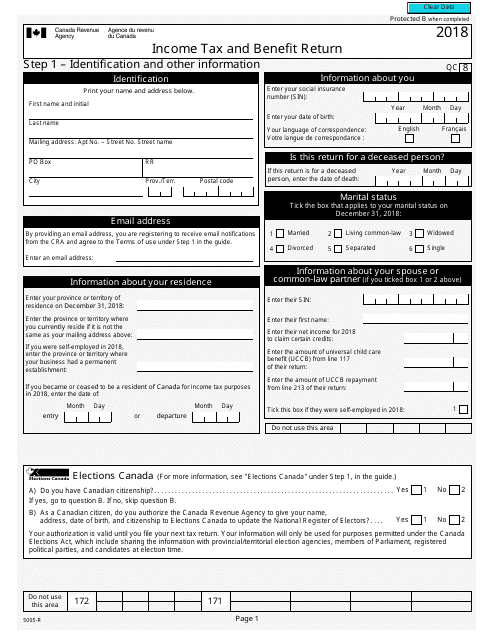

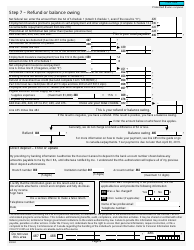

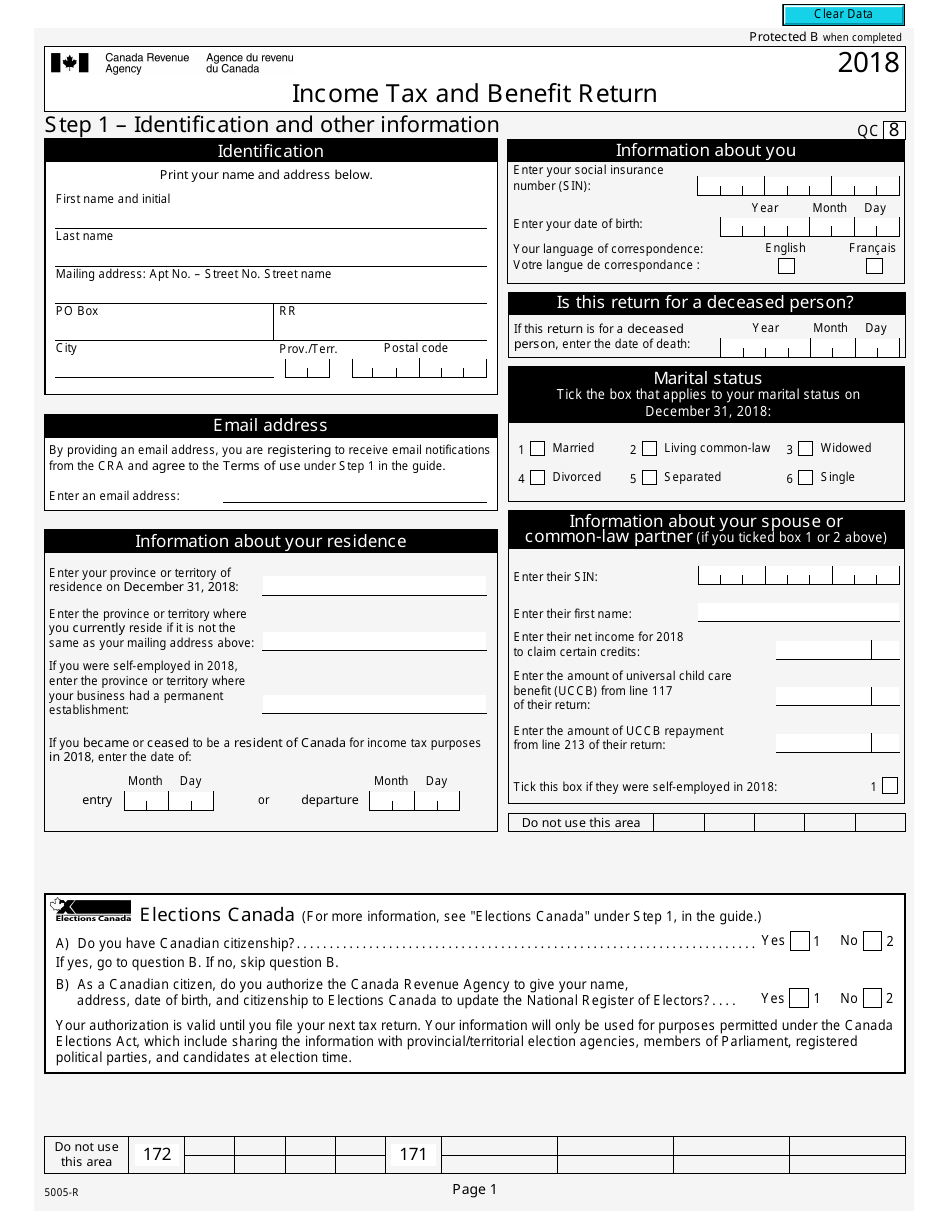

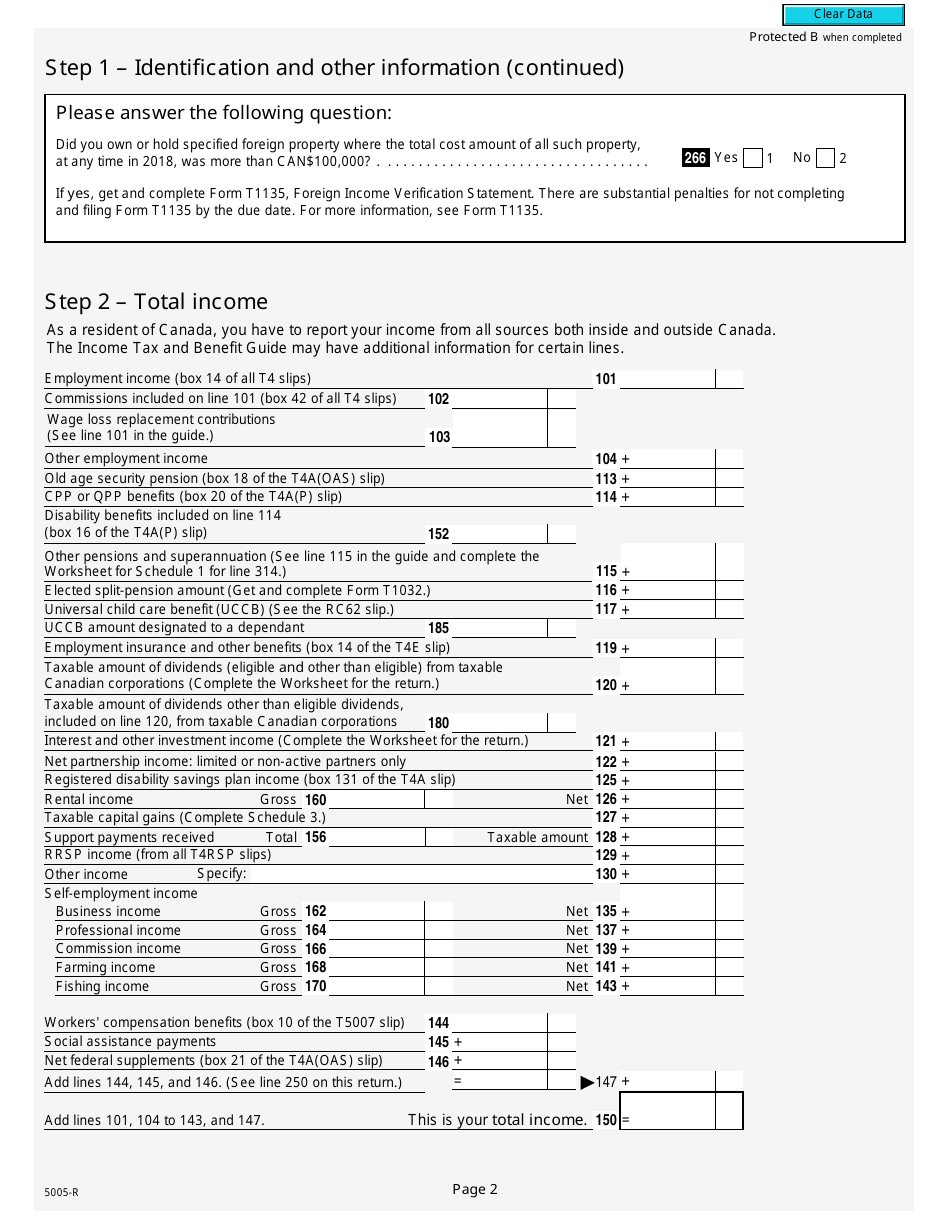

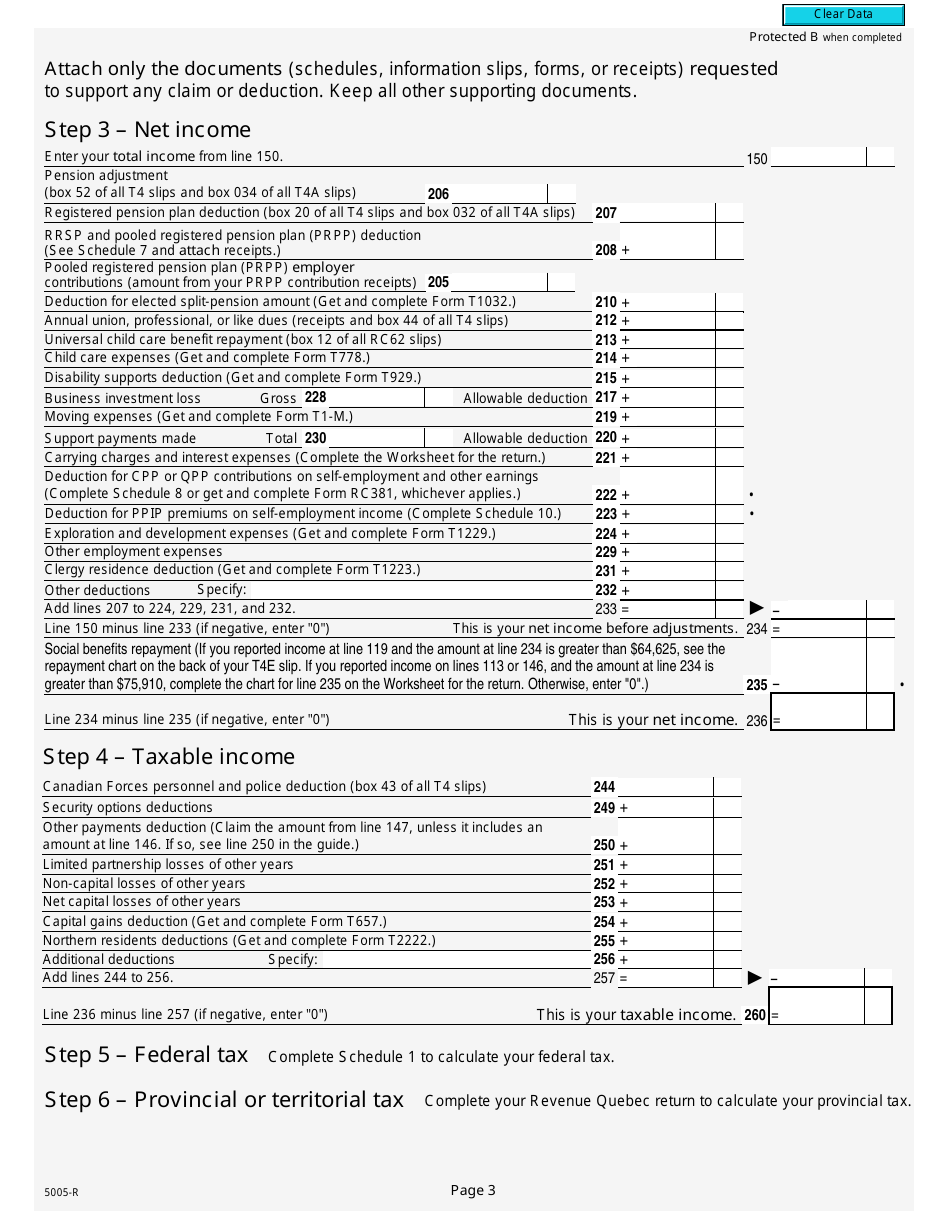

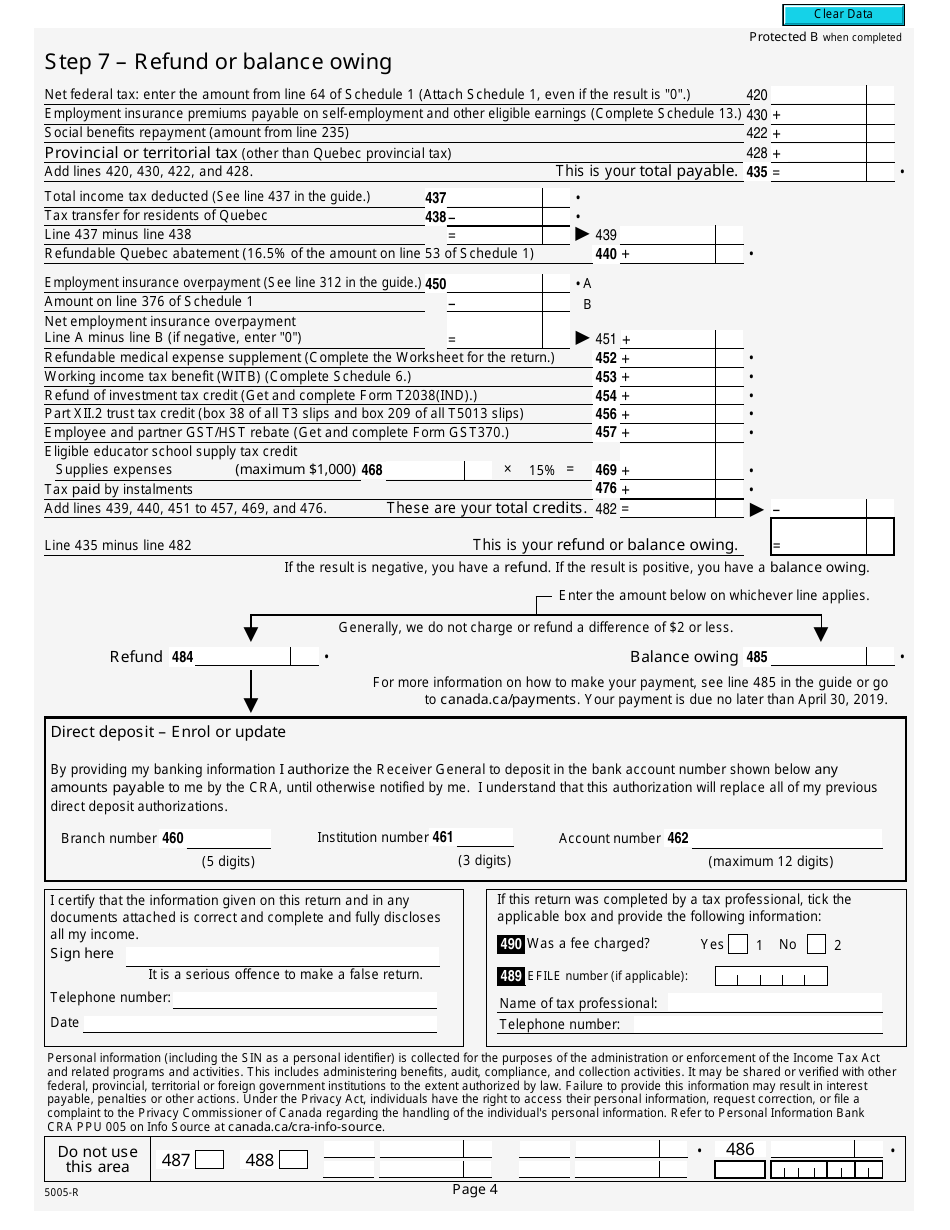

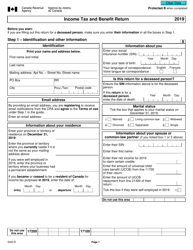

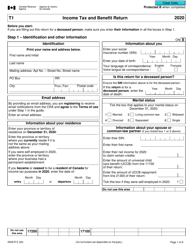

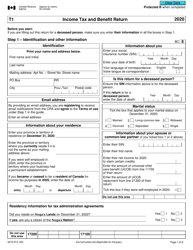

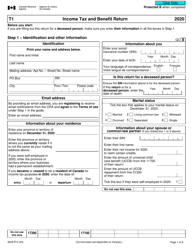

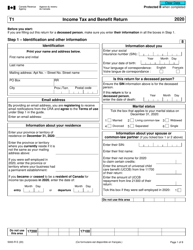

Form 5005-R Income Tax and Benefit Return - Canada

Form 5005-R Income Tax and Benefit Return is used by residents of Canada to report their income and claim various tax credits and deductions to determine their tax liability for the year.

The Form 5005-R Income Tax and Benefit Return in Canada is filed by individual taxpayers to report their income and claim any eligible tax credits and deductions.

FAQ

Q: What is Form 5005-R?

A: Form 5005-R is the Income Tax and Benefit Return form for individuals in Canada.

Q: Who needs to file Form 5005-R?

A: Canadian residents who need to report their income and claim tax benefits must file Form 5005-R.

Q: When is Form 5005-R due?

A: The due date for filing Form 5005-R is usually April 30th of each year.

Q: Are there any penalties for late filing of Form 5005-R?

A: Yes, late filing of Form 5005-R may result in penalties and interest charges.