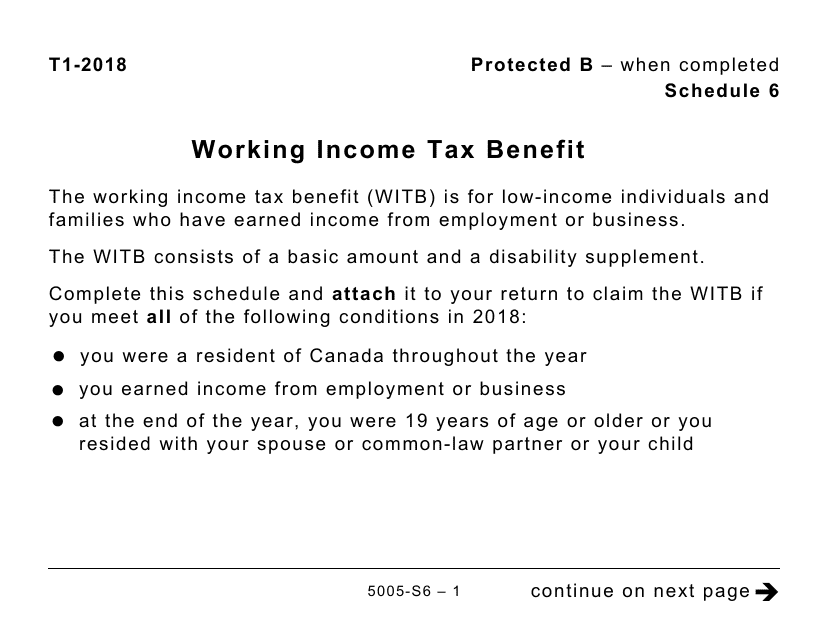

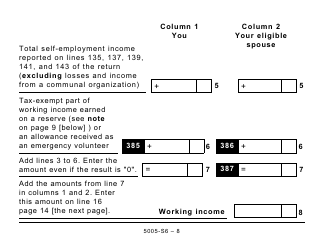

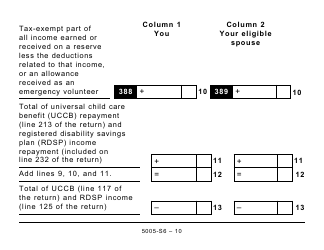

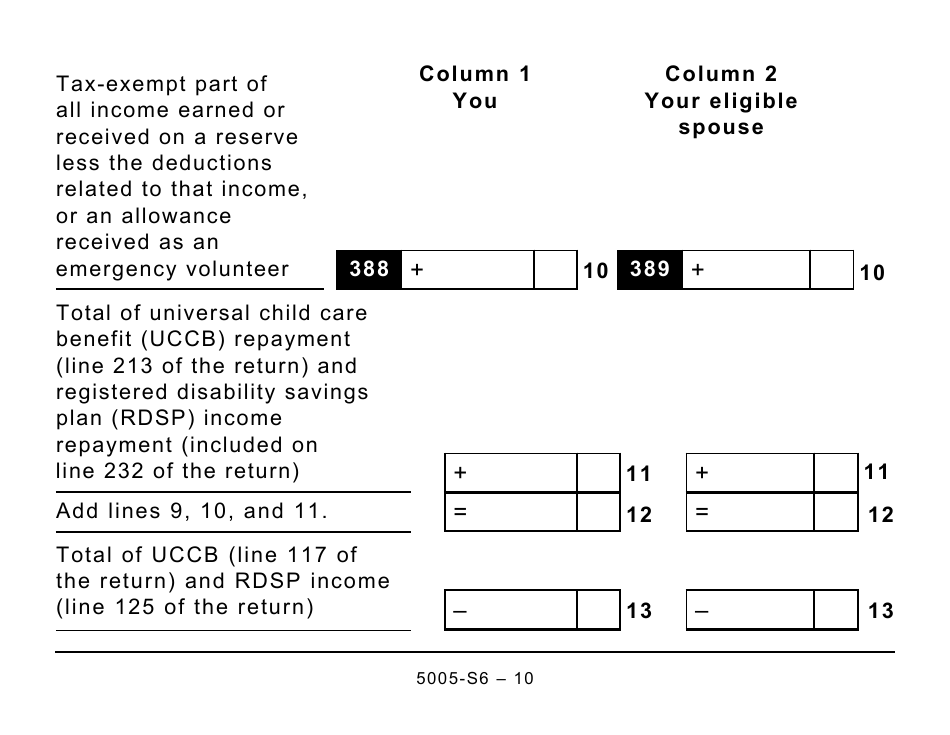

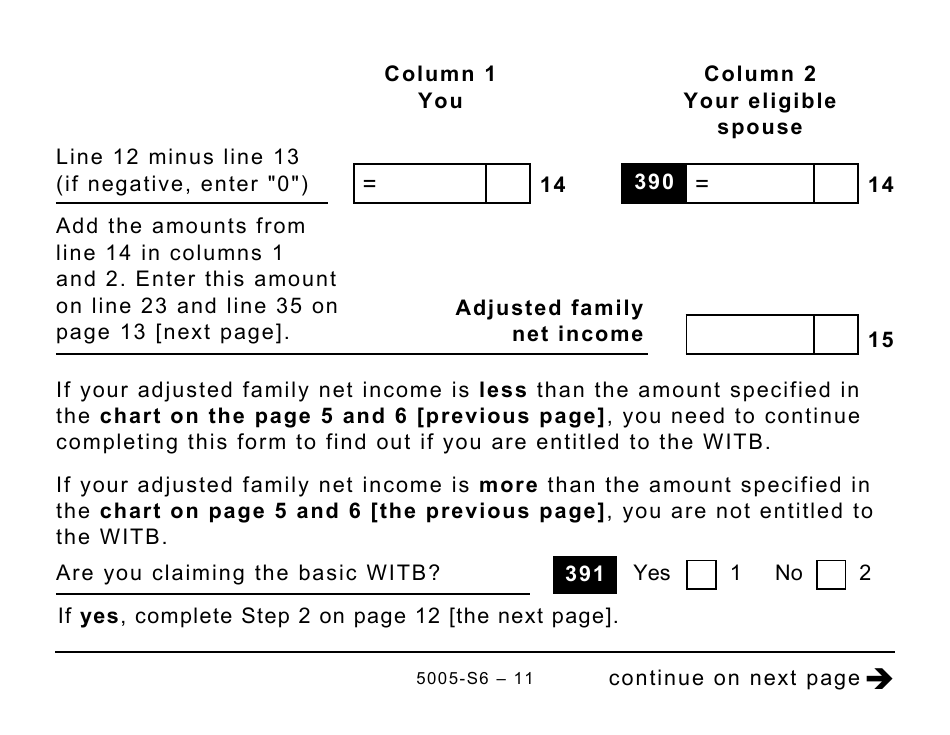

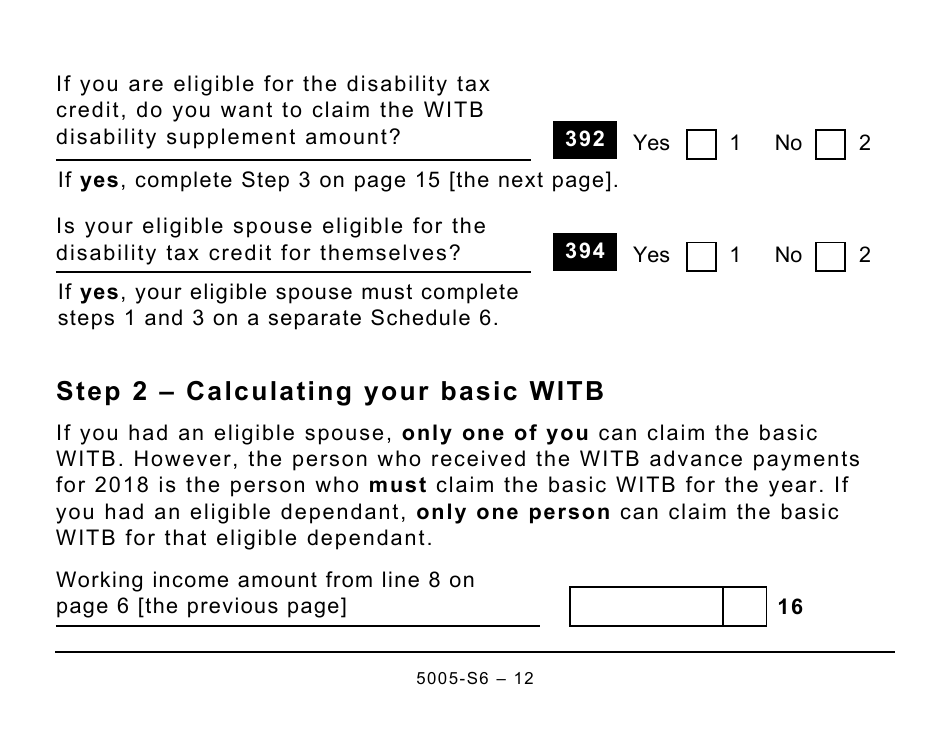

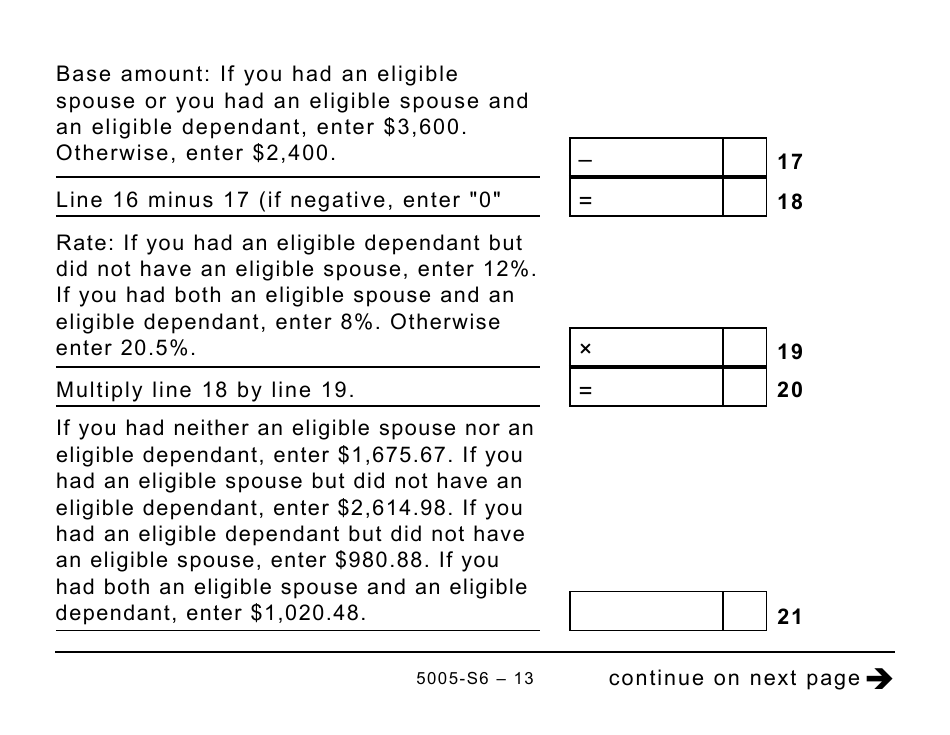

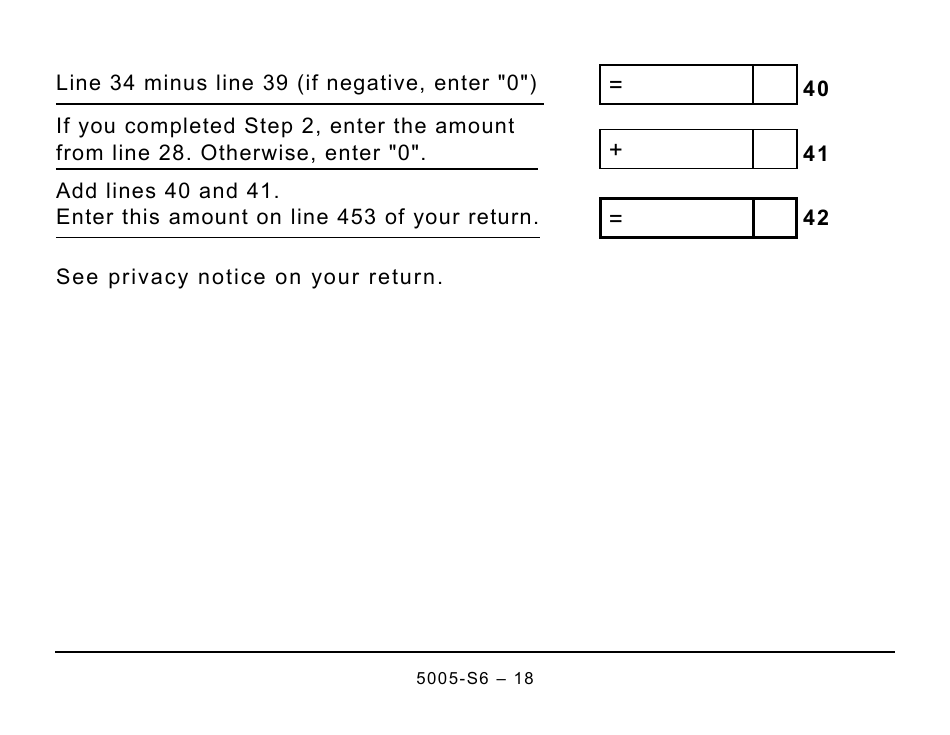

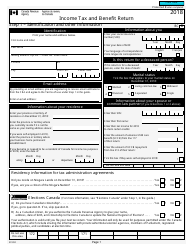

Form 5005-S6 Schedule 6 Working Income Tax Benefit (Large Print) - Canada

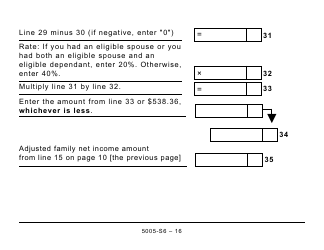

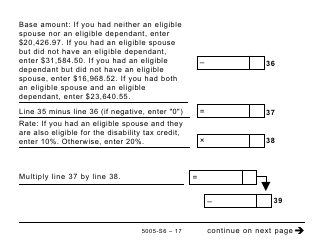

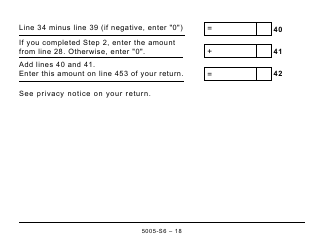

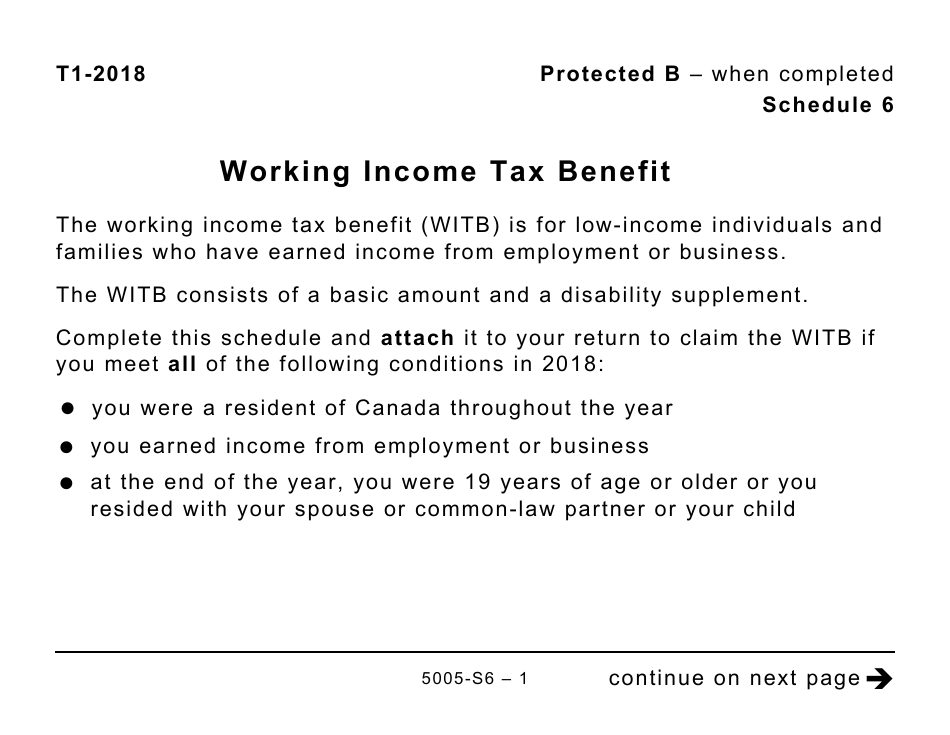

Form 5005-S6 Schedule 6 Working Income Tax Benefit (Large Print) in Canada is used to calculate the Working Income Tax Benefit for individuals with a visual impairment, as it is provided in a large print format for easier readability.

The Form 5005-S6 Schedule 6 Working Income Tax Benefit (Large Print) in Canada is filed by individuals who are eligible for the Working Income Tax Benefit.

FAQ

Q: What is Form 5005-S6?

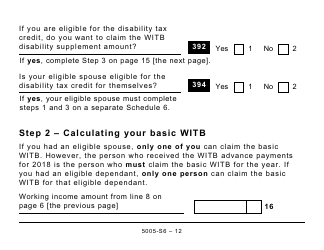

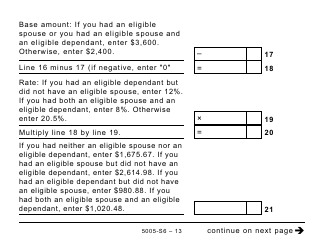

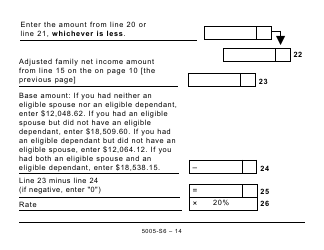

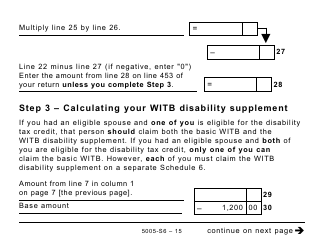

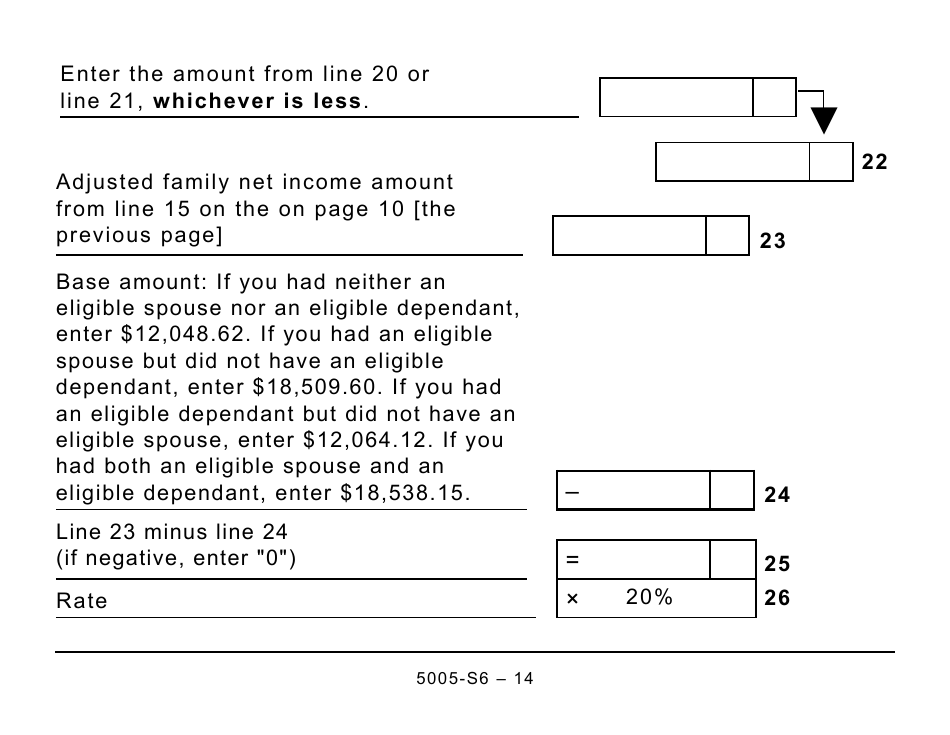

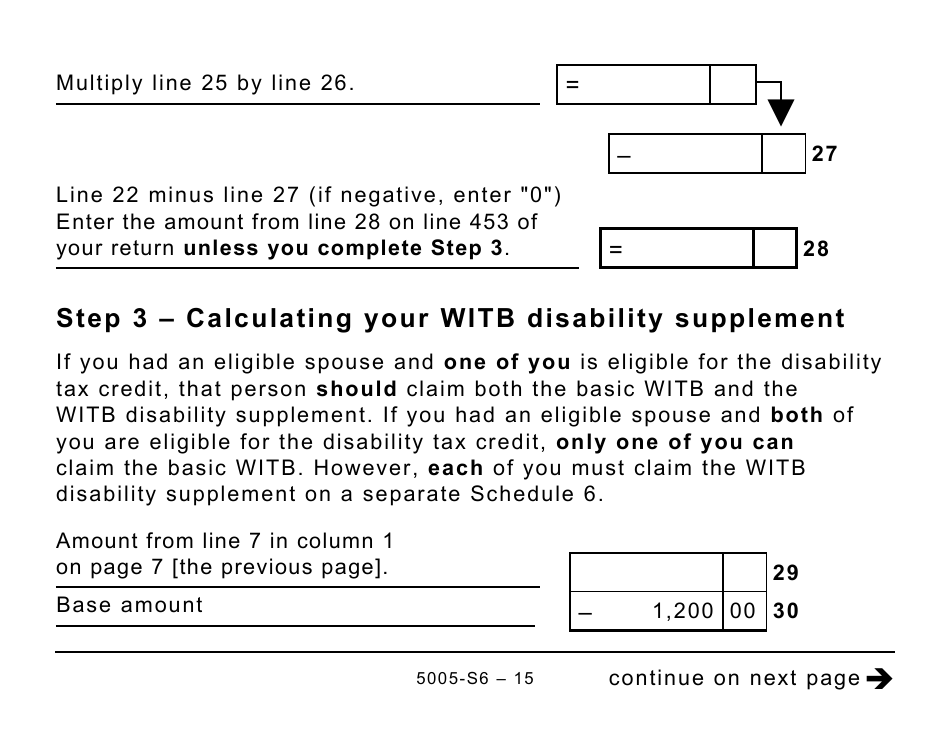

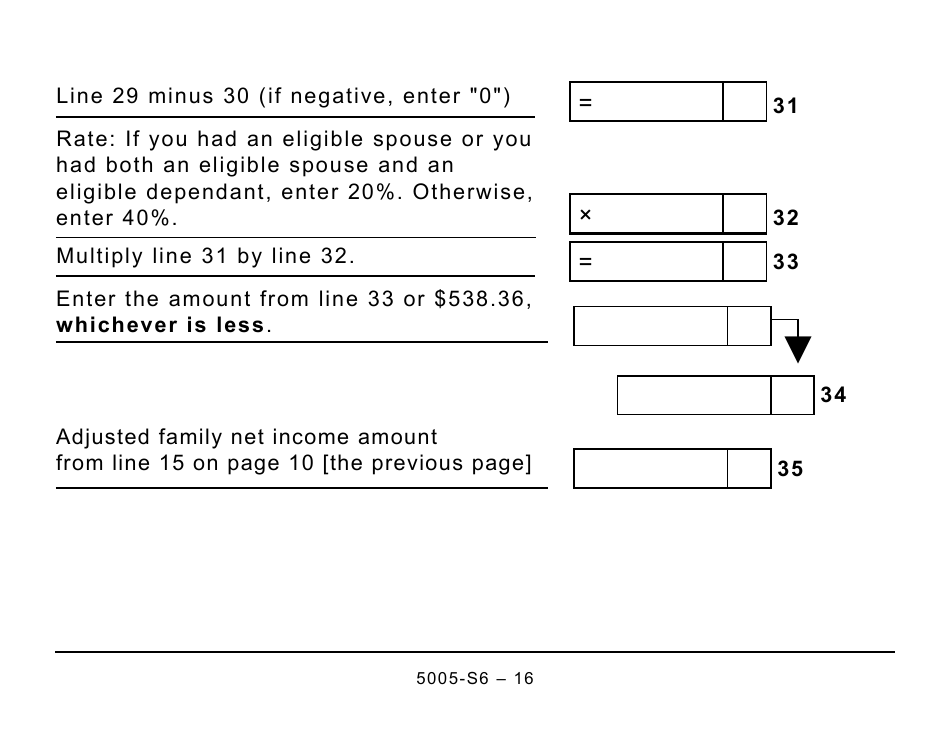

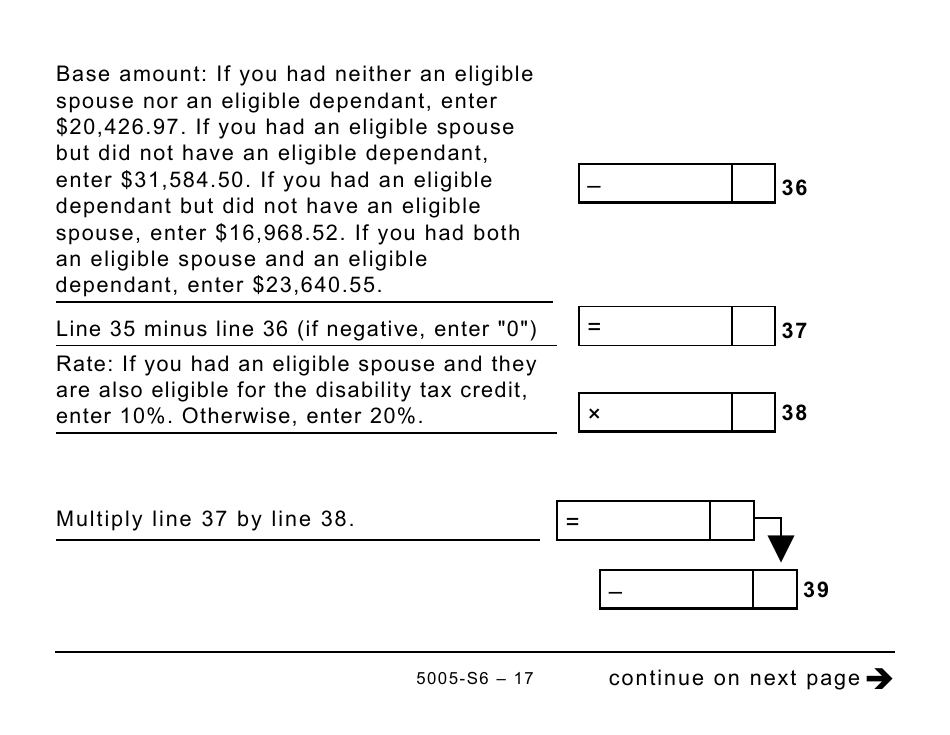

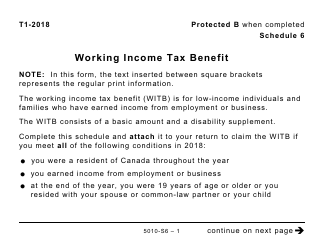

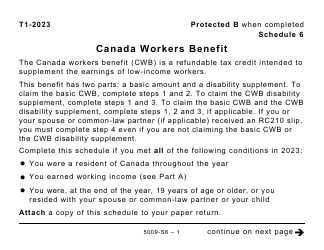

A: Form 5005-S6 is a schedule for reporting the working income tax benefit.

Q: What is the working income tax benefit?

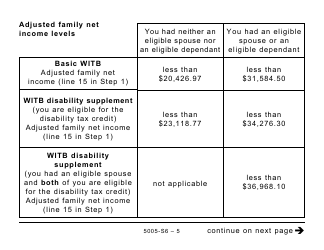

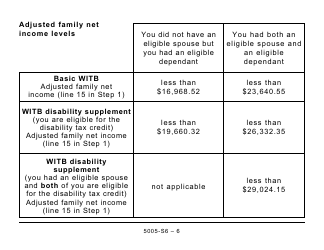

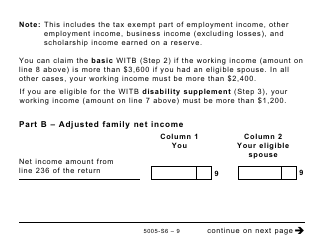

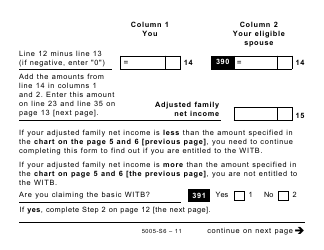

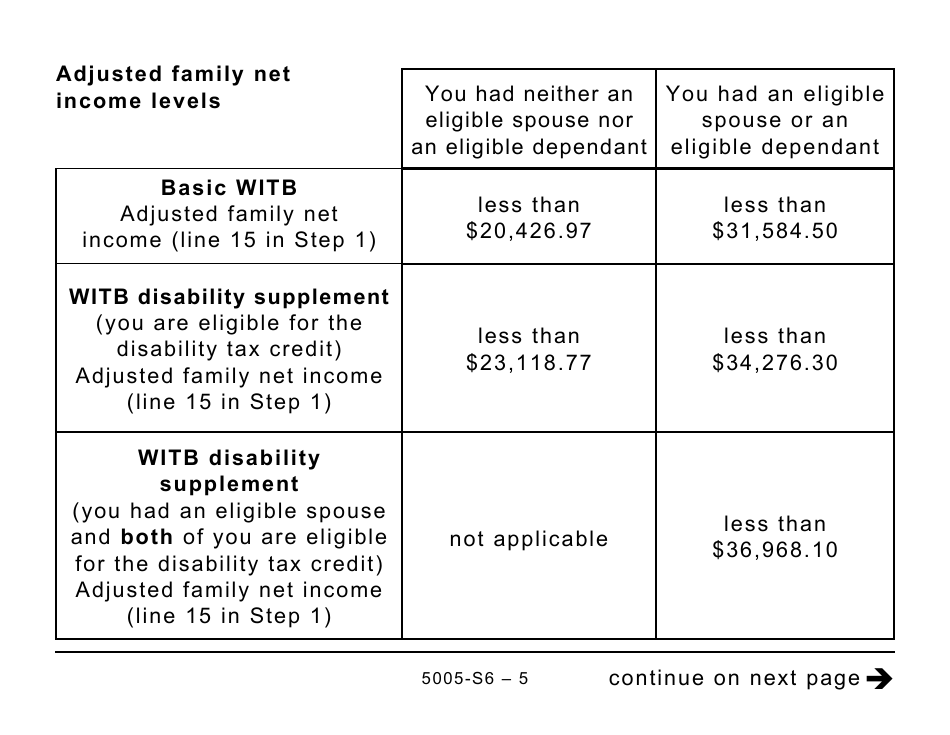

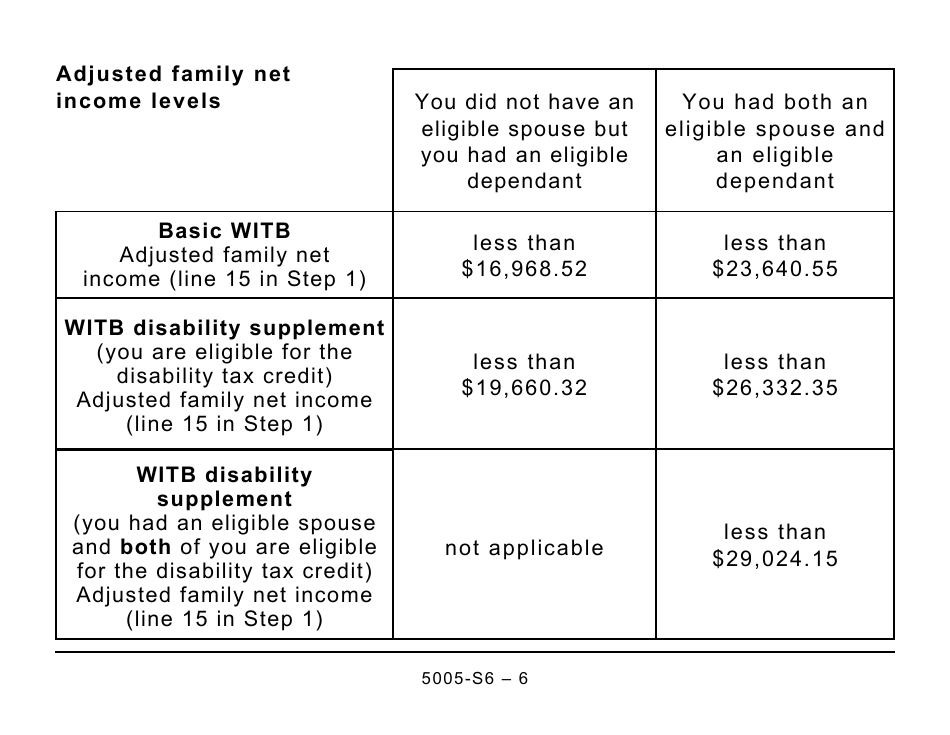

A: The working income tax benefit is a refundable tax credit for low-income individuals and families who are in the workforce.

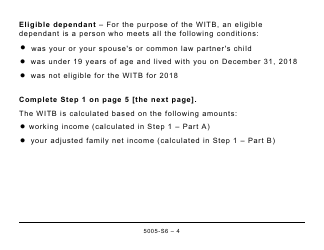

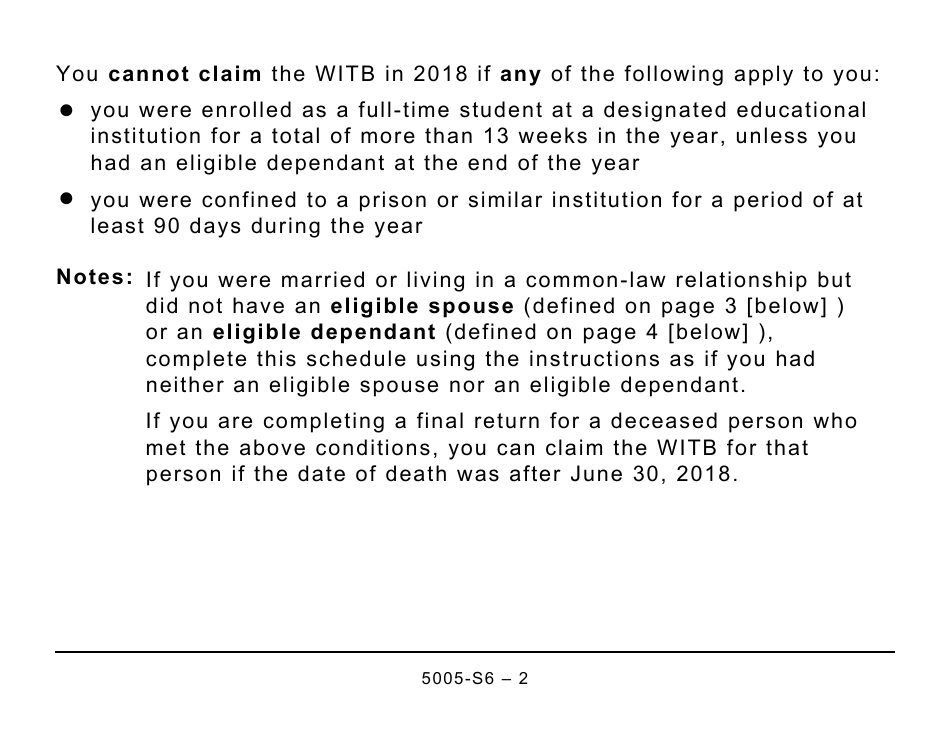

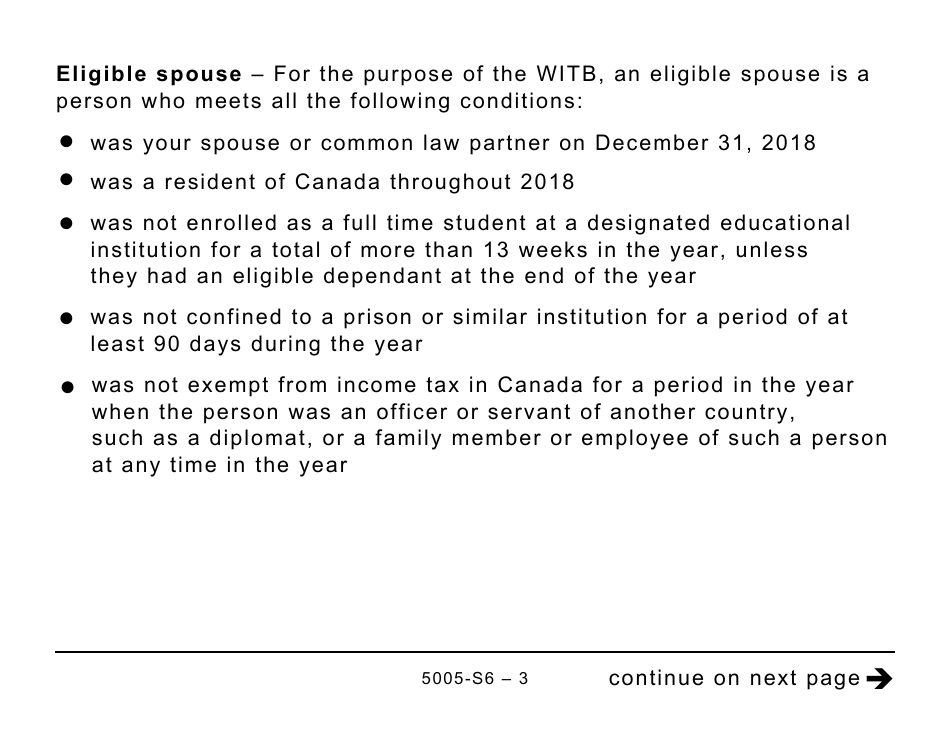

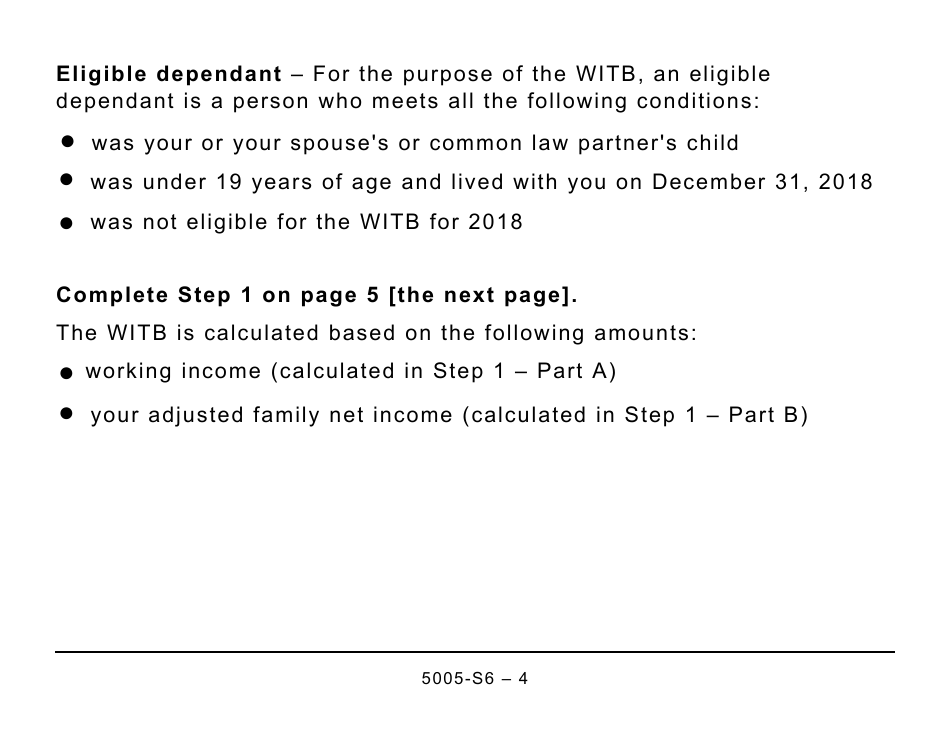

Q: Who is eligible for the working income tax benefit?

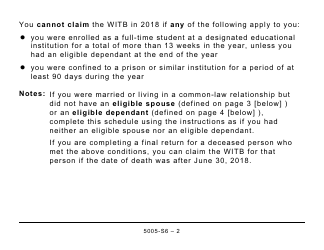

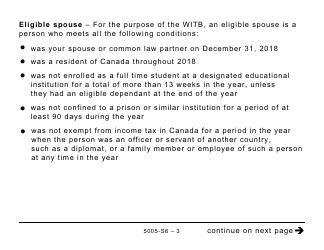

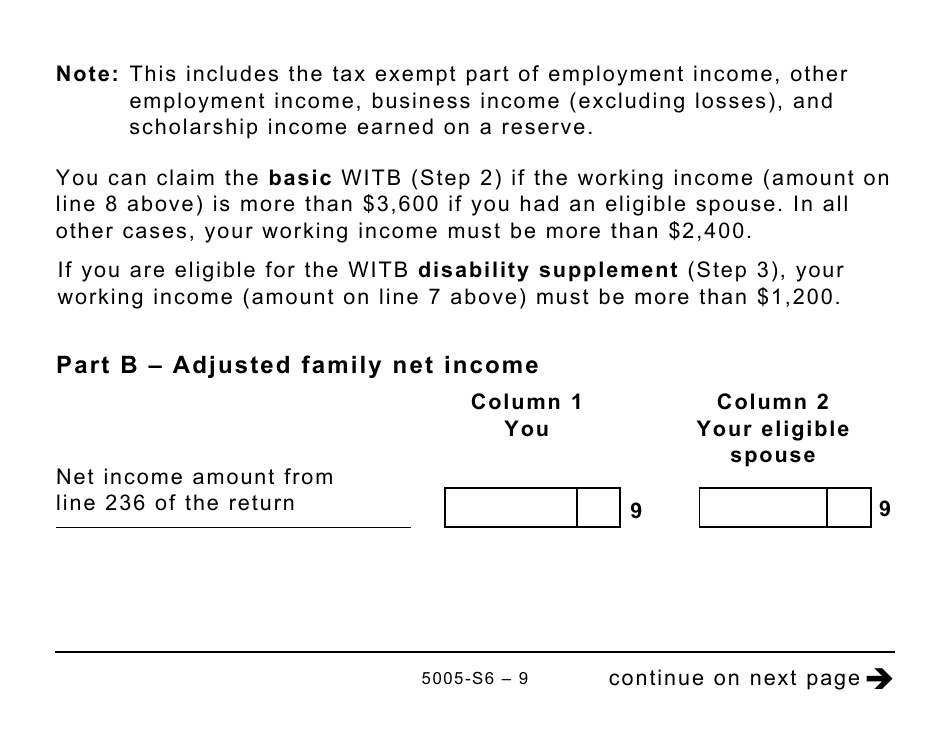

A: People who earn a minimum amount of working income and meet certain other criteria may be eligible for the working income tax benefit.

Q: What does the working income tax benefit provide?

A: The working income tax benefit provides a tax credit that supplements the income of low-income individuals and families.

Q: What is Form 5005-S6 used for?

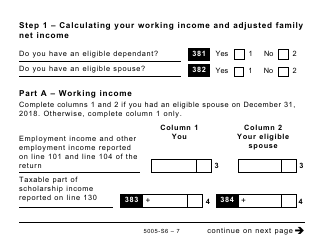

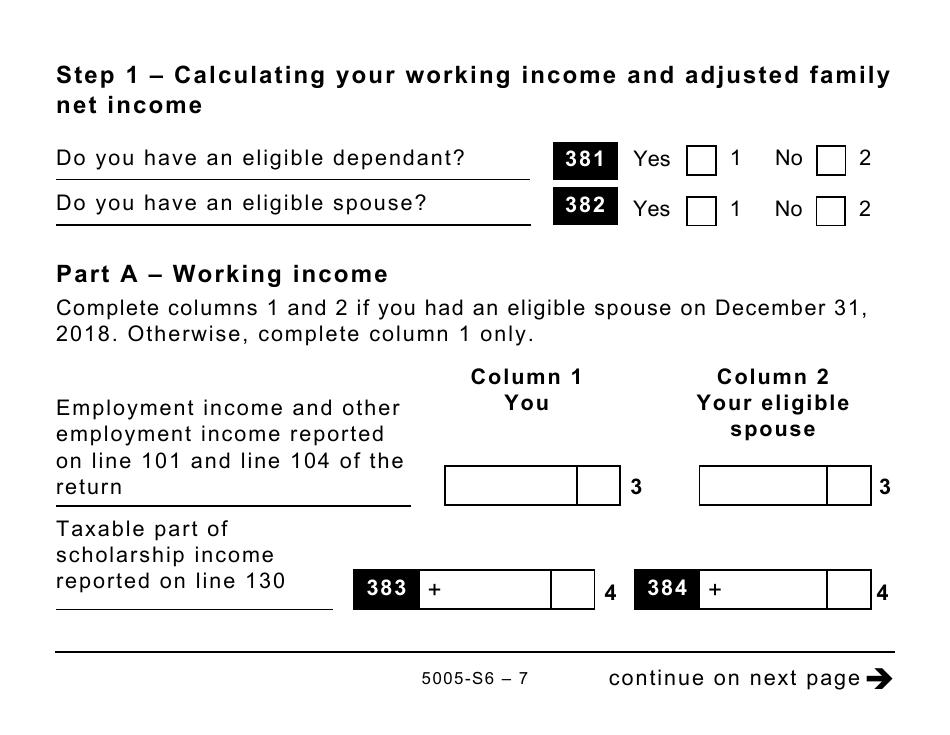

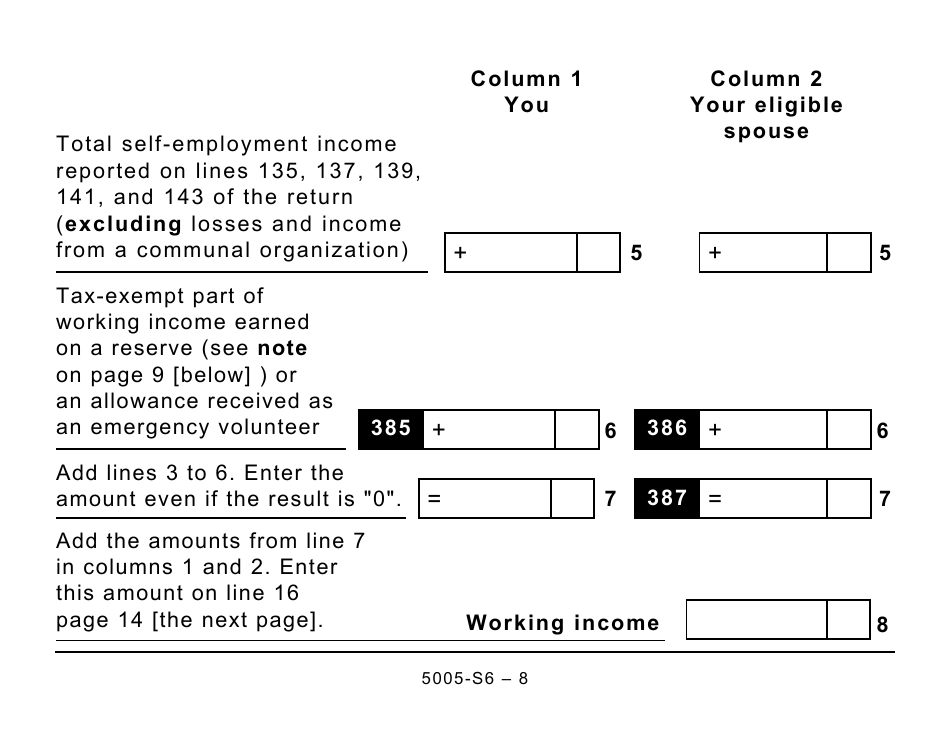

A: Form 5005-S6 is used to calculate and claim the working income tax benefit in Canada.

Q: Are there any specific instructions for completing Form 5005-S6?

A: Yes, the CRA provides instructions on how to complete Form 5005-S6. It is important to follow these instructions carefully.

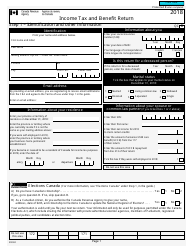

Q: When is the deadline for filing Form 5005-S6?

A: The deadline for filing Form 5005-S6 is the same as the deadline for filing your income tax return in Canada, which is usually April 30th.

Q: What should I do if I have questions or need assistance with Form 5005-S6?

A: If you have questions or need assistance with Form 5005-S6, you can contact the CRA directly or seek help from a tax professional.

Q: Can I claim the working income tax benefit if I live in the United States?

A: No, the working income tax benefit is only available to residents of Canada who meet the eligibility criteria.