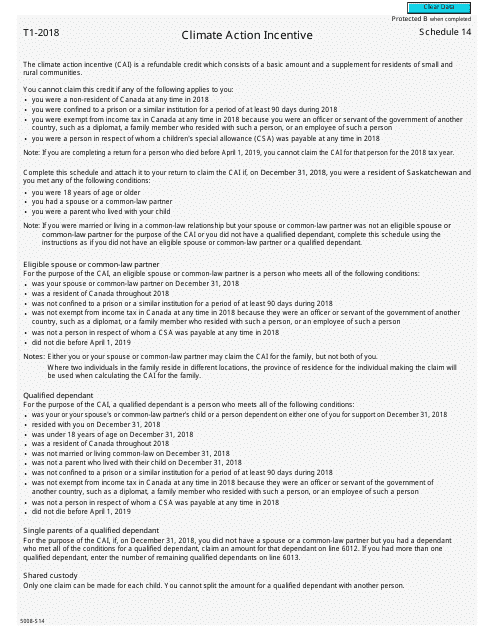

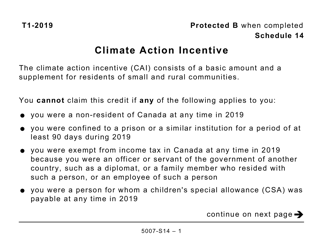

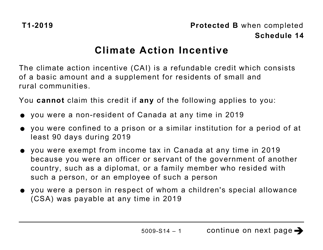

Form 5008-S14 Schedule 14 Climate Action Incentive - Canada

This Canada-specific " Climate Action Incentive " is a document released by the Canadian Revenue Agency .

Download the fillable PDF by clicking the link below and use it according to the applicable legal guidelines.

FAQ

Q: What is Form 5008-S14 Schedule 14?

A: The Form 5008-S14 Schedule 14 is a document related to the Climate Action Incentive in Canada.

Q: What is the Climate Action Incentive?

A: The Climate Action Incentive is a program in Canada that aims to reduce greenhouse gas emissions and promote the use of clean energy.

Q: What is the purpose of Form 5008-S14 Schedule 14?

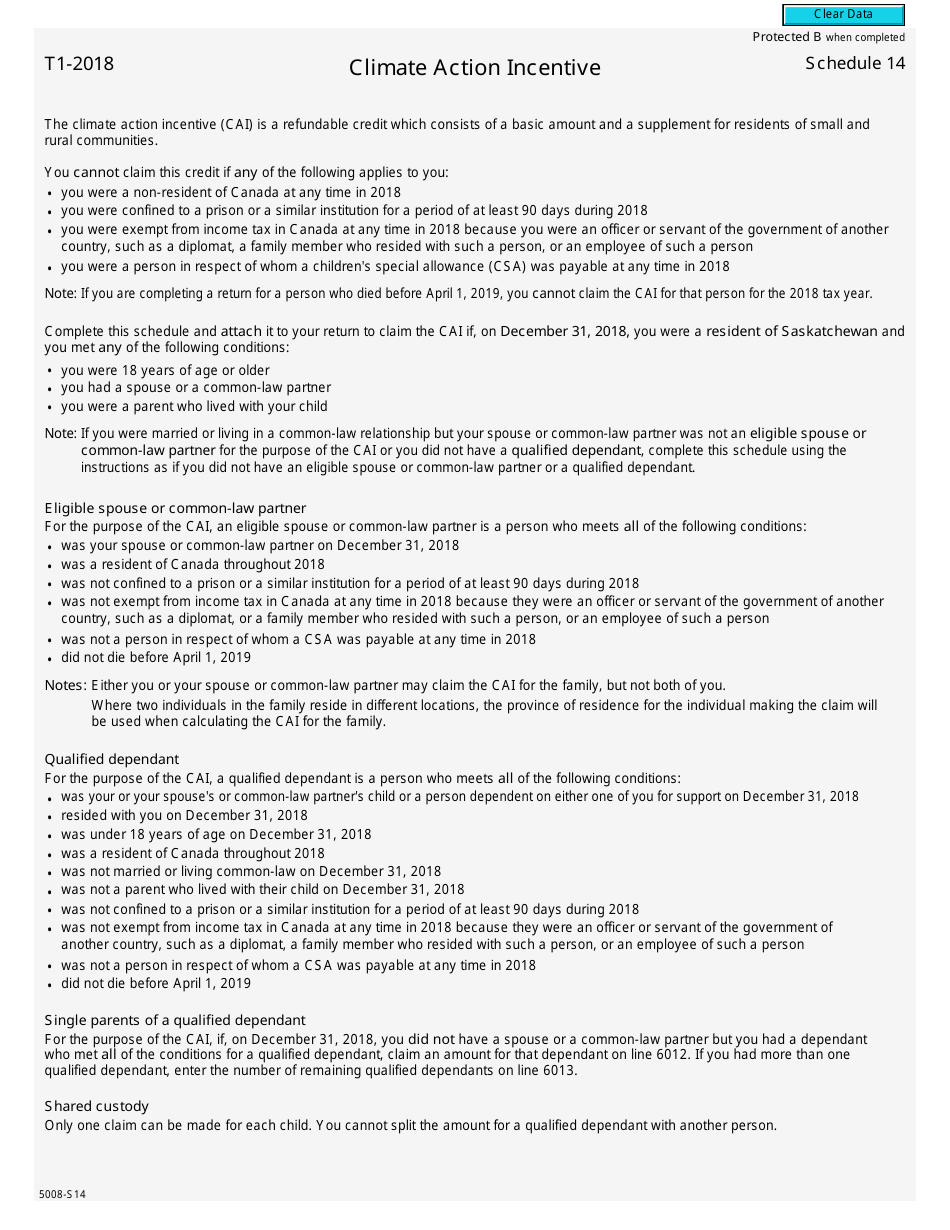

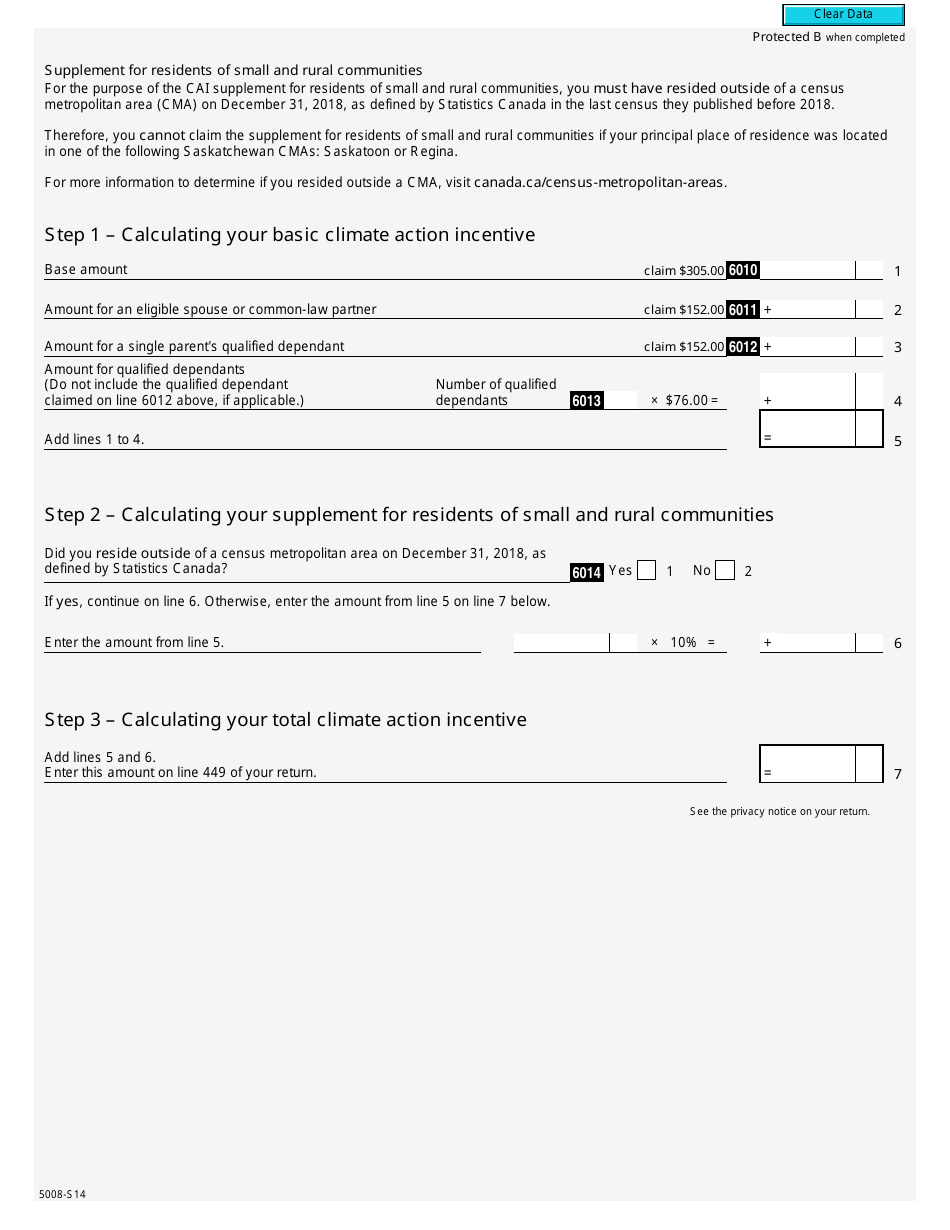

A: The purpose of this form is to provide information related to the Climate Action Incentive, such as eligible expenses and the amount of incentive claimed.

Q: Who needs to fill out Form 5008-S14 Schedule 14?

A: Individuals and businesses who have eligible expenses related to the Climate Action Incentive need to fill out this form.

Q: When is the deadline to submit Form 5008-S14 Schedule 14?

A: The deadline to submit this form is usually by April 30th of the year following the tax year in which the expenses were incurred.

Q: Are there any penalties for not submitting Form 5008-S14 Schedule 14?

A: Yes, there can be penalties for not submitting this form or providing inaccurate information. It is important to comply with the requirements of the Climate Action Incentive program.

Q: What are some examples of eligible expenses for the Climate Action Incentive?

A: Some examples of eligible expenses include energy-efficient home upgrades, public transit passes, and electric vehicle expenses.

Q: How much incentive can I claim on Form 5008-S14 Schedule 14?

A: The amount of incentive you can claim depends on various factors, such as the type and amount of eligible expenses you have incurred.

Q: Can I claim the Climate Action Incentive on my tax return?

A: Yes, you can claim the Climate Action Incentive on your tax return by filling out Form 5008-S14 Schedule 14 and including it with your tax filing.