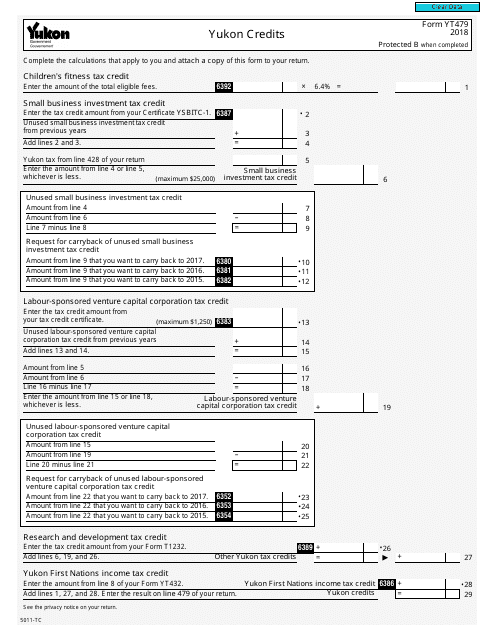

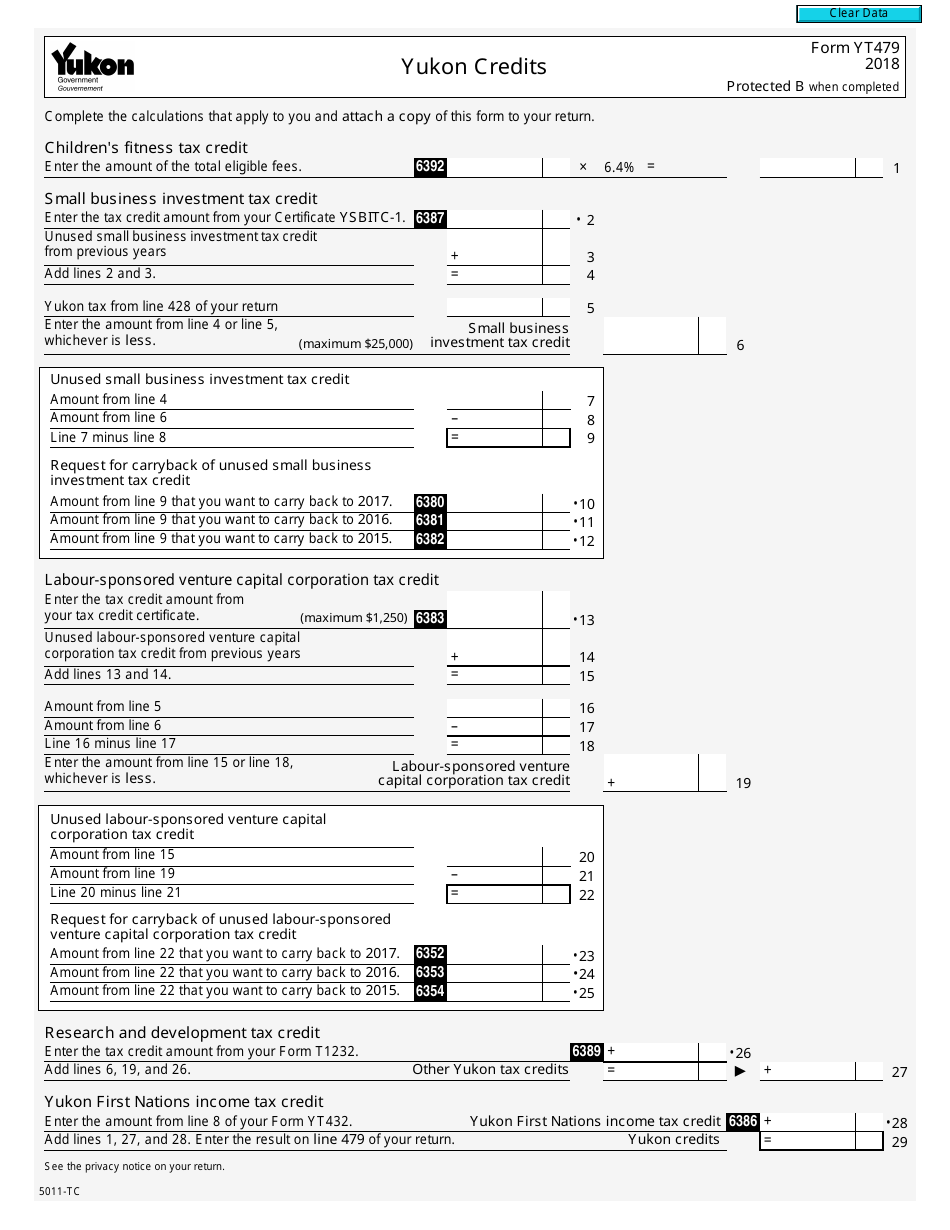

This version of the form is not currently in use and is provided for reference only. Download this version of

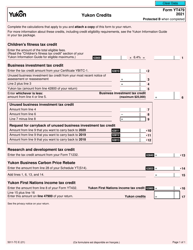

Form 5011-TC (YT479)

for the current year.

Form 5011-TC (YT479) Yukon Credits - Canada

Form 5011-TC (YT479) is used in Yukon, Canada to claim tax credits.

The Form 5011-TC (YT479) for Yukon Credits in Canada is filed by individuals or businesses in Yukon who are eligible for certain tax credits.

FAQ

Q: What is Form 5011-TC (YT479)?

A: Form 5011-TC (YT479) is a tax credit form used in the Yukon Territory, Canada.

Q: What are Yukon Credits?

A: Yukon Credits are tax credits specific to the Yukon Territory in Canada.

Q: Who is eligible to claim Yukon Credits?

A: Residents of the Yukon Territory who meet the eligibility criteria specified by the government are eligible to claim Yukon Credits.

Q: What are the types of Yukon Credits?

A: Yukon Credits include the Homeowner's Credit, Seniors Property Tax Deferment Credit, and the Yukon Mineral Exploration Tax Credit.

Q: How do I complete Form 5011-TC (YT479)?

A: Form 5011-TC (YT479) includes instructions to help you complete it correctly. Follow the instructions carefully and provide the required information.

Q: When is the deadline to submit Form 5011-TC (YT479)?

A: The deadline to submit Form 5011-TC (YT479) may vary. Check the instructions on the form or contact the CRA for the most up-to-date deadline information.

Q: What happens after I submit Form 5011-TC (YT479)?

A: After you submit Form 5011-TC (YT479), the CRA will review your application and determine if you are eligible for the Yukon Credits you have claimed.

Q: Will I receive a refund for the Yukon Credits claimed?

A: If you are eligible and your application is approved, you may receive a refund for the Yukon Credits claimed on your tax return.

Q: Can I claim Yukon Credits if I don't live in the Yukon Territory?

A: No, Yukon Credits are specifically for residents of the Yukon Territory. If you do not live in the Yukon, you are not eligible to claim these credits.