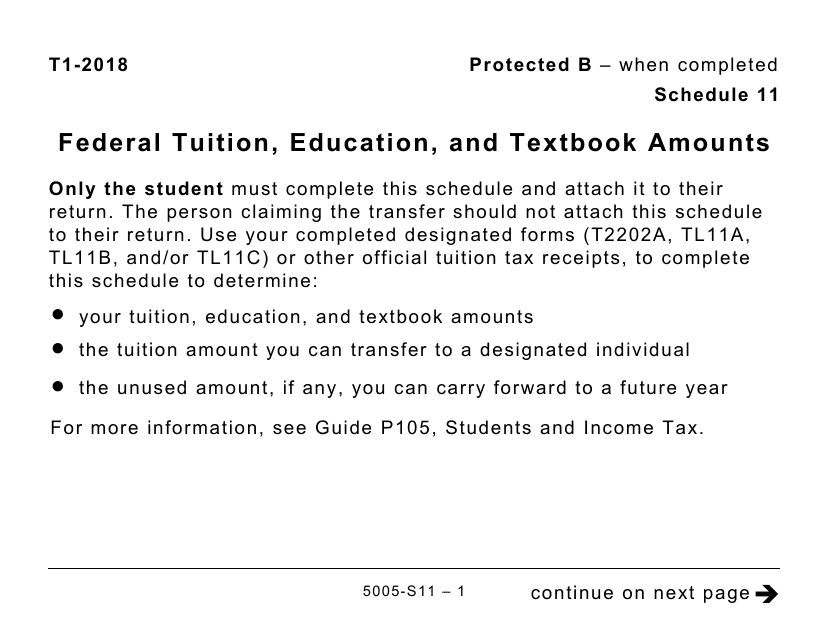

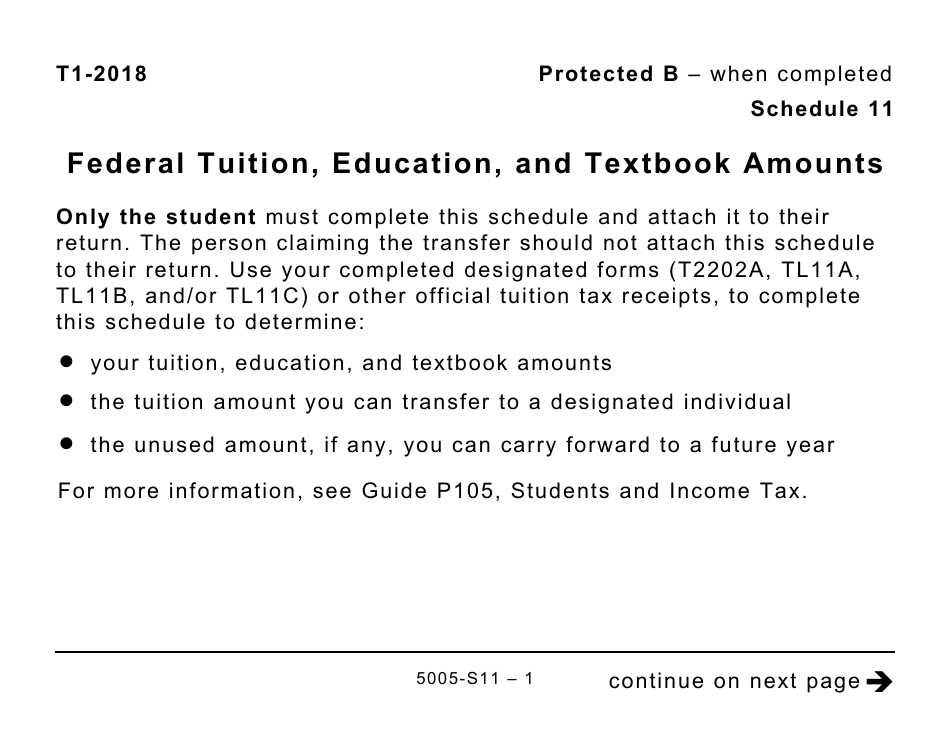

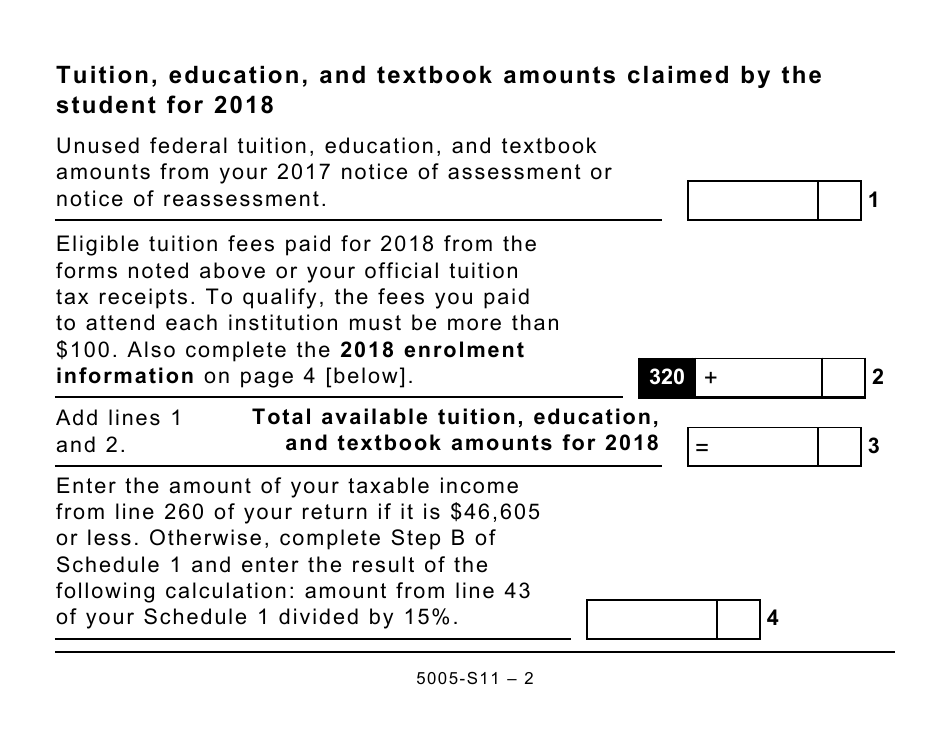

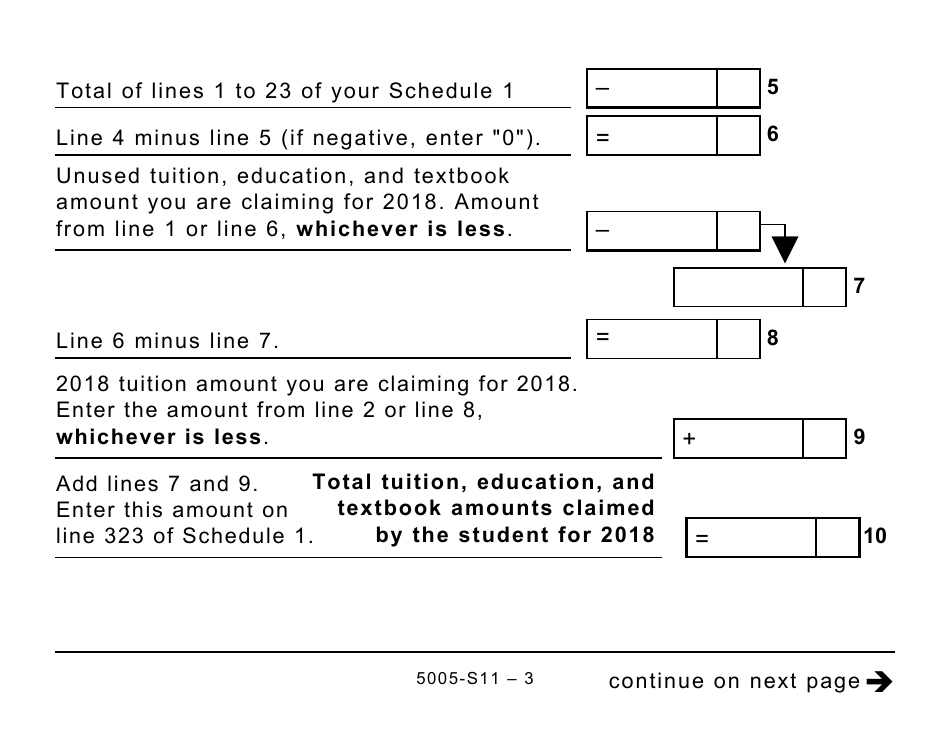

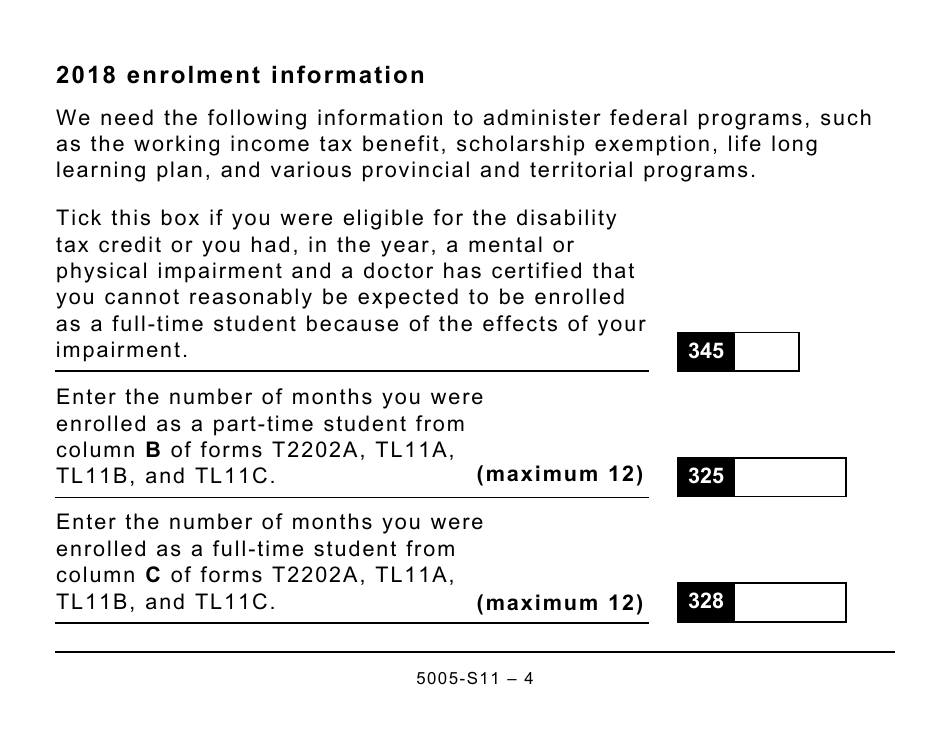

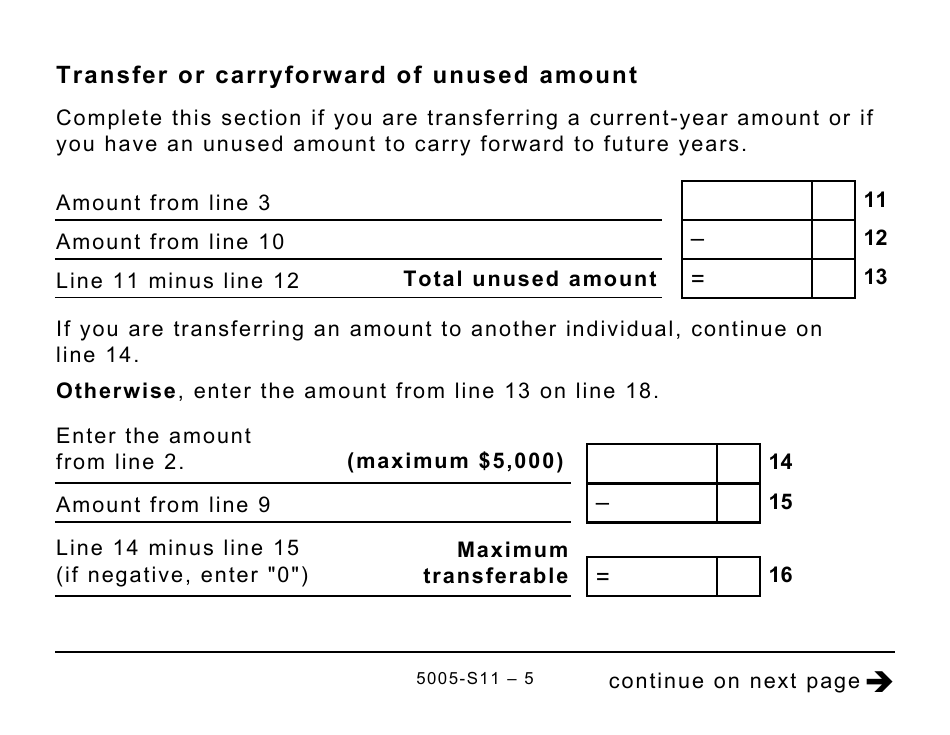

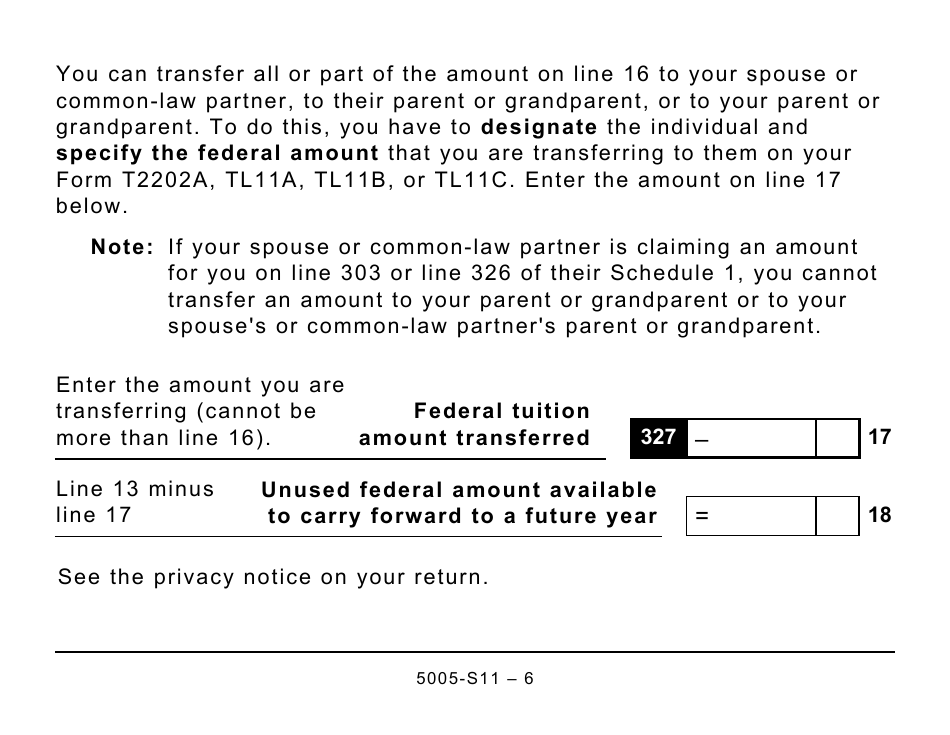

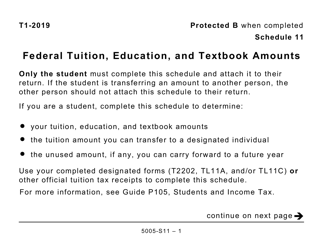

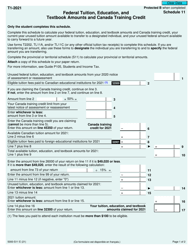

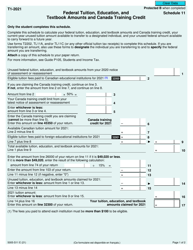

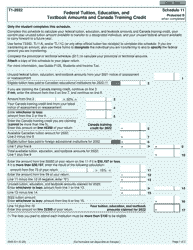

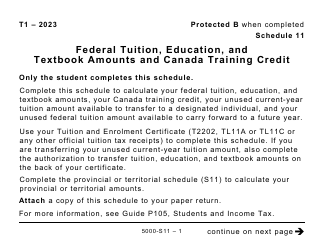

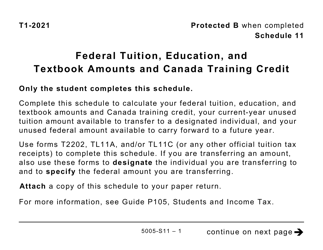

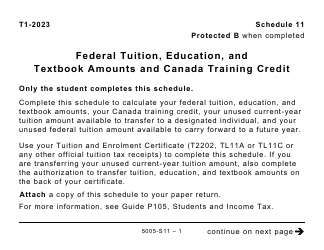

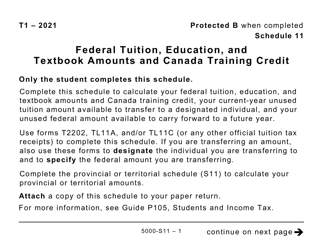

Form 5005-S11 Schedule 11 Federal Tuition, Education, and Textbook Amounts (Large Print) - Canada

Form 5005-S11 Schedule 11 Federal Tuition, Education, and Textbook Amounts (Large Print) in Canada is used to claim federal tax credits for tuition, education, and textbook expenses.

Individuals who are residents of Canada and who want to claim the federal tuition, education, and textbook amounts can file the Form 5005-S11 Schedule 11 (Large Print).

FAQ

Q: What is Form 5005-S11 Schedule 11?

A: Form 5005-S11 Schedule 11 is a federal tax form in Canada specifically for reporting tuition, education, and textbook amounts.

Q: Who is eligible to use Form 5005-S11 Schedule 11?

A: Canadian taxpayers who are eligible to claim tuition, education, and textbook amounts on their federal taxes can use this form.

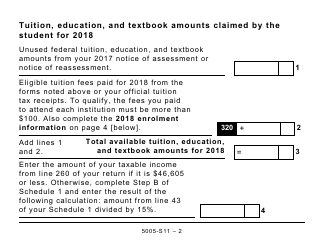

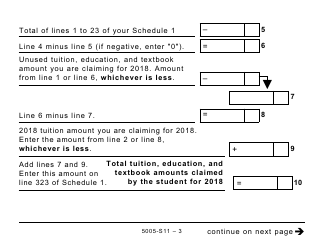

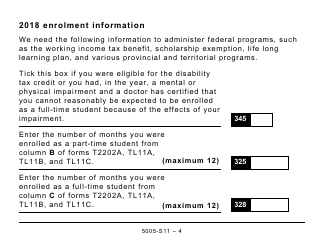

Q: What information do I need to fill out Form 5005-S11 Schedule 11?

A: You will need to gather your receipts and documents related to tuition fees, education amounts, and textbook amounts to accurately fill out this form.

Q: When is the deadline to submit Form 5005-S11 Schedule 11?

A: The deadline to submit Form 5005-S11 Schedule 11 is usually the same as the deadline for filing your federal income tax return, which is April 30th of the following year (or June 15th for self-employed individuals).

Q: Can I claim tuition, education, and textbook amounts on my taxes?

A: Yes, if you are eligible, you can claim these amounts on your federal taxes to potentially reduce your tax liability or receive a refund.

Q: How do I know if I am eligible to claim tuition, education, and textbook amounts?

A: You may be eligible if you were a student enrolled in a qualifying educational program and received a tax certificate (T2202) from your educational institution.

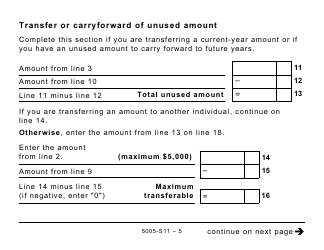

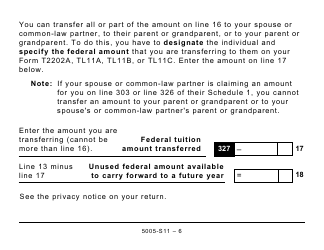

Q: Are there any limits to the tuition, education, and textbook amounts I can claim?

A: Yes, there are limits set by the Canadian government on the maximum amounts you can claim for each category. These limits can vary each year.

Q: Do I need to include supporting documents when submitting Form 5005-S11 Schedule 11?

A: You should keep all supporting documents (receipts, T2202, etc.) in case the CRA requests them for verification. However, you do not need to submit them with your tax return.

Q: What happens after I submit Form 5005-S11 Schedule 11?

A: The CRA will review your tax return and either process your refund or send you a notice of assessment if additional information is needed.