This version of the form is not currently in use and is provided for reference only. Download this version of

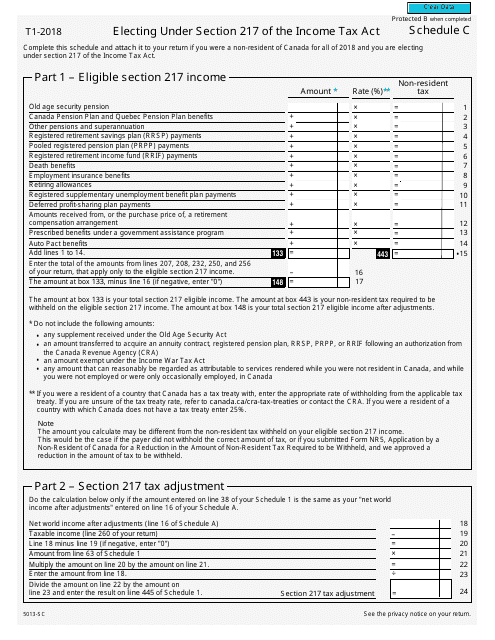

Form 5013-SC Schedule C

for the current year.

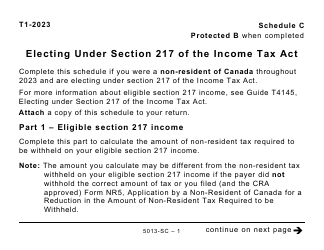

Form 5013-SC Schedule C Electing Under Section 217 of the Income Tax Act - Canada

This fillable " Electing Under Section 217 Of The Income Tax Act " is a document issued by the Canadian Revenue Agency specifically for Canada residents.

Download the PDF by clicking the link below and complete it directly in your browser or through the Adobe Desktop application.

FAQ

Q: What is form 5013-SC?

A: Form 5013-SC is a Schedule C form.

Q: What is Schedule C?

A: Schedule C is a form used for electing under Section 217 of the Income Tax Act in Canada.

Q: What is Section 217 of the Income Tax Act?

A: Section 217 of the Income Tax Act allows individuals to deduct certain foreign taxes paid on employment income earned outside of Canada.

Q: Who is eligible to use form 5013-SC?

A: Individuals who meet the requirements of Section 217 of the Income Tax Act and have foreign employment income may use form 5013-SC.

Q: What is the purpose of form 5013-SC?

A: The purpose of form 5013-SC is to elect to claim a deduction for foreign taxes paid on employment income earned outside of Canada.