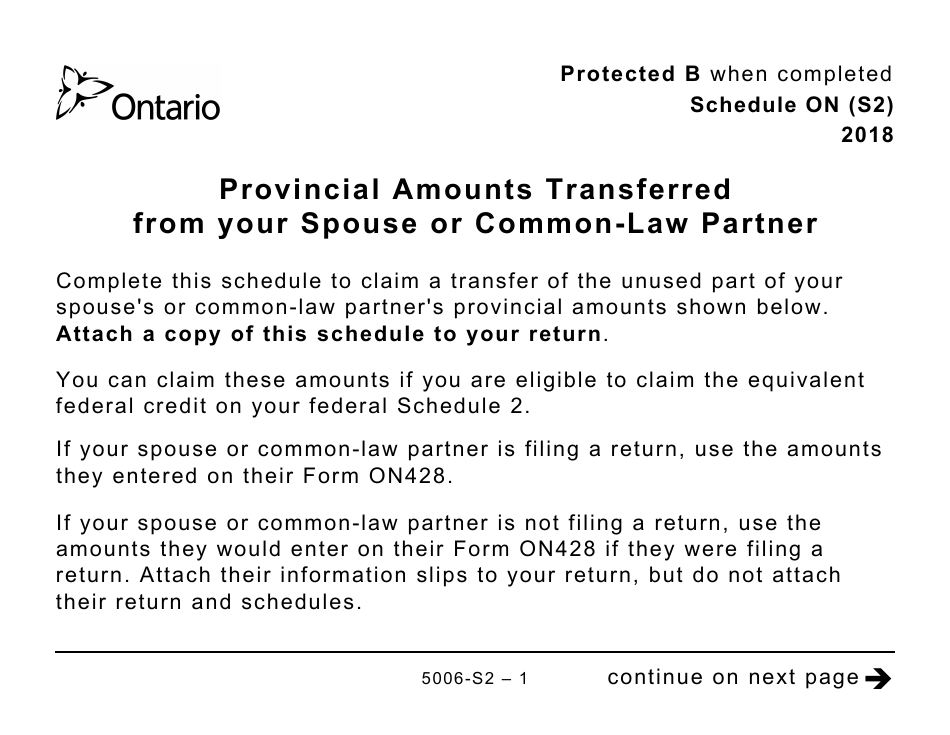

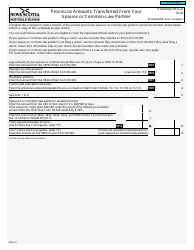

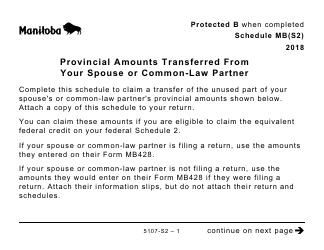

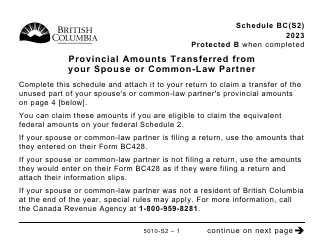

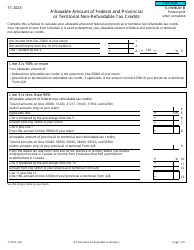

Form 5006-S2 Schedule ON (S2) Provincial Amounts Transferred From Your Spouse or Common-Law Partner (Large Print) - Canada

The Form 5006-S2 Schedule ON (S2) Provincial Amounts Transferred From Your Spouse or Common-Law Partner (Large Print) in Canada is used to report any provincial tax credits that you are transferring from your spouse or common-law partner. It is specifically designed for individuals with visual impairments, as it is in large print format.

The Form 5006-S2 Schedule ON (S2) Provincial Amounts Transferred From Your Spouse or Common-Law Partner (Large Print) in Canada is filed by individuals who want to transfer certain provincial amounts from their spouse or common-law partner.

FAQ

Q: What is Form 5006-S2 Schedule ON (S2)?

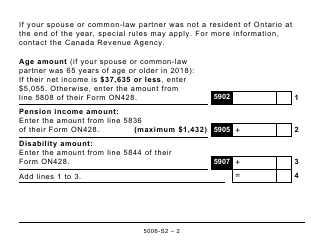

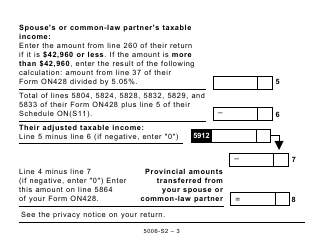

A: Form 5006-S2 Schedule ON (S2) is used in Canada to report provincial amounts transferred from your spouse or common-law partner.

Q: Why would I need to use Form 5006-S2 Schedule ON (S2)?

A: You would need to use Form 5006-S2 Schedule ON (S2) if you want to claim any provincial amounts transferred from your spouse or common-law partner on your Canadian tax return.

Q: Is Form 5006-S2 Schedule ON (S2) only applicable to residents of Ontario?

A: Yes, Form 5006-S2 Schedule ON (S2) is specifically designed for residents of Ontario.

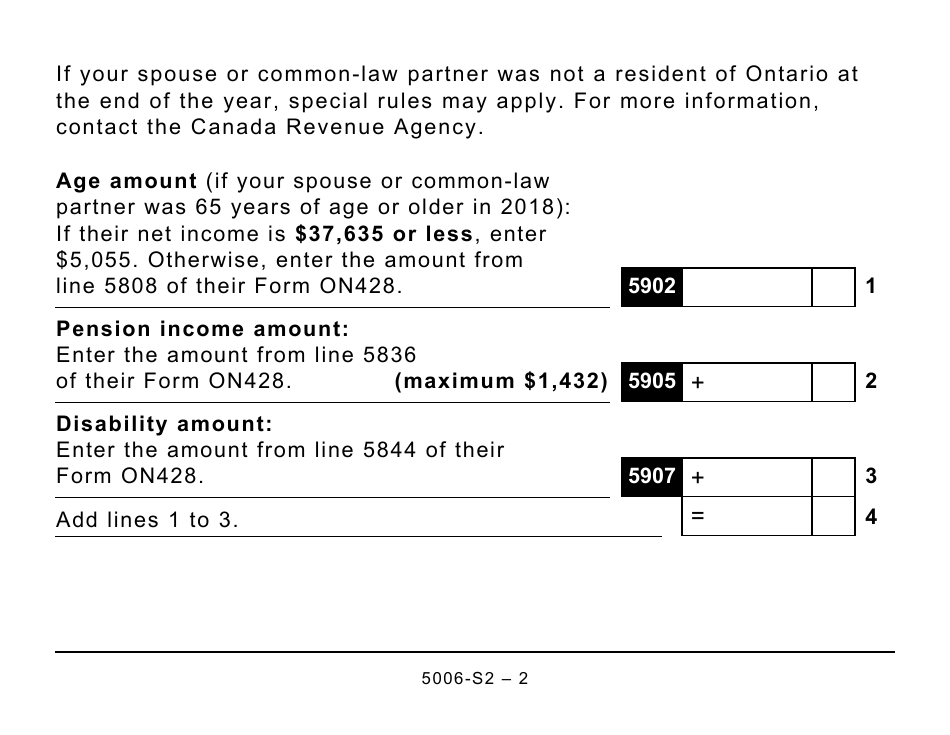

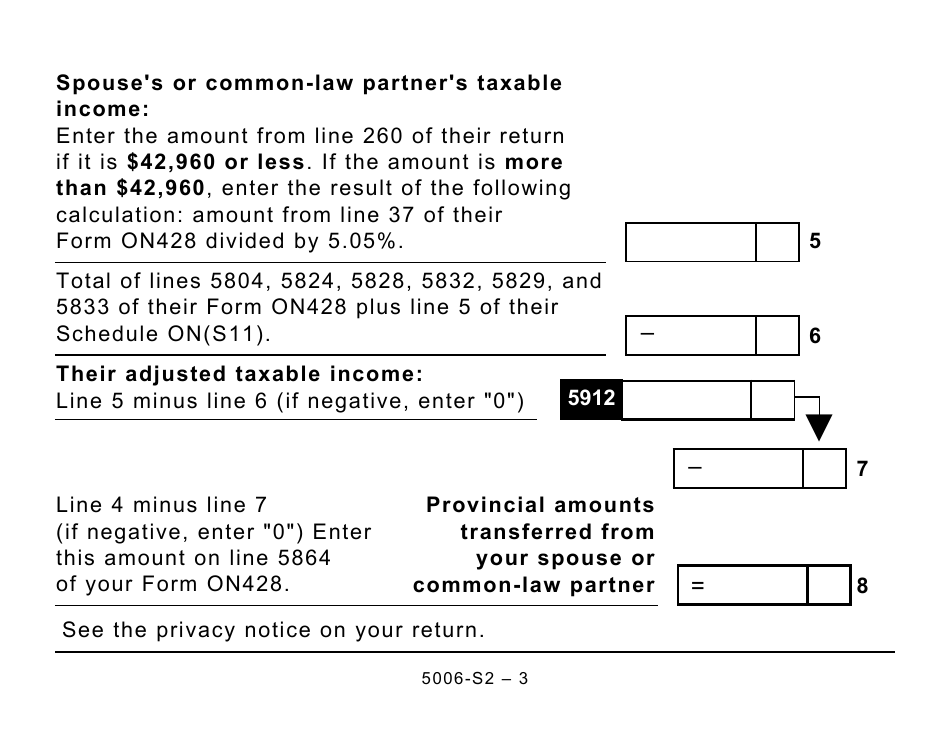

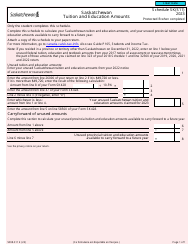

Q: What information do I need to fill out Form 5006-S2 Schedule ON (S2)?

A: To fill out Form 5006-S2 Schedule ON (S2), you will need the transferor's social insurance number, the amount being transferred, and details of the transfer.

Q: When is the deadline to submit Form 5006-S2 Schedule ON (S2)?

A: The deadline to submit Form 5006-S2 Schedule ON (S2) is usually the same as the deadline for filing your Canadian income tax return, which is April 30th, unless that day falls on a weekend or holiday.

Q: Can I claim amounts transferred from my spouse or common-law partner for any tax year?

A: No, you can only claim amounts transferred from your spouse or common-law partner for the current tax year or any unused amounts from the previous tax year.

Q: What do I do with Form 5006-S2 Schedule ON (S2) once I have completed it?

A: Once you have completed Form 5006-S2 Schedule ON (S2), you should keep a copy for your records and submit it along with your Canadian tax return to the CRA.