This version of the form is not currently in use and is provided for reference only. Download this version of

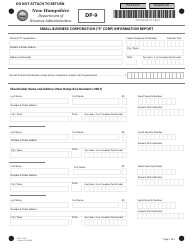

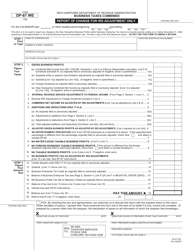

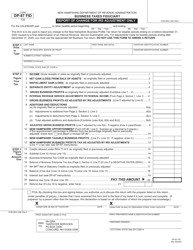

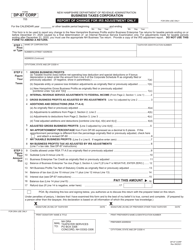

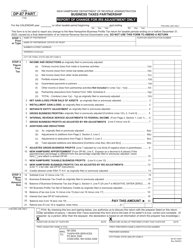

Form DP-9

for the current year.

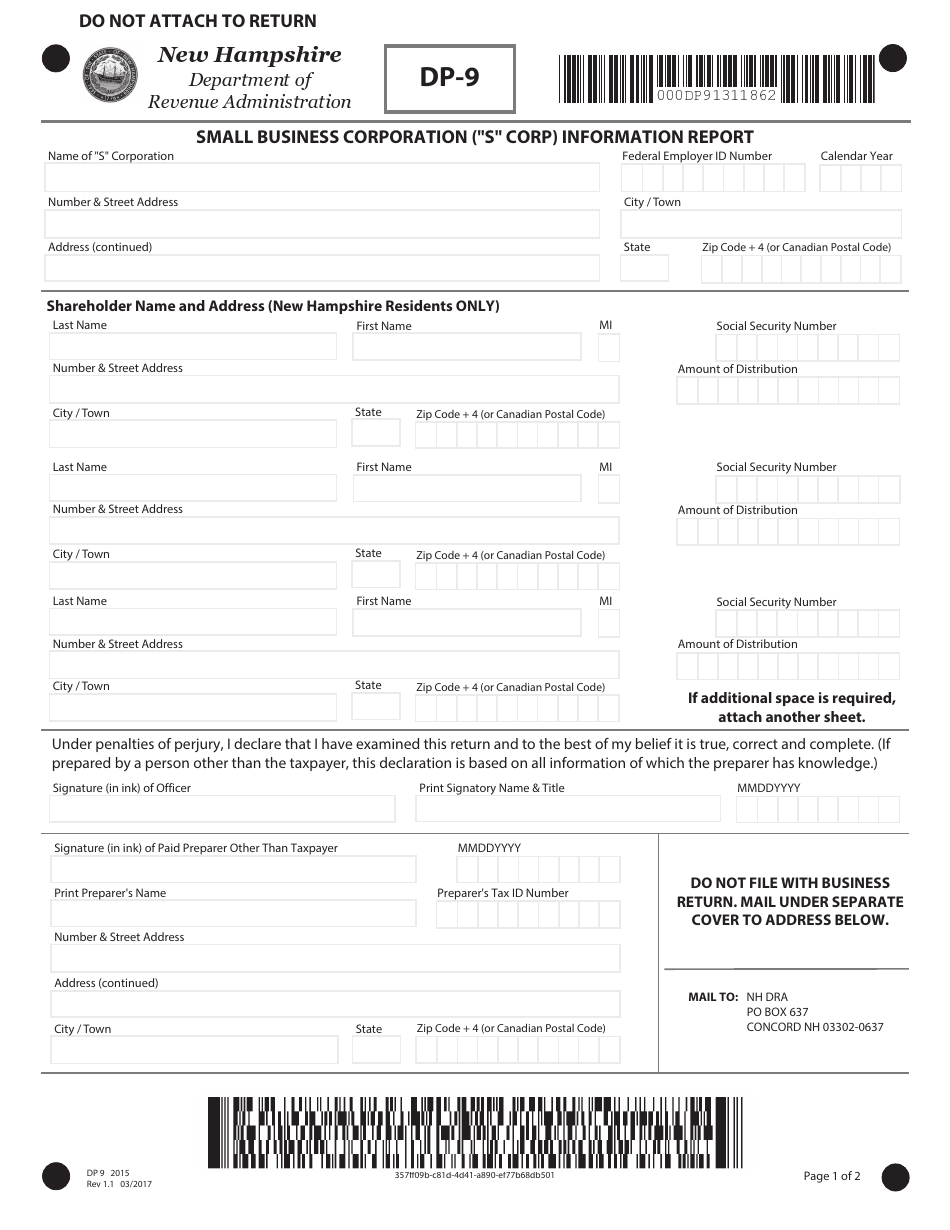

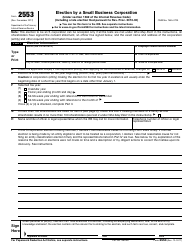

Form DP-9 Small Business Corporation ("s" Corp) Information Report - New Hampshire

What Is Form DP-9?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-9?

A: Form DP-9 is the Small Business Corporation ("s" Corp) Information Report.

Q: What is the purpose of Form DP-9?

A: Form DP-9 is used to report information about a small business corporation ("s" Corp) in New Hampshire.

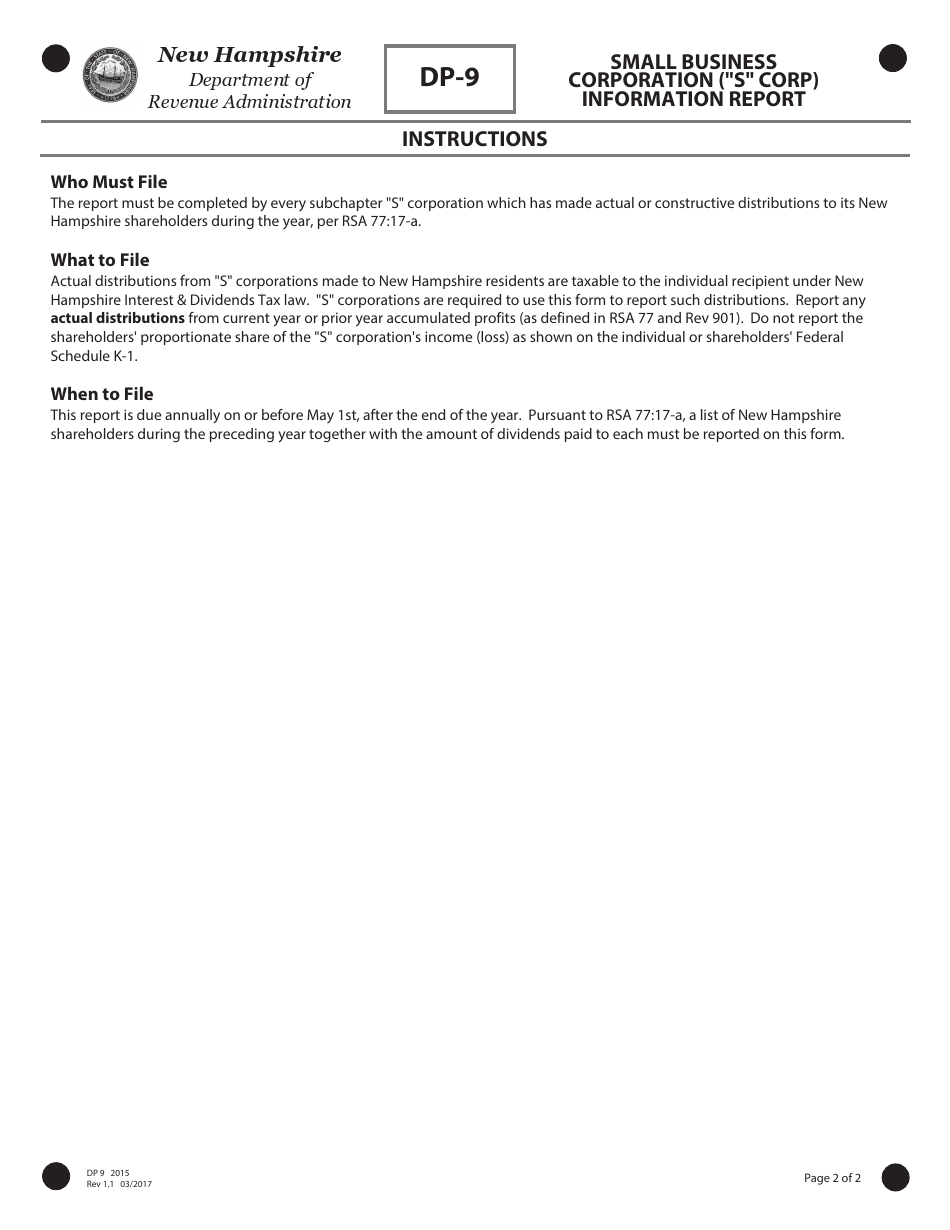

Q: Who needs to file Form DP-9?

A: Small business corporations ("s" Corps) in New Hampshire need to file Form DP-9.

Q: What information is required on Form DP-9?

A: Form DP-9 requires basic information about the small business corporation ("s" Corp), such as its name, address, and federal employer identification number (FEIN).

Q: When is Form DP-9 due?

A: Form DP-9 is due on or before April 15th of the following tax year.

Q: Are there any filing fees for Form DP-9?

A: No, there are no filing fees for Form DP-9.

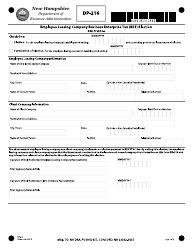

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DP-9 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.