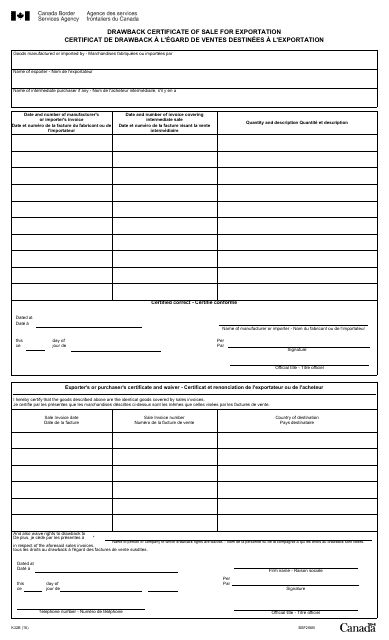

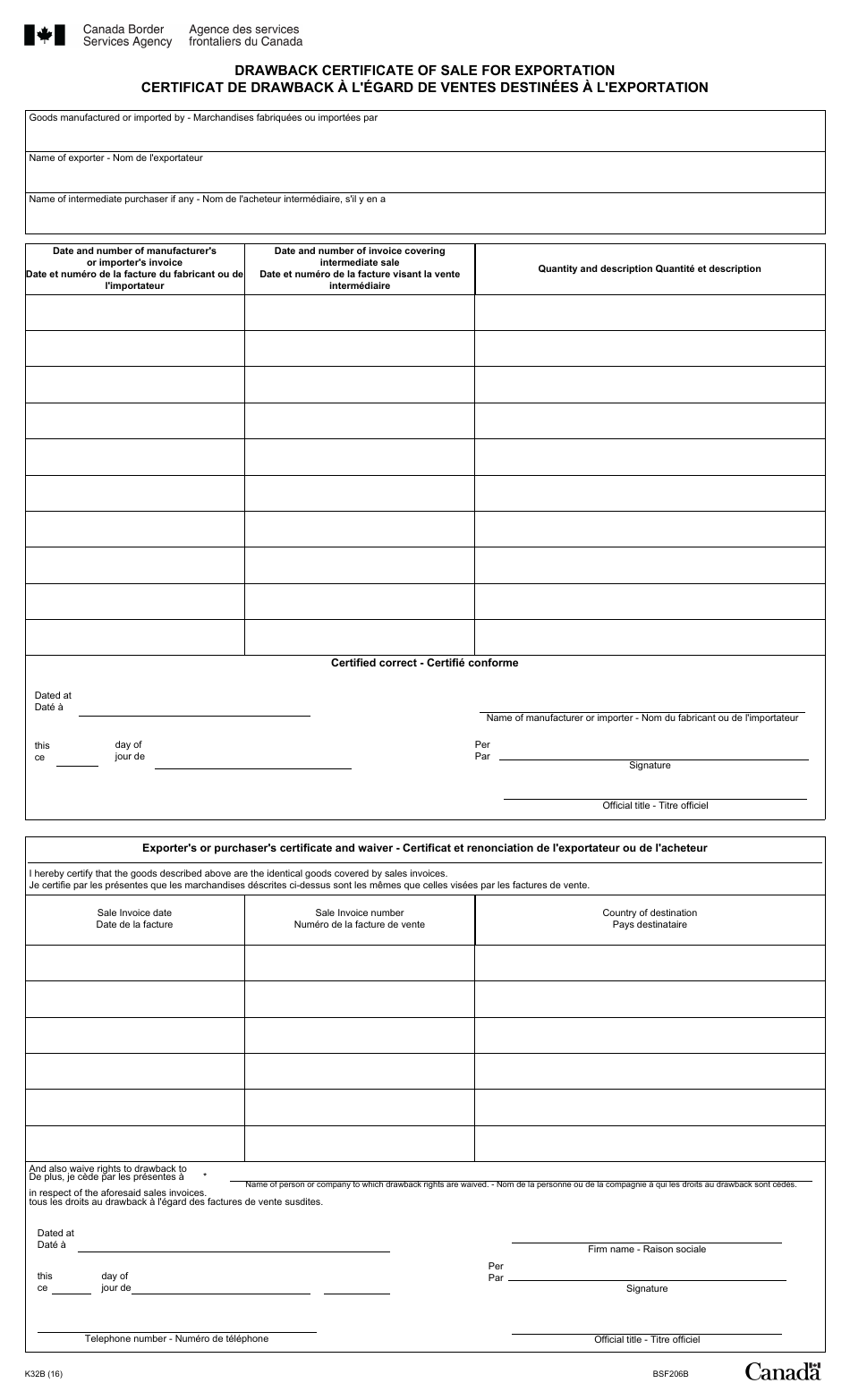

Form K32B Drawback Certificate of Sale for Exportation - Canada (English / French)

Form K32B Drawback Certificate of Sale for Exportation is used in Canada for claiming a refund of duties, taxes, or fees paid on goods that are subsequently exported. The form is available in both English and French and serves as documentation for requesting a drawback.

The Form K32B Drawback Certificate of Sale for Exportation in Canada can be filed by the exporter or their authorized agent. The form is available in both English and French.

FAQ

Q: What is a Form K32B Drawback Certificate of Sale for Exportation?

A: Form K32B is a document used in Canada to claim a refund of duties paid on imported goods that are subsequently exported.

Q: What information do I need to provide on Form K32B?

A: You will need to provide details about the imported goods, such as the invoice number, importer name, and description of the goods. You will also need to provide information about the export sale, including the sale price and the exporter's name.

Q: Can I submit Form K32B electronically?

A: Yes, you can submit Form K32B electronically through the CBSA's Electronic Data Interchange (EDI) system.

Q: How long does it take to receive a refund after submitting Form K32B?

A: The processing time for refunds can vary, but it generally takes several weeks to several months to receive a refund after submitting Form K32B.

Q: Is there a fee for filing Form K32B?

A: No, there is no fee for filing Form K32B.

Q: Does Form K32B apply to all goods exported from Canada?

A: No, Form K32B applies only to goods that were previously imported into Canada and on which duties were paid.