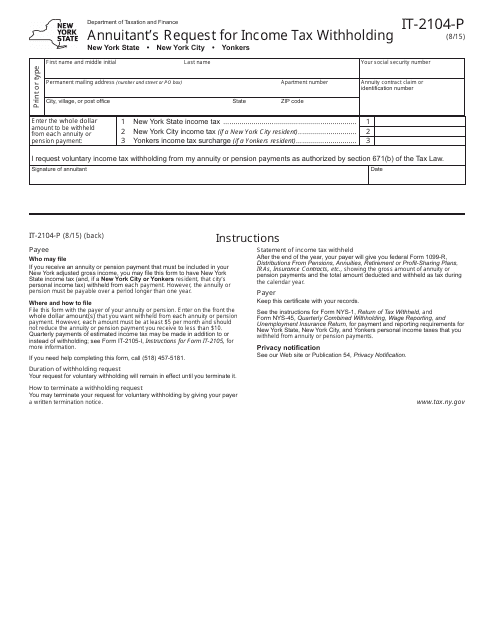

Form IT-2104-P Annuitant's Request for Income Tax Withholding - New York

What Is Form IT-2104-P?

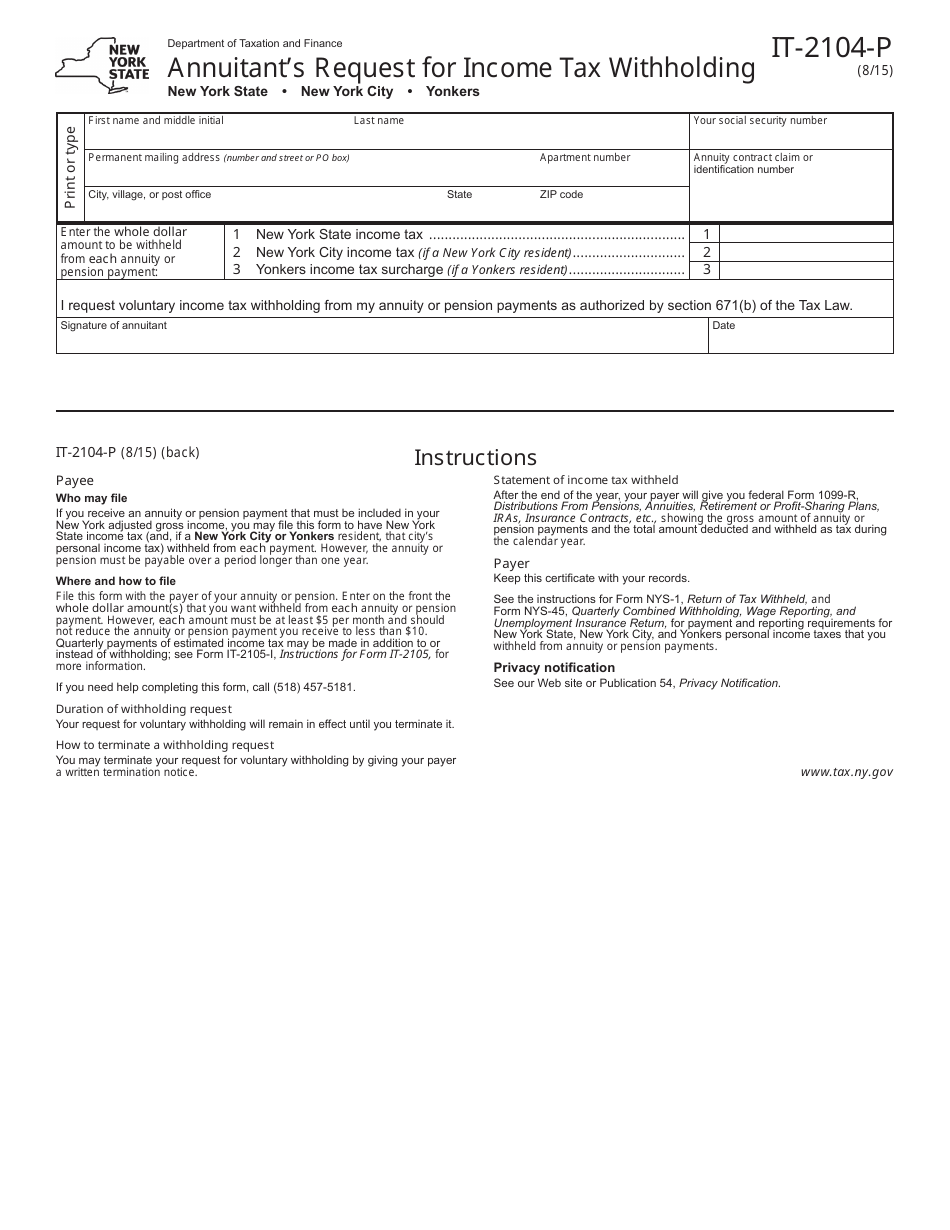

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-2104-P?

A: Form IT-2104-P is a document used by annuitants in New York to request income tax withholding from their annuity payments.

Q: Who needs to fill out Form IT-2104-P?

A: Form IT-2104-P needs to be filled out by annuitants in New York who want to have income tax withheld from their annuity payments.

Q: What is the purpose of Form IT-2104-P?

A: The purpose of Form IT-2104-P is to authorize the withholding of income tax from annuity payments in order to meet tax obligations.

Q: Is Form IT-2104-P mandatory?

A: Form IT-2104-P is not mandatory, but it is recommended for annuitants who want income tax withheld from their annuity payments.

Q: What information is required on Form IT-2104-P?

A: Form IT-2104-P requires annuitants to provide personal information, annuity payment details, and make choices regarding income tax withholding.

Q: When should I submit Form IT-2104-P?

A: Form IT-2104-P should be submitted to the annuity payer as soon as possible, preferably before the first annuity payment is made.

Q: Can I make changes to Form IT-2104-P?

A: Yes, annuitants can make changes to Form IT-2104-P at any time by submitting a new form to the annuity payer.

Q: What happens if I don't submit Form IT-2104-P?

A: If Form IT-2104-P is not submitted, no income tax will be withheld from the annuity payments by default.

Form Details:

- Released on August 1, 2015;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2104-P by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.