This version of the form is not currently in use and is provided for reference only. Download this version of

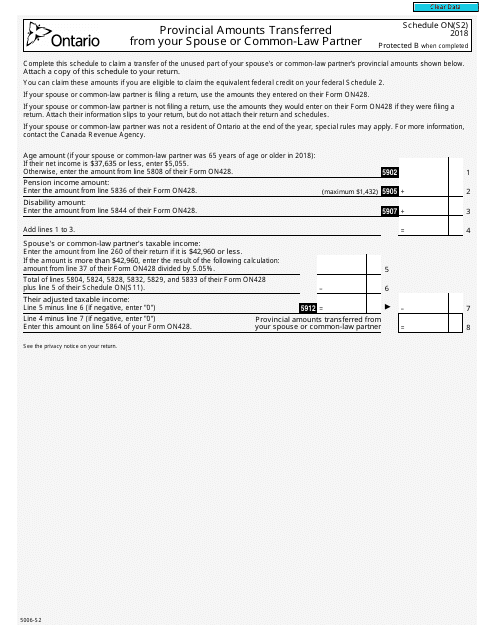

Form 5006-S2 Schedule ON(S2)

for the current year.

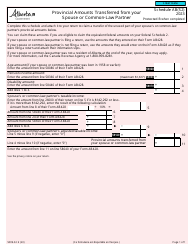

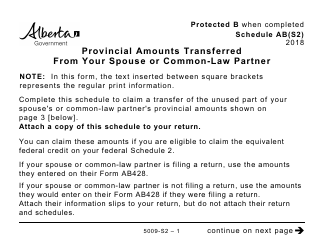

Form 5006-S2 Schedule ON(S2) Provincial Amounts Transferred From Your Spouse or Common-Law Partner - Canada

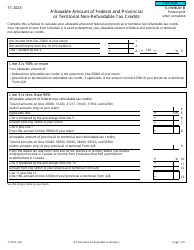

Form 5006-S2 Schedule ON(S2) is used in Canada to report provincial amounts transferred from your spouse or common-law partner on your tax return. It is used to determine if you are eligible for certain provincial tax credits or deductions based on your partner's income.

The Form 5006-S2 Schedule ON(S2) is filed by individuals in Canada who want to report provincial amounts transferred from their spouse or common-law partner.

FAQ

Q: What is Form 5006-S2?

A: Form 5006-S2 is a tax form in Canada.

Q: What is Schedule ON(S2) on Form 5006-S2?

A: Schedule ON(S2) on Form 5006-S2 is used to report provincial amounts transferred from your spouse or common-law partner.

Q: What is a provincial amount?

A: A provincial amount is an amount that can be transferred from one spouse or partner to another for provincial tax purposes.

Q: Who can transfer a provincial amount?

A: A provincial amount can be transferred by a spouse or common-law partner if certain conditions are met.

Q: What are the conditions to transfer a provincial amount?

A: The conditions to transfer a provincial amount vary depending on the province or territory.

Q: Why would someone want to transfer a provincial amount?

A: Transferring a provincial amount can help reduce the overall tax burden for a couple.