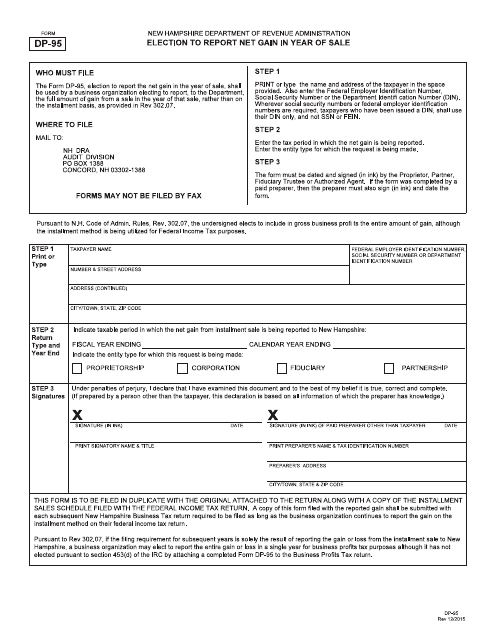

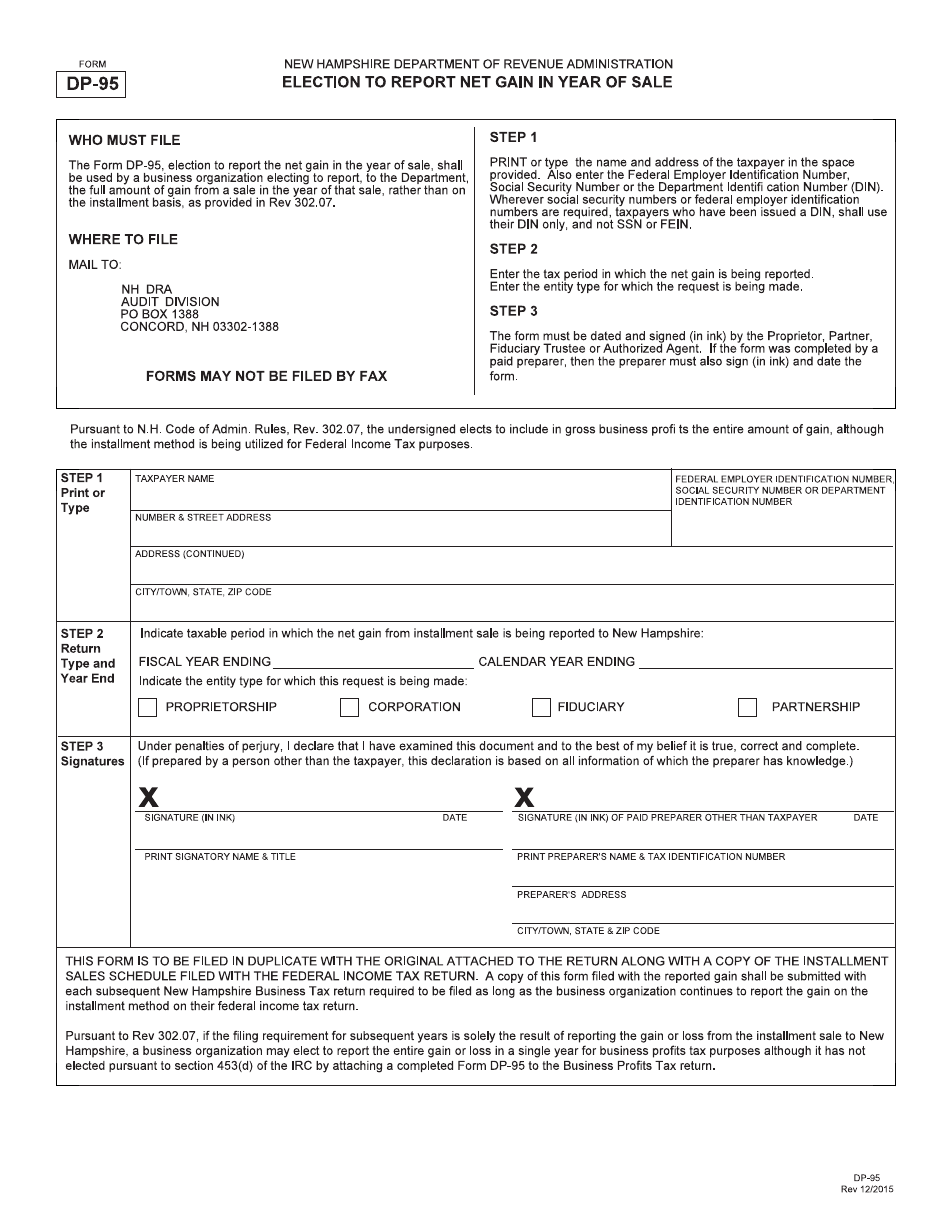

Form DP-95 Election to Report Net Gain in Year of Sale - New Hampshire

What Is Form DP-95?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-95?

A: Form DP-95 is the Election to Report Net Gain in Year of Sale.

Q: What does Form DP-95 do?

A: Form DP-95 allows taxpayers in New Hampshire to report net gain from the sale of property in the year of sale.

Q: Who needs to file Form DP-95?

A: Taxpayers in New Hampshire who have sold property and want to report the net gain in the year of sale need to file Form DP-95.

Q: Is there a deadline for filing Form DP-95?

A: Yes, Form DP-95 must be filed by April 15th of the year following the year of the sale.

Q: Do I need to include any supporting documents with Form DP-95?

A: Yes, you need to include a copy of your federal income tax return, Schedule D, and any other documents showing the sale of the property.

Q: Can I e-file Form DP-95?

A: No, currently New Hampshire does not support e-filing for Form DP-95. It must be mailed to the Department of Revenue Administration.

Q: What happens if I don't file Form DP-95?

A: If you don't file Form DP-95 and report the net gain from the sale of property in the year of sale, you may be subject to penalties and interest.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-95 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.