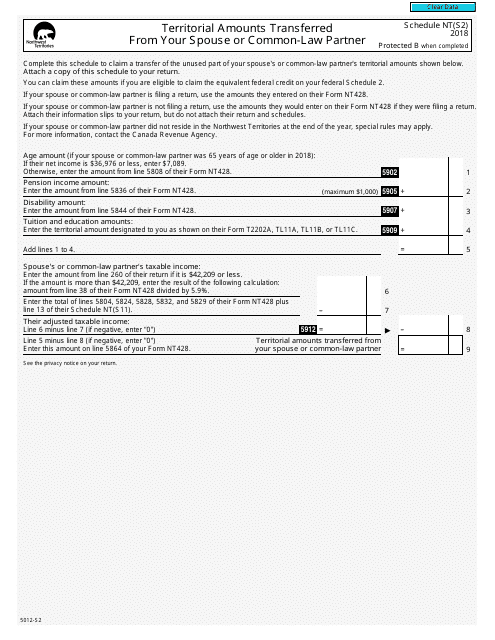

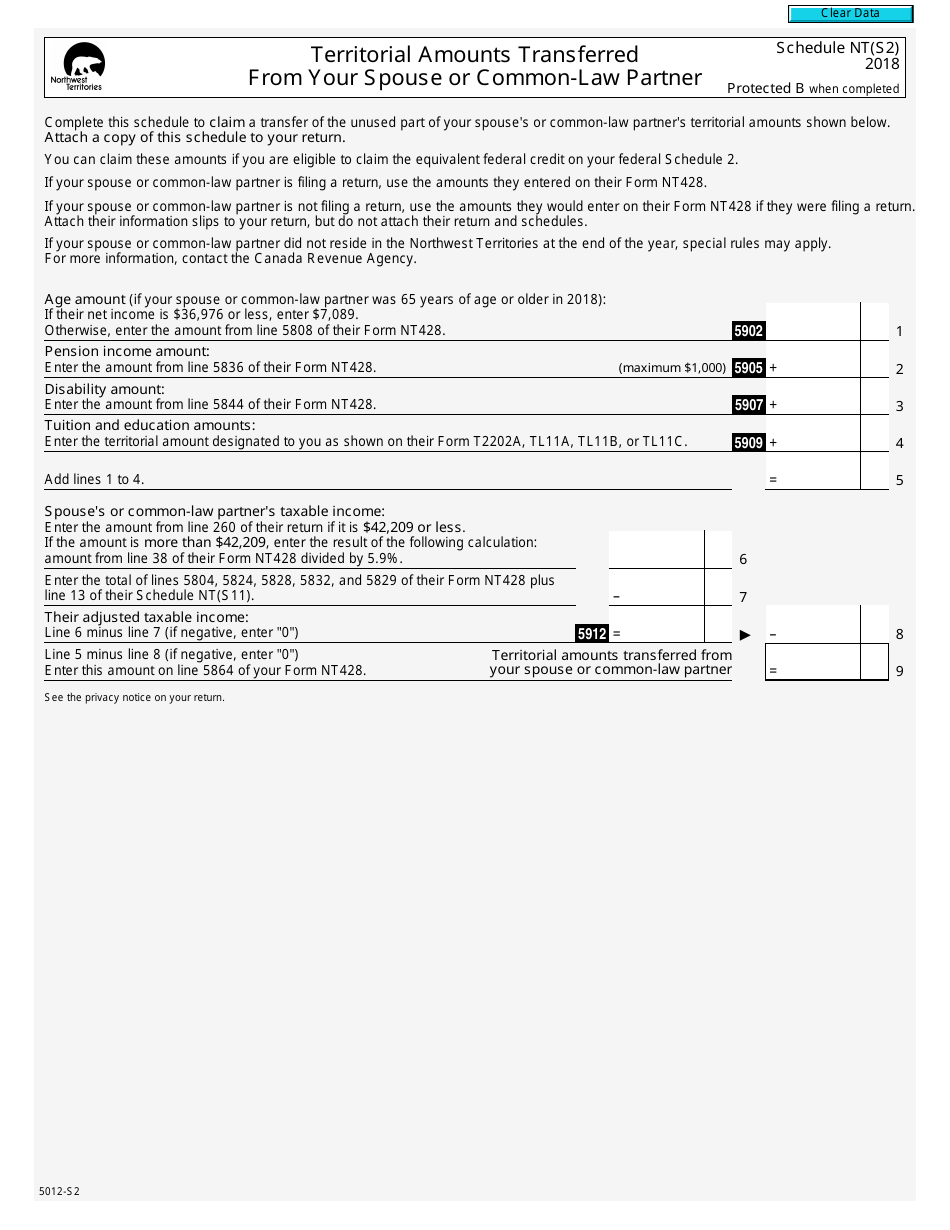

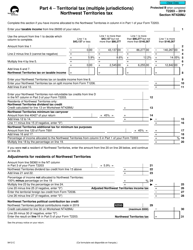

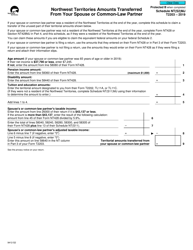

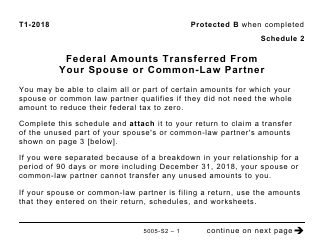

Form 5012-S2 Schedule NT(S2) Territorial Amounts Transferred From Your Spouse or Common-Law Partner - Canada

FAQ

Q: What is Form 5012-S2 Schedule NT(S2)?

A: Form 5012-S2 Schedule NT(S2) is a tax form used in Canada.

Q: What is Schedule NT(S2) used for?

A: Schedule NT(S2) is used to report territorial amounts transferred from your spouse or common-law partner.

Q: Who needs to file Schedule NT(S2)?

A: Individuals in Canada who have territorial amounts transferred from their spouse or common-law partner need to file Schedule NT(S2).

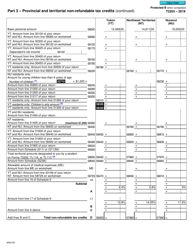

Q: What are territorial amounts?

A: Territorial amounts refer to certain tax credits or deductions that can be transferred from one spouse or common-law partner to the other.

Q: Why would someone transfer territorial amounts?

A: Transferring territorial amounts can help optimize tax savings for a couple, as it allows one partner to use the other partner's unused credits or deductions.

Q: When is the deadline to file Schedule NT(S2)?

A: The deadline to file Schedule NT(S2) typically aligns with the deadline for filing your income tax return in Canada, which is April 30th for most individuals.

Q: Do I need to include Schedule NT(S2) with my tax return?

A: Yes, if you have territorial amounts transferred from your spouse or common-law partner, you must include Schedule NT(S2) with your tax return.

Q: What happens if I don't file Schedule NT(S2)?

A: If you're eligible to transfer territorial amounts but don't file Schedule NT(S2), you may miss out on potential tax savings.