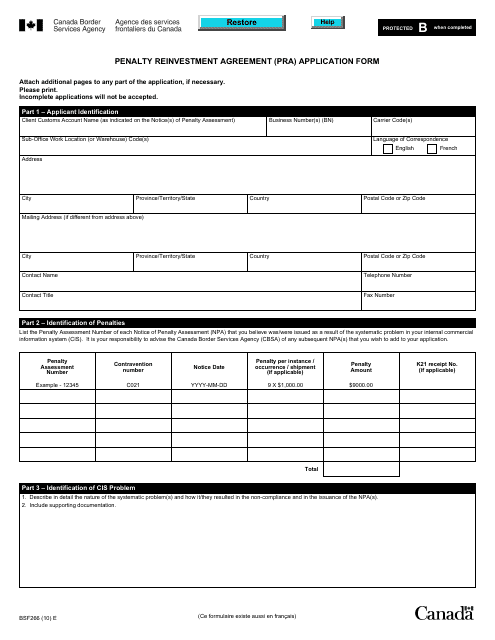

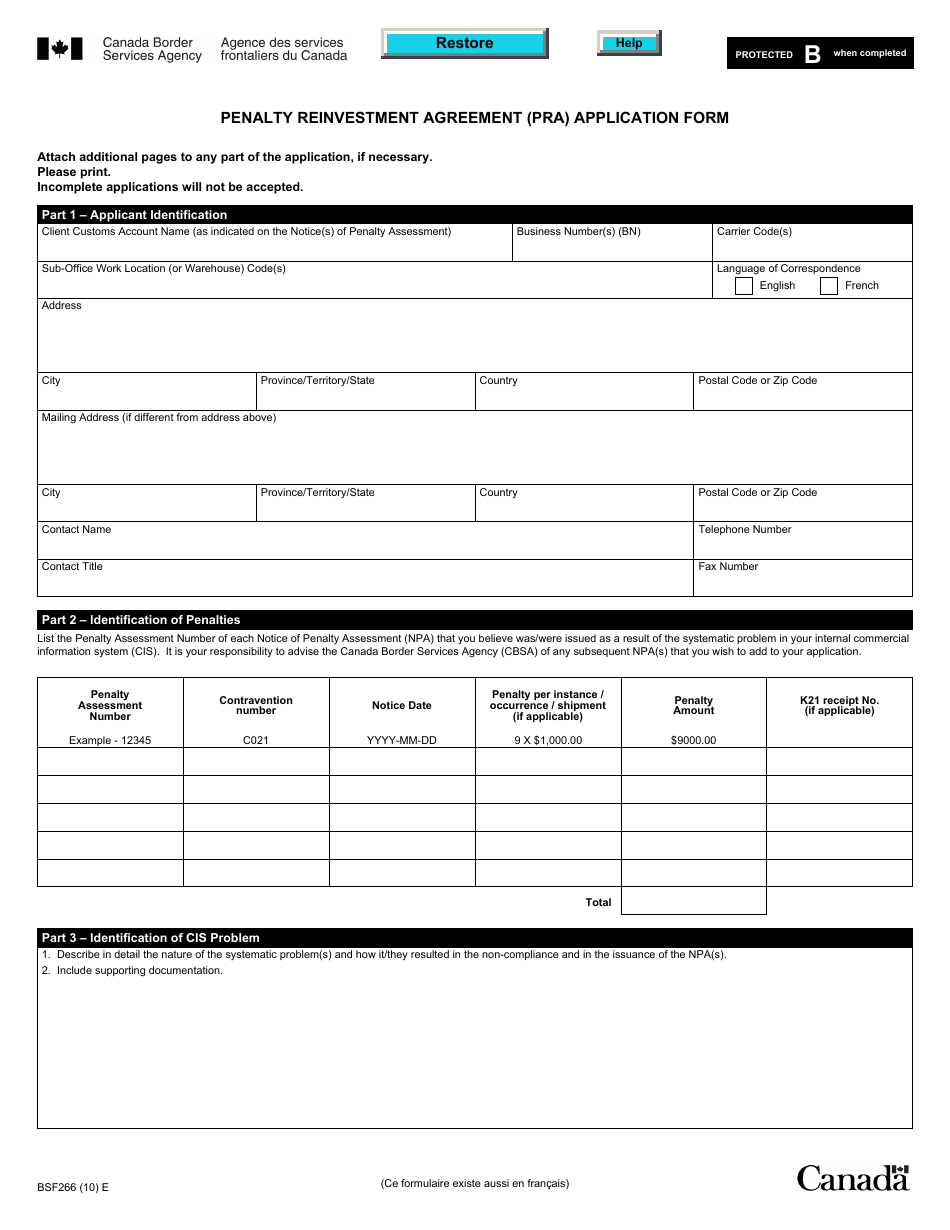

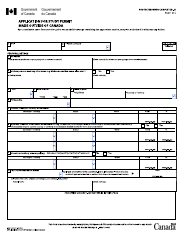

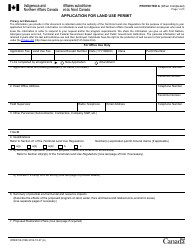

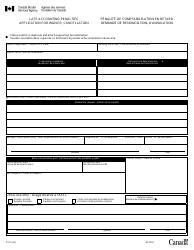

Form BSF266 Penalty Reinvestment Agreement (Pra) Application Form - Canada

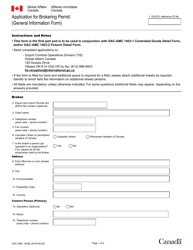

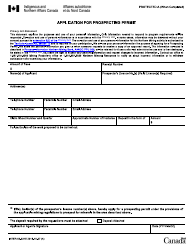

Form BSF266 Penalty Reinvestment Agreement (PRA) Application Form is used in Canada for applying for a Penalty Reinvestment Agreement (PRA). This agreement allows businesses to reinvest certain penalties they incurred for non-compliance with customs regulations into eligible customs compliance activities.

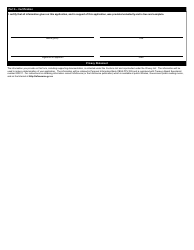

The Form BSF266 Penalty Reinvestment Agreement (PRA) Application Form in Canada is typically filed by individuals or businesses who have been assessed penalties by the Canada Border Services Agency (CBSA) and wish to request a reinvestment agreement.

FAQ

Q: What is Form BSF266?

A: Form BSF266 is the Penalty Reinvestment Agreement (PRA) Application Form.

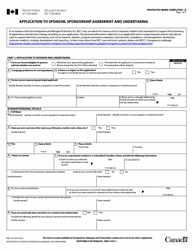

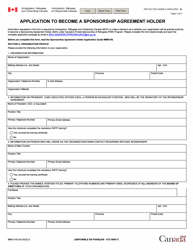

Q: What is the Penalty Reinvestment Agreement?

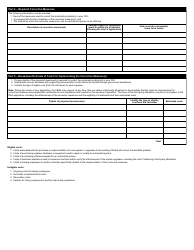

A: The Penalty Reinvestment Agreement (PRA) is an agreement between an individual or a company and the Canada Border Services Agency (CBSA) to reinvest a portion of the penalties received into projects that enhance CBSA programs and services.

Q: Who needs to fill out Form BSF266?

A: Individuals or companies who have received penalties from the CBSA and wish to apply for the Penalty Reinvestment Agreement (PRA) need to fill out Form BSF266.

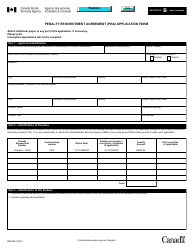

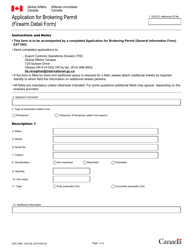

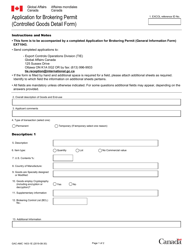

Q: What information is required on Form BSF266?

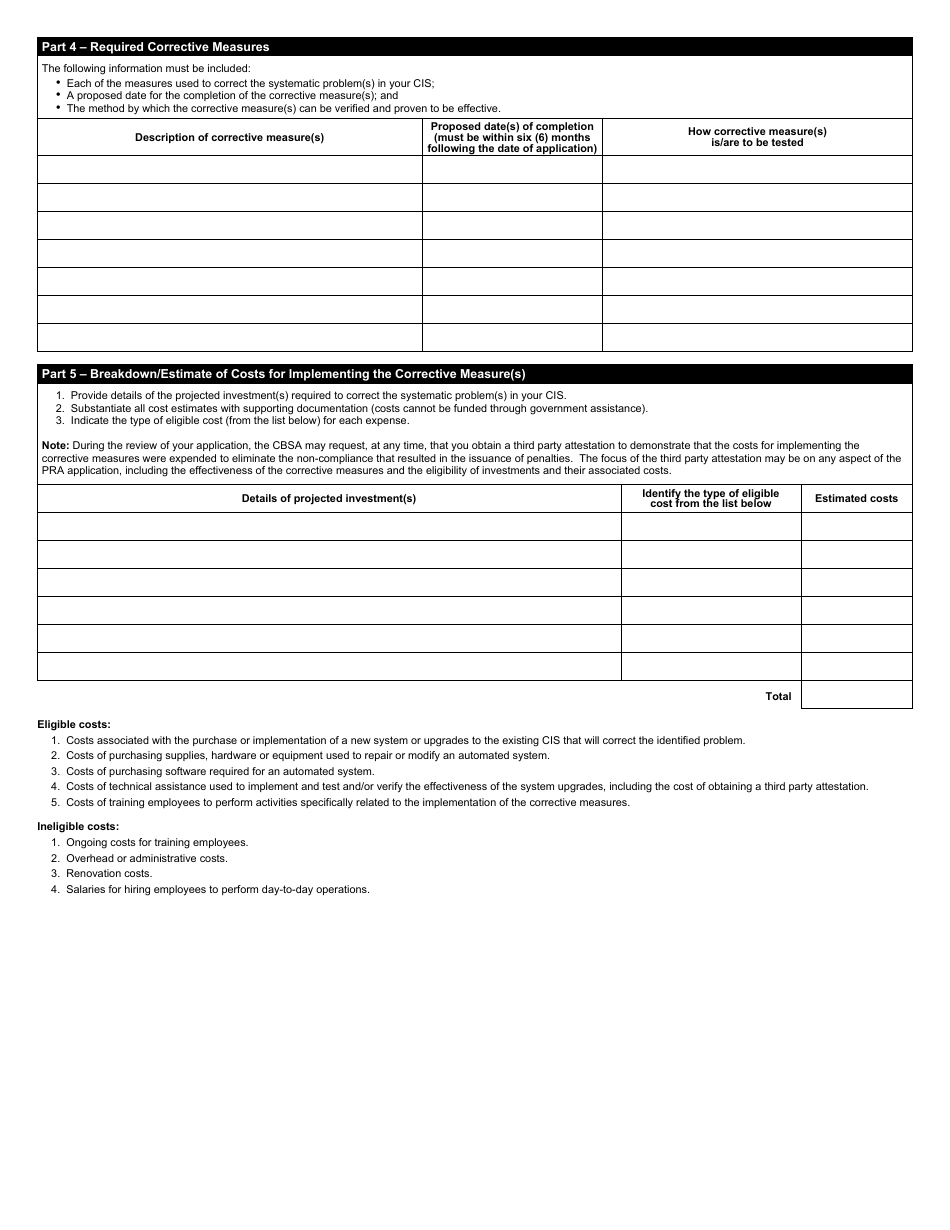

A: Form BSF266 requires information about the individual or company applying for the Penalty Reinvestment Agreement (PRA), details of the penalties received, and a proposed reinvestment project.

Q: Is there a deadline to submit Form BSF266?

A: There is no specific deadline mentioned for submitting Form BSF266. However, it is advisable to submit the form as soon as possible after receiving the penalty.

Q: Are there any fees associated with the Penalty Reinvestment Agreement (PRA)?

A: There are no fees associated with the Penalty Reinvestment Agreement (PRA) application.

Q: Can I appeal a decision regarding the Penalty Reinvestment Agreement (PRA)?

A: Yes, if your application for the Penalty Reinvestment Agreement (PRA) is denied, you have the right to appeal the decision.