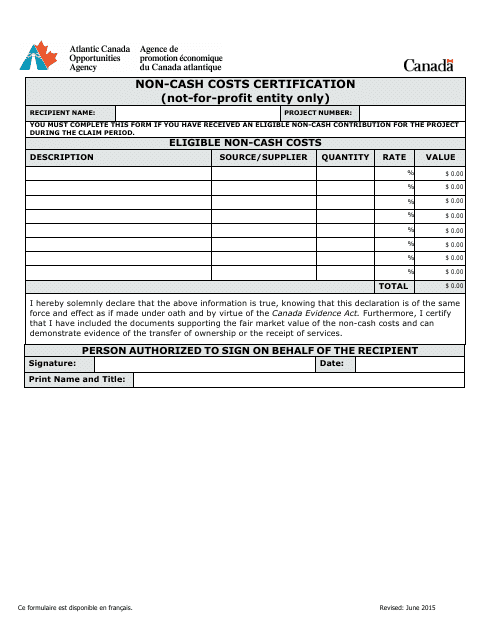

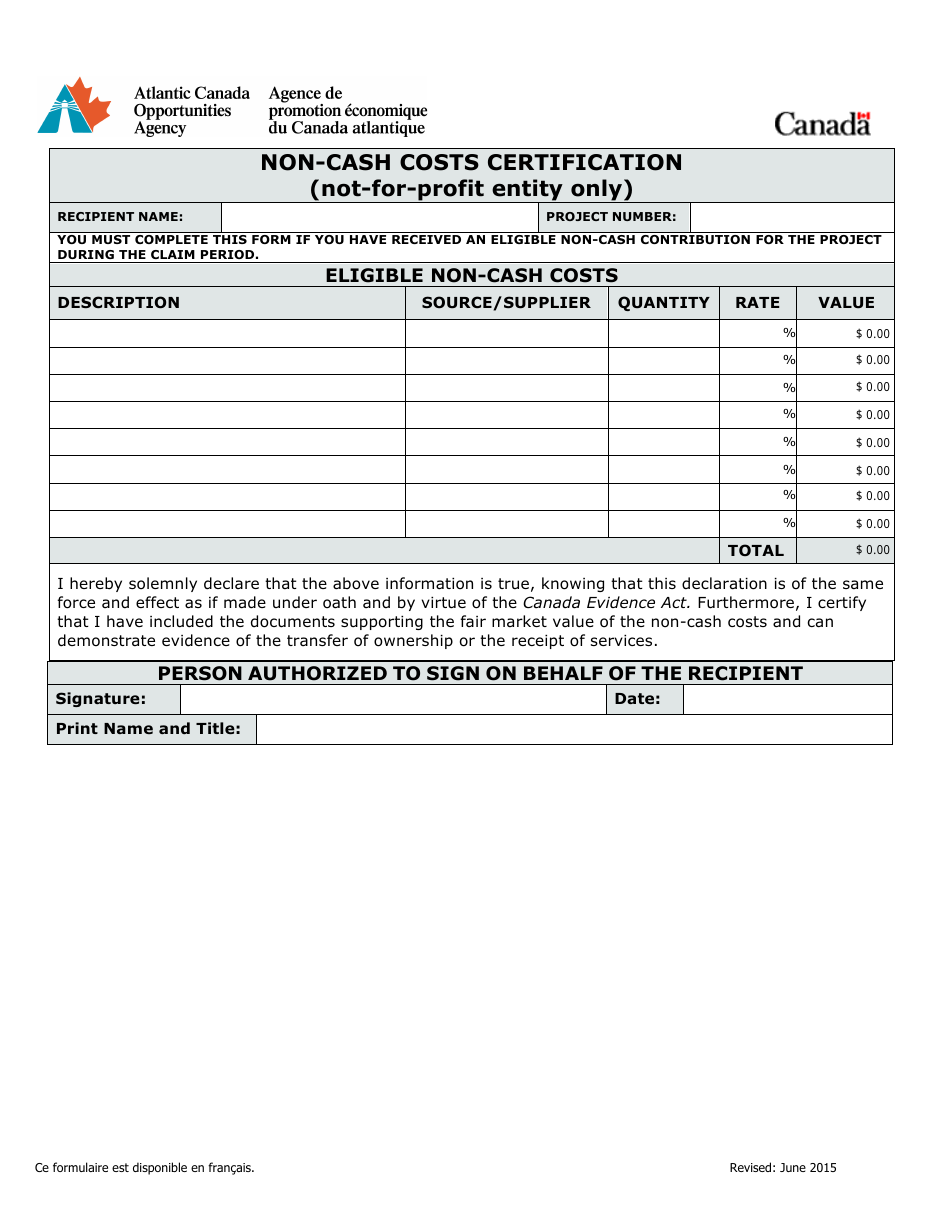

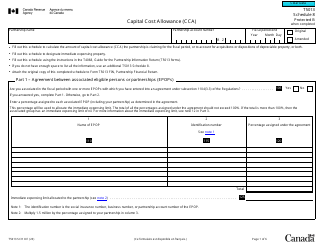

Non-cash Costs Certification (Not-For-Profit Entity Only) - Canada

This " Non-cash Costs Certification (not-for-profit Entity Only) " is a document issued by the Atlantic Canada Opportunities Agency specifically for Canada residents with its latest version released on June 1, 2015.

Download the up-to-date fillable PDF by clicking the link below or find it on the forms website of the Atlantic Canada Opportunities Agency.

FAQ

Q: What is a non-cash cost certification?

A: A non-cash cost certification is a process that helps not-for-profit entities in Canada calculate and report the value of non-cash contributions they receive.

Q: Why is non-cash cost certification important for not-for-profit entities?

A: Non-cash cost certification is important for not-for-profit entities because it allows them to accurately reflect the value of non-cash contributions in their financial statements and demonstrate transparency.

Q: Who requires non-cash cost certification in Canada?

A: Not-for-profit entities in Canada are required to undergo non-cash cost certification to comply with financial reporting regulations and standards.

Q: What does the non-cash cost certification process involve?

A: The non-cash cost certification process involves identifying, valuing, and reporting the non-cash contributions received by a not-for-profit entity.

Q: What are examples of non-cash contributions?

A: Examples of non-cash contributions can include donated goods, services, property, and equipment.

Q: How is the value of non-cash contributions determined?

A: The value of non-cash contributions is typically determined based on fair market value, which is the price that would be agreed upon between a willing buyer and a willing seller.

Q: Can non-cash contributions be tax-deductible?

A: Yes, non-cash contributions can be tax-deductible for both the donor and the not-for-profit entity, subject to specific tax regulations and limitations.

Q: What are the reporting requirements for non-cash contributions in Canada?

A: Not-for-profit entities in Canada are required to report non-cash contributions in their financial statements, including the method used to determine their value.

Q: Are there any guidelines or standards for non-cash cost certification?

A: Yes, there are guidelines and standards issued by regulatory bodies, such as the Canada Revenue Agency (CRA) and the Accounting Standards for Not-for-Profit Organizations (ASNPO), that provide guidance on non-cash cost certification.