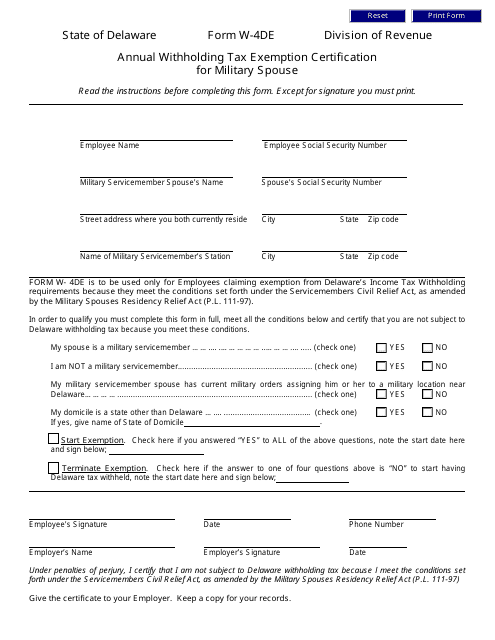

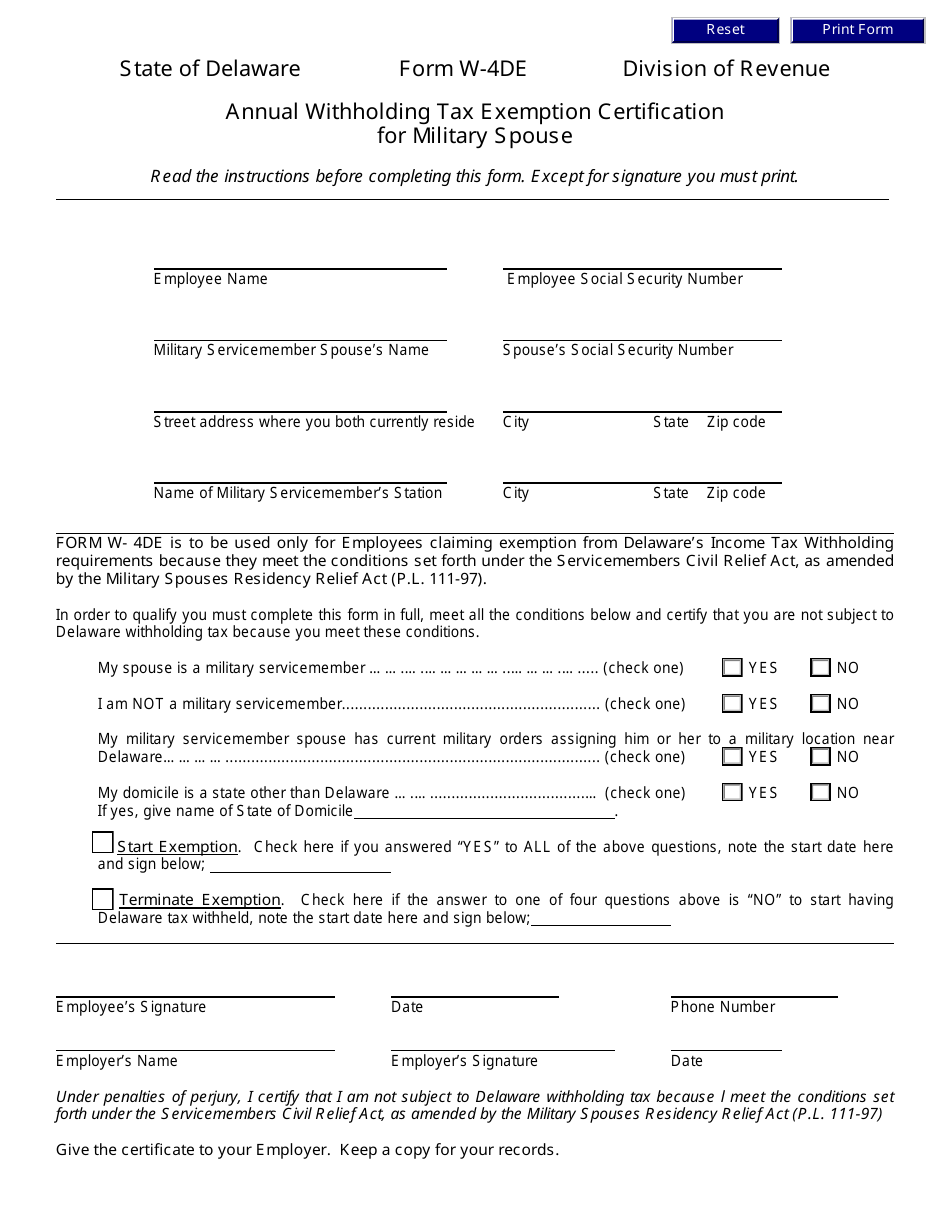

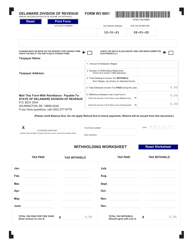

Form W-4DE Annual Withholding Tax Exemption Certification for Military Spouse - Delaware

What Is Form W-4DE?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W-4DE?

A: Form W-4DE is an Annual Withholding Tax Exemption Certification for Military Spouse in Delaware.

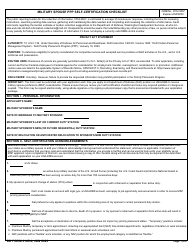

Q: Who is eligible to use Form W-4DE?

A: Military spouses who want to claim exemption from withholding tax in Delaware are eligible to use Form W-4DE.

Q: What is the purpose of Form W-4DE?

A: The purpose of Form W-4DE is to certify that a military spouse is exempt from state income tax withholding in Delaware.

Q: Do I need to submit Form W-4DE every year?

A: No, you only need to submit Form W-4DE once, unless your exemption status changes.

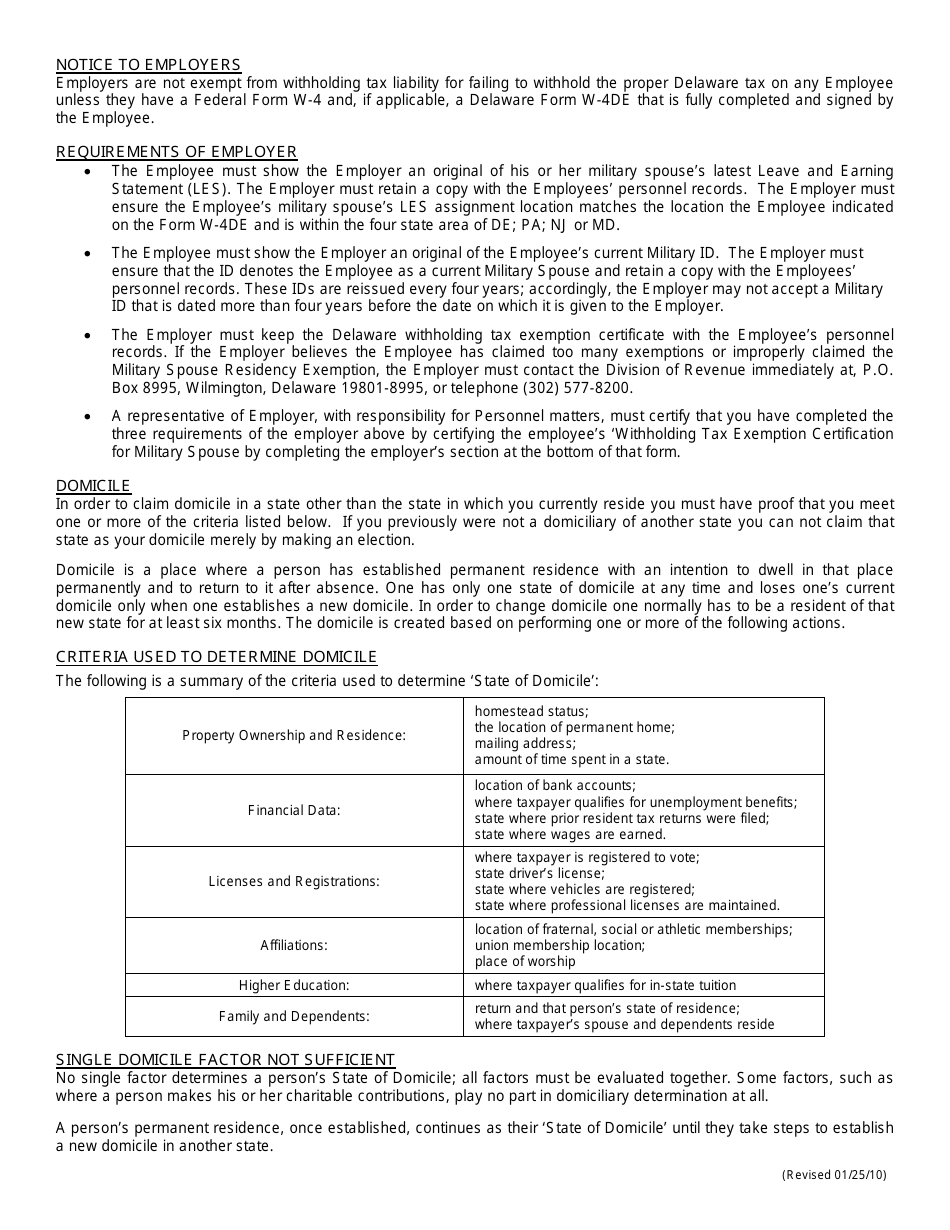

Q: What documents do I need to submit with Form W-4DE?

A: You generally do not need to submit any documents with Form W-4DE, unless requested by the Delaware Division of Revenue.

Q: Can I claim exemption from federal income tax using Form W-4DE?

A: No, Form W-4DE is specific to claiming exemption from state income tax withholding in Delaware.

Q: Is there a deadline for submitting Form W-4DE?

A: There is no specific deadline for submitting Form W-4DE, but it is recommended to submit it as soon as possible to ensure the exemption is applied.

Q: What happens if my exemption status changes?

A: If your exemption status changes, you will need to submit a new Form W-4DE with the updated information.

Q: Can I use Form W-4DE if I am not a military spouse?

A: No, Form W-4DE is specifically designed for military spouses claiming exemption from withholding tax in Delaware.

Form Details:

- Released on January 25, 2010;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-4DE by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.