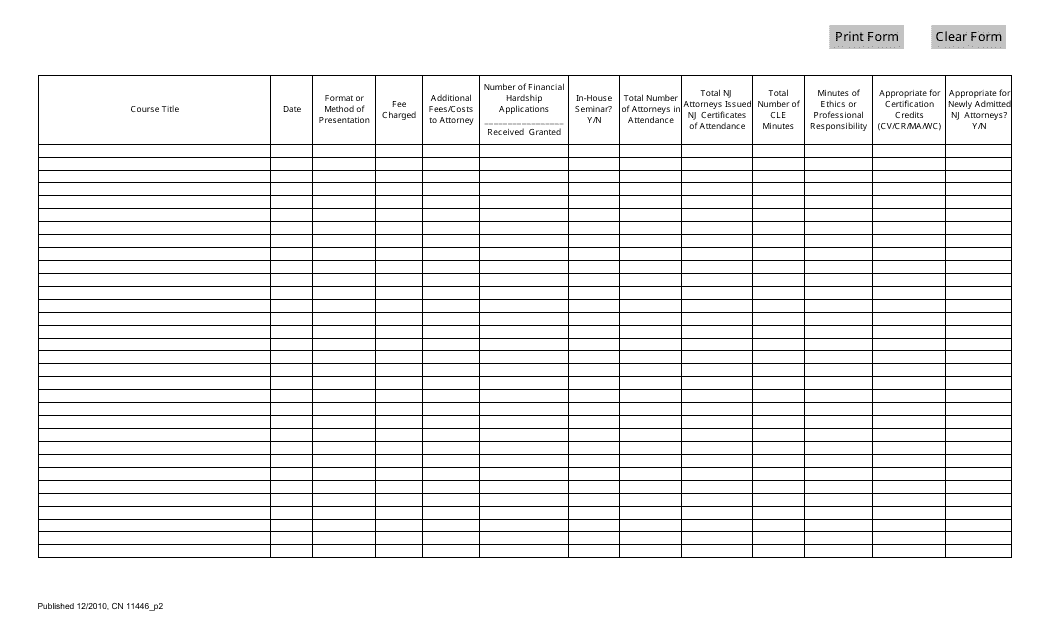

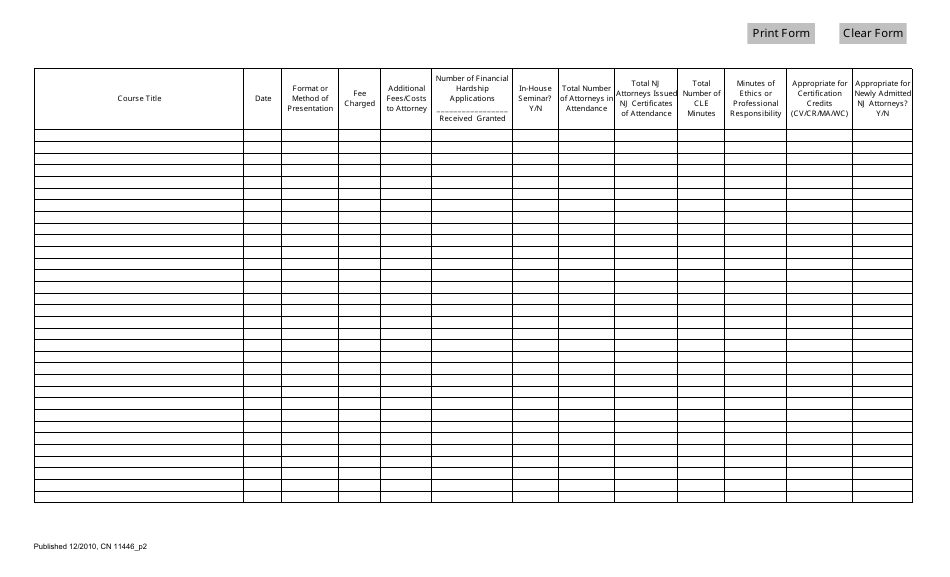

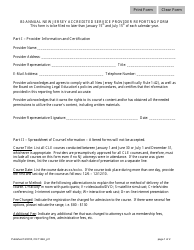

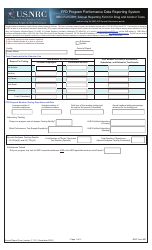

Form 11446 Part 2 BI-Annual Reporting Form - New Jersey

What Is Form 11446 Part 2?

This is a legal form that was released by the New Jersey Judiciary Court System - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 11446 Part 2?

A: Form 11446 Part 2 is the BI-Annual Reporting Form for New Jersey.

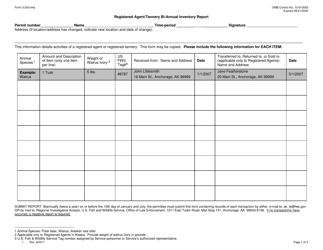

Q: Who needs to file Form 11446 Part 2?

A: Certain businesses and organizations in New Jersey are required to file Form 11446 Part 2.

Q: What is the purpose of Form 11446 Part 2?

A: Form 11446 Part 2 is used to report information about certain business activities in New Jersey.

Q: When should Form 11446 Part 2 be filed?

A: Form 11446 Part 2 should be filed bi-annually, meaning twice a year.

Q: What information needs to be reported on Form 11446 Part 2?

A: Form 11446 Part 2 requires reporting of various business activities, such as gross income and number of employees.

Q: Are there any penalties for not filing Form 11446 Part 2?

A: Yes, there may be penalties for failure to file or late filing of Form 11446 Part 2.

Q: Is Form 11446 Part 2 the same as Form 11446?

A: No, Form 11446 Part 2 is a separate form from Form 11446.

Q: Can I request an extension to file Form 11446 Part 2?

A: Yes, you may be able to request an extension to file Form 11446 Part 2. Contact the New Jersey Division of Revenue and Enterprise Services for more information.

Form Details:

- Released on December 1, 2010;

- The latest edition provided by the New Jersey Judiciary Court System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 11446 Part 2 by clicking the link below or browse more documents and templates provided by the New Jersey Judiciary Court System.