This version of the form is not currently in use and is provided for reference only. Download this version of

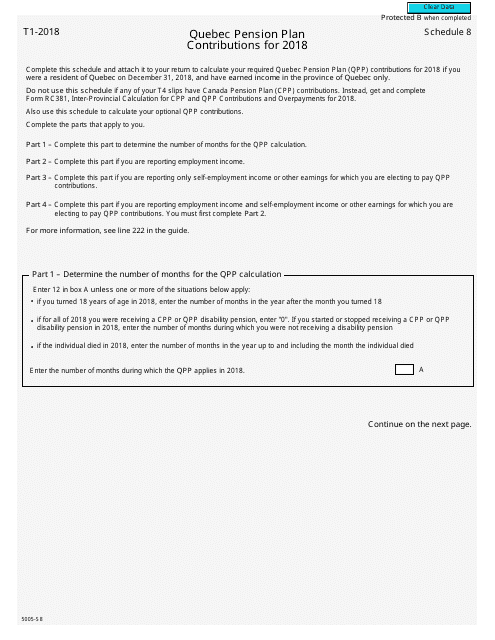

Form 5005-S8 Schedule 8

for the current year.

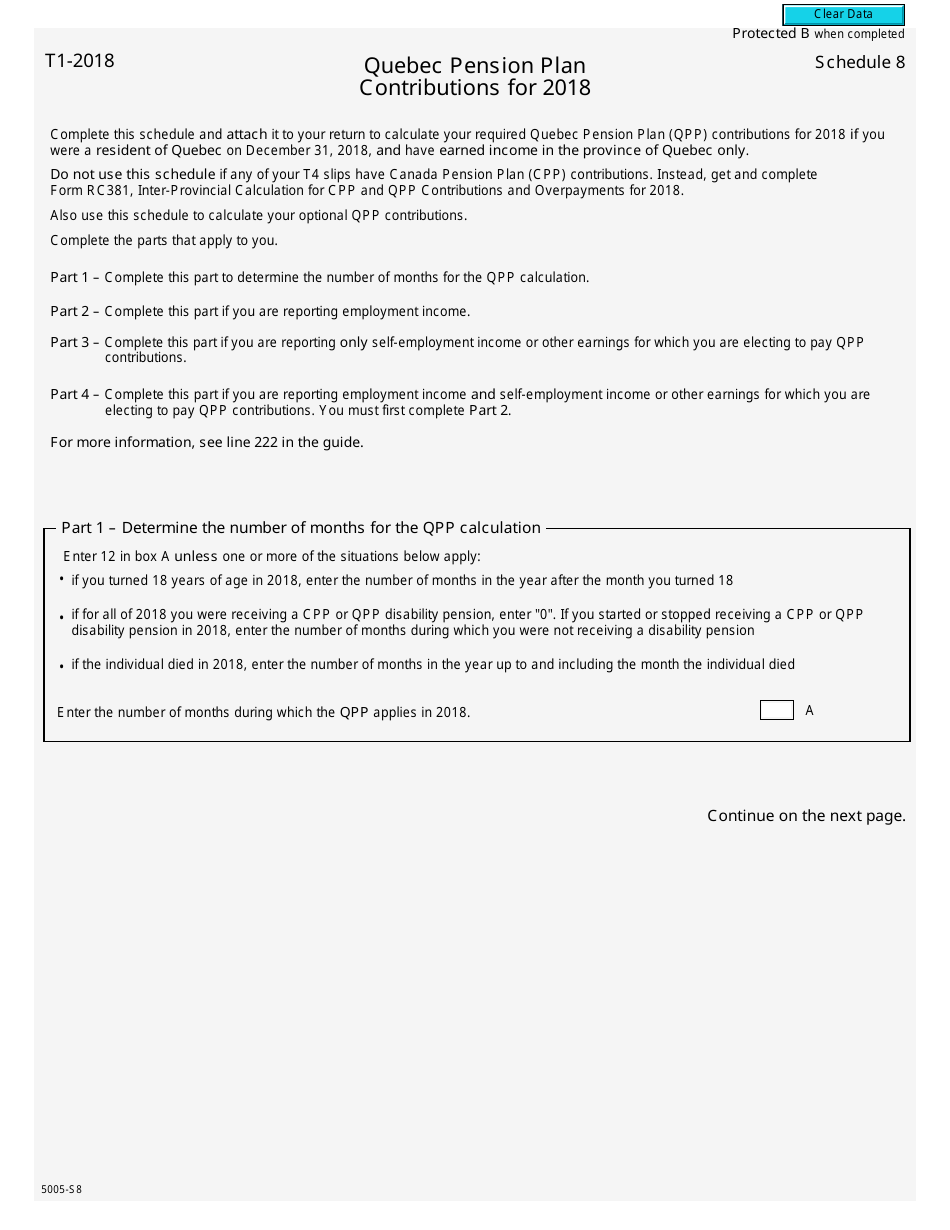

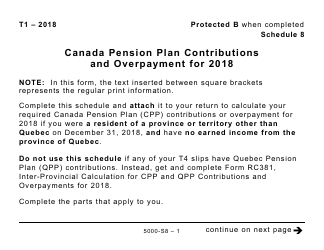

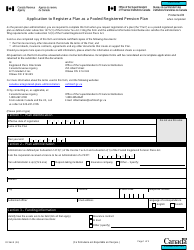

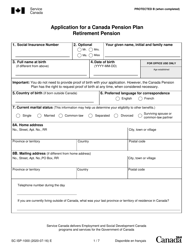

Form 5005-S8 Schedule 8 Quebec Pension Plan Contributions - Canada

Form 5005-S8 Schedule 8 of the Quebec Pension Plan Contributions is used in Canada for reporting contributions made to the Quebec Pension Plan. It is a part of the annual incometax filing process.

Individuals who are residents of Quebec and contribute to the Quebec Pension Plan (QPP) in Canada file the Form 5005-S8 Schedule 8 for reporting their QPP contributions.

FAQ

Q: What is Form 5005-S8?

A: Form 5005-S8 is a schedule used to report Quebec Pension Plan (QPP) contributions in Canada.

Q: What is the Quebec Pension Plan (QPP)?

A: The Quebec Pension Plan (QPP) is a mandatory pension plan for residents of Quebec, Canada.

Q: Who needs to file Form 5005-S8?

A: Individuals who are employers in Quebec and have employees who participate in the Quebec Pension Plan (QPP) are required to file Form 5005-S8.

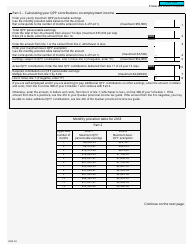

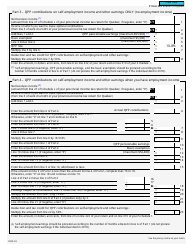

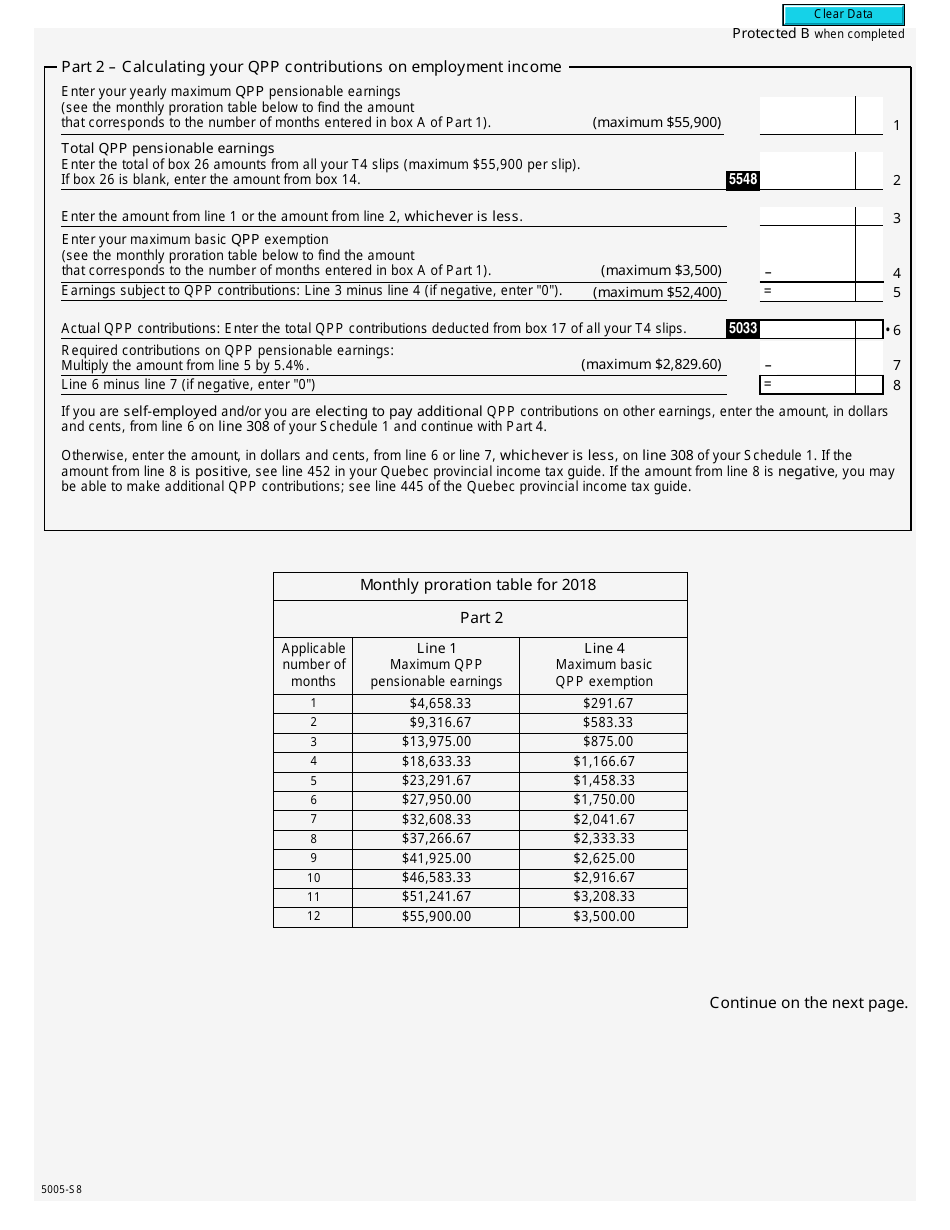

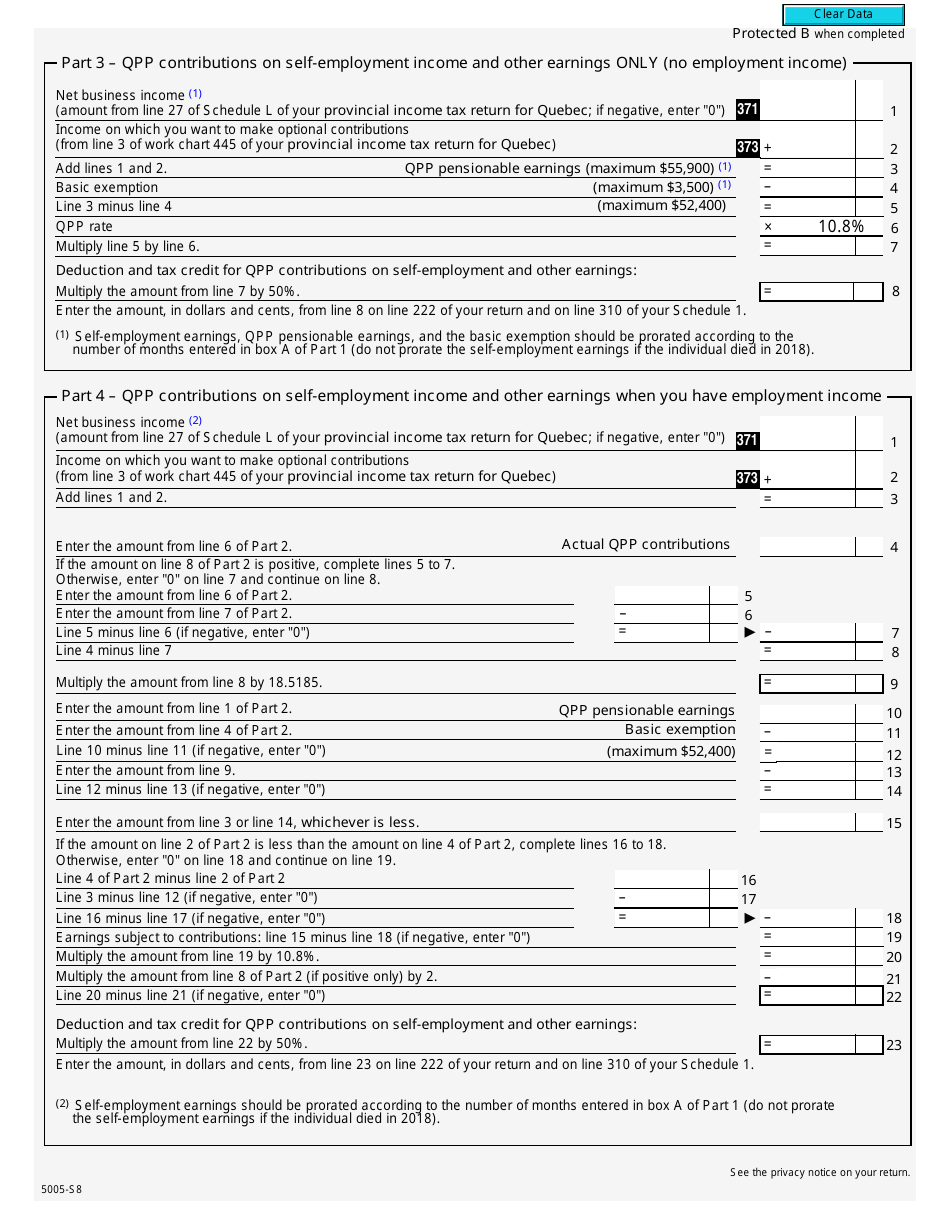

Q: What information is required on Form 5005-S8?

A: Form 5005-S8 requires information about the employer, the employee, and the QPP contributions made during the tax year.

Q: When is the deadline to file Form 5005-S8?

A: The deadline to file Form 5005-S8 is usually the same as the deadline for filing the T4 slips, which is the last day of February following the end of the tax year.

Q: What happens if I don't file Form 5005-S8?

A: Failure to file Form 5005-S8 or filing it late can result in penalties and interest charges imposed by the Canada Revenue Agency (CRA).