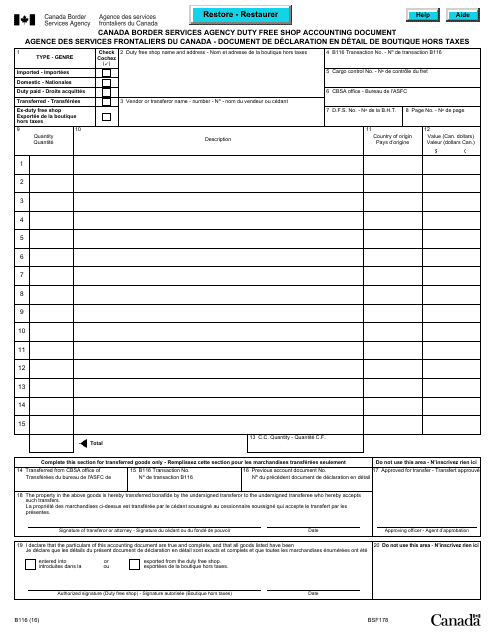

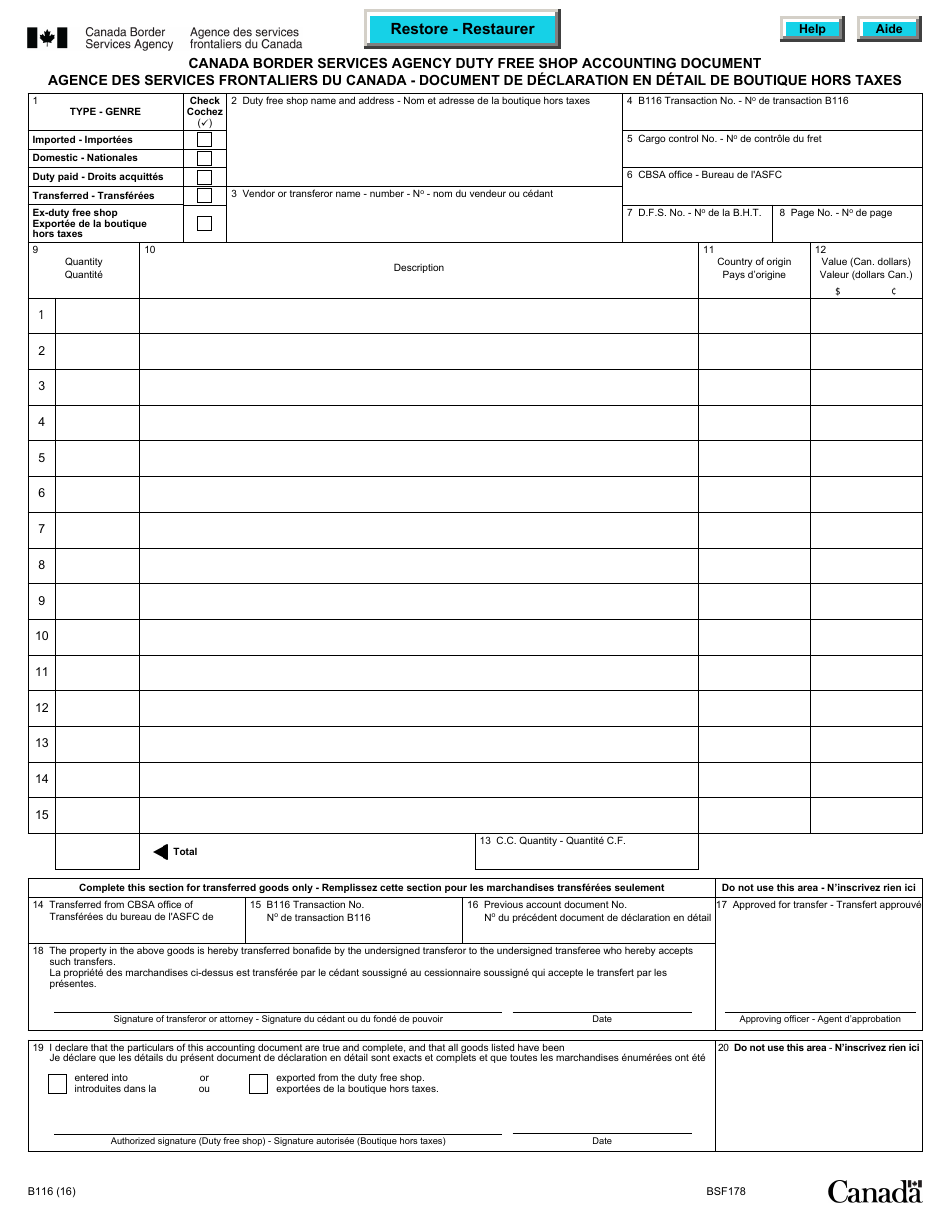

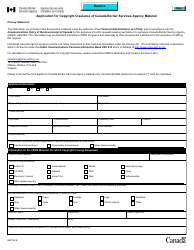

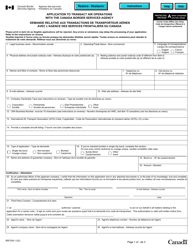

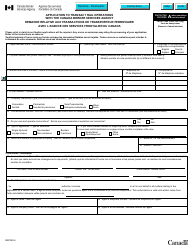

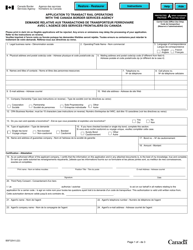

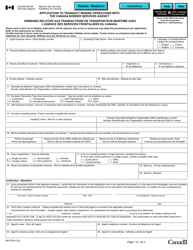

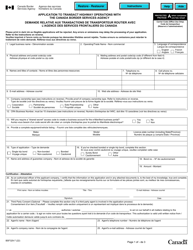

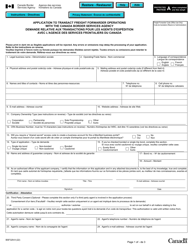

Form B116 Canada Border Services Agency Duty Free Shop Accounting Document - Canada (English / French)

Form B116 is a Canadian Border Services Agency form also known as the "Form B116 "canada Border Services Agency Duty Free Shop Accounting Document" - Canada (english/french)" . The latest edition of the form was released in January 1, 2016 and is available for digital filing.

Download an up-to-date Form B116 in PDF-format down below or look it up on the Canadian Border Services Agency Forms website.

FAQ

Q: What is Form B116?

A: Form B116 is an accounting document used by the Canada Border Services Agency (CBSA) for duty-free shops in Canada.

Q: What is the purpose of Form B116?

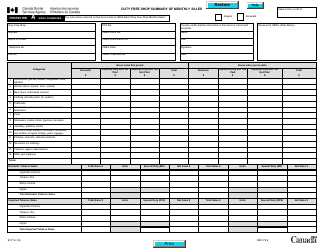

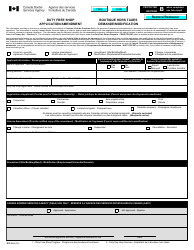

A: The purpose of Form B116 is to track and record the sales and inventory of duty-free shops in Canada.

Q: Who uses Form B116?

A: Duty-free shops in Canada use Form B116.

Q: What information does Form B116 include?

A: Form B116 includes information such as the shop's name, location, sales information, and inventory details.

Q: Is Form B116 available in both English and French?

A: Yes, Form B116 is available in both English and French to accommodate the official languages of Canada.

Q: What are duty-free shops?

A: Duty-free shops are retail stores that sell goods to international travelers without charging certain taxes and duties.

Q: Can anyone shop at a duty-free shop?

A: No, only eligible travelers who are leaving the country can shop at duty-free shops.

Q: What items can I buy at a duty-free shop?

A: Duty-free shops typically sell a range of products such as alcohol, tobacco, perfume, cosmetics, and luxury goods.

Q: Are the prices in duty-free shops cheaper?

A: Prices in duty-free shops can often be lower than regular retail prices due to the exemption from certain taxes and duties.