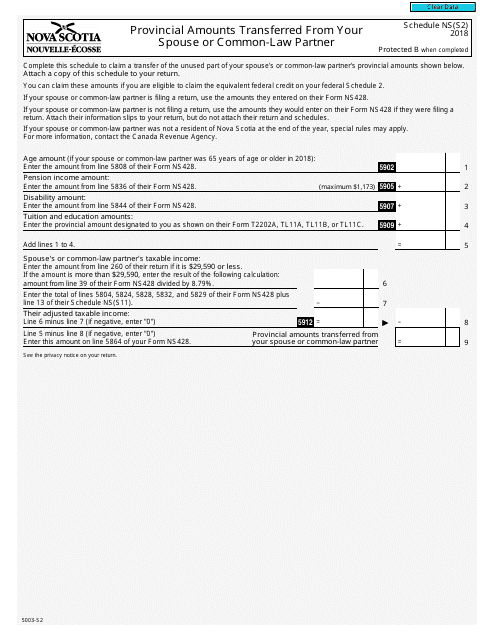

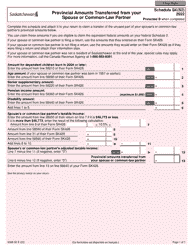

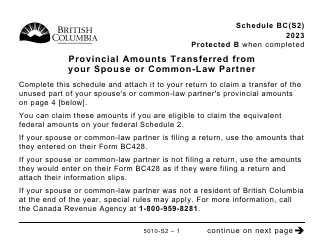

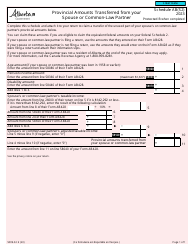

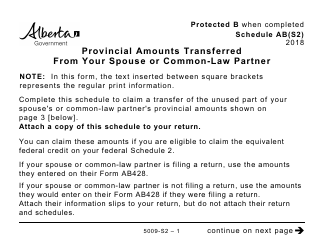

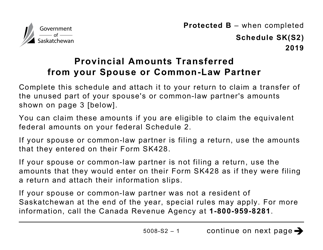

Form 5003-S2 Schedule NS(S2) Provincial Amounts Transferred From Your Spouse or Common-Law Partner - Canada

FAQ

Q: What is Form 5003-S2?

A: Form 5003-S2 is a schedule used in Canada for reporting provincial amounts transferred from your spouse or common-law partner.

Q: What is Schedule NS(S2)?

A: Schedule NS(S2) refers to the specific section of Form 5003-S2 that deals with provincial amounts transferred from your spouse or common-law partner.

Q: What are provincial amounts transferred from a spouse or common-law partner?

A: Provincial amounts transferred from a spouse or common-law partner refer to the transfer of certain tax credits or deductions from one spouse to the other in Canada.

Q: Who needs to use Form 5003-S2 Schedule NS(S2)?

A: Form 5003-S2 Schedule NS(S2) needs to be used by individuals in Canada who are transferring provincial amounts from their spouse or common-law partner.

Q: Why would someone transfer provincial amounts from their spouse or common-law partner?

A: People may choose to transfer provincial amounts from their spouse or common-law partner to optimize their tax situation and potentially reduce their overall tax liability.

Q: Is Form 5003-S2 required for everyone filing taxes in Canada?

A: No, Form 5003-S2 is only required for individuals who are transferring provincial amounts from their spouse or common-law partner. It is not necessary for everyone.