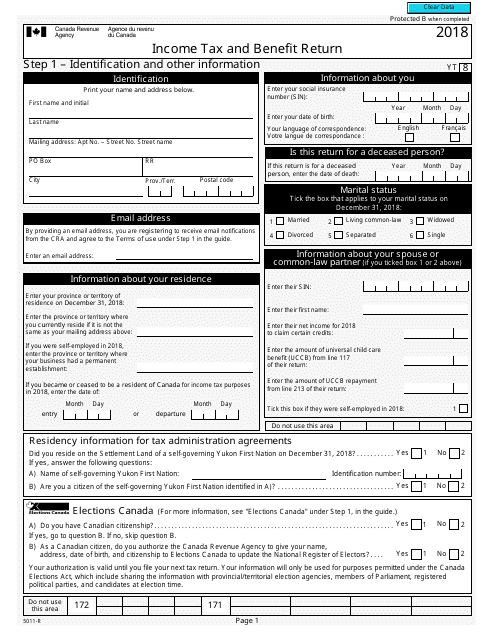

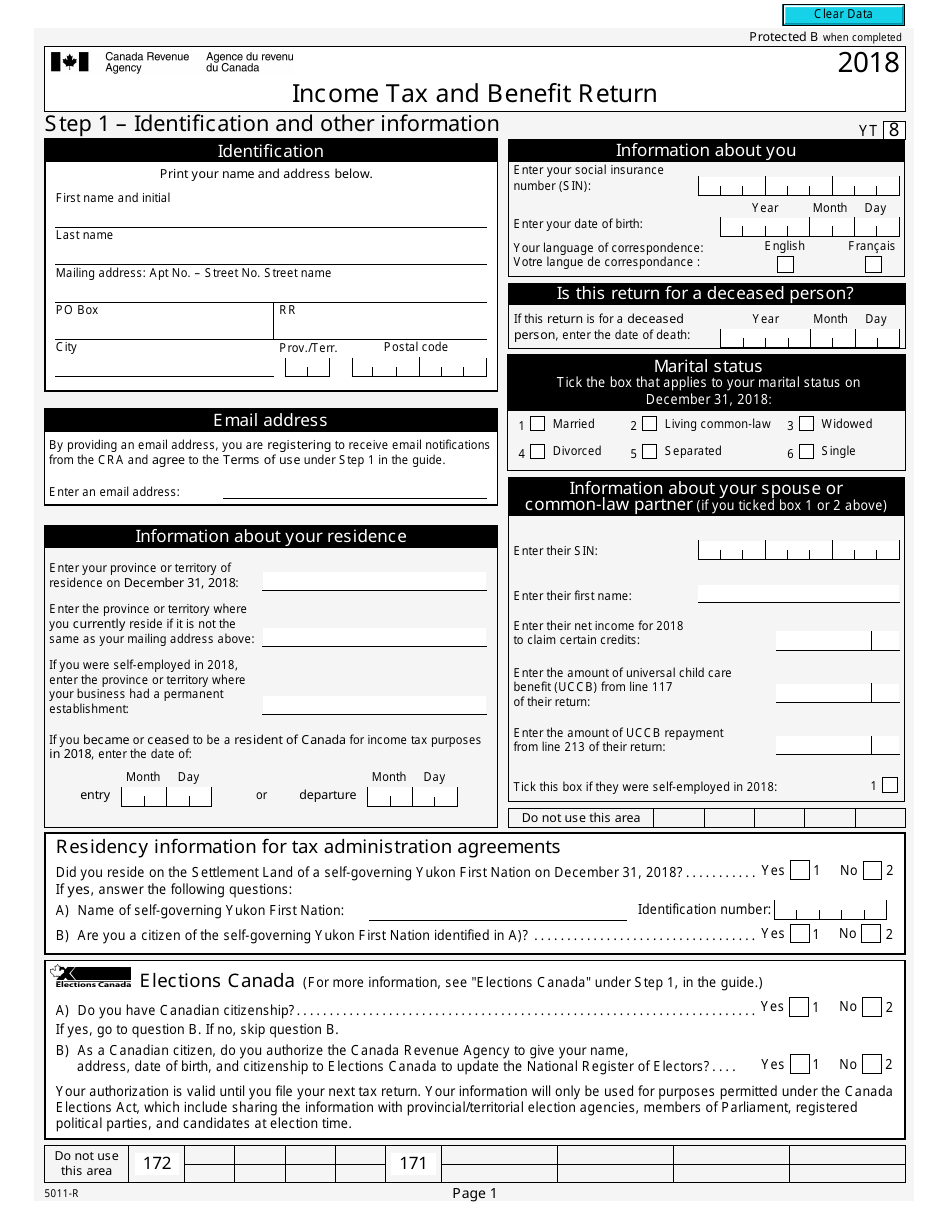

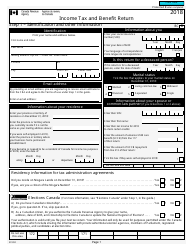

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5011-R

for the current year.

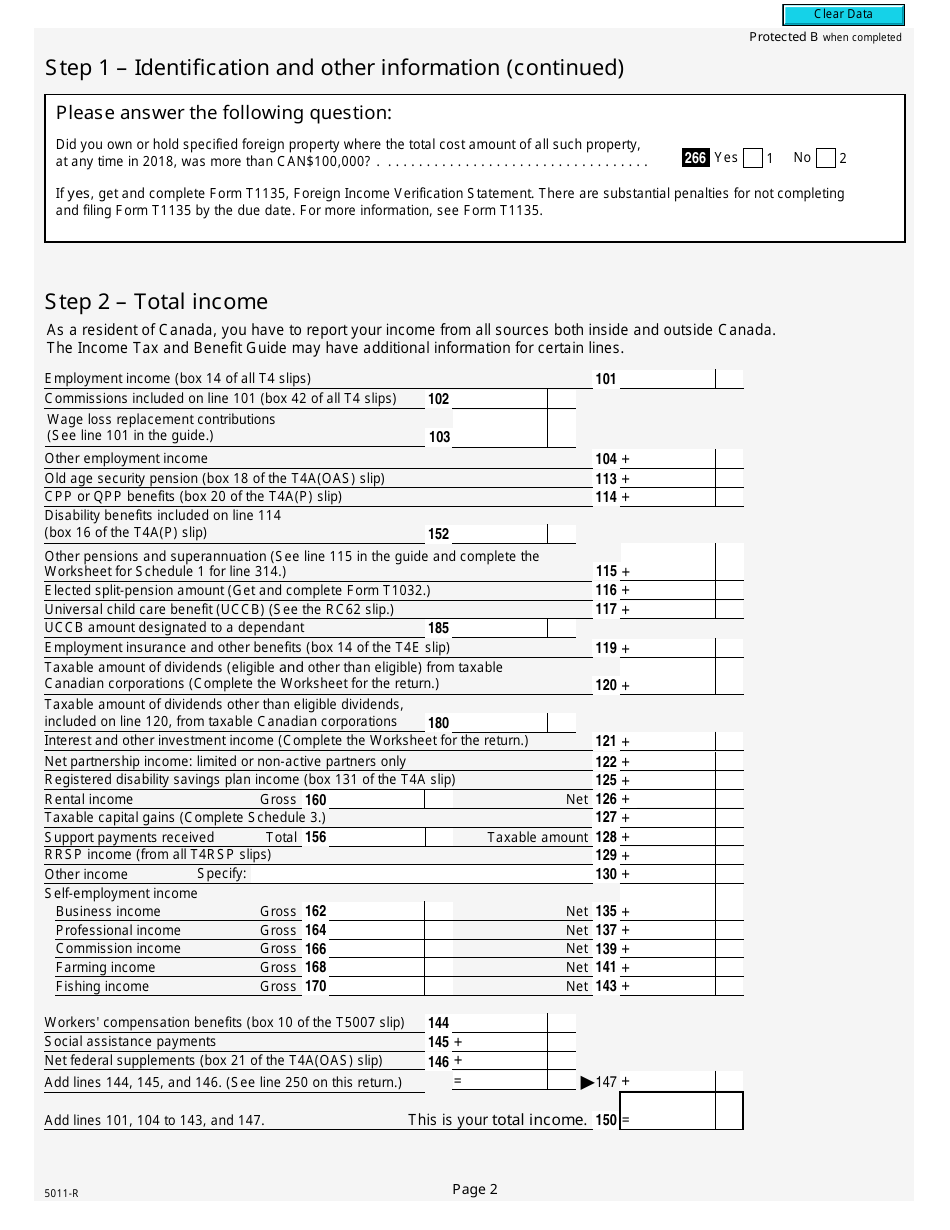

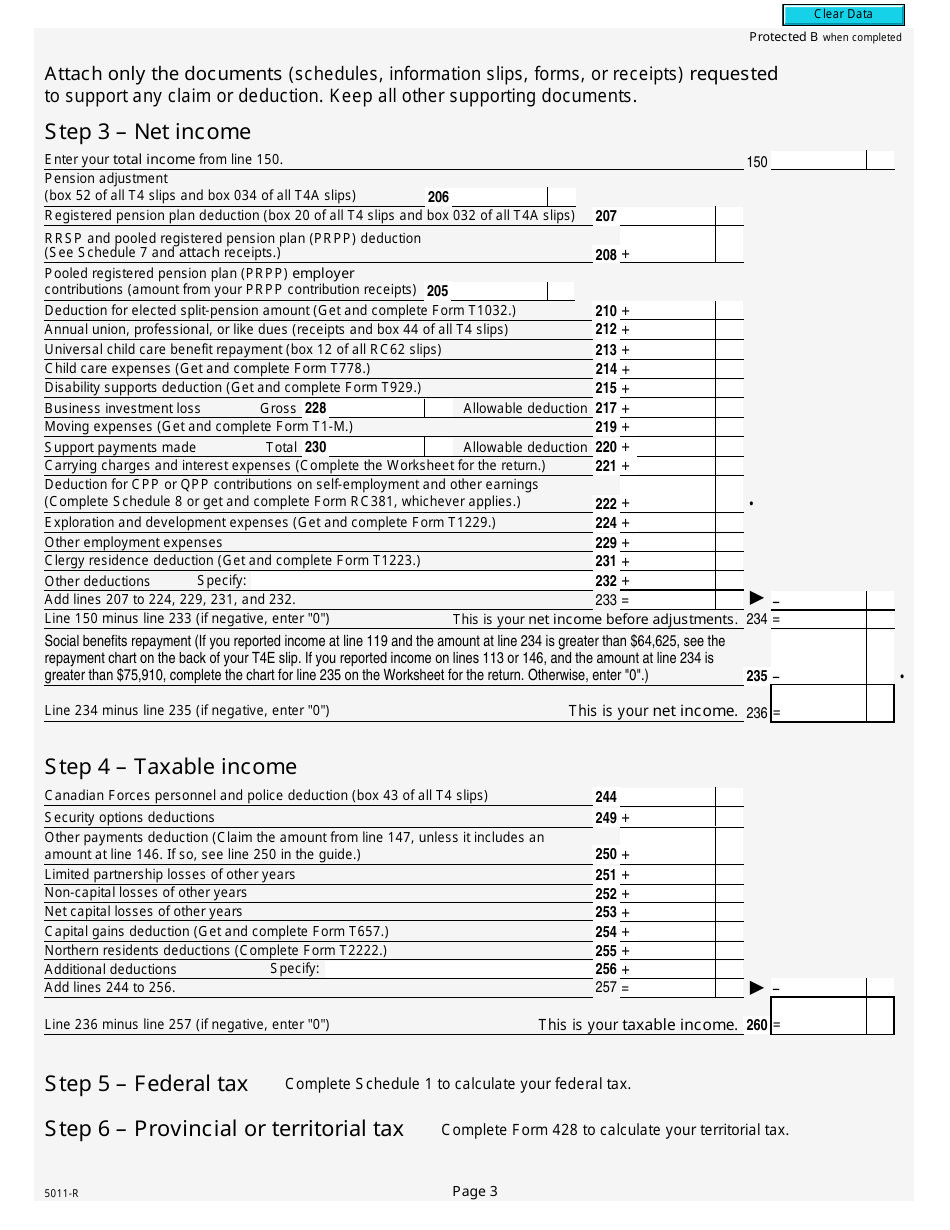

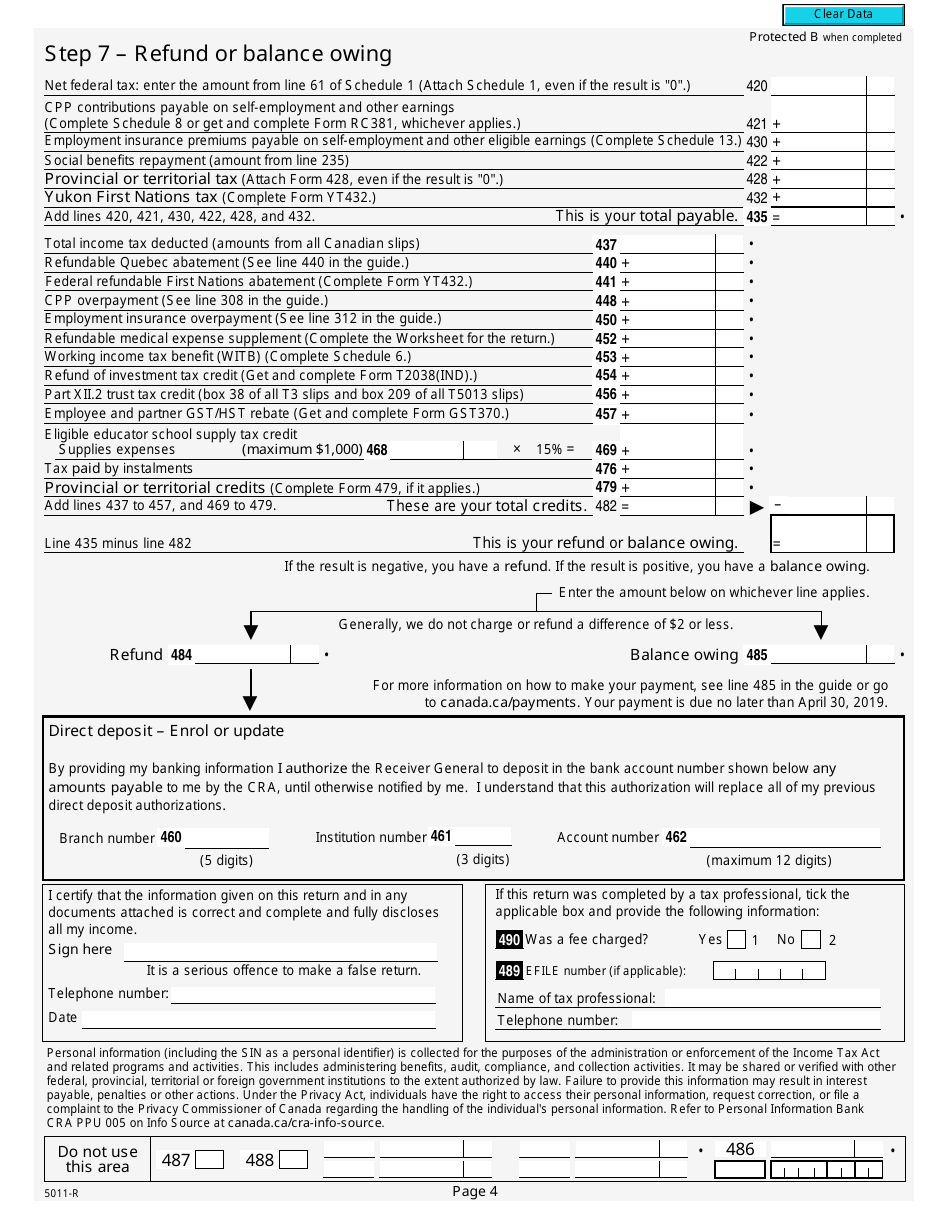

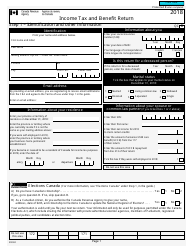

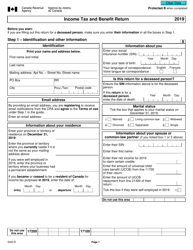

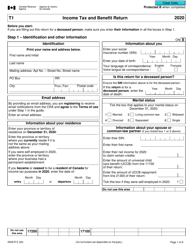

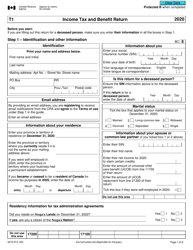

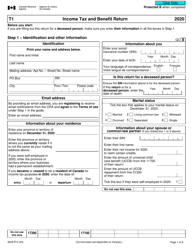

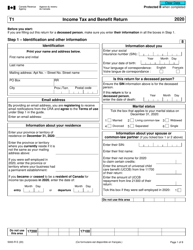

Form 5011-R Income Tax and Benefit Return - Canada

The Form 5011-R Income Tax and Benefit Return is used by individuals in Canada to report their income, claim tax deductions, and determine if they are eligible for any tax benefits or credits.

Individuals and residents of Canada who have income to report and are required to pay taxes file the Form 5011-R Income Tax and Benefit Return.

FAQ

Q: What is Form 5011-R?

A: Form 5011-R is the Income Tax and Benefit Return for residents of Canada.

Q: What is the purpose of Form 5011-R?

A: The purpose of Form 5011-R is to report your income and claim various tax benefits and credits.

Q: Who should file Form 5011-R?

A: Residents of Canada who have income to report and want to claim tax benefits and credits should file Form 5011-R.

Q: When is the deadline to file Form 5011-R?

A: The deadline to file Form 5011-R is usually April 30th of the following year.

Q: What supporting documents do I need to submit with Form 5011-R?

A: You may need to submit supporting documents such as T4 slips, receipts, and other relevant documents depending on your income and claims.

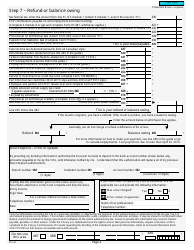

Q: Can I get a tax refund if I file Form 5011-R?

A: Yes, if you have overpaid your taxes or are eligible for tax credits, you may be entitled to a tax refund.

Q: What happens if I file Form 5011-R late?

A: If you file Form 5011-R late, you may be subject to penalties and interest on any taxes owing.