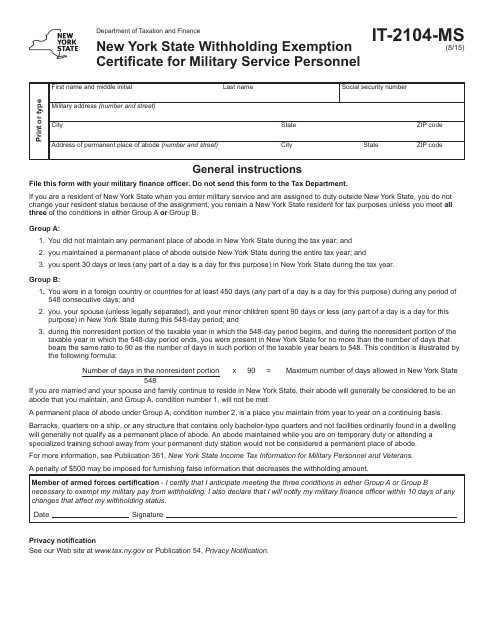

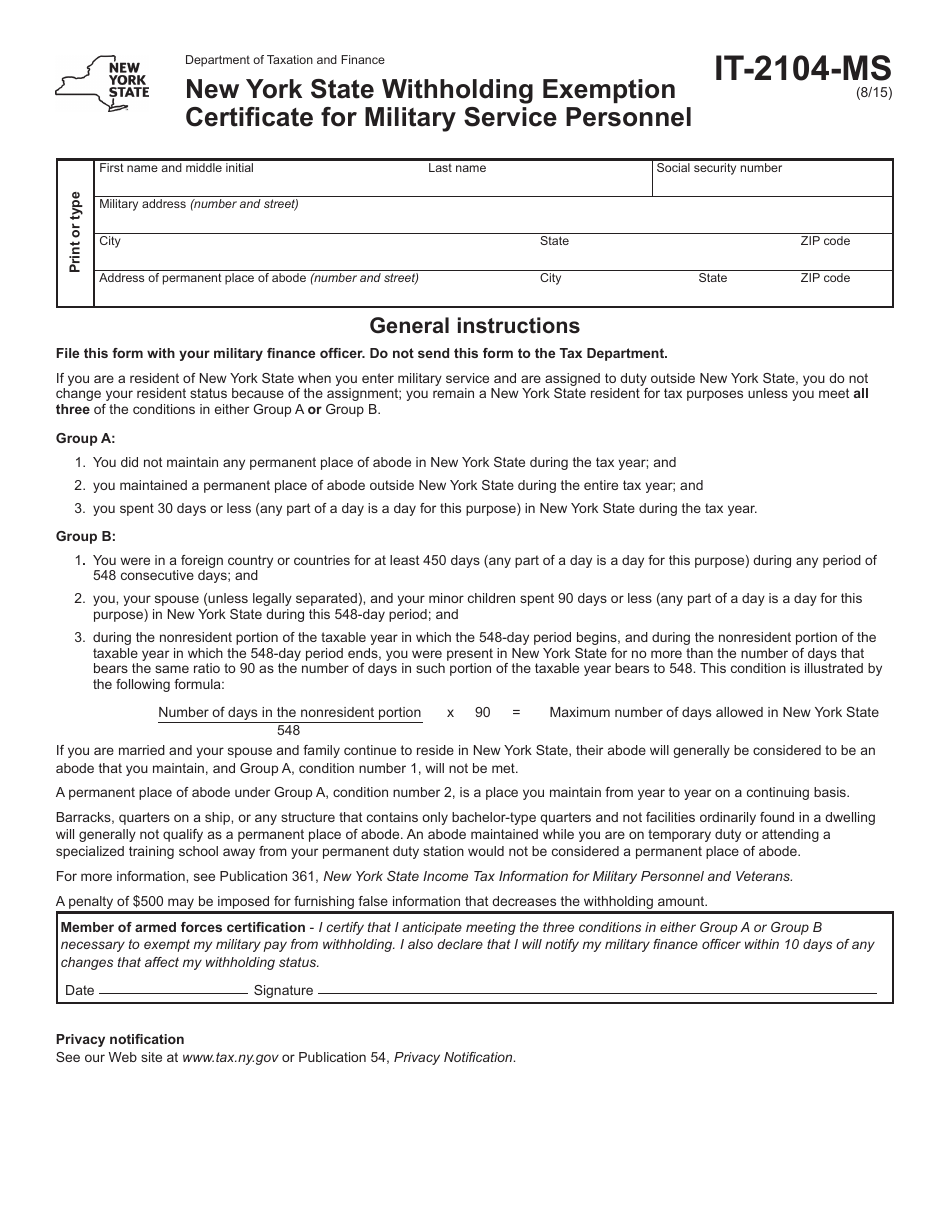

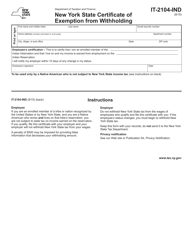

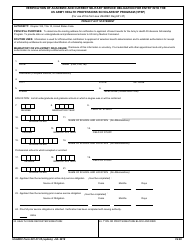

Form IT-2104-MS New York State Withholding Exemption Certificate for Military Service Personnel - New York

What Is Form IT-2104-MS?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-2104-MS?

A: Form IT-2104-MS is the New York State Withholding Exemption Certificate specifically designed for military service personnel in New York.

Q: Who should use Form IT-2104-MS?

A: Form IT-2104-MS should be used by military service personnel who are stationed or domiciled in New York and want to claim an exemption from state income tax withholding.

Q: Why would military service personnel use Form IT-2104-MS?

A: Military service personnel stationed or domiciled in New York may use Form IT-2104-MS to exempt themselves from state income tax withholding.

Q: Are there any eligibility requirements for using Form IT-2104-MS?

A: To be eligible to use Form IT-2104-MS, you must be a military service member stationed or domiciled in New York and meet other requirements outlined in the instructions.

Q: How long is Form IT-2104-MS valid for?

A: Form IT-2104-MS is valid until revoked or a new certificate is submitted.

Form Details:

- Released on August 1, 2015;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2104-MS by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.