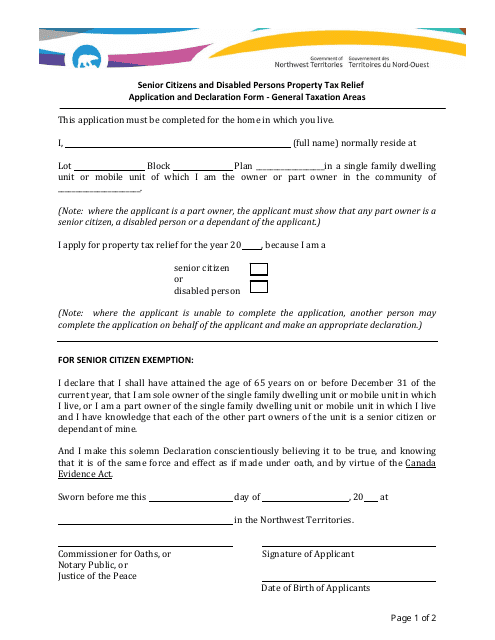

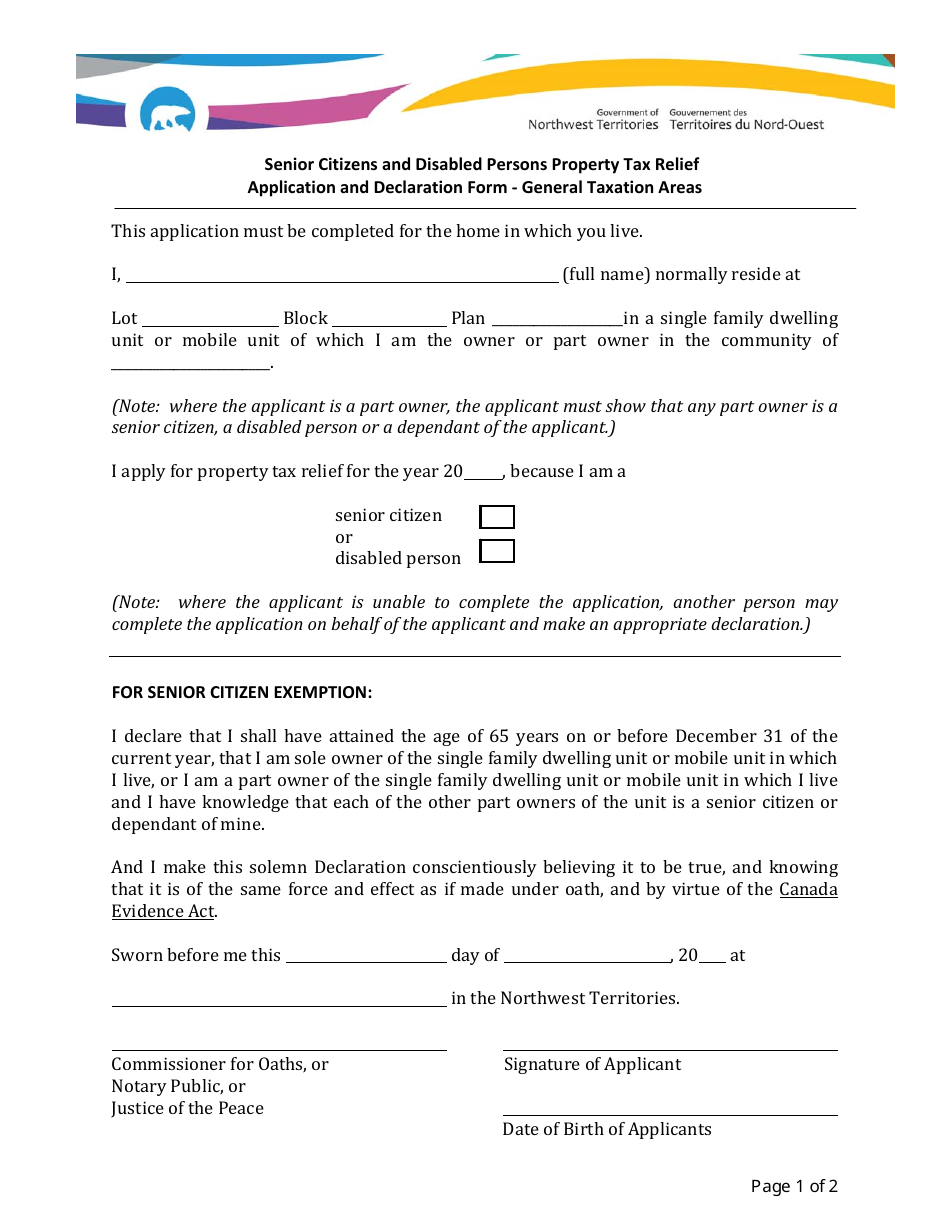

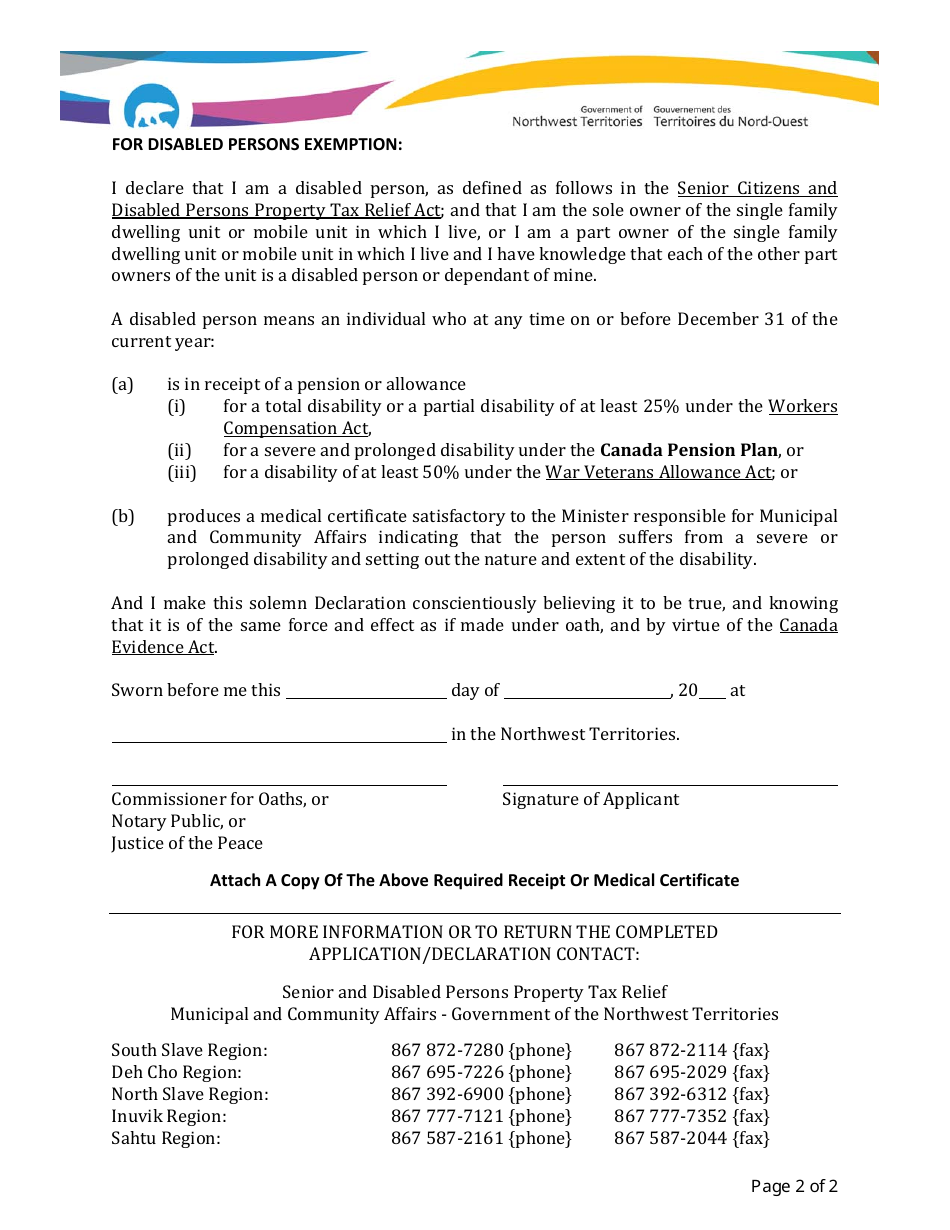

Senior Citizens and Disabled Persons Property Tax Relief Application and Declaration Form - General Taxation Areas - Northwest Territories, Canada

The Senior Citizens and Disabled Persons Property Tax Relief Application and Declaration Form is used in the Northwest Territories, Canada to apply for property tax relief for senior citizens and individuals with disabilities. It allows eligible individuals to seek a reduction in property taxes to alleviate the financial burden.

In Northwest Territories, Canada, the Senior Citizens and Disabled Persons Property Tax Relief Application and Declaration Form is typically filed by the senior citizens or disabled persons themselves.

FAQ

Q: What is the Senior Citizens and Disabled Persons Property Tax Relief Application and Declaration Form?

A: It is a form used in Northwest Territories, Canada to apply for property tax relief for senior citizens and disabled persons.

Q: Who is eligible for property tax relief?

A: Senior citizens and disabled persons who reside in Northwest Territories, Canada.

Q: What is the purpose of this form?

A: The purpose of this form is to provide property tax relief to eligible senior citizens and disabled persons in Northwest Territories.

Q: What information is required on the form?

A: The form requires personal information, property details, and documentation to support your eligibility for property tax relief.

Q: When should I submit the form?

A: It is recommended to submit the form before the deadline specified by the tax office in Northwest Territories.

Q: Is there a fee to submit the form?

A: Typically, there is no fee to submit the Senior Citizens and Disabled Persons Property Tax Relief Application and Declaration Form.

Q: What if I need assistance with filling out the form?

A: You can contact the tax office or local government officials for assistance in completing the form.

Q: Can I apply for property tax relief if I am not a senior citizen or disabled person?

A: No, this specific form is for senior citizens and disabled persons only in Northwest Territories.

Q: What benefits can I expect from property tax relief?

A: The specific benefits vary depending on the eligibility criteria set by the government of Northwest Territories.