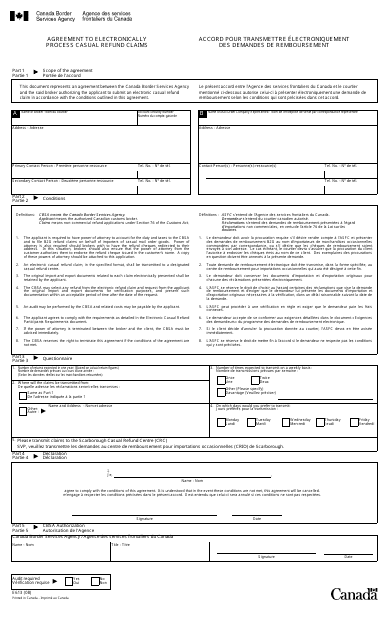

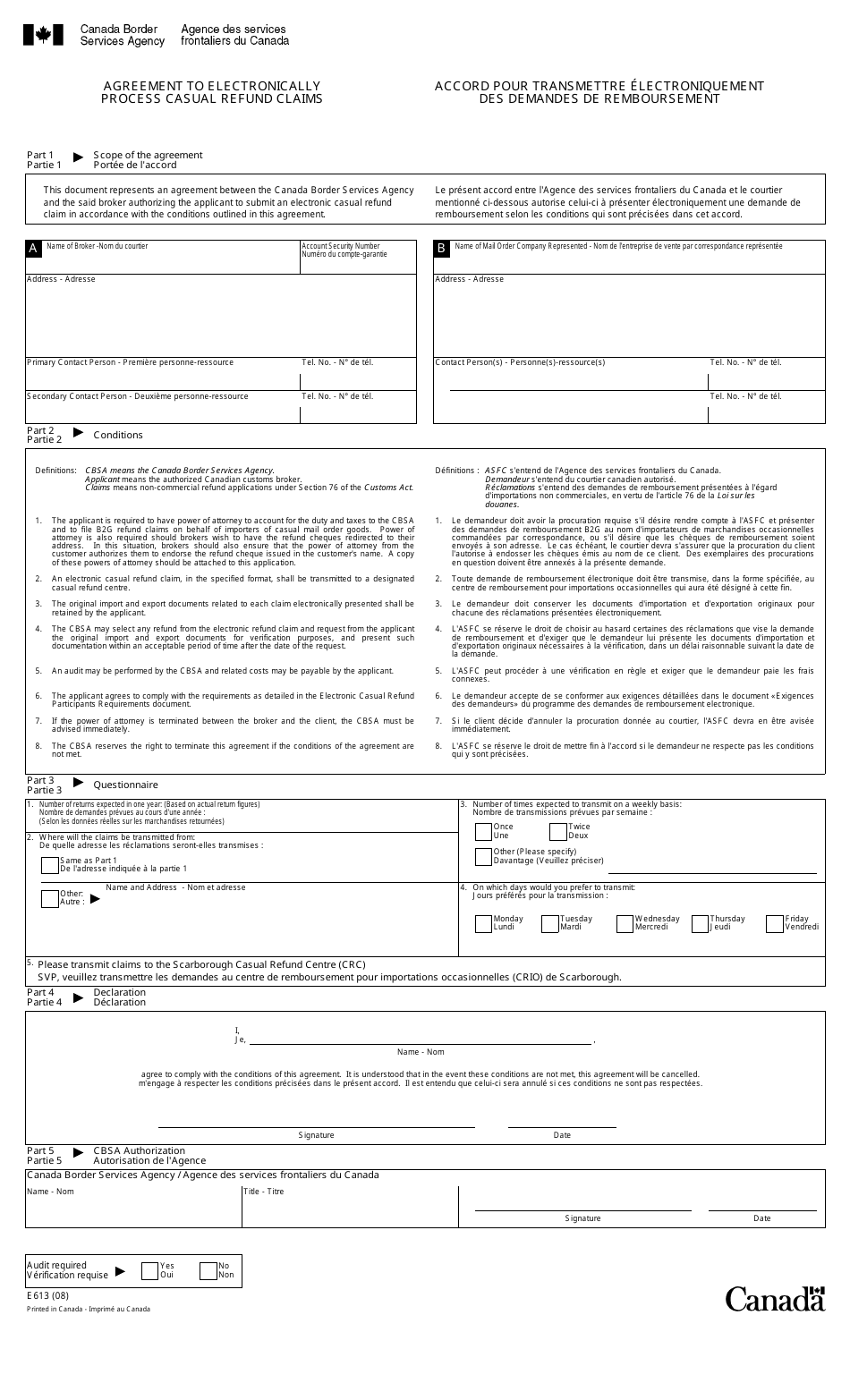

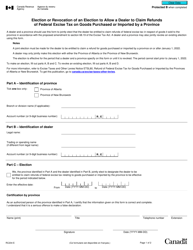

Form E613 Agreement to Electronically Process Casual Refund Claims - Canada (English / French)

Form E613 Agreement to Electronically Process Casual Refund Claims is used in Canada for individuals or businesses to authorize the Canada Revenue Agency (CRA) to process their casual refund claims electronically. It allows the CRA to directly deposit the refunds into the taxpayer's designated bank account.

The Form E613 Agreement to Electronically Process Casual Refund Claims in Canada can be filed by individuals or businesses who are making casual refund claims. It is available in both English and French.

FAQ

Q: What is the Form E613?

A: The Form E613 is an agreement to electronically process casual refund claims in Canada.

Q: What does the Form E613 allow?

A: The Form E613 allows for the electronic processing of casual refund claims.

Q: Is the Form E613 available in both English and French?

A: Yes, the Form E613 is available in both English and French.

Q: What is the purpose of the Form E613?

A: The purpose of the Form E613 is to streamline the process of claiming casual refunds.

Q: Who can use the Form E613?

A: Any individual or business who qualifies for a casual refund in Canada can use the Form E613.