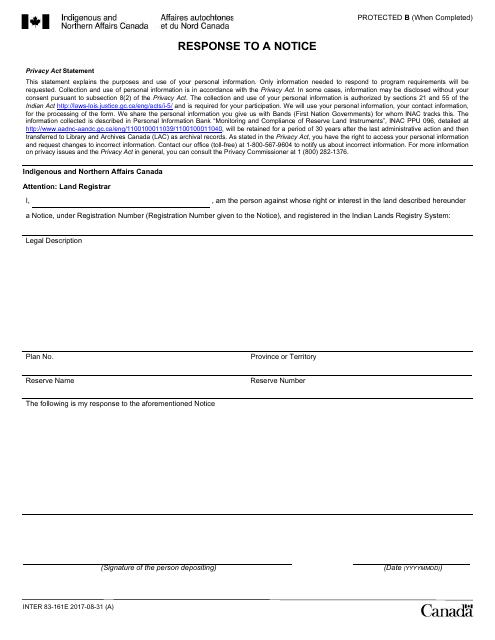

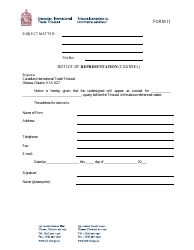

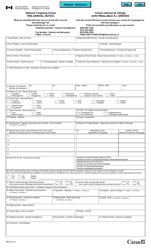

Form INTER83-161E Response to a Notice - Canada

Form INTER83-161E, Response to a Notice - Canada is used to respond to a notice issued by the Canada Revenue Agency (CRA). It allows individuals or businesses to provide information or clarification requested by the CRA in regards to their taxes or other matters.

The Form INTER83-161E, Response to a Notice, is typically filed by individuals or businesses in Canada who have received a notice from the Canada Revenue Agency (CRA). It allows the recipient to provide a response or provide additional information requested by the CRA.

FAQ

Q: What is Form INTER83-161E?

A: Form INTER83-161E is a response form to a notice in Canada.

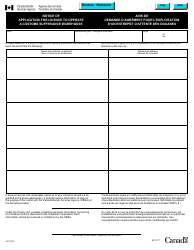

Q: When is Form INTER83-161E used?

A: Form INTER83-161E is used when you need to respond to a notice from the Canadian government.

Q: What is the purpose of Form INTER83-161E?

A: The purpose of Form INTER83-161E is to provide your response and information to the Canadian government based on the notice you received.

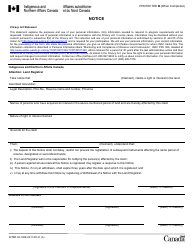

Q: What information should I include in my response on Form INTER83-161E?

A: You should include all the requested information and any supporting documents as required by the notice you received.

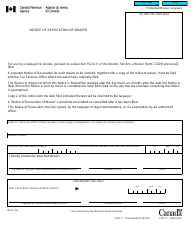

Q: Is there a deadline to submit Form INTER83-161E?

A: Yes, there is usually a deadline mentioned in the notice for submitting Form INTER83-161E. It is important to submit your response before the deadline to avoid any penalties or consequences.

Q: What should I do if I need help filling out Form INTER83-161E?

A: If you need help, you can consult the instructions provided with the form or seek assistance from a legal professional or an authorized representative.

Q: What happens after I submit Form INTER83-161E?

A: After you submit Form INTER83-161E, the government will review your response and take appropriate action based on the information provided.

Q: What if I don't submit Form INTER83-161E?

A: If you don't submit Form INTER83-161E as required by the notice, you may face penalties or legal consequences. It is important to comply with the instructions provided in the notice.

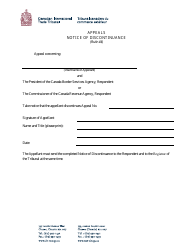

Q: Can I appeal a decision made based on my response on Form INTER83-161E?

A: Yes, in some cases, you may have the right to appeal a decision made based on your response. Consult the notice or seek legal advice to understand the appeal process.