This version of the form is not currently in use and is provided for reference only. Download this version of

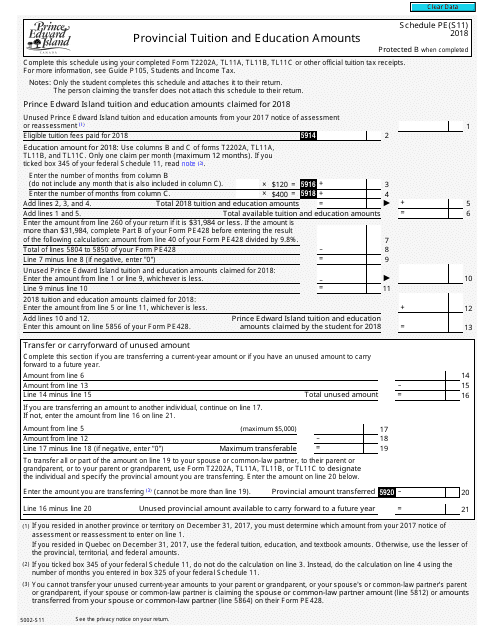

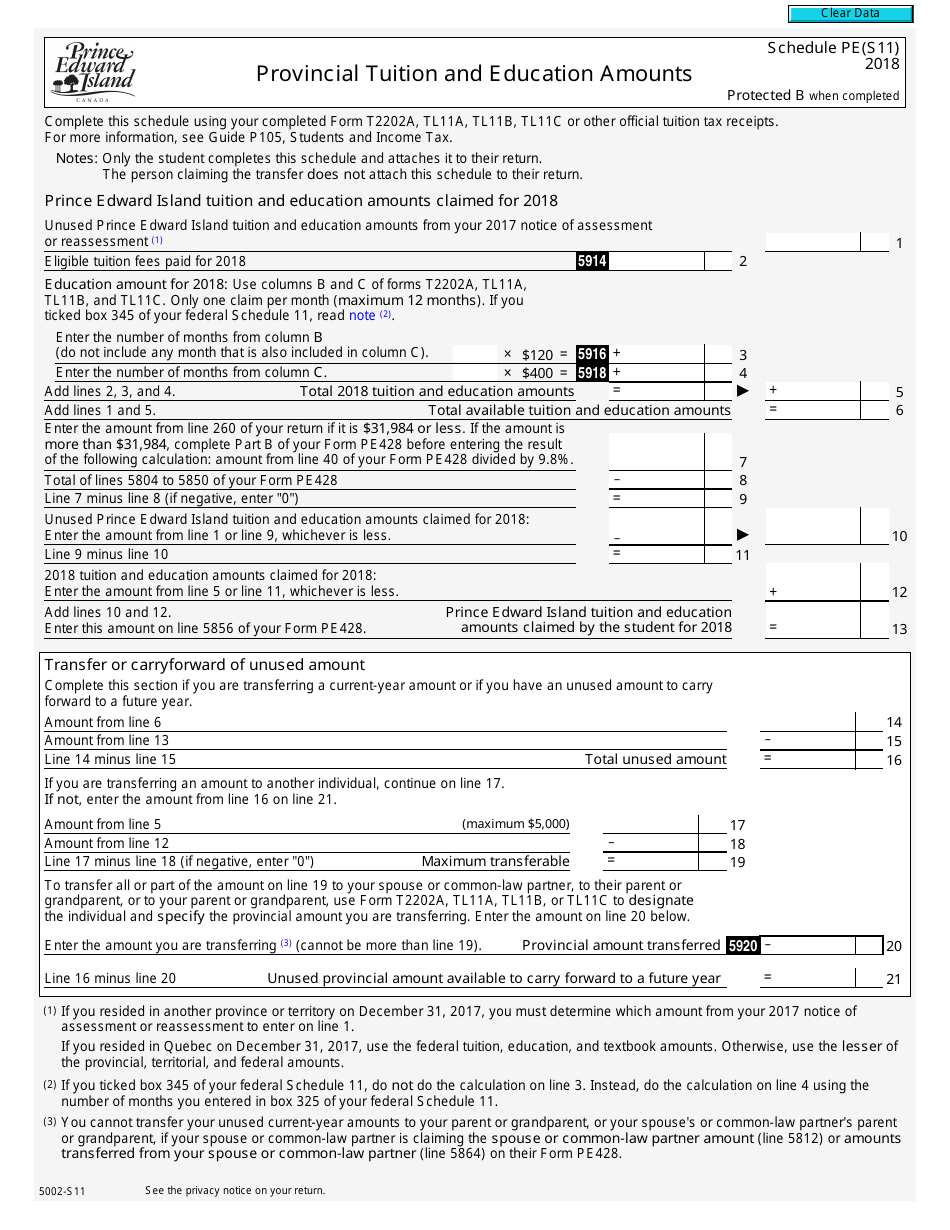

Form 5002-S11 Schedule PE(S11)

for the current year.

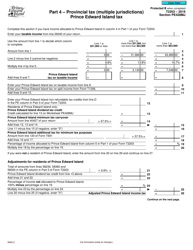

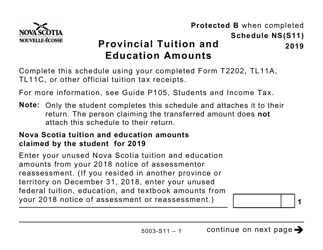

Form 5002-S11 Schedule PE(S11) Provincial Tuition and Education Amounts - Canada

Form 5002-S11 Schedule PE(S11) Provincial Tuition and Education Amounts - Canada is used to claim any provincial or territorial tuition and education amounts, if applicable.

In Canada, the Form 5002-S11 Schedule PE(S11) for Provincial Tuition and Education Amounts is typically filed by students or their parents who wish to claim tuition and education-related tax credits.

FAQ

Q: What is Form 5002-S11?

A: Form 5002-S11 is a schedule used in Canada to claim provincial tuition and education amounts.

Q: What is Schedule PE(S11)?

A: Schedule PE(S11) is a specific version of Form 5002-S11 that is used to claim provincial tuition and education amounts.

Q: What are provincial tuition and education amounts?

A: Provincial tuition and education amounts are deductions that can be claimed on your Canadian tax return for eligible education expenses.

Q: Who can use Schedule PE(S11)?

A: Schedule PE(S11) can be used by Canadian residents who paid tuition fees for post-secondary education at a qualifying educational institution in a participating province or territory.

Q: What information is required to complete Schedule PE(S11)?

A: To complete Schedule PE(S11), you will need to provide details about your educational institution, the amount of tuition fees paid, and any scholarships or bursaries received.

Q: Can I claim both federal and provincial tuition and education amounts?

A: Yes, you may be eligible to claim both federal and provincial tuition and education amounts on your tax return. However, the rules and eligibility criteria may vary between the two.