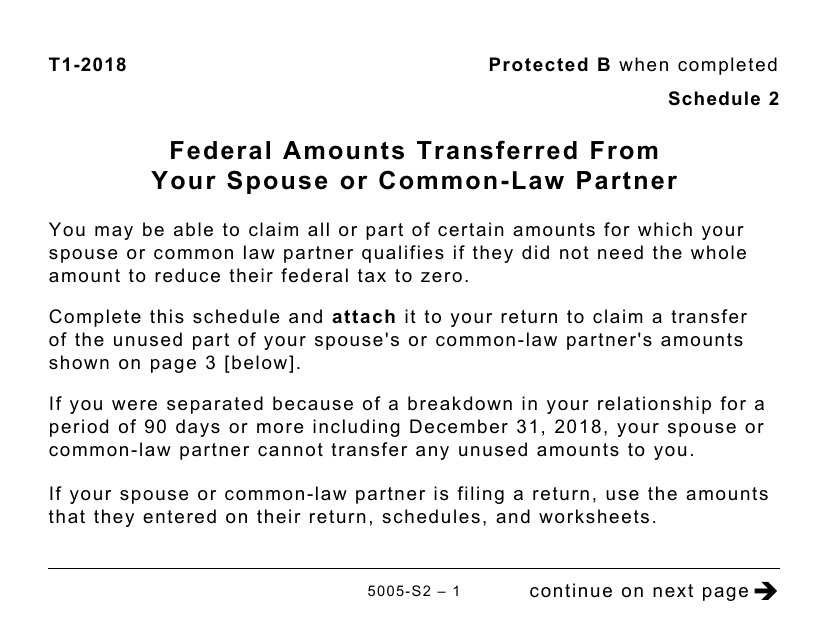

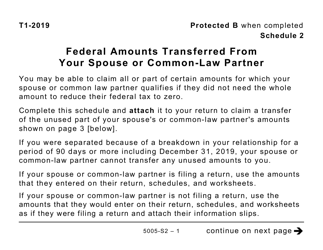

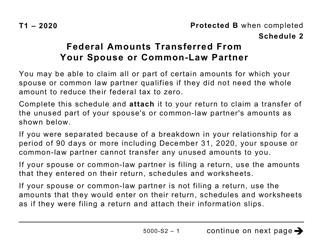

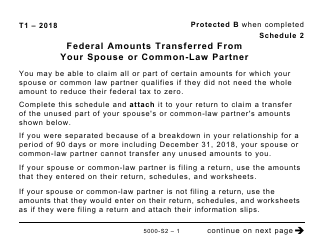

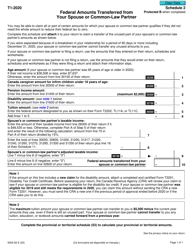

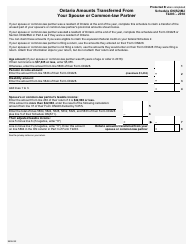

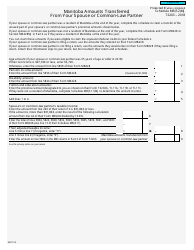

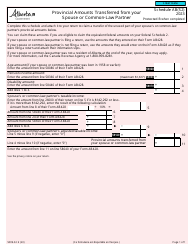

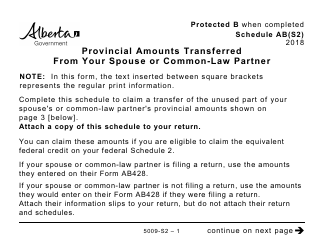

Form 5005-S2 Schedule 2 Federal Amounts Transferred From Your Spouse or Common-Law Partner (Large Print) - Canada

This Canada-specific " Federal Amounts Transferred From Your Spouse Or Common-law Partner (large Print) " is a document released by the Canadian Revenue Agency .

Download the fillable PDF by clicking the link below and use it according to the applicable legal guidelines.

FAQ

Q: What is Form 5005-S2?

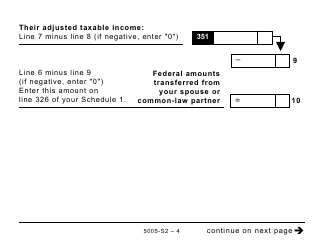

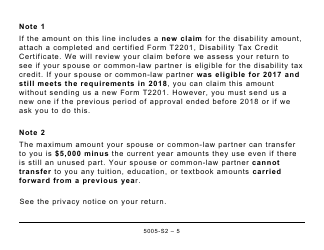

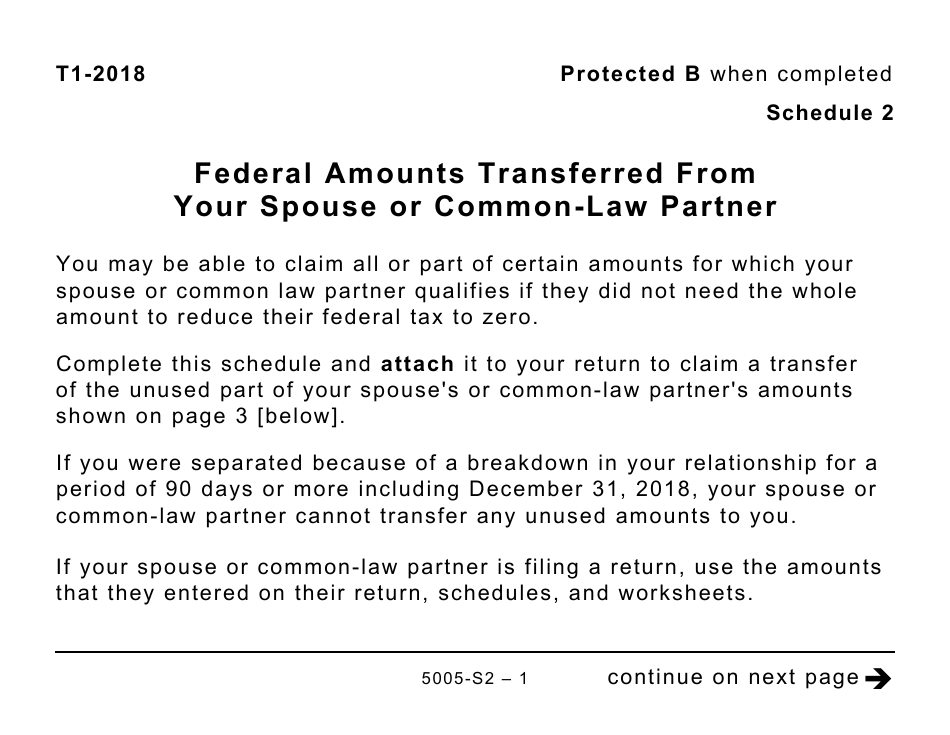

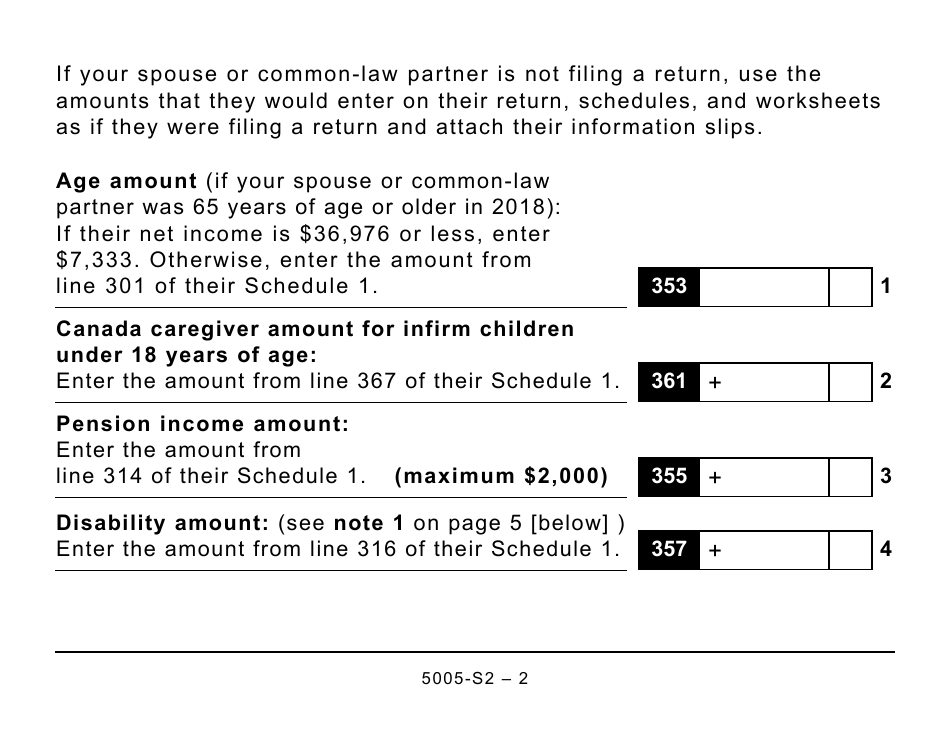

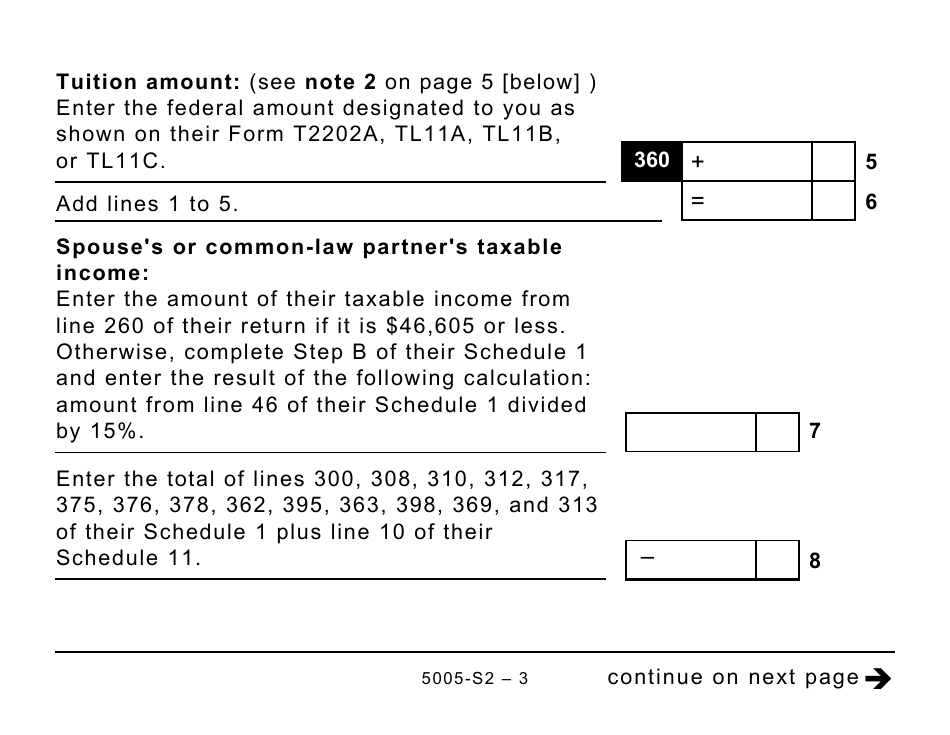

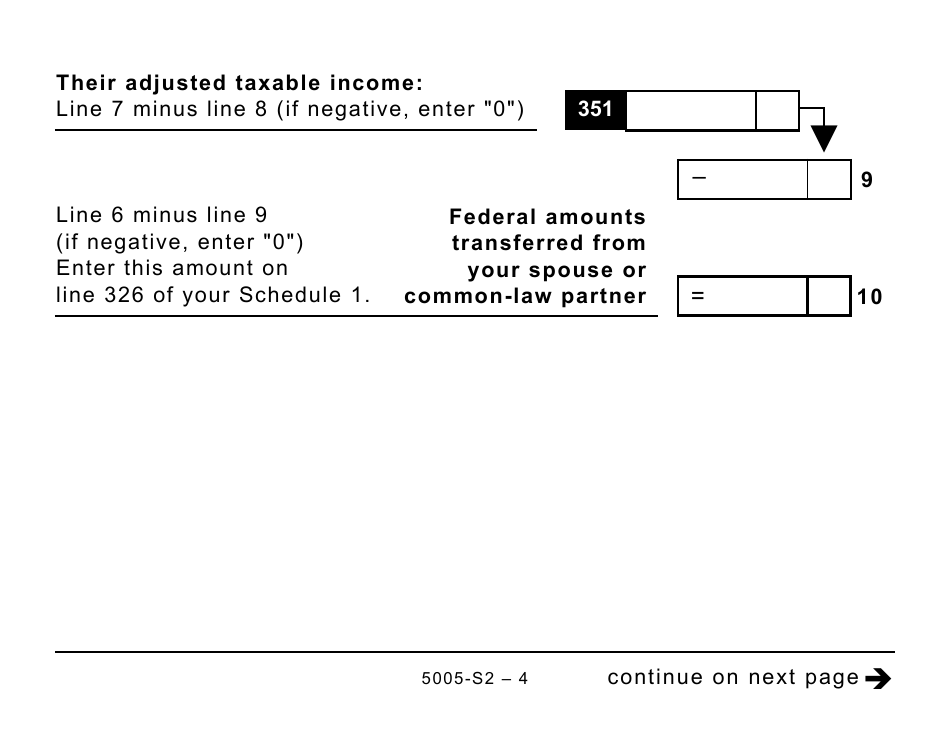

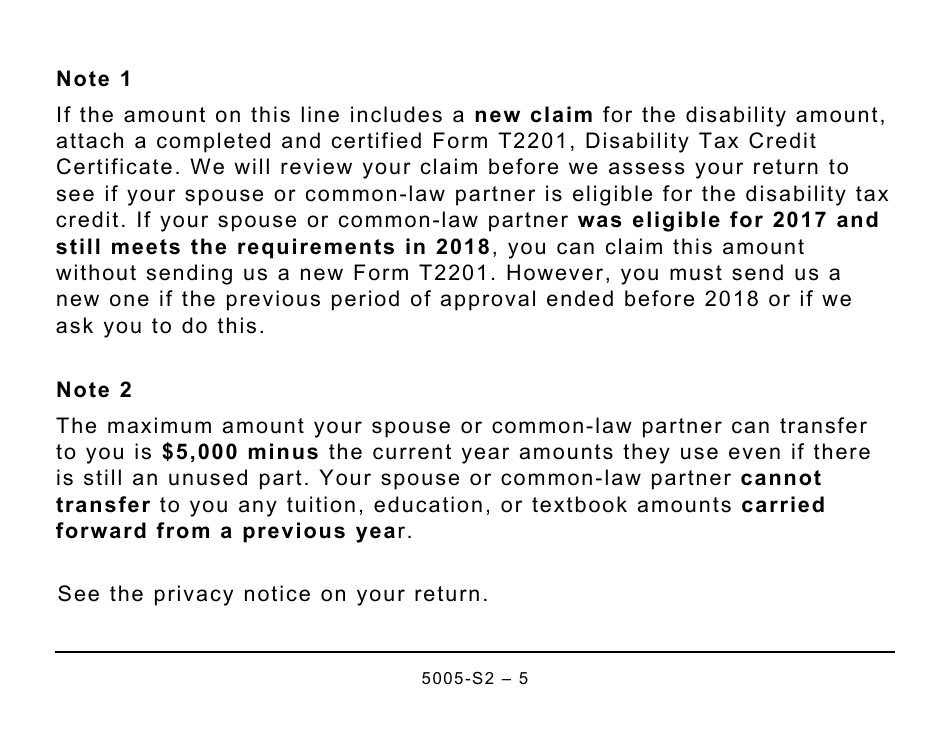

A: Form 5005-S2 is a schedule used in Canada for reporting federal amounts transferred from your spouse or common-law partner.

Q: What is the purpose of Schedule 2?

A: The purpose of Schedule 2 is to report any federal amounts that you have transferred from your spouse or common-law partner.

Q: Who needs to fill out Schedule 2?

A: You need to fill out Schedule 2 if you have transferred any federal amounts from your spouse or common-law partner.

Q: What are federal amounts?

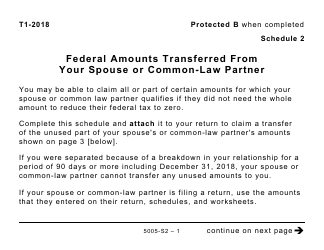

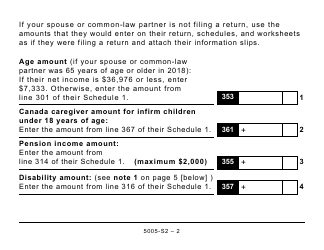

A: Federal amounts are certain tax credits, deductions, or other tax benefits that you can transfer to your spouse or common-law partner to reduce their tax liability.

Q: Why would I transfer federal amounts to my spouse or common-law partner?

A: Transferring federal amounts to your spouse or common-law partner can help reduce their tax liability and may result in a overall lower tax burden for your household.

Q: Is Schedule 2 available in large print?

A: Yes, Form 5005-S2 Schedule 2 is available in large print for individuals who require it.