canada who want to report provincial amounts transferred from their spouse or common-law partner should use Form 5001-S2 Schedule NL(S2).

Q: Do I need to complete Schedule NL(S2)?

A: You need to complete Schedule NL(S2) if you want to claim provincial amounts transferred from your spouse or common-law partner.

Q: Are there any eligibility requirements to transfer provincial amounts?

A: Yes, there are specific eligibility requirements that you and your spouse or common-law partner must meet in order to transfer provincial amounts.

Q: Can I transfer provincial amounts if I am not married?

A: Yes, you can transfer provincial amounts if you have a common-law partner. Marriage is not a requirement for transferring provincial amounts.

Q: Which provinces allow the transfer of provincial amounts?

A: The transfer of provincial amounts varies by province. It is important to check the specific rules and regulations of your province to determine if you are eligible to transfer provincial amounts.

Q: When is the deadline to file Form 5001-S2 Schedule NL(S2)?

A: The deadline to file Form 5001-S2 Schedule NL(S2) is usually April 30th of each year for most individuals in Canada.

Q: What happens if I don't file Form 5001-S2 Schedule NL(S2)?

A: If you are eligible to transfer provincial amounts and fail to file Form 5001-S2 Schedule NL(S2), you may miss out on potential tax savings.

Q: Do I need to submit supporting documents with Form 5001-S2 Schedule NL(S2)?

A: In most cases, you do not need to submit supporting documents with Form 5001-S2 Schedule NL(S2). However, it is important to keep them in case the CRA requests them for verification.