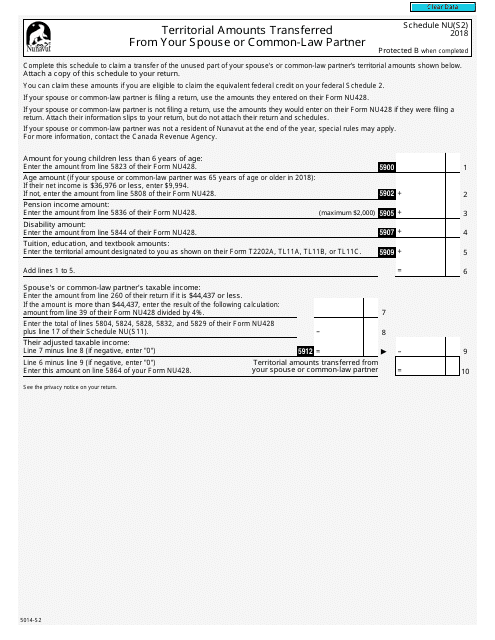

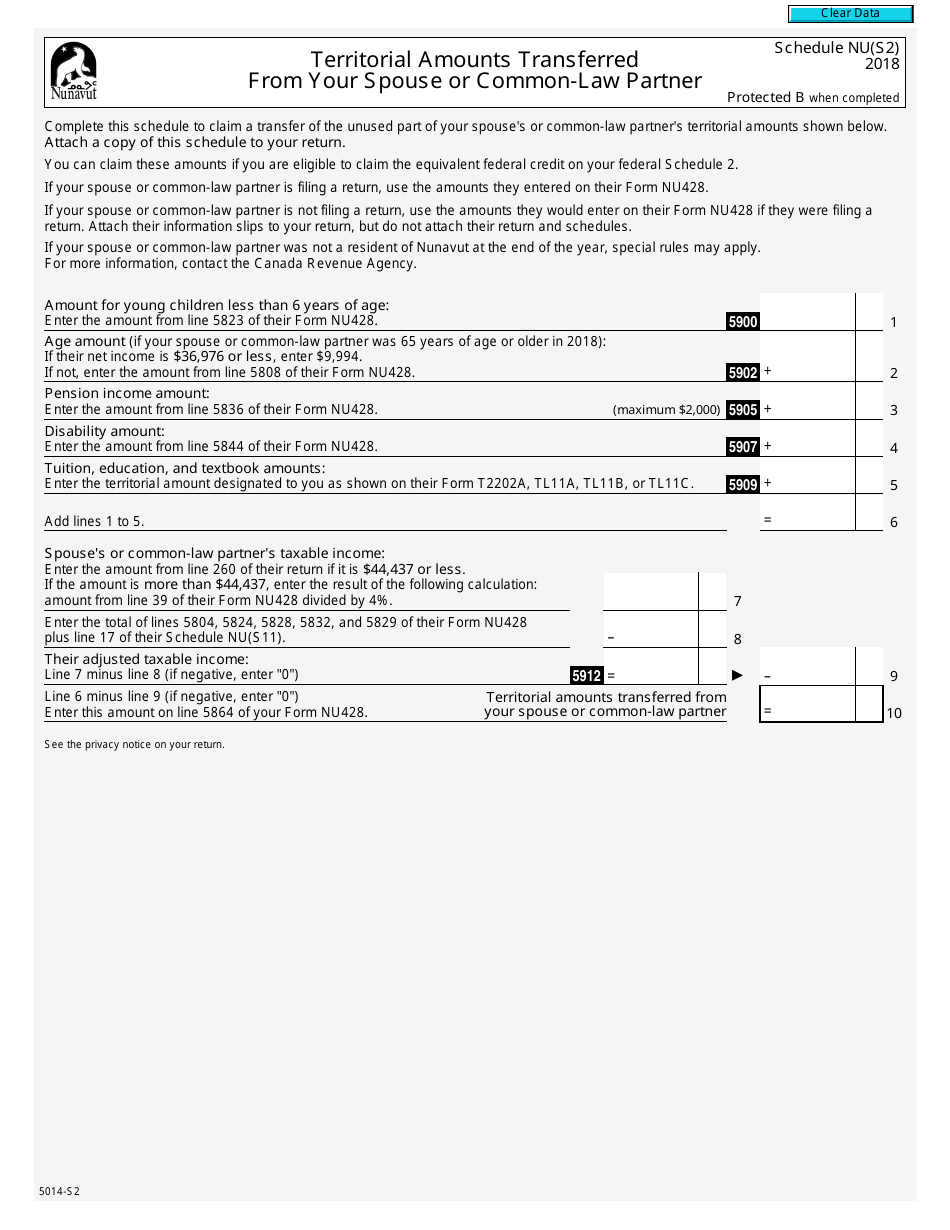

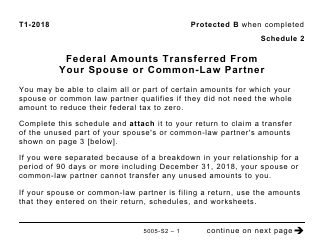

Form 50104-S2 Schedule NU(S2) Territorial Amounts Transferred From Your Spouse or Common-Law Partner - Canada

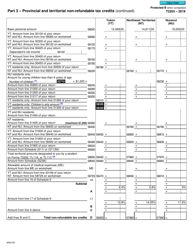

Form 50104-S2 Schedule NU(S2) is used in the Canadian tax system to report territorial amounts transferred from a spouse or common-law partner. These amounts are transferred to help reduce the tax liability of one partner by allocating certain income or deductions to the other partner.

FAQ

Q: What is Form 50104-S2?

A: Form 50104-S2 is a schedule used in Canada to report territorial amounts transferred from your spouse or common-law partner.

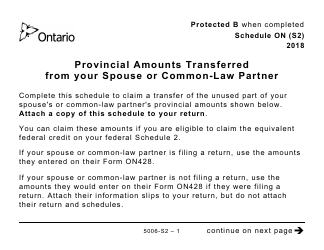

Q: What is Schedule NU(S2)?

A: Schedule NU(S2) is a specific part of Form 50104-S2 that deals with territorial amounts transferred from your spouse or common-law partner.

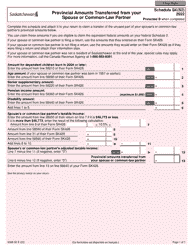

Q: What are territorial amounts?

A: Territorial amounts refer to income, deductions, or credits that are specific to a particular province or territory in Canada.

Q: Why would I transfer territorial amounts from my spouse or common-law partner?

A: Transferring territorial amounts from your spouse or common-law partner can help reduce your overall tax liability by using their unused amounts.

Q: What is considered a spouse or common-law partner?

A: In Canada, a spouse refers to a legally married partner, while a common-law partner is someone who has been living with you in a conjugal relationship for at least 12 continuous months.

Q: Do I need to file this form in the United States?

A: No, this form is specific to Canadian tax requirements and does not need to be filed in the United States.