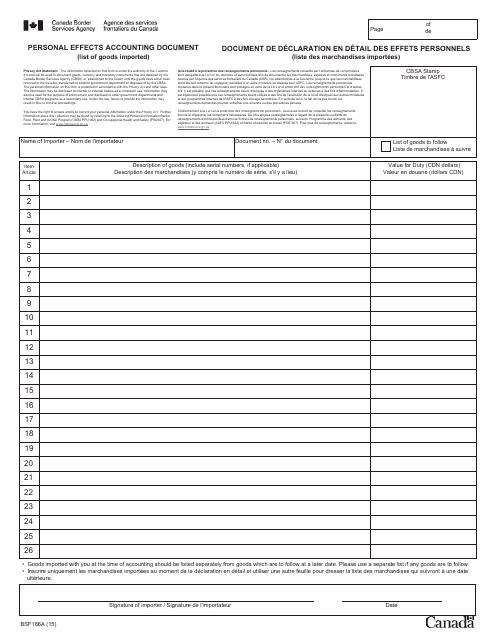

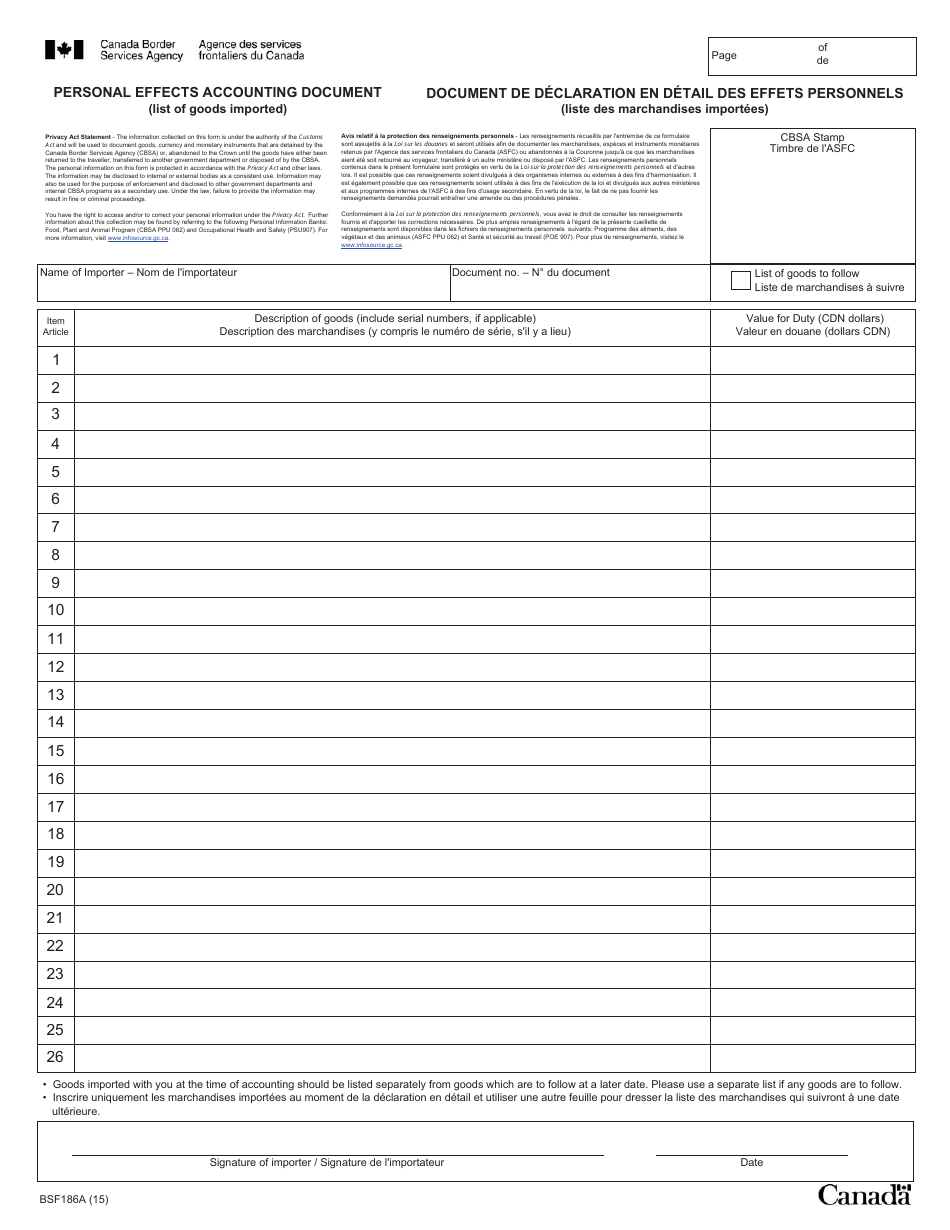

Form BSF186A Personal Effects Accounting Document (List of Goods Imported) - Canada (English / French)

Form BSF186A Personal Effects Accounting Document is used in Canada for listing the goods imported as personal effects. It is a document that must be completed by individuals who are importing their personal belongings into Canada. This form helps Canadian customs authorities assess the eligibility and duty requirements for these imported goods. It is available in both English and French to cater to the bilingual nature of Canada.

The Form BSF186A Personal Effects Accounting Document (List of Goods Imported) in Canada can be filed by individuals who are importing personal belongings into the country. This form is used to declare the list of goods being imported and is available in both English and French. Individuals who are moving to Canada or returning after an extended stay abroad often use this form to account for their personal effects.

FAQ

Q: What is the Form BSF186A Personal Effects Accounting Document?

A: The Form BSF186A is a document used to declare personal effects imported into Canada.

Q: Do I need to fill out the Form BSF186A when bringing personal effects into Canada?

A: Yes, if you are importing personal effects into Canada, you are required to complete the Form BSF186A.

Q: Is the Form BSF186A available in both English and French?

A: Yes, the Form BSF186A is available in both English and French. You can choose the language you prefer.

Q: What information needs to be provided on the Form BSF186A?

A: The Form BSF186A requires you to provide information such as your personal details, a list of items being imported, their values, and supporting documentation.

Q: Can I declare any personal effects on the Form BSF186A?

A: You can declare personal effects such as clothing, electronics, jewelry, and household items on the Form BSF186A. However, there are limitations and restrictions on certain items.

Q: Do I need to pay any duties or taxes when importing personal effects into Canada?

A: In most cases, personal effects that are being imported for personal use and are not intended for sale are exempt from duties and taxes. However, there may be exceptions depending on the value and type of items being imported.

Q: How should I complete the Form BSF186A accurately?

A: It is important to accurately and honestly complete the Form BSF186A by providing detailed and truthful information about the personal effects being imported. Failure to do so may result in penalties or delays.

Q: Can I declare personal effects on behalf of someone else using the Form BSF186A?

A: Yes, if you have been authorized by the owner of the personal effects, you can complete the Form BSF186A on their behalf. Make sure to include all required information and supporting documentation.

Q: What should I do after completing the Form BSF186A?

A: After completing the Form BSF186A, you should submit it to the CBSA officer at the port of entry into Canada. They will review the form, verify the information, and provide any further instructions if necessary.