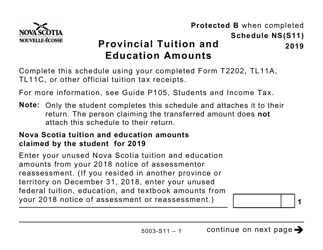

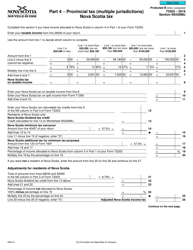

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5003-S11 Schedule NS(S11)

for the current year.

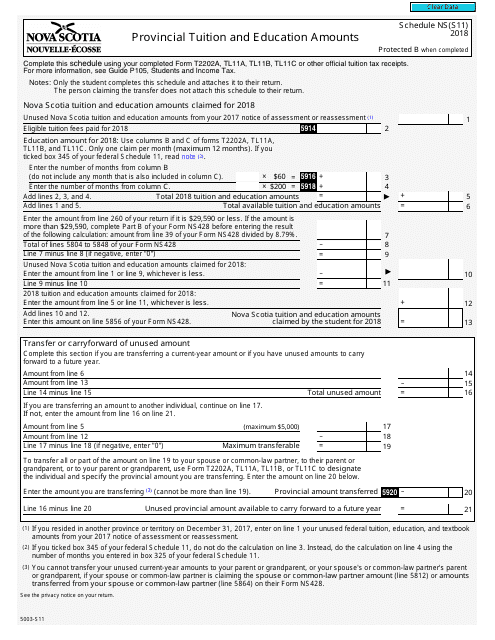

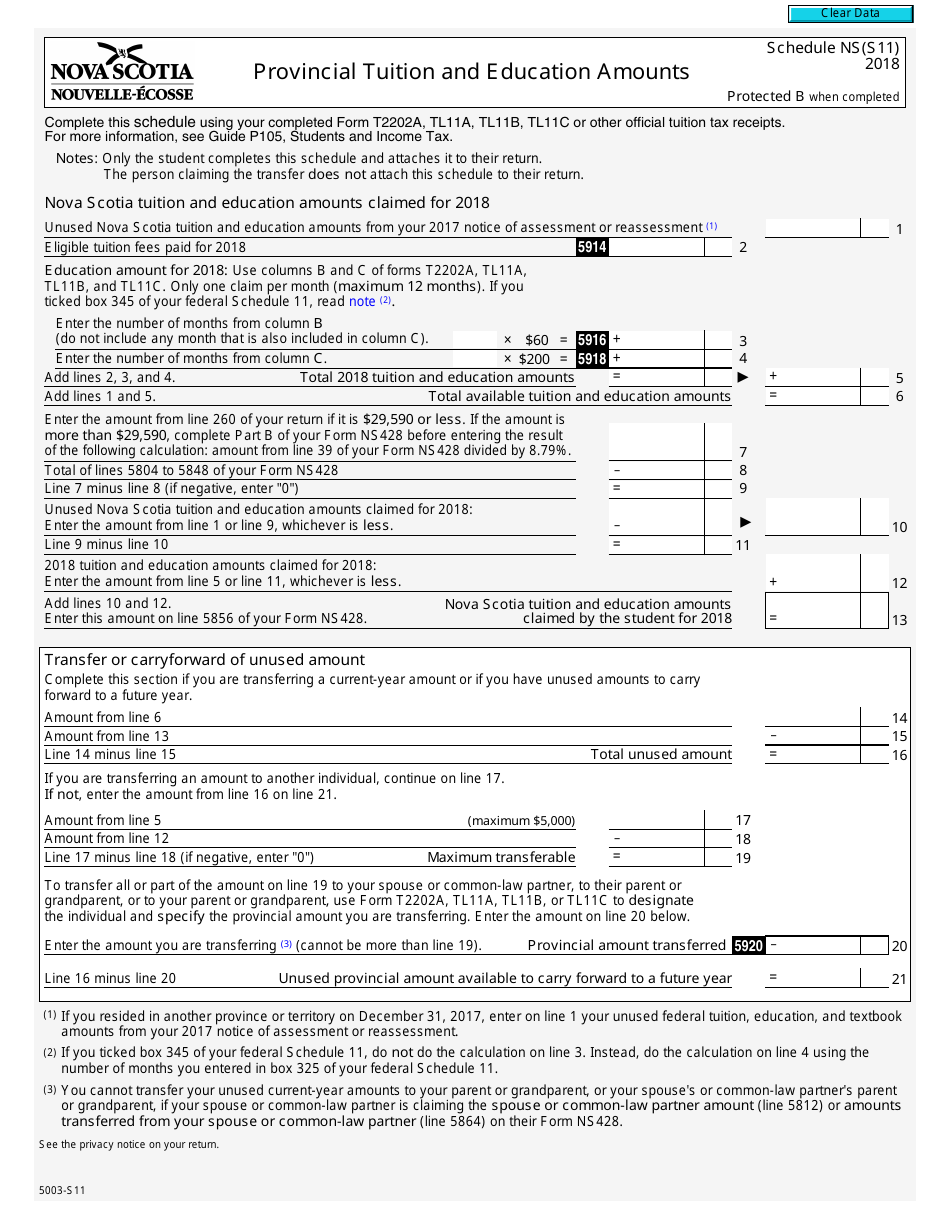

Form 5003-S11 Schedule NS(S11) Provincial Tuition and Education Amounts - Canada

Form 5003-S11 Schedule NS(S11) Provincial Tuition and Education Amounts in Canada is used to claim education-related tax credits specific to the province of Nova Scotia.

The Form 5003-S11 Schedule NS(S11) Provincial Tuition and Education Amounts in Canada is typically filed by individuals who are residents of the province of Nova Scotia.

FAQ

Q: What is Form 5003-S11?

A: Form 5003-S11 is a schedule used in Canada to claim provincial tuition and education amounts.

Q: What is Schedule NS(S11)?

A: Schedule NS(S11) is a specific version of Form 5003-S11 used in Canada.

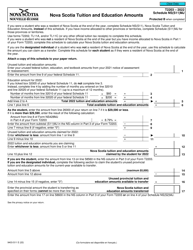

Q: What can I claim on Schedule NS(S11)?

A: On Schedule NS(S11), you can claim provincial tuition and education amounts.

Q: Who can use Schedule NS(S11)?

A: Schedule NS(S11) can be used by Canadian residents who paid tuition fees for post-secondary education in certain provinces or territories.

Q: How do I fill out Schedule NS(S11)?

A: To fill out Schedule NS(S11), you need to enter the required information about your tuition and education amounts for the specific province or territory.

Q: When is Schedule NS(S11) due?

A: Schedule NS(S11) is due along with your annual income tax return, which is typically due by April 30th of each year.