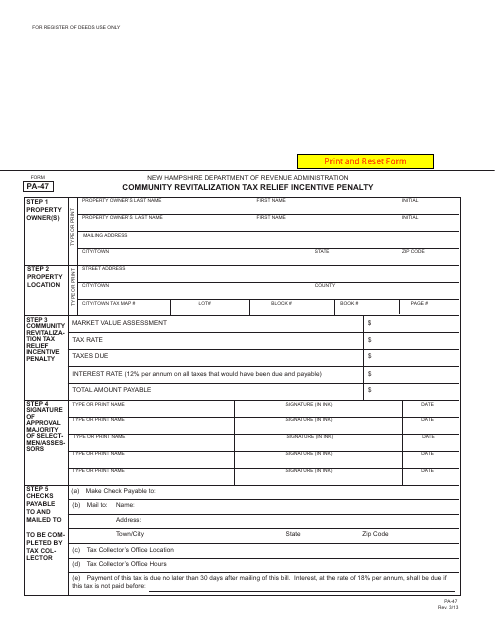

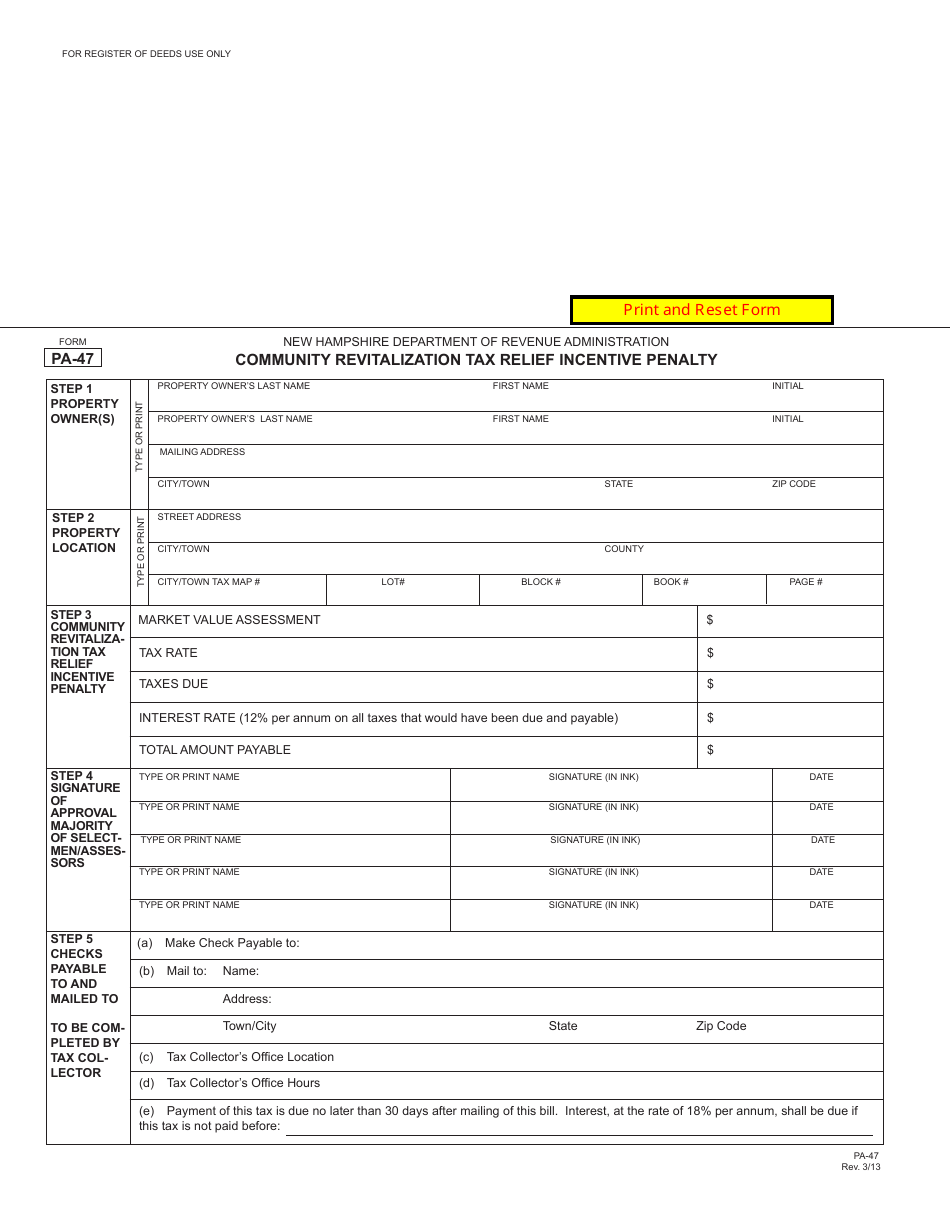

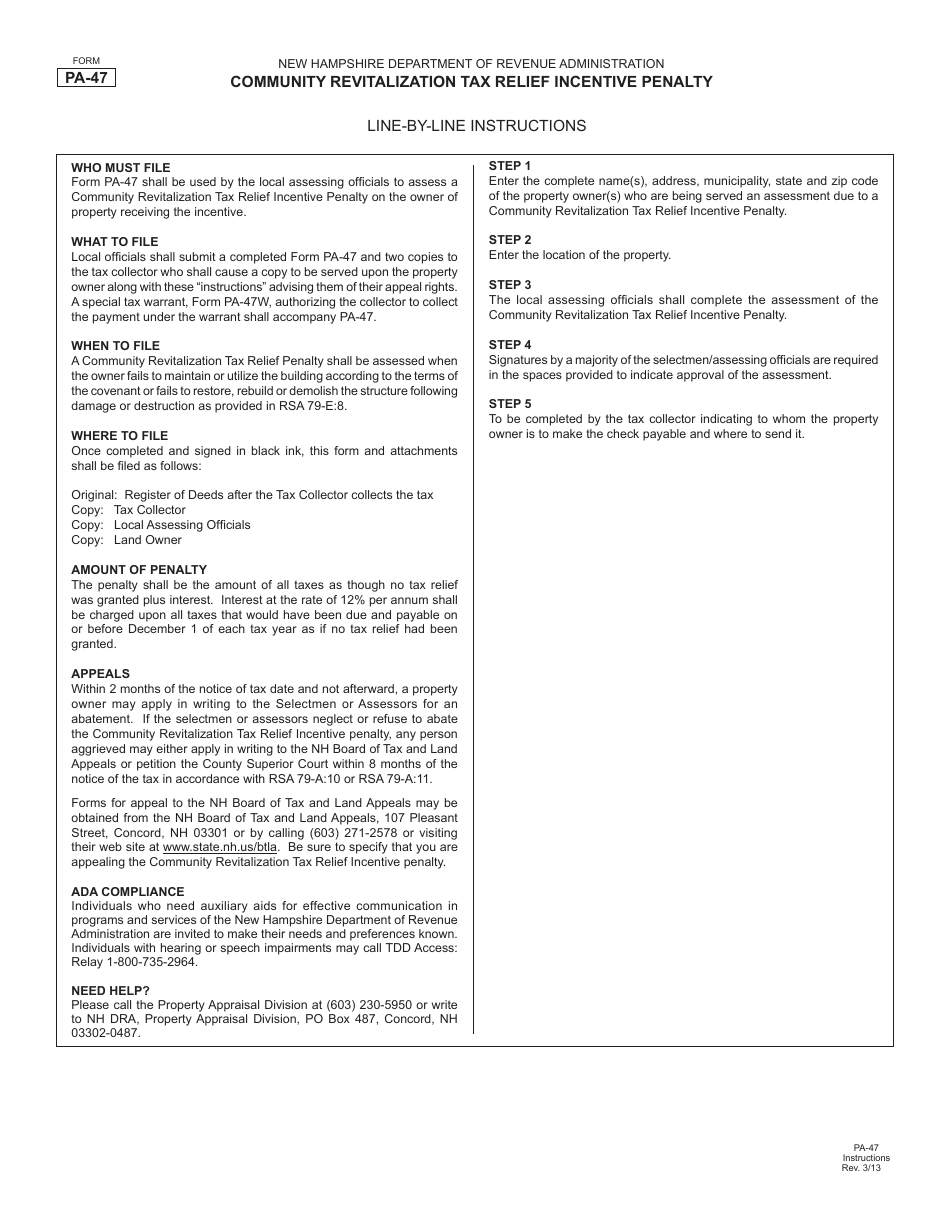

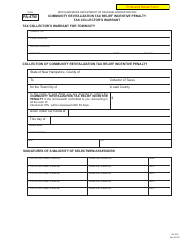

Form PA-47 Community Revitalization Tax Relief Incentive Penalty - New Hampshire

What Is Form PA-47?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-47?

A: Form PA-47 is a document used to apply for the Community Revitalization Tax Relief Incentive Penalty in New Hampshire.

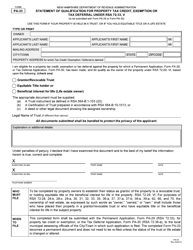

Q: What is the Community Revitalization Tax Relief Incentive?

A: The Community Revitalization Tax Relief Incentive is a program in New Hampshire that provides tax relief for certain qualifying properties.

Q: Who is eligible for the Community Revitalization Tax Relief Incentive?

A: Property owners who own qualifying properties in designated community revitalization zones are eligible for the incentive.

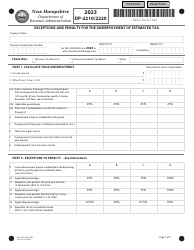

Q: What is the penalty for not submitting Form PA-47?

A: The penalty for not submitting Form PA-47 is the loss of eligibility for the Community Revitalization Tax Relief Incentive.

Form Details:

- Released on March 1, 2013;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-47 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.