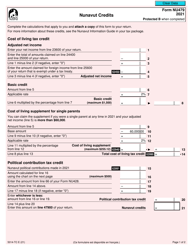

This version of the form is not currently in use and is provided for reference only. Download this version of

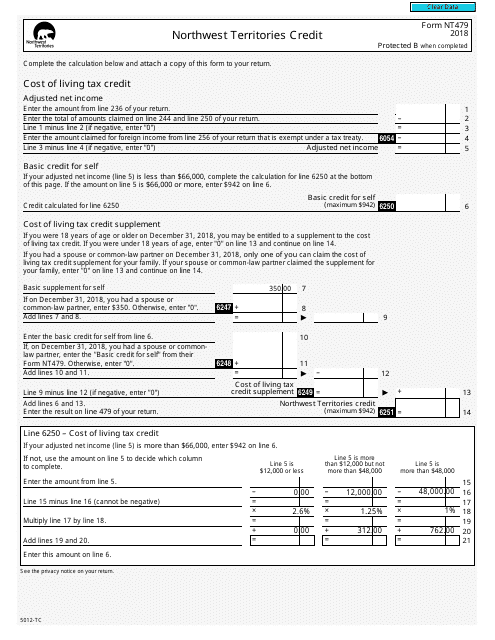

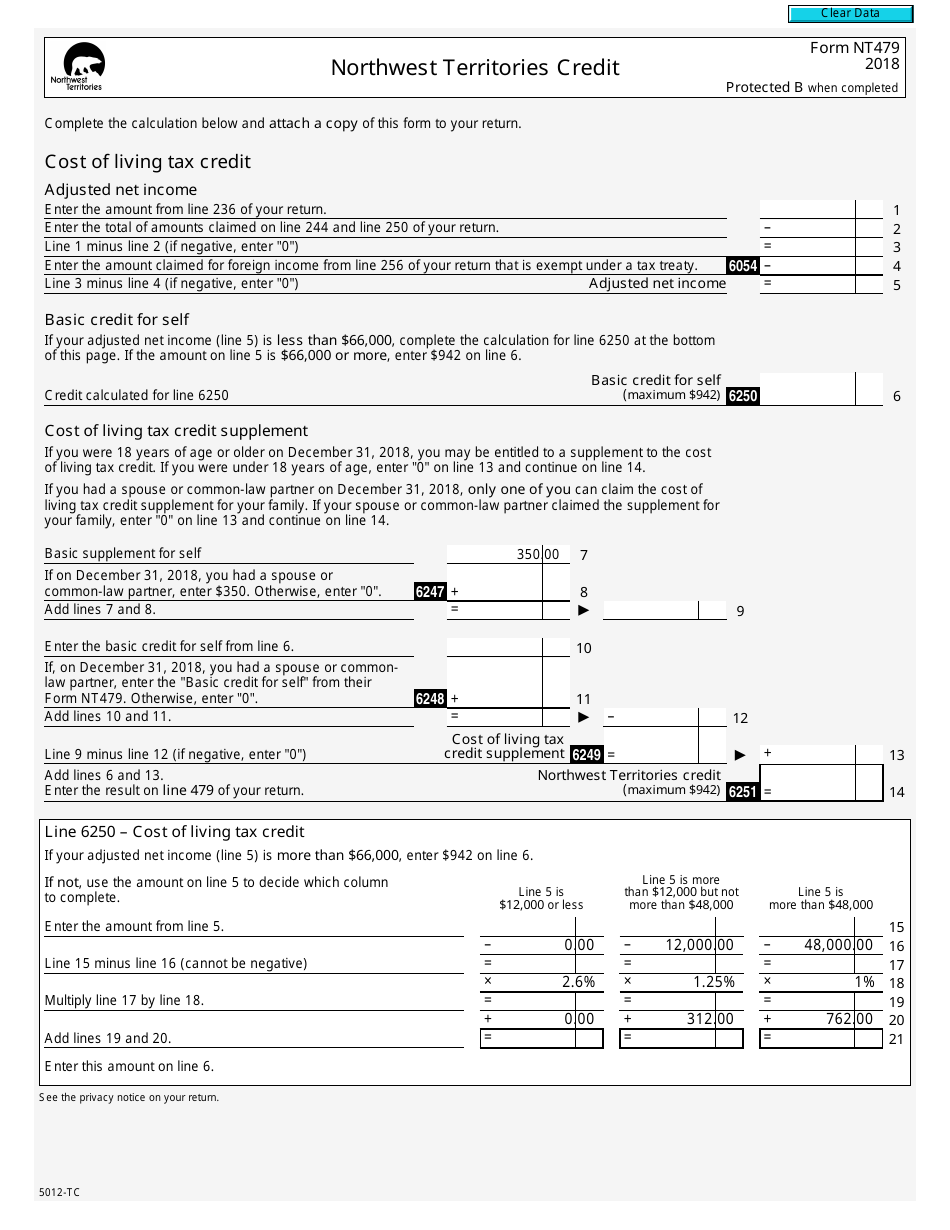

Form 5012-TC (NT479)

for the current year.

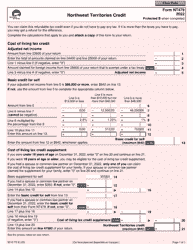

Form 5012-TC (NT479) Northwest Territories Credit - Canada

Form 5012-TC (NT479) is used in the Northwest Territories of Canada to claim the Northwest Territories Credit on your income tax return. It provides information about your eligibility for the credit and helps determine the amount that you may be eligible to receive.

The Form 5012-TC (NT479) Northwest Territories Credit in Canada must be filed by eligible individuals residing in the Northwest Territories.

FAQ

Q: What is Form 5012-TC (NT479)?

A: Form 5012-TC (NT479) is a tax credit form specific to the Northwest Territories in Canada.

Q: What is the Northwest Territories Credit?

A: The Northwest Territories Credit is a tax credit specific to residents of the Northwest Territories in Canada.

Q: Who is eligible for the Northwest Territories Credit?

A: Residents of the Northwest Territories in Canada are eligible for the Northwest Territories Credit, provided they meet certain criteria.

Q: What are the eligibility criteria for the Northwest Territories Credit?

A: The eligibility criteria for the Northwest Territories Credit vary and are outlined on Form 5012-TC (NT479).

Q: How do I fill out Form 5012-TC (NT479)?

A: Instructions for filling out Form 5012-TC (NT479) are provided with the form itself. Follow the instructions carefully to ensure accurate completion.

Q: When is the deadline for filing Form 5012-TC (NT479)?

A: The deadline for filing Form 5012-TC (NT479) is usually the same as the deadline for filing your annual income tax return.

Q: Is the Northwest Territories Credit refundable?

A: No, the Northwest Territories Credit is a non-refundable tax credit, meaning it can only be used to reduce your tax payable.

Q: Can I claim the Northwest Territories Credit if I live in a different province or territory?

A: No, the Northwest Territories Credit is only available to residents of the Northwest Territories.

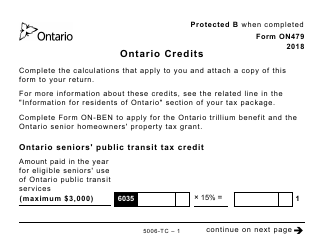

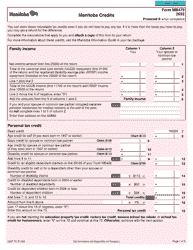

Q: What other tax credits are available in Canada?

A: There are several tax credits available in Canada, including the federal and provincial/territorial tax credits. These vary depending on your province or territory of residence.